Gold lastly exhaled.

After sprinting to file highs, it posted its sharpest drop in years this week as merchants took income and reset their positions. However massive strikes like that don’t kill a bull market; they clear the deck.

If the longer-term drivers – central financial institution shopping for, deficit worries, and a agency greenback development that may flip – keep in place, the steel nonetheless has room. Pullbacks are merely the toll you pay on the freeway.

That units the stage for Barrick Mining (NYSE: B).

Barrick is a diversified operator, not a one-mine wager. It runs Tier One gold property in Nevada, the Dominican Republic, Tanzania, and Congo, plus a rising copper arm in Zambia and an enormous copper-gold venture in Pakistan.

The corporate’s playbook is straightforward: Hold a powerful stability sheet, push prices down, and fund the following wave of development from inner money relatively than debt or dilutive offers.

Its newest numbers again that up. Within the second quarter of 2025, income was $3.7 billion. Web earnings had been $811 million, or $0.47 per share, with adjusted EPS additionally $0.47. Attributable EBITDA (earnings earlier than curiosity, taxes, depreciation, and amortization) hit $1.69 billion with a 55% margin.

Free money circulate was $395 million whilst Barrick stepped up spending at Lumwana (the copper mine in Zambia) and Reko Diq (the copper-gold venture in Pakistan). The corporate ended the quarter with $4.8 billion in money and a small net-cash place of $73 million. Shareholders acquired a $0.15 quarterly dividend – together with a $0.05 enhancement tied to internet money – and $268 million of buybacks throughout the quarter.

Operations are trending the fitting method. Gold manufacturing rose 5% quarter over quarter. Manufacturing at Nevada Gold Mines elevated 11% from the primary quarter on higher grades and throughput, whereas output jumped 28% within the Dominican Republic as plant upgrades took maintain. Copper manufacturing climbed 34% as Lumwana improved mining charges and unit prices fell.

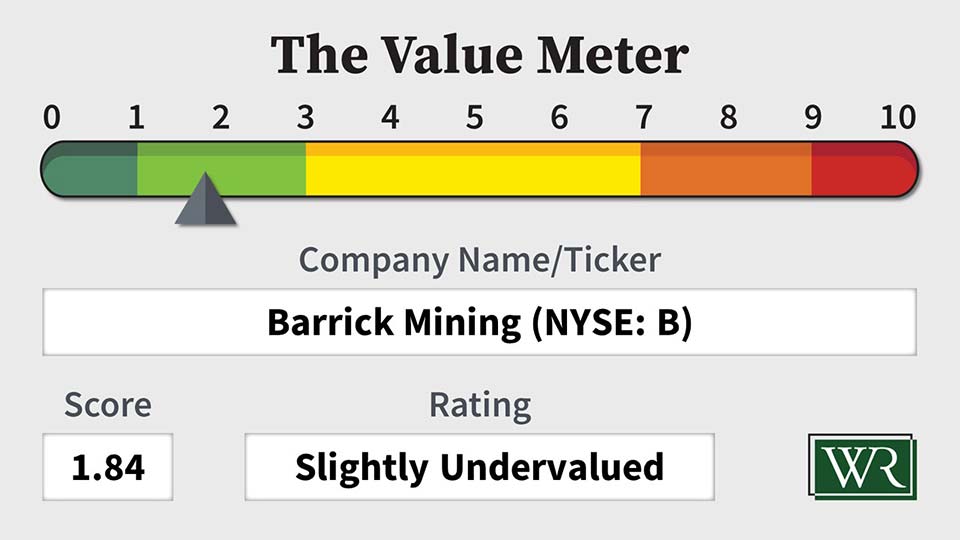

Now to the Worth Meter breakdown.

On valuation, Barrick’s common EV/NAV is 1.64, versus a universe common of three.79. That tells us the inventory is cheaper than its friends, since you pay much less for every greenback of internet property.

On money effectivity, the corporate’s common FCF/NAV is 0.84%, versus 1.11% for its friends. That’s a notch worse, that means Barrick turns property into free money a bit much less effectively than the common firm in our universe proper now.

However there’s extra to the story right here. On momentum of the money engine, Barrick’s 12-quarter FCF development fee is 54.50% versus 46.25% for its friends. That’s higher, suggesting money era is trending sooner than the pack.

What in regards to the inventory?

Shares have ripped from the mid-teens final winter to the low $30s now, with a short spike towards the mid $30s as gold went vertical. (The current dip tracks the steel’s cooldown greater than any change to Barrick’s story.)

If bullion finds help and copper stays agency, Barrick’s mix of low-cost gold and increasing copper ought to hold free money circulate coming. The pipeline – together with the ramp-up within the Dominican Republic, Reko Diq, and a “Tremendous Pit Enlargement” at Lumwana – provides actual torque to 2026 by means of 2028 with out stretching the stability sheet as we speak.

So apart from the dip in gold costs, this can be a high quality operator priced under the peer pack with enhancing operations and a clear stability sheet. For buyers who need leverage to the steel with out betting the farm, Barrick nonetheless appears to be like just like the grownup within the room.

The Worth Meter charges Barrick Mining as “Barely Undervalued.”

What inventory would you want me to run by means of The Worth Meter subsequent? Publish the ticker image(s) within the feedback part under.