It’s uncommon to discover a small biotech inventory that’s seemingly standing on the sting of a medical breakthrough – however Stoke Therapeutics (Nasdaq: STOK) is one in all them.

Stoke’s mission is straightforward however daring: Use RNA science to “repair” illnesses attributable to lacking or inadequate proteins.

The corporate’s strategy works by boosting protein manufacturing solely in tissues the place the protein usually exists. It doesn’t alter DNA or insert new genes. As an alternative, it teaches the physique to make extra of what it’s already constructed to make.

In August, Stoke dosed the primary affected person in its Section 3 EMPEROR trial for zorevunersen, which is a possible disease-modifying therapy for Dravet syndrome – a extreme type of childhood epilepsy marked by fixed seizures and developmental delay. Sufferers will obtain 4 doses over a 52-week interval.

The principle aim of the examine is a discount in seizure frequency at week 28, with secondary objectives associated to cognition and conduct.

Present medicine can cut back seizures however don’t handle the foundation drawback. Zorevunersen may.

Early knowledge have been encouraging. In long-term research, sufferers on zorevunersen confirmed substantial seizure reductions and lasting enhancements in cognition and conduct – indicators that the therapy might actually modify the illness, not simply masks it.

Outcomes by 36 months have proven continued seizure discount and regular features in day by day dwelling, communication, and motor abilities.

Past zorevunersen, Stoke is advancing one other therapy known as STK-002 for autosomal dominant optic atrophy (ADOA). Administration confirmed that STK-002 has begun a Section 1 examine within the U.Okay. The corporate can be exploring different issues reminiscent of SYNGAP1, increasing its attain throughout uncommon neurological circumstances.

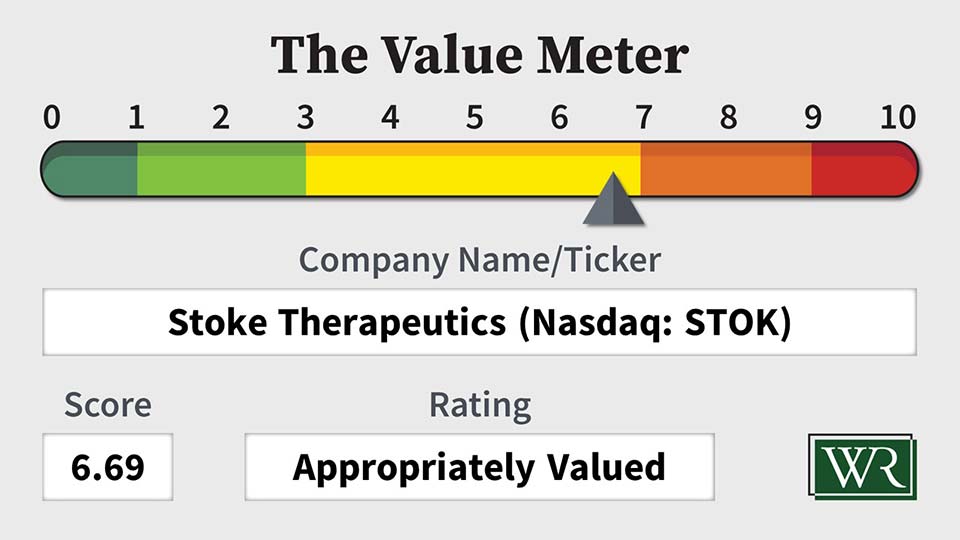

Now, the Worth Meter check.

On valuation, EV/NAV stands at 2.13, about half the peer common of 4.20. Traders are paying much less for Stoke’s property than for comparable firms, leaving room for upside if zorevunersen succeeds.

On money effectivity, FCF/NAV averages -2.69%, in contrast with a peer common of 0.79%. That’s regular for a clinical-stage biotech. It alerts regular spending, not waste.

On consistency, Stoke’s 12-quarter FCF progress fee of 45.5% almost matches the peer common of 46.2%. For an organization nonetheless within the clinic, that’s a quiet signal of management.

(The corporate expects its present money to fund operations by mid-2028, helped by its collaboration with Biogen, which can deal with commercialization outdoors the U.S., Canada, and Mexico.)

Collectively, these numbers reveal that the market is giving Stoke credit score for the science and its sturdy steadiness sheet whereas nonetheless pricing within the danger of a binary trial final result.

The inventory displays that steadiness. It constructed a protracted base over the previous 12 months, then broke greater into the autumn. Shares lately traded within the excessive $30s after a robust run.

With Section 3 now underway and outcomes years away, volatility will stay a part of the journey.

For traders, Stoke is a patient-capital story. If the EMPEROR examine for zorevunersen delivers, in the present day’s low cost may vanish shortly. If not, the market’s warning will look clever. Till then, this one belongs on the watchlist, not within the “set-and-forget” pile.

The Worth Meter charges Stoke Therapeutics as “Appropriately Valued.”

What inventory would you want me to run by The Worth Meter subsequent? Publish the ticker image(s) within the feedback part beneath.