Yves right here. Wolf Richter has two informative items on the newest inflation knowledge. His companion publish, Large Outlier in Proprietor’s Equal of Lease Pushed Down CPI, Core CPI, Core Providers CPI: One thing Went Awry on the BLS, appears to be like at the place there was figures-fixing that had the impact of reducing the reported key inflation measures. This one appears to be like on the persevering with ache of meals value will increase.

By Wolf Richter, editor at Wolf Avenue. Initially printed as Wolf Avenue

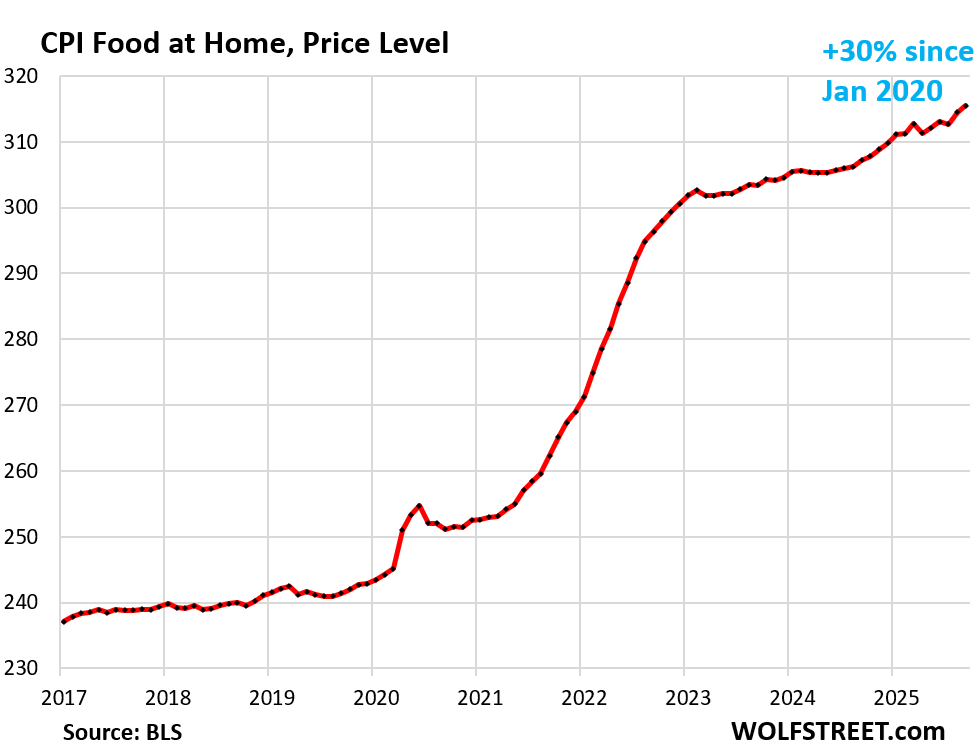

he CPI inflation index for “Meals at residence” rose by 0.32% in September from August (4.0% annualized), and by 2.7% year-over-year, the worst improve since August 2023, as per the information launched belatedly by the Bureau of Labor Statistics at the moment. Since January 2020, the CPI for meals at residence has surged by 30%.

The CPI “Meals at residence” tracks quite a few classes of meals and drinks that customers buy at shops and markets and devour off-premise, equivalent to at residence. However their costs don’t march in lockstep. Egg costs have re-plunged for months off their avian-flu spike and continued to drop in September. However beef costs soared. Espresso costs dipped off the massive spike. And dairy has been plateauing at very excessive ranges. Tons of of foods and drinks objects kind the general meals at residence CPI.

This chart reveals the value stage of the CPI meals at residence: A surge in 2021 by way of 2022, a tiny dip in early 2023, after which continued however slower value will increase that began re-accelerating in mid-2024. By now, costs of meals at residence have risen by 30% since early 2020.

