[ad_1]

Within the delicate balancing act between assembly the rising international demand for essential minerals and guaranteeing environmental accountability in useful resource extraction, processes and applied sciences that may obtain each goals are profitable within the eyes of junior explorers and buyers.

In copper mining, in-situ restoration (ISR) is rising as a cost-efficient and lower-impact various to open-pit and underground mining. ISR is a mining technique that extracts copper instantly from orebodies with out conventional excavation. Initiatives which might be amenable to the ISR course of, which entails injecting a leaching resolution into the bottom and recovering dissolved copper by means of wells, are attracting rising curiosity from miners and buyers alike.

This shift comes as the worldwide push for electrification accelerates copper demand throughout industries — from electrical automobiles and solar energy to grid growth and information infrastructure. Conventional copper mines, usually burdened by rising prices, deeper orebodies and environmental opposition, are struggling to satisfy this demand.

With diminished capital requirement, minimal floor disruption and faster allowing timelines, ISR represents a scalable and ESG-aligned method to copper extraction. Lively tasks within the US and Central Asia are already demonstrating ISR’s feasibility, and exploration is increasing into new areas the place the geology is appropriate.

ISR positive aspects momentum

Some of the compelling causes ISR is drawing investor curiosity is its potential to resolve a number of longstanding points in copper mining. Conventional mines are going through greater prices as they chase deeper and extra advanced orebodies. On the similar time, environmental and social opposition to disruptive mining practices is on the rise. ISR, by comparability, generates much less visible and bodily disturbance, usually making it extra palatable to regulators and communities.

ISR additionally gives scalability and suppleness. In areas the place appropriate geology exists, it allows smaller corporations to convey tasks on-line quicker and with fewer allowing delays.

Within the present market, the place provide chain pressures and copper shortage are high of thoughts, the flexibility to deploy a lower-cost extraction technique with fewer environmental dangers presents a powerful worth proposition.

A number of ISR copper tasks have already demonstrated industrial and technical viability. Within the US, the Florence copper challenge in Arizona, operated by Taseko Mines (TSX:TKO,NYSEAMERICAN:TGB), is advancing towards manufacturing with an estimated 85 million kilos of annual copper output and a pre-tax web current worth of greater than $1 billion.

Gunnison Copper’s (TSX:MIN,OTCQB:GCUMF) Gunnison copper challenge, additionally in Arizona, has accomplished allowing and begun phased implementation with minimal floor impression. Comparable ISR purposes are being examined in Kazakhstan and Chile, increasing the worldwide footprint of this expertise.

ISR-amenable geology

Not each copper deposit is suited to ISR.

Success relies on a selected set of geological and hydrogeological situations. The ore have to be permeable sufficient to permit the leaching resolution to stream and work together with copper minerals. It ought to ideally be situated beneath the water desk in a contained setting, lowering the danger of resolution migration outdoors the goal zone. Mineralogy issues too; minerals like chalcocite, that are extremely amenable to acid leaching, make the very best candidates.

Areas like Arizona and components of Central Asia have lengthy been recognised for these attributes. Now, new ISR frontiers are rising in Africa, the place nations comparable to Botswana provide favorable geology and a secure mining jurisdiction. Botswana’s Kalahari Copper Belt, specifically, is quickly attracting exploration curiosity for its sediment-hosted copper techniques and untapped ISR potential.

Cobre Restricted: Pioneering ISR within the Kalahari Copper Belt

Some of the promising ISR prospects in Botswana is being developed by Cobre Restricted (ASX:CBE), an ASX-listed junior explorer with a strategic footprint within the Kalahari Copper Belt. Via its flagship Ngami copper challenge, Cobre is positioning itself as a primary mover in ISR growth throughout the area.

The Ngami deposit meets key ISR standards. Metallurgical testing has confirmed that its copper-silver mineralisation — primarily fine-grained chalcocite — is very appropriate for acid leaching. Fracture mapping and pump assessments have demonstrated that the orebody is permeable, with robust fluid connectivity and competent bounding rock that may include resolution stream. A lot of the ore lies beneath the water desk, an important situation for efficient in-situ leaching.

“Our aim is to convey a scalable, low-impact copper challenge to life in Botswana, utilizing cutting-edge ISR expertise. This isn’t nearly producing copper — it’s about doing it smarter and extra sustainably,” stated CEO Adam Wooldridge.

