Municipals weakened additional Tuesday as U.S. Treasuries had been little modified and equities ended up.

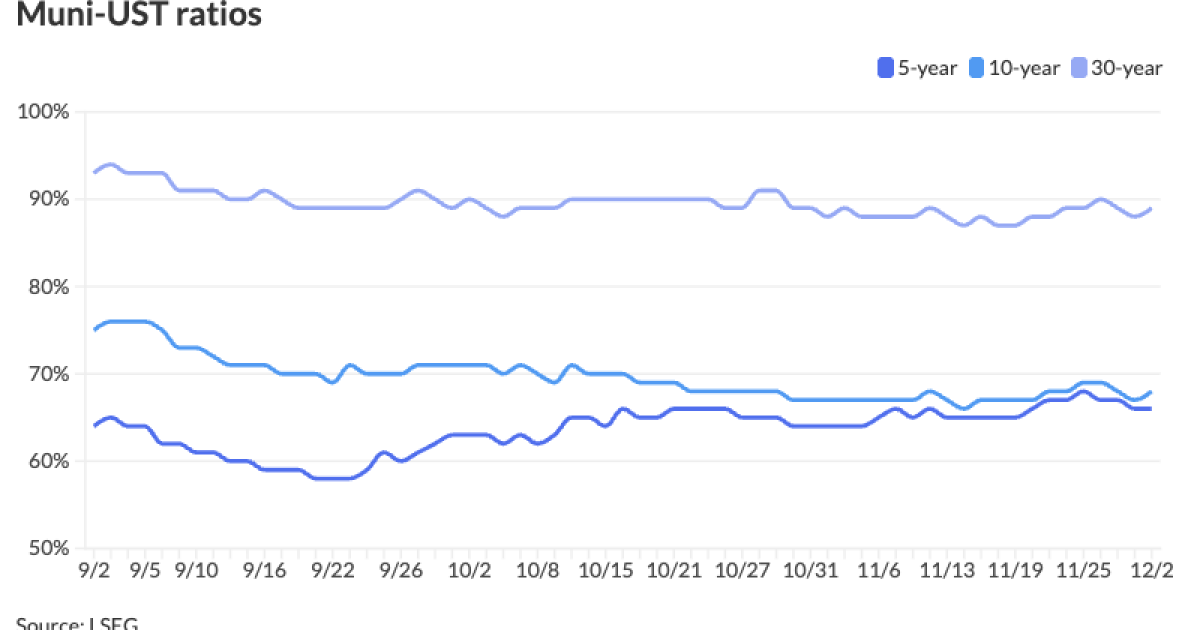

The 2-year muni-UST ratio Tuesday was at 70%, the five-year at 66%, the 10-year at 68% and the 30-year at 89%, in response to Municipal Market Knowledge’s 3 p.m. EDT learn. ICE Knowledge Companies had the two-year at 70%, the five-year at 66%, the 10-year at 68% and the 30-year at 88% at a 3 p.m. learn.

Munis noticed small cuts as soon as once more on Tuesday. This comes on the heels of muni yields remaining comparatively unchanged all through November “regardless of uncertainty concerning the reopening of the U.S. authorities, conflicting data from Federal Reserve policymakers and the wild swings in market sentiment concerning the prospects of one other charge lower,” stated Tim Iltz, a set earnings credit score and market analyst at HJ Sims.

Final month’s stability within the fastened earnings markets can “partially be attributed to the dearth of key financial knowledge throughout the shutdown and the continuation of long-term traits with structural labor market considerations and continued stubbornly excessive inflation,” he stated.

This week, the market will “waste no time” because the new-issue calendar soars to $16 billion, stated Chris Brigati, CIO and managing director of SWBC, and Ryan Riffe, SVP of capital markets on the agency.

“Enticing ratios, elevated reinvestment capital, and a stronger conviction of a December charge lower ought to assist the market take up the bigger calendar,” they stated.

Together with the sizable issuance this week, there are giant offers already on the calendar for the subsequent two weeks.

Subsequent week will see $1.003 billion of Chicago O’Hare Worldwide Airport common airport senior line refunding bonds, $997.76 million of multi-family housing income bonds from the New York Metropolis Housing Growth Corp. and $730 million of particular obligation income bonds from Alabama Freeway Authority.

A $1 billion fuel provide income bond deal from the Texas Municipal Gasoline Acquisition and Provide Corp. is about to cost as early as Dec. 9.

For the week of Dec. 15, the New York Metropolis Transitional Finance Authority is about to come back to market with $1.3 billion of future tax-secured subordinate refunding bonds.

