Contingency funds can be found to fund SNAP disbursements for at the least a part of November. OMB Director Vought’s unprecedented resolution to ban use of those funds can have macro implications (I eschew any ethical or moral judgments on this dialogue), particularly if the federal government shutdown continues.

In FY2024, SNAP expenditures had been about $100 bn. Canning and Mentzer Morrison/ERS (2019) point out the multiplier for SNAP expenditures are about 1.54. The multiplier is probably going state contingent, smaller with fast development, bigger when development is slower (which seemingly pertains to the present labor market state).

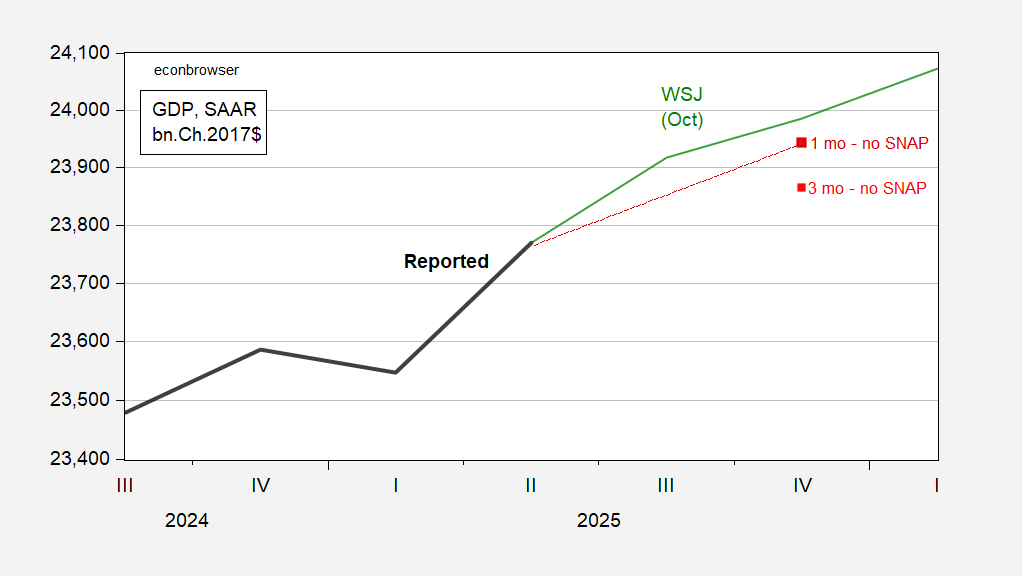

Assuming the unconditional multiplier is 1.54, and SNAP expenditures at about 0.33 % of GDP, one obtains the next image:

Determine 1: GDP (daring black), WSJ imply survey forecast (inexperienced), 1 month SNAP cessation (giant darkish pink sq.), 3 month SNAP cessation (small pink sq.), all in bn.Ch.2017$, SAAR. Supply: BEA, WSJ, ERS, writer’s calculations.

It appears implausible that the SNAP cessation may final three months. Then again, the $5 bn or so within the contingency fund is inadequate to fund SNAP for the complete month of November.

In contemplating the trajectory of the economic system, it is very important observe that the responses to the WSJ survey had been in all probability conditional on a comparatively brief Federal authorities shutdown, in order that the unfavorable results had been reversed upon authorities reopening. Ought to that not be the case (and/or the legislation violated such that Federal staff weren’t paid for the time furloughed), then the economic system’s baseline trajectory can be decrease than that depicted. (Observe that contractors are not offered funds for the interval below which the federal government was shut down.)