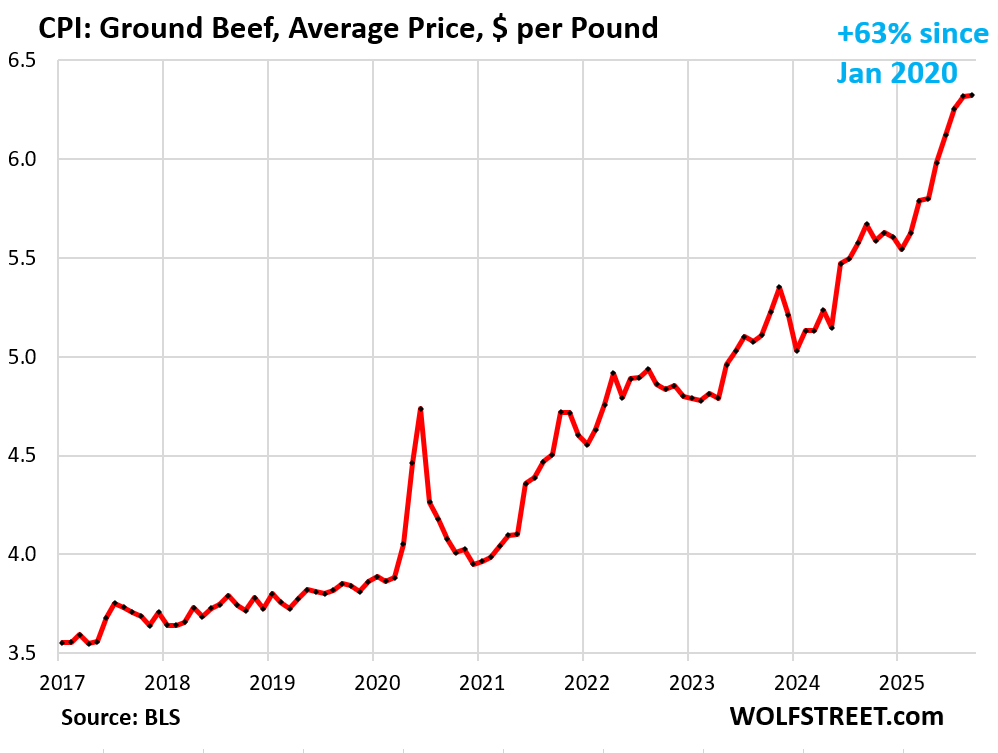

Beef costs have been hovering for 5 years, because the US cattle herd has dropped to a 64-year low for quite a few causes, inflicting tight provide. People’ demand for beef regardless of excessive costs has continued to push costs even greater. People gripe, moan, and groan about excessive beef costs, however don’t hand over on their beef simply.

General beef costs spiked by 1.2% in September from August, and by 14.7% year-over-year. However there are indicators that the multi-year surge is starting to gradual.

For instance, the typical value of floor beef, which had exploded by 63% for the reason that starting of 2020, ticked up solely 0.1% in September from August, which obtained misplaced as a rounding error, and the value per pound remained at $6.32.