The everyday year-end portfolio changes are anticipated to “present a strong backdrop for continued two-way exercise available in the market earlier than flows subside nearer to the Christmas vacation,” Brigati and Riffe stated.

Whereas traders had been nonetheless debating if the Fed would maintain charges regular at its December assembly only one week in the past, a charge lower is now virtually a certainty, stated Tom Kozlik, managing director and head of public coverage and municipal technique at HilltopSecurities.

“The Fed futures are pricing in near 100% chance and the announcement from San Francisco Fed President Mary Daly supporting a lower solely added gas to the hearth at the start of final week,” he stated.

The anticipated charge lower means the market’s urge for food for munis is prone to choose up, Kozlik stated.

Flows into muni mutual funds are likely to “choose up” when charge cuts are anticipated and December appears to be like like it would “match that sample,” he stated.

“Sturdy demand is probably going and thankfully sellers may have the stock to satisfy it,” Kozlik famous.

Within the major market Tuesday, J.P. Morgan priced for the San Francisco Airport Fee (Aa3/AA-//) $900.885 million of San Francisco Worldwide Airport second sequence income bonds. The primary tranche, $847.85 million of AMT Sequence 2025D bonds, noticed 5s of 5/2029 at 2.99%, 5s of 2030 at 3.00%, 5s of 2032 at 3.14%, 5.25s of 2055 at 4.81% and 5.5s of 2055 at 4.76%, callable 5/1/2035.

The second tranche, $53.035 million of non-AMT Sequence 2025E bonds, noticed 5s of 8/2045 at 3.98% and 5s of 2046 at 4.06%, callable 5/1/2035.

BofA Securities priced for Monroe County Industrial Growth Corp. (Aa3/AA-//) $224.495 million of income bonds (College of Rochester challenge). The primary tranche, $122.515 million of non-AMT Sequence 2025A bonds, noticed 5s of seven/2027 at 2.46%, 5s of 2030 at 2.49%, 5s of 2035 at 2.83%, 5s of 2040 at 3.48% and 5s of 2045 at 4.10%.

The second tranche, $101.98 million of taxable Sequence 2025B bonds, noticed all bonds at par: 4.105s of seven/2030 and 4.535s of 2033.

AAA scales

MMD’s scale was lower as much as three foundation factors: 2.50% (unch) in 2026 and a pair of.44% (unch) in 2027. The five-year was 2.43% (+2), the 10-year was 2.77% (+2) and the 30-year was 4.21% (+2) at 3 p.m.

The ICE AAA yield curve was lower as much as three foundation factors: 2.50% (+1) in 2026 and a pair of.47% (unch) in 2027. The five-year was at 2.43% (unch), the 10-year was at 2.78% (+1) and the 30-year was at 4.16% (+2) at 3 p.m.

The S&P World Market Intelligence municipal curve was lower as much as three foundation factors: The one-year was at 2.50% (unch) in 2025 and a pair of.44% (unch) in 2026. The five-year was at 2.42% (+2), the 10-year was at 2.77% (+2) and the 30-year yield was at 4.19% (+3) at 3 p.m.

Bloomberg BVAL was lower as much as two foundation factors: 2.50% (unch) in 2025 and a pair of.46% (unch) in 2026. The five-year at 2.40% (+1), the 10-year at 2.74% (+1) and the 30-year at 4.09% (+1) at 3 p.m.

Treasuries had been little modified.

The 2-year UST was yielding 3.511% (-2), the three-year was at 3.529% (-1), the five-year at 3.656% (-1), the 10-year at 4.086% (flat), the 20-year at 4.703% (flat) and the 30-year at 4.739% (flat) at 3:15 p.m.

Main to come back

Connecticut (Aa2/AA/AA/AAA/) is about to cost Wednesday $1.56 billion of transportation infrastructure functions particular tax obligation refunding bonds, Sequence 2025A. Raymond James.

The Utility Debt Securitization Authority, New York, (Aaa/AAA/AAA/) is about to cost Thursday $1.026 billion of restructuring bonds, consisting of $112.03 million of Sequence 2025 inexperienced bonds and $914.275 million of Sequence 2025 TE-2 bonds. BofA Securities.

Massachusetts (Aa1/AA+/AA+/) is about to cost Wednesday $1.019 billion of GOs, consisting of $750 million of Sequence 2025G bonds and $269.585 million of Sequence 2025B refunding bonds. BofA Securities.

The California Neighborhood Alternative Financing Authority (Aa1///) is about to cost $950 million of inexperienced clear vitality challenge income bonds, Sequence 2025G. Goldman Sachs.

