The gold worth noticed unimaginable features in 2025, rising from US$2,600 per ounce to a report excessive of over US$4,300.

Gold has moved to larger floor in practically each month of 2025, and is on observe for its greatest annual acquire in 46 years.

Numerous components have lent assist, together with ongoing geopolitical instability in Japanese Europe and the Center East, US President Donald Trump’s risky commerce insurance policies and the ensuing uncertainty in international monetary markets. A reversal within the US Federal Reserve’s financial coverage is one other main issue that has influenced the gold worth this 12 months.

Learn on for extra on what moved the gold worth in every of the 12 months’s 4 quarters.

Gold worth in This fall

The gold worth started This fall at US$3,865.10, however rapidly shot to an all-time excessive of US$4,379.13 on October 17. The surge was fueled by numerous circumstances supportive of safe-haven demand and retailer of worth.

First up was the deepening commerce battle between the US and China.

In response to US lawmakers demanding broader bans on gear gross sales to Chinese language chipmakers, President Xi Jinping’s authorities introduced additional uncommon earth factor export restrictions. The motion spurred Trump to reply by threatening 100% tariffs on Chinese language items and export controls on vital software program.

Different forces behind gold’s spectacular rally within the fourth quarter embody the US authorities shutdown and expectations that the Fed would start lowering rates of interest. On the similar time, central banks continued to be internet patrons of gold amid elevated gold exchange-traded funds (ETF) inflows.

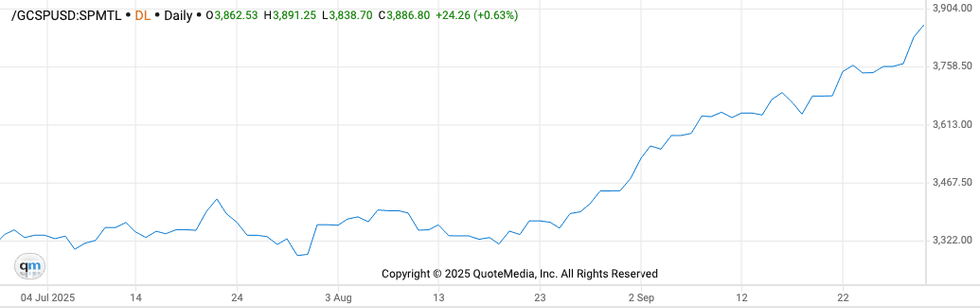

Gold worth, This fall 2025.

Chart by way of the Investing Information Community.

By October 27, the value of gold had fallen to its quarterly low of US$3,897.30. Nevertheless, the yellow steel managed to rise once more, closing out the month above the US$4,000 degree.

Gold took one other run at its report excessive within the second week of November because the longest US authorities shutdown in historical past got here to an finish and labor market weak point within the US primed expectations of additional Fed price cuts in December. The dear steel reached US$4,242.50 on November 13 earlier than falling again beneath US$4,100 the subsequent day.

The long-delayed launch of the September US jobs knowledge on November 20 additionally positioned downward strain on gold because the numbers had been stronger than anticipated. Nonfarm payrolls elevated by 119,000, greater than double the 50,000 acquire analysts had projected. The report lowered expectations of a Fed price reduce in December.

The value of gold fell as little as US$4,022 the subsequent day. Nevertheless, the final week of November noticed gold on one other upward pattern. Market watchers predict the Fed to as soon as once more reduce rates of interest at its December 9 assembly. The prospect of decrease rates of interest is weakening the US greenback and therefore strengthening the funding case for gold.

New York Fed President John Williams mentioned continued weak point within the labor market makes the case for a December price reduce possible, whereas Fed Governor Christopher Waller additionally talked about a December reduce can be acceptable.

Whereas the US Division of Labor won’t be releasing an October jobs report as a result of authorities shutdown, a report from job placement agency Challenger, Grey & Christmas reveals that US employers shed 153,074 jobs in October. That’s up 183 % from September 2025 and 175 % from October 2024.

The newest client confidence survey additionally hasn’t helped, particularly since numbers have been down for 10 consecutive months, signaling the potential for a recession. “Client confidence tumbled in November to its lowest degree since April after transferring sideways for a number of months,” mentioned Dana M. Peterson, chief economist on the Convention Board. “All 5 elements of the general index flagged or remained weak.”

On November 28, gold returned to buying and selling above the US$4,200 degree. By December 1, it had reached its highest degree in six weeks, at US$4,263 earlier than settling all the way down to US$4,237 on the finish of the buying and selling day.