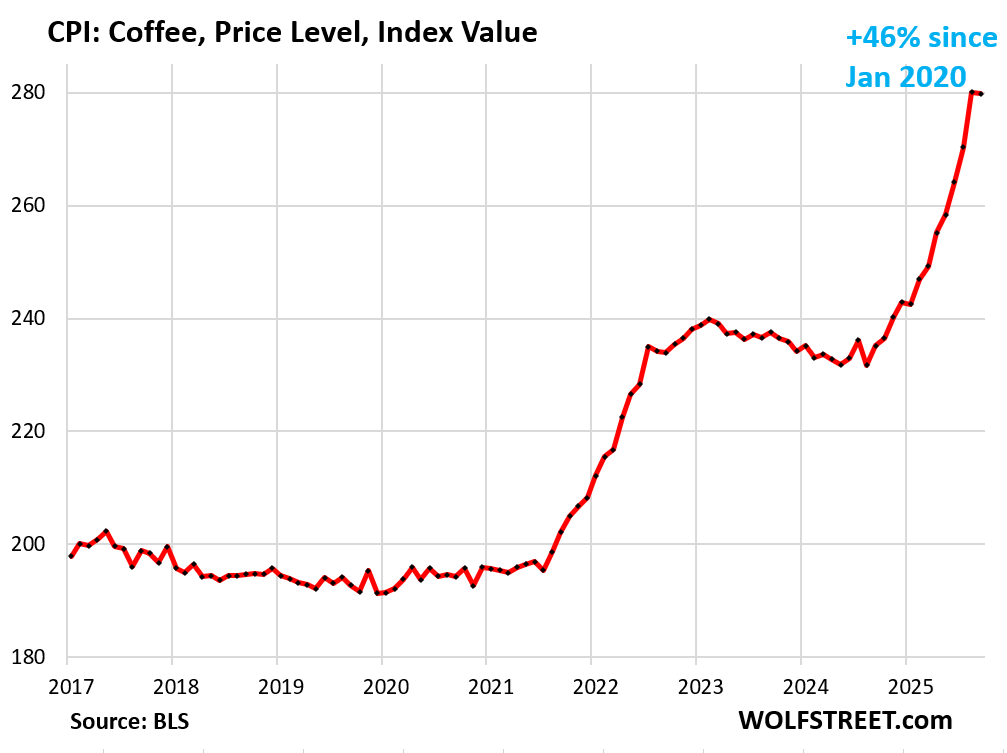

The CPI for roasted espresso – contains roasted complete bean, floor, and prompt espresso – dipped by 0.1% in September from August, after the multi-year spike that got here in two phases, roughly following with some lag world commodity costs of inexperienced espresso beans:

- +22% from Jul 2021 to Feb 2023

- +21% from Aug 2024 to Aug 2025.

Since January 2020, the CPI for espresso spiked by 46%.

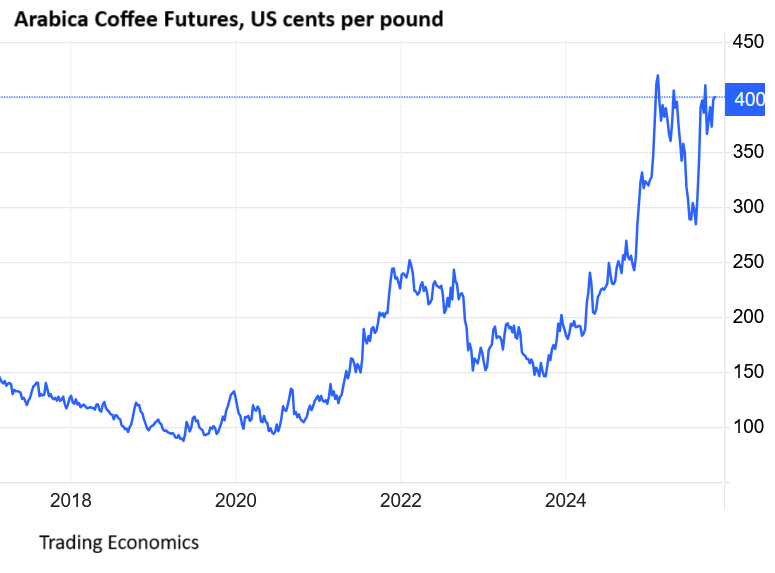

Inexperienced espresso beans, as a worldwide commodity product, are traded on varied platforms, and costs are very risky, typically pushed by fears of droughts, dangerous harvests, market forces, and now tariffs.

For instance, Arabica espresso futures costs (chart under through Buying and selling Economics):

- +150% from mid-2020 – early 2022

- Then they gave up a part of that spike.

- +125% from late 2023 – late 2024.

- In 2025, they spiked, plunged, and re-spiked and are actually slightly below the place they’d been in early February, as futures markets reacted strongly to tariff bulletins.

