Key Takeaways

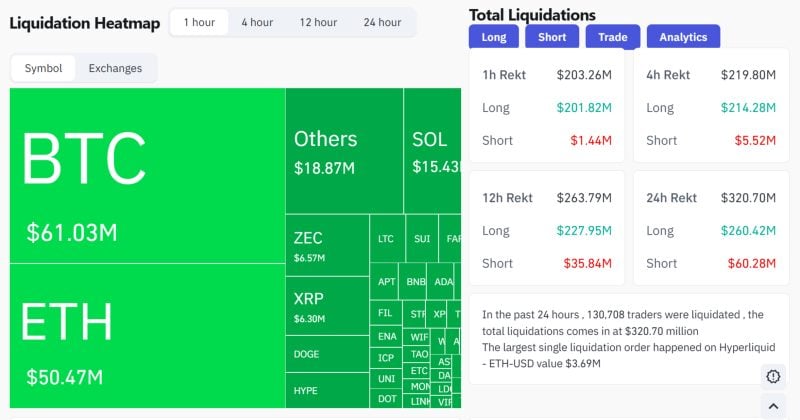

- Bitcoin’s latest worth plunge triggered about $200 million in liquidations of leveraged lengthy positions inside an hour.

- Liquidations happen when exchanges robotically shut positions to restrict additional losses for merchants who borrowed to wager on greater Bitcoin costs.

Share this text

Bitcoin fell from above $91,000 to $88,900 up to now hour, wiping out greater than $200 million in leveraged lengthy positions throughout the crypto market, in line with information from Coinglass and CoinGecko.

The sharp drop pressured computerized closure of positions the place merchants had borrowed funds to wager on rising Bitcoin costs. When costs fall under sure thresholds, exchanges robotically promote these positions to stop additional losses.

Bitcoin has prolonged latest losses into bear market territory, with ongoing fluctuations influenced by macroeconomic elements.

The decline comes after Bitcoin suffered its worst November in seven years, closing the month with an 18% drop. The digital asset hit a low of $82,100 earlier than resurging to above $92,00 earlier this week.