How did gold carry out for the remainder of the 12 months?

Gold worth in Q1

Gold gained 20 % in Q1 and closed above US$3,000 for the primary time ever on March 18. The dear steel’s sturdy efficiency through the interval is linked to international uncertainty surrounding Trump’s second time period.

Commerce coverage was on the middle of these considerations. Quickly after his inauguration, the Trump administration utilized tariffs to imports from Canada and Mexico, solely to press pause two days later and delay implementation till March.

The seesaw between on-again, off-again tariff bulletins continued all through the quarter alongside rising tensions within the Center East and Japanese Europe, including to market instability and bolstering gold’s safe-haven enchantment. This was extremely evident in what the Phrase Gold Council (WGC) referred to as “sturdy international inflows” into gold ETFs.

Gold worth, Q1 2025.

Chart by way of the Investing Information Community.

“There was an enormous spike within the motion of bodily gold from all over the world into US depositories,” mentioned David Barrett, CEO of EBC Monetary Group UK, in feedback to the Investing Information Community (INN).

“This appears to have been pushed by the worldwide political stress and potential tariff impacts. The quantities concerned have brought on disruption in the actual demand and promoted new patrons as nicely,”

Gold worth in Q2

The gold worth continued to set new report highs within the second quarter of 2025, breaking via the US$3,500 degree briefly on April 21 earlier than closing the quarter barely decrease at US$3,434.40.

Trump’s tariffs had been as soon as once more the primary theme influencing the steel’s features via the quarter. On April 2, Trump declared “Liberation Day,” an govt order making use of tariffs on a broad vary of imports coming from most US commerce companions. The next international market meltdown brought on US debt holders, comparable to Japan and Canada, to promote US treasuries, which led to larger yields on 10 12 months bonds. Traders in flip sought the protection of gold.

On the again of these components, the WGC’s June ETF report reveals that ETF flows within the first half of 2025 had been the best semiannual inflows for the reason that first half of 2020.

Gold worth, Q2 2025.

Chart by way of the Investing Information Community.

“The bond market understands that Washington is so damaged and the debt state of affairs is so dangerous,” defined Chris Temple, founder, editor and writer of the Nationwide Investor, in a June 19 interview with INN. “It varies in levels in comparison with different nations, however all people’s in the identical boat. That’s why gold rapidly … gold is the protected haven now, much more than treasuries. And I do not suppose lots of people each thought they’d see that once more.”

Gold worth in Q3

Gold set one other report throughout Q3, rising over 15 % to a quarterly excessive of US$3,858.41 on September 30.

The substantial rally was attributed to declining yield curves, US financial coverage and the weakening greenback. Gold historically has had an inverse relationship to the greenback, and a pattern that has benefited the steel immensely this 12 months.

On this vein, the 25 foundation level rate of interest reduce from the Consumed September 17 was a serious catalyst. Some analysts imagine it’s a sign to buyers that the financial system could also be on the verge of a stagflationary atmosphere.

That is mirrored in WGC’s reporting of report ETF inflows to the tune of US$26 billion for the third quarter, with North American markets accounting for US$16.1 billion.

Gold worth, Q3 2025.

Chart by way of the Investing Information Community.

“On the coronary heart of all of it is a query across the position of the greenback, the position of dollar-based belongings and diversification in portfolios. And that’s the place individuals are taking a look at alternate options. Alternate options that can provide you safe-haven traits like gold,” Joe Cavatoni, the WGC’s senior market strategist, Americas, mentioned in a mid-September INN interview.

Investor takeaway

Secure-haven funding demand has been the important thing driver for gold in 2025.

Traders have sought refuge in treasured steel all year long as geopolitical tensions, Trump-related commerce turmoil and a worsening financial outlook have sparked volatility within the inventory market.

Within the first three quarters of the 12 months, the WGC reported 1,556 metric tons of gold funding demand, representing US$161 billion in gold belongings. That’s solely 6 % beneath the report reached within the first three quarters of 2020.

Central banks have continued to extend their bodily holdings as a possible buffer in opposition to a worldwide financial downturn. The most up-to-date knowledge on central financial institution gold shopping for from the WGC reveals that they added 634 metric tons of gold to their coffers through the first three quarters, with greater than one-third of these purchases occurring in Q3.

Because the situations for gold’s present year-long rally develop into additional entrenched, buyers can fairly anticipate this 12 months’s story to be subsequent 12 months’s story, however with even larger gold costs.

Do not forget to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t replicate the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Web site Articles

Associated Articles Across the Internet