These are violent value actions that don’t go by way of to retail costs of roasted espresso. Since early 2020, espresso futures exploded by 300% whereas the CPI of roasted espresso bought by retailers rose 46% over the identical interval.

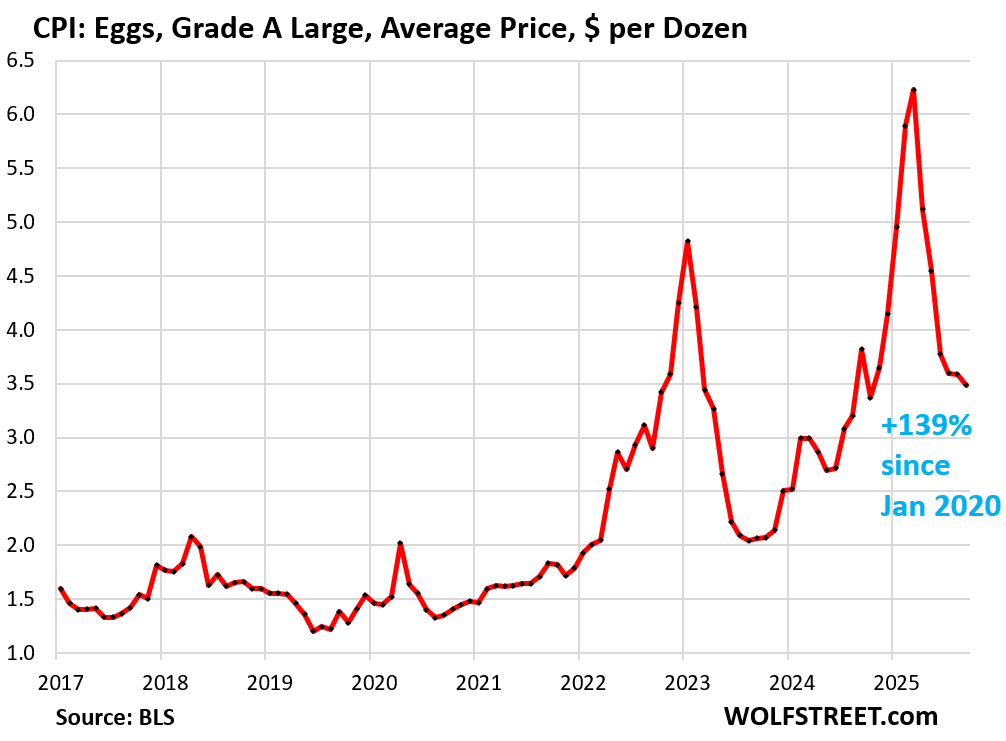

Egg costs have now collapsed after the spikes, however are nonetheless excessive. The avian flu got here in two waves, the primary in 2022 and the second in 2024, every triggering shortages of eggs, empty cabinets, buy restrictions when eggs have been out there, and big value spikes.

The typical value of Grade A Giant Eggs had soared by 368% from $1.33 per dozen in mid-2020 to $6.23 on the peak of the second wave in March 2025. Since then, costs have plunged.

In September, they continued to fall, -2.8% for the month, to $3.49 per dozen Grade A big eggs, in accordance with the BLS at the moment. They’ve now plunged by 44% from the March peak, however are nonetheless 146% costlier than that they had been in mind-2020.

