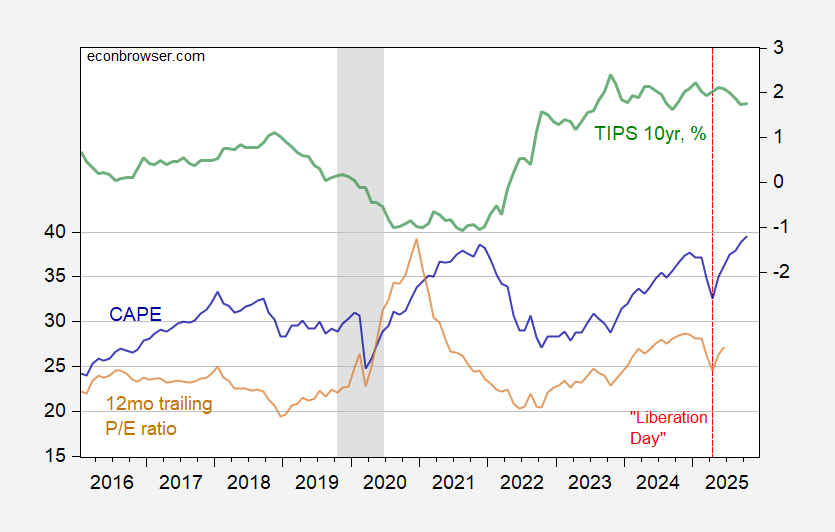

See this clip, at 2:17. Over the long run, the inventory costs ought to equal the current discounted worth of dividends, themselves relective of earnings and earnings. That’s fundamental finance. That being mentioned, there are over time substantial (obvious) deviations from the PDV of dividends (see Shiller, AER 1981), or huge strikes within the price-earnings ratio, outlined in any approach you need (12 month trailing, cyclically-adjusted, 1 12 months ahead), as earnings fail to materialize, or the fairness threat premium seemingly adjustments.

Total, the cyclically adjusted price-earnings (CAPE) ratio is simply barely greater than the 2021M11 stage, within the mixture. Alternatively, the inflation protected 10 12 months yield is now a full 2.8 share factors greater than then!

Determine 1: CAPE (blue, left scale), P/E ratio, 12 mo trailing earnings (tan, left scale), and TIPS 10 yr yield, % (inexperienced, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: Shiller, Treasury by way of FRED, NBER, and writer’s calculations.

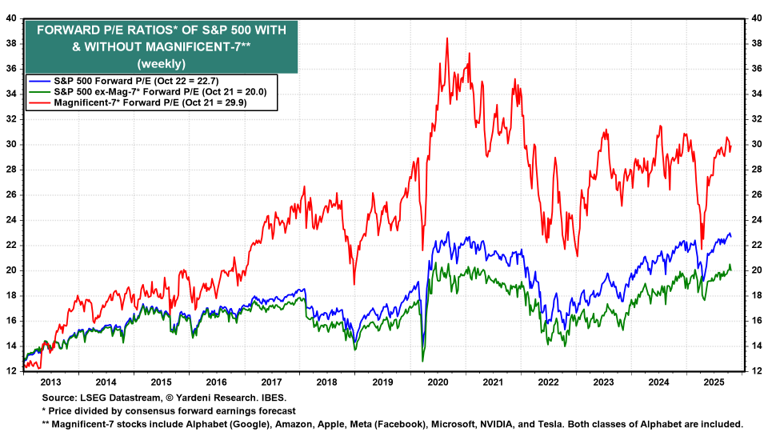

Listed here are the price-earnings ratios for the Magnificent-7 vs. S&P500 ex-Magazine 7.

Supply: Yardeni.com.

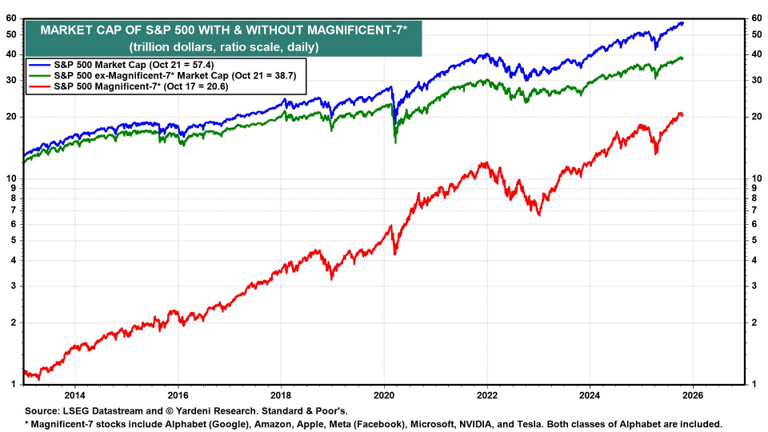

Does it matter that this specific sector appears, to me a minimum of, probably overvalued given present actual rates of interest? Nicely, maybe, as present capitalization of Magazine-7 is 35.9% of the S&P500.

Supply: Yardeni.com.

So time will inform. Personally, I factor the purportedly pro-growth insurance policies (monetary deregulation, dilution of capital necessities) alluded to will improve a probability of a “discontinuous change” in asset costs (recall, the 2008 monetary disaster adopted a interval of monetary regulatory disarmament, as mentioned right here).