Bitcoin has continued its constructive pattern by remaining above the $106,000 assist stage following the drop on October 17. BTC value evaluation by Coinidol.com.

BTC value long-term prediction: bearish

The biggest cryptocurrency has traded above the $106,000 assist however beneath the transferring common traces. Because the restoration, consumers have defended the $107,000 stage in an effort to maintain the worth above the transferring common traces.

On October 21, consumers tried to push the worth above the transferring common traces however had been blocked by the 50-day SMA. Bitcoin will return to its earlier excessive of $126,110 if consumers keep the worth above the transferring common traces. As we speak, Bitcoin has retraced however stays above the $107,000 assist stage. On the draw back, if bears breach the $107,000 assist, BTC may fall to its earlier low of $103,310.

Technical indicators

-

Key provide zones: $120,000, $125,000, $130,000 -

Key demand zones: $100,000, $95,000, $90,000

BTC value indicators evaluation

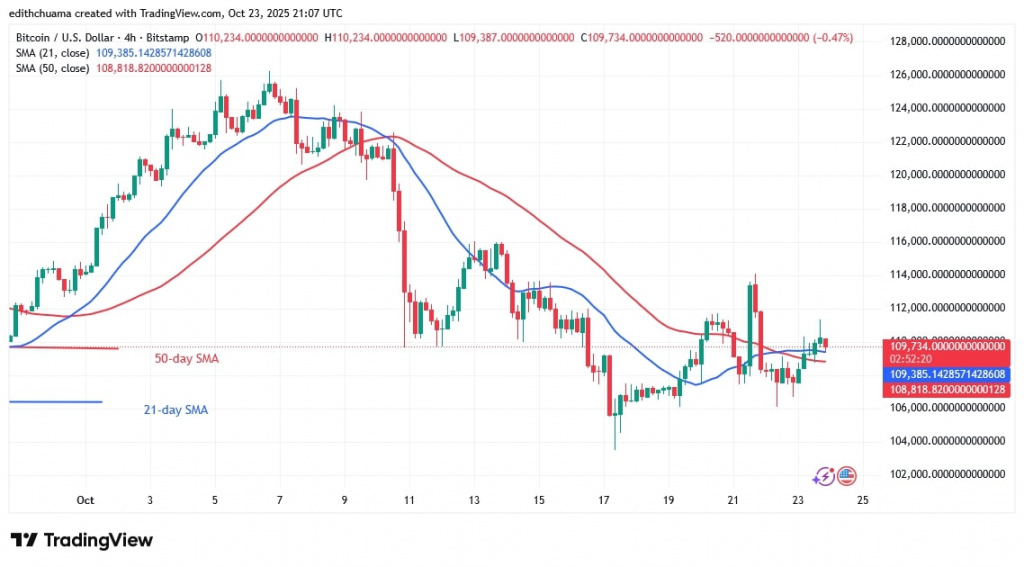

The transferring common traces are horizontal, indicating a sideways pattern following the downturn. The 21-day SMA assist has crossed beneath the 50-day SMA, signalling a downturn. On the 4-hour chart, the transferring common traces are horizontal, however the value bars are positioned above them. Value motion has been constrained by the presence of Doji candlesticks.

BTC/USD day by day chart – September 24, 2025

What’s the subsequent transfer for BTC?

Bitcoin’s value has resumed a sideways pattern, remaining above the $107,000 stage. On the upside, if consumers maintain the $107,000 assist, Bitcoin will start a range-bound transfer between the $107,000 assist and the $126,000 excessive. The 4-hour chart reveals BTC value bouncing between the $106,000 assist and $116,000. The upward motion has been slowed by the resistance at $114,000.

BTC/USD 4-hour chart – September 24, 2025

Disclaimer. This evaluation and forecast are the non-public opinions of the creator. The info offered is collected by the creator and isn’t sponsored by any firm or token developer. This isn’t a suggestion to purchase or promote cryptocurrency and shouldn’t be seen as an endorsement by Coinidol.com. Readers ought to do their analysis earlier than investing in funds.