Now we have acquired the identical query from a number of of our subscribers over the previous week. It’s certainly counterintuitive, because the Greenback usually rallied throughout risk-off intervals previously.

The Greenback selloff is presently fueled by 4 elements:

Falling actual charges

The Greenback is falling as a result of steep drop in actual charges. Primarily, financial development is slowing whereas inflation expectations usually are not falling as a lot.

Falling US price expectations

Falling actual charges are placing the Fed below stress to chop charges extra shortly. The 3-month / 1-month SOFR spreads are one of the best ways to trace this dynamic, and so they started falling properly forward of the Greenback. Decrease charges make Greenback property much less enticing.

Increasing EURUSD price differentials

Capital wants a spot to allocate, and EURUSD price differentials have expanded quickly. Whereas price expectations have been falling within the U.S., Euro charges have been rising as a result of proposed German abandonment of the Schuldenbremse (debt brake). Unleashing lots of of billions of € would push each development and inflation greater, necessitating greater charges. Furthermore, financing all of this with new debt additional supercharges charges, as somebody must purchase all the brand new provide. The short-term impact is decrease US charges and better Euro charges, which attracts capital to higher-yielding Euro property.

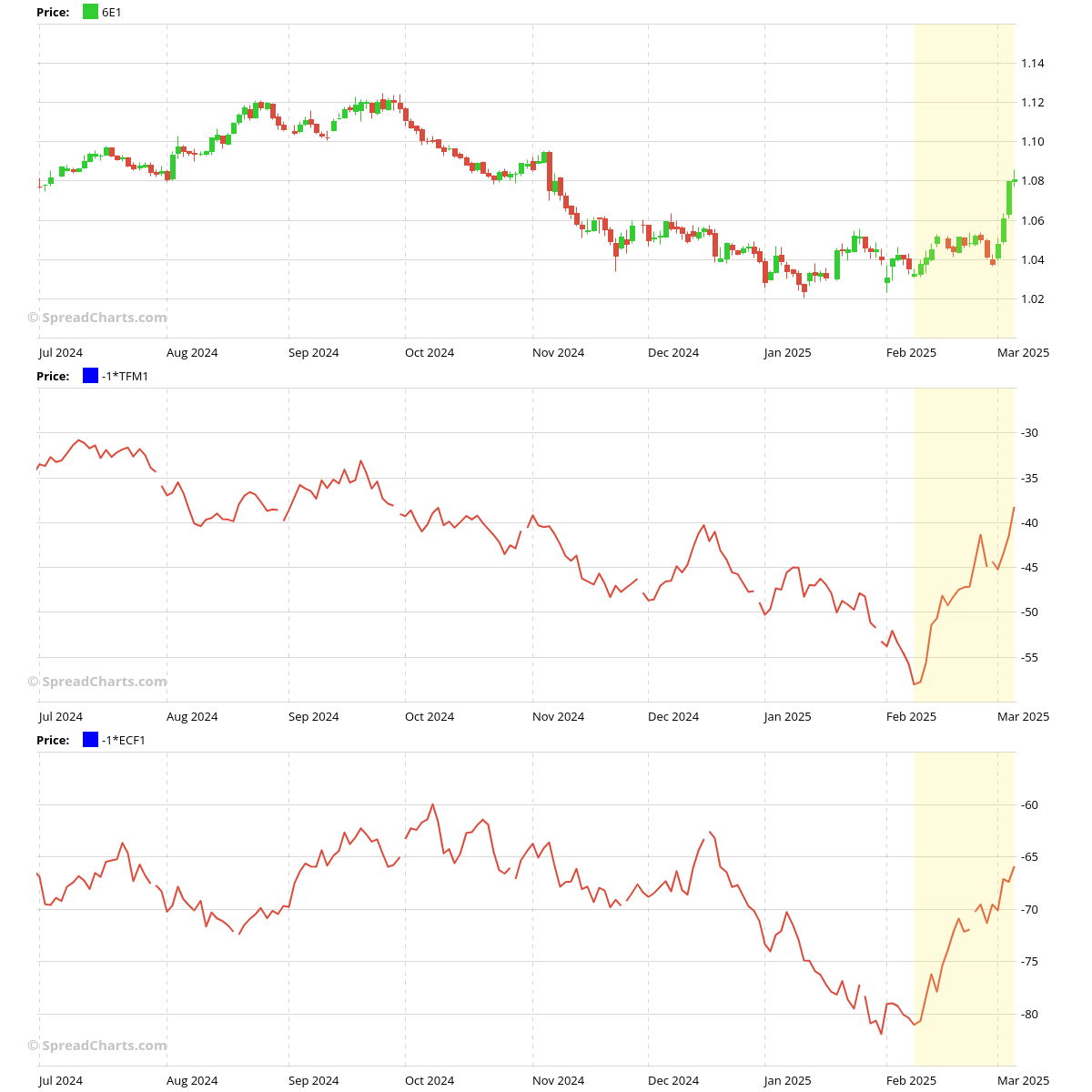

Falling vitality costs in Europe

TTF pure fuel and carbon costs have declined sharply (inverted within the chart above), easing stress on the Euro. Sure, short-term climate results now affect macro flows – welcome to Europe.

One which guidelines all of them

Nevertheless, all of those results change into irrelevant as soon as market situations worsen to the purpose of a liquidity disaster. At that second, margin calls begin coming, and asset managers dump their portfolios no matter value or elementary worth. We’re not there but, and there’s no assure that we’ll be.

A great illustration of this phenomenon was the COVID disaster in March 2020. Initially, the Greenback fell together with shares. However sooner or later, the correlation turned destructive, and the Greenback spiked greater whereas the fairness selloff accelerated.

Conclusion

So, what now? We don’t present funding recommendation, so everybody should align their technique with market actuality. Personally, I wouldn’t wager in opposition to the Greenback right here. When you want a clue, watch crude oil – examine the contango on the again finish of the curve, interdelivery spreads, cracks, and many others. Yow will discover all this knowledge within the SpreadCharts app.

Lastly, equities are in an fascinating spot. I gained’t attempt to formulate any opinions right here, as they’d be completely ineffective. I’m trying ahead to my Bayesian mannequin for the S&P 500 – the one which issued a powerful promote sign previous to this selloff. Its end-of-week output will likely be very fascinating, and naturally, we’ll ship it by means of a particular electronic mail discover to all premium customers over the weekend.

Get the premium model of SpreadCharts within the app or on our web site.