Each few years, Wall Avenue rediscovers nuclear energy.

As soon as shunned as harmful, nuclear energy is now getting a second probability because the world scrambles to fulfill rising energy demand with out choking the planet.

This time round, the story is being fueled by synthetic intelligence.

Knowledge facilities are on observe to triple electrical energy consumption by 2030, and governments are pouring billions into carbon-neutral vitality options. That places nuclear energy within the highlight like by no means earlier than.

Enter NuScale Energy (NYSE: SMR).

Based in 2007, NuScale has constructed the one small modular reactor, or SMR, design permitted by the Nuclear Regulatory Fee. That provides it an enormous head begin over its rivals. Every NuScale Energy Module generates 77 megawatts of fresh vitality, and as much as 12 modules will be mixed at a web site.

The kicker? They’re “walk-away secure,” requiring no operator motion or exterior energy to close down. That security profile is a serious promoting level.

NuScale has additionally structured its enterprise cleverly. By way of an unique partnership with vitality manufacturing firm ENTRA1, it sells Energy Modules whereas ENTRA1 funds, develops, and operates the vegetation. That makes NuScale extra asset-light, counting on service income, royalties, and module gross sales somewhat than taking up heavy building threat. Consider it as “nuclear-as-a-service.”

The macro image couldn’t be higher.

The U.S. Division of Power estimates we’ll have to quadruple our nuclear capability by 2050 simply to maintain up with demand. Latest government orders are streamlining regulation, and federal subsidies are flowing. Bipartisan assist is in place, which is uncommon in as we speak’s political local weather.

If ever there have been a time for nuclear to shine, it’s now.

Financially, although, NuScale continues to be within the proving stage.

Income spiked to $34.2 million within the fourth quarter of 2024 however cooled to $13.4 million and $8.1 million within the first two quarters of 2025. Working bills stay steep at round $43 million 1 / 4.

On the plus aspect, liquidity is strong at practically $490 million as of June 2025. That provides NuScale respiratory room, however it’s nonetheless burning money.

The inventory has mirrored the drama. After spending a lot of 2023 and early 2024 below $10, shares started a livid rally. By mid-2025, they’d rocketed above $50 earlier than tumbling again to the excessive $30s as we speak.

That’s nonetheless a greater than tenfold achieve from the lows. However the volatility reveals how rapidly sentiment can swing between euphoria and warning.

Now to The Worth Meter.

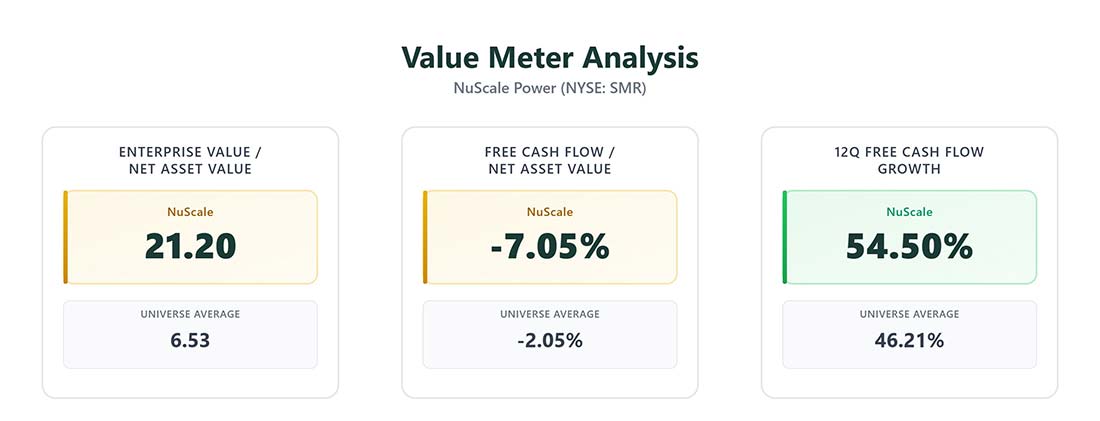

On enterprise value-to-net asset worth (EV/NAV), NuScale clocks in at 21.20, in contrast with a peer common of 6.53. Traders are paying an enormous premium relative to the corporate’s property.

On free money flow-to-net asset worth (FCF/NAV), NuScale posts -7.05%, worse than the universe common of -2.05%. Which means it’s much less environment friendly at producing money than its friends.

The place NuScale does stand out is in consistency: Its 12-quarter FCF progress price of 54.5% beats the peer group’s 46.2%. The course is sweet, even when the money burn stays actual.

If nuclear vitality is certainly getting into a renaissance, NuScale is arguably the best-positioned SMR play on the market. However the inventory worth already displays quite a lot of optimism.

For conservative traders, the prudent transfer is to attend for a greater entry level. For speculative traders, it’s a high-risk, high-reward guess on the way forward for energy.

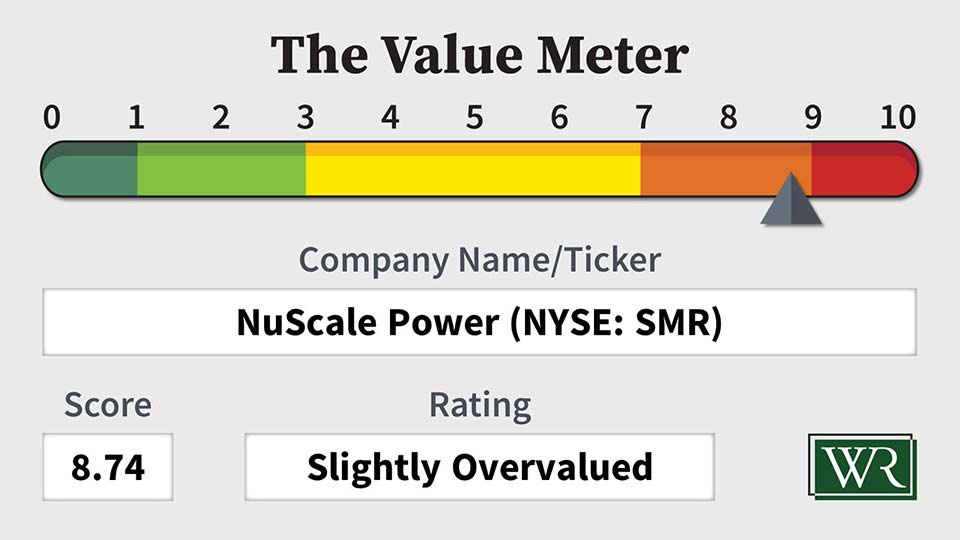

The Worth Meter charges NuScale Energy as “Barely Overvalued.”

What inventory would you want me to run by way of The Worth Meter subsequent? Put up the ticker image(s) within the feedback part under.