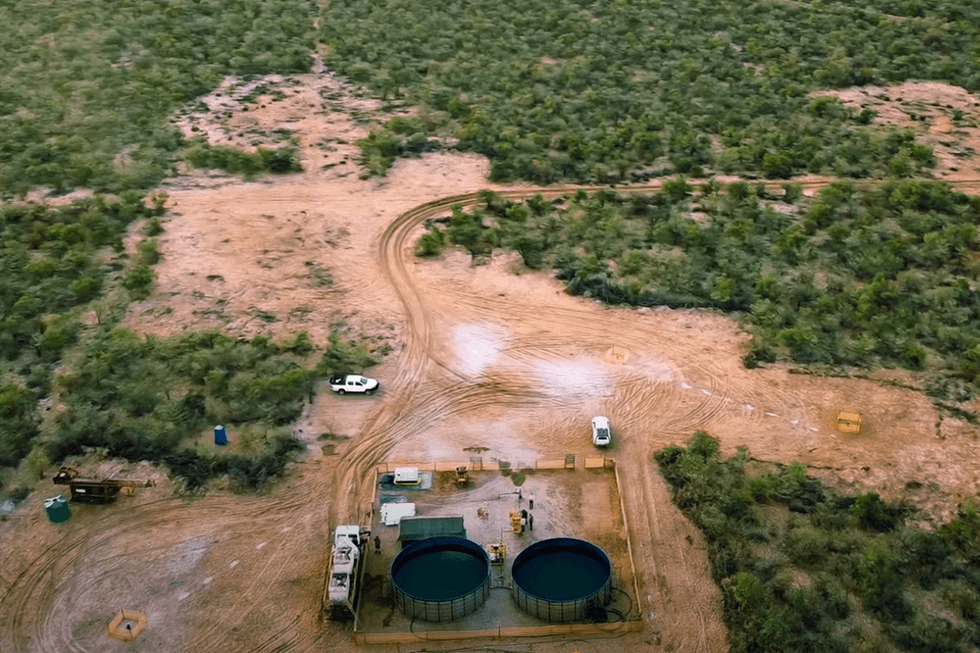

The corporate has already accomplished injection and pumping assessments, simulating fluid motion between wells to construct a three-dimensional mannequin of the orebody’s hydrology. Preliminary outcomes point out glorious permeability and fluid stream traits. Bottle roll assessments have yielded copper recoveries as excessive as 90.7 %, with low reagent consumption. As well as, long-term leach field assessments designed to simulate the in-situ surroundings have been efficiently accomplished with recoveries of as much as 82 % copper.

The corporate is backing this technical progress with a complete exploration and growth technique. It has outlined a major exploration goal, lately accomplished infill drilling to improve components of the useful resource into the JORC class, and is pursuing engineering and monetary modeling to help future feasibility research.

These milestones, coupled with an earn-in settlement with mining large BHP (ASX:BHP,NYSE:BHP,LSE:BHP), strengthen Cobre’s place as a reputable ISR innovator within the African area.

Investor takeaway

Cobre’s ISR method displays the broader pattern of aligning mineral extraction with ESG ideas. By minimising land disturbance, utilizing water-efficient techniques and lowering floor infrastructure, ISR suits properly into fashionable sustainability frameworks. In Botswana — a rustic ranked among the many high 10 mining jurisdictions, globally — Cobre can also be benefiting from robust institutional help and a transparent regulatory surroundings.

As copper demand continues to outpace conventional provide development, in-situ copper restoration gives a well timed and compelling various. For buyers searching for publicity to scalable, ESG-conscious mining alternatives, ISR is not simply an experimental technique; it’s a sensible resolution with rising momentum.

This INNspired article is sponsored by Cobre Restricted (ASX:CBE). This INNspired article offers info which was sourced by the Investing Information Community (INN) and authorized by Cobre Restricted with the intention to assist buyers be taught extra concerning the firm. Cobre Restricted is a shopper of INN. The corporate’s marketing campaign charges pay for INN to create and replace this INNspired article.

This INNspired article was written in line with INN editorial requirements to coach buyers.

INN doesn’t present funding recommendation and the knowledge on this profile shouldn’t be thought of a suggestion to purchase or promote any safety. INN doesn’t endorse or suggest the enterprise, merchandise, companies or securities of any firm profiled.

The data contained right here is for info functions solely and isn’t to be construed as a proposal or solicitation for the sale or buy of securities. Readers ought to conduct their very own analysis for all info publicly out there regarding the firm. Prior to creating any funding choice, it is suggested that readers seek the advice of instantly with Cobre Restricted and search recommendation from a certified funding advisor.

[ad_2]