The Battery Park Metropolis Authority (Aaa//AAA/) is about to cost Wednesday $662.285 million of senior income sustainability refunding bonds, RBC Capital Markets.

CPS Power (Aa2/AA-/AA-/) is about to cost Thursday $599.765 million of income refunding bonds, New Sequence 2026A. Jefferies.

The Maryland Well being and Greater Instructional Amenities Authority (Aa2/AA-/AA-/) is about to cost Wednesday $335.115 million of income bonds (The Johns Hopkins Well being System Difficulty), Sequence 2025A. J.P. Morgan.

Oakland (Aa2/AA-//) is about to cost Wednesday $333.99 million of Measure U GO bonds, consisting of $94.26 million of tax-exempt Sequence 2025B-1 bonds, $48.94 million of tax-exempt Sequence 2025 Refunding bonds, $180.745 million of taxable Sequence 2025B-2 bonds, and $10.045 million of taxable Sequence 2025B-3 bonds.

The Oklahoma Water Sources Board (/AAA//) is about to cost Thursday $261.81 million of state mortgage program income bonds, Sequence 2025C. BOK Monetary Securities.

The Pennsylvania Turnpike Fee (A1/AA-/AA-/) is about to cost Wednesday $206.595 million of motorcar registration price income bonds, Sequence 2025. BofA Securities.

The North Dakota Housing Finance Company (Aa1///) is about to cost Wednesday $185 million of non-AMT housing finance program social bonds (House Mortgage Finance Program), Sequence 2025C. RBC Capital Markets.

Ohio (Aa1/AA+/AA+/) is about to cost Wednesday $173.82 million of tax-exempt capital amenities lease-appropriation bonds, consisting of $89.59 million of psychological well being amenities enchancment fund initiatives, Sequence 2025A; $58.055 million of parks and recreation enchancment fund initiatives refunding bonds, Sequence 2025A; and $26.175 million of grownup correctional constructing fund initiatives refunding bonds, Sequence 2025C. Jefferies.

The Summit County Growth Finance Authority (/AA//) is about to cost Wednesday $157.595 million of BAM-insured pupil housing income bonds (PRG – Akron Properties LLC – The College of Akron Undertaking), consisting of $157.305 million of Sequence 2025A bonds and $209,000 of taxable Sequence 2025B bonds. RBC Capital Markets.

The Arkansas Growth Finance Authority (/AAA/AAA/) is about to cost Wednesday $150 million of revolving mortgage fund income bonds, Sequence 2026. Stephens Inc.

CSU Strata (/BB+//) is about to cost Thursday $144.435 million of pupil housing income bonds (The Prospect Undertaking), consisting of $137.15 million of Sequence 2025A bonds and $7.285 million of subordinate Sequence 2025B bonds. Morgan Stanley.

The South Carolina Jobs-Financial Growth Authority (/A+//) is about to cost Thursday $132.79 million of credit-enhanced residential growth income bonds (Sixteenth Ground Obligated Group Initiatives), Sequence 2025. KeyBanc Capital Markets.

Fort Price Impartial College District (Aaa///) is about to cost Thursday $131.54 million of PSF-insured limitless tax refunding bonds, Sequence 2025A. BofA Securities.

The Public Finance Authority (/AA//) is about to cost Thursday $120.24 million of BAM-insured pupil housing income bonds (PRG – Oxford Properties LLC Undertaking), consisting of $117.59 million of Sequence 2025A and $2.65 million of Sequence 2025B. Raymond James.

Irving Impartial College District (/AAA//) is about to cost Wednesday $118.655 million of PSF-insured limitless tax refunding bonds. BOK Monetary Securities.

The Eagle Mountain-Saginaw Impartial College District (Aaa//AAA/) is about to cost $112.775 million of PSF-insured limitless tax refunding bonds, Sequence 2025-A. Mesirow Monetary.

Aggressive

The California Infrastructure and Financial Growth Financial institution (Aaa//AAA/) is about to promote $554.625 million of inexperienced clear water and consuming water state revolving fund income bonds at 11:30 a.m. Japanese Thursday.

King County, Washington, (/AAA//) is about to promote $234.170 million of restricted tax GOs and refunding bonds, Sequence 2025B, at 10:45 a.m. Wednesday, and $118.035 million of taxable restricted tax GOs, Sequence 2025C, at 11:15 a.m. on Wednesday.

St. Petersburg, Florida, (Aa2//AA/) is about to promote $127.940 million of public utility income bonds, Sequence 2025C, at 10:30 a.m. Wednesday.

The Moorestown Township Board of Schooling is about to promote $108.298 million of faculty bonds at 11 a.m. Wednesday.