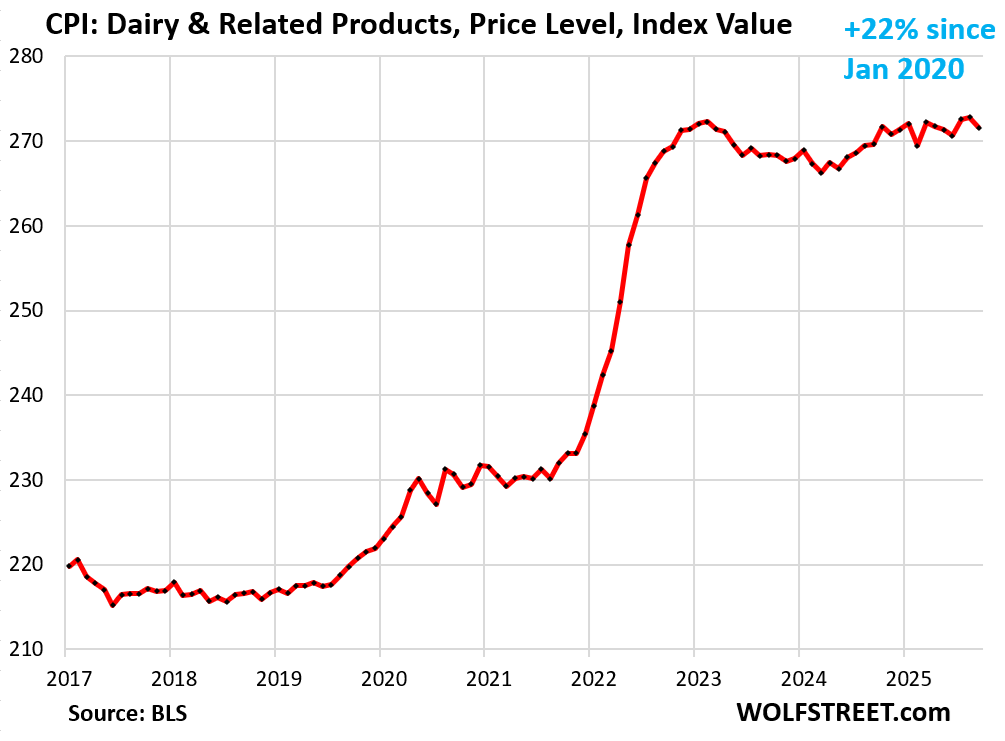

Dairy and associated merchandise have been one other shocker in the course of the excessive inflation years of 2020 to 2022, after they spiked by 22%, and costs have remained at these excessive ranges since then.

The CPI for dairy and associated merchandise declined by 0.5% in September from August, in accordance with the BLS at the moment. Yr-over-year, it rose by 0.7%.

Main Classes of CPI Meals at Dwelling

Beef, espresso, eggs, and dairy are among the many most risky meals classes. However there have been different classes with value spikes, all for their very own causes. For instance, costs of child system spiked in 2022 and 2023, amid shortages, all of a sudden placing monumental stress on households with younger youngsters, whereas different customers by no means seen it.

The class “Espresso, tea, and many others.” within the desk under additionally contains tea and “different beverage supplies.” The CPI for espresso proven within the chart above is only for espresso (floor, whole-bean, prompt).

The class “Beef and veal” within the desk is much broader than floor beef, the instance within the chart above.

The class “Eggs” contains all kinds of eggs, not simply Grade A big depicted within the chart above.

| MoM | YoY | |

| Meals at residence | 0.3% | 2.7% |

| Cereals, breads, bakery merchandise | 0.7% | 1.6% |

| Beef and veal | 1.2% | 14.7% |

| Pork | 0.5% | 1.6% |

| Poultry | 0.1% | 1.4% |

| Fish and seafood | -0.3% | 2.1% |

| Eggs | -4.7% | -1.3% |

| Dairy and associated merchandise | -0.5% | 0.7% |

| Recent fruits | -0.5% | -0.2% |

| Recent greens | 0.0% | 2.8% |

| Juices and nonalcoholic drinks | 1.4% | 3.1% |

| Espresso, tea, and many others. | -0.1% | 18.9% |

| Fat and oils | 0.3% | -1.7% |

| Child meals & system | 1.3% | 0.6% |

| Alcoholic drinks at residence | 0.0% | 0.3% |

Rising and spiking meals costs, and these continued excessive meals costs after a spike, trigger a number of hardship amongst customers that aren’t wealthy who all of a sudden need to make all types of compromises to place meals on the desk. Meals costs are nothing to be trifled with.