Former Binance CEO Changpeng Zhao, aka CZ, has made a daring declare about Bitcoin’s future. The cryptopreneur turned philanthropist and bitcoin proponent tweeted that the premier digital foreign money will flip Gold’s market capitalization within the close to future. Nonetheless, he didn’t give a precise timeline for this improvement, however needs everybody to mark his tweet for the long run.

CZ tweeted:

“Prediction: Bitcoin will flip gold.

I don’t know precisely when. May take a while, however it is going to occur. Save the tweet”

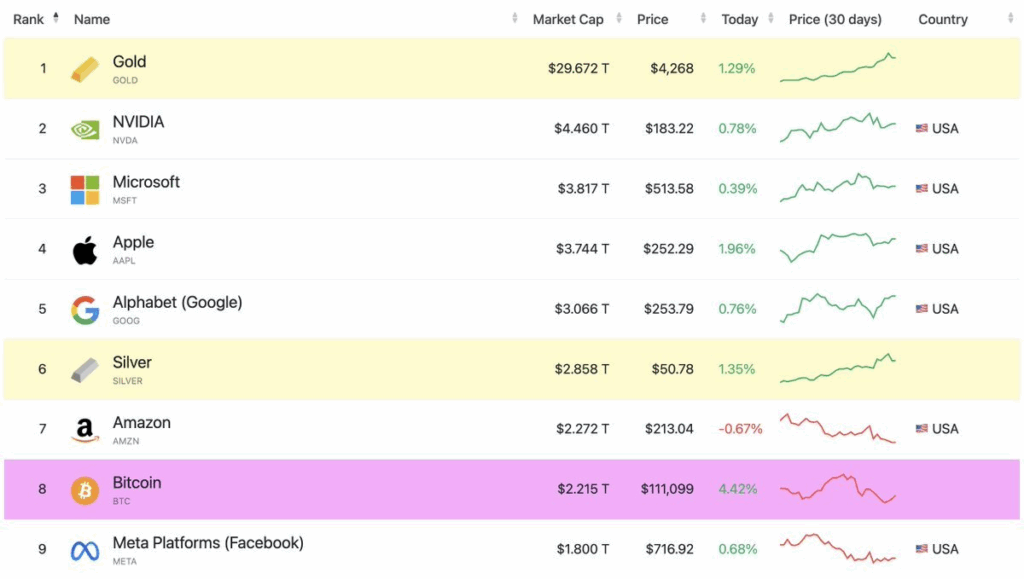

He then adopted the tweet with this listing of high property by market capitalization:

It’s tough to foretell the way forward for commodities like Gold and Bitcoin due to their provide dynamics and market sentiment. Nonetheless, if Gold theoretically maintains its present market worth, BTC might want to recognize by 1300% to meet up with its huge $29 trillion valuation. It can simply breach the $1 million valuation throughout this worth surge.

A transfer like this could place BTC firmly on the high of the asset class’s pecking order and make it universally acceptable for transactions.

The Bitcoin-Gold Debate

The Bitcoin-Gold debate is an attention-grabbing discourse that exhibits how essentially the most distinguished legacy asset stacks up towards BTC, the “power foreign money.” Whereas Gold and Silver have been used as currencies over the previous few millennia, the previous has all the time accounted for the lion’s share of worth due to the issue of mining and refining it.

Gold’s inertness, sparkle, use in jewellery, and coinage properties have made it a super alternative over time. Nonetheless, it has seen its ups and downs over time, famously affected by an prolonged interval of oversupply within the sixteenth and seventeenth centuries as a result of plunder of South and Central America.

Bitcoin, however, has a historical past of 15 years and continues to be gaining floor. However throughout this quick interval, it has amassed greater than $2 trillion in worth and is trying more and more upward as customers choose its lean system of digital existence, low charges, decentralized, consensus-based community, and self-custodial characteristic.

Evaluating the 2 property shouldn’t be a good comparability, however sure similarities can’t be ignored. Each are higher suited as store-of-value than as on a regular basis foreign money. Each might be recognized independently, and each swimsuit central banks due to their restricted circulation.

Nonetheless, Bitcoin is undoubtedly the one main asset that may problem Gold’s hegemony proper now.

The Future

Gold is at present in main bullish territory, as its worth has elevated by greater than 50% because the begin of the calendar 12 months, pushing its complete market cap near $30 trillion. Bitcoin, however, has underperformed the dear steel and struggled to answer main worth good points within the bullion market. Its present market cap is under $2.3 trillion.

Nonetheless, even with the premier digital asset off its sport, it has had fairly first rate worth motion over the last 12 months. It might look to chop its losses within the close to future and reassert its significance within the evolving financial system.