Should you’ve been across the markets lengthy sufficient, you’ll discover a humorous factor: Some corporations are so beloved that folks cease asking whether or not the inventory is definitely definitely worth the value. They simply assume it’s.

Netflix (Nasdaq: NFLX) is a type of corporations.

It’s the streaming big that modified how the world watches TV, and it retains reinventing itself with new content material, new tech, and now even stay sports activities. The query is… with shares working scorching once more, is Netflix nonetheless purchase? Or are traders simply paying up for nostalgia?

The corporate’s second quarter outcomes give us a lot to chew on.

Income got here in at $11.1 billion, up 16% from final 12 months. Working margin was a large 34%, up from 27% a 12 months in the past. Earnings per share climbed to $7.19 – practically 50% increased than the second quarter of final 12 months – and free money stream was $2.3 billion, nearly double final 12 months’s inflows.

Administration nudged full-year steerage increased, now anticipating $44.8 billion to $45.2 billion in income and $8 billion to $8.5 billion in free money stream. Progress is being fueled by regular subscriber positive aspects, value hikes, and an advert enterprise that’s on monitor to double gross sales this 12 months.

That’s no small feat for an organization of Netflix’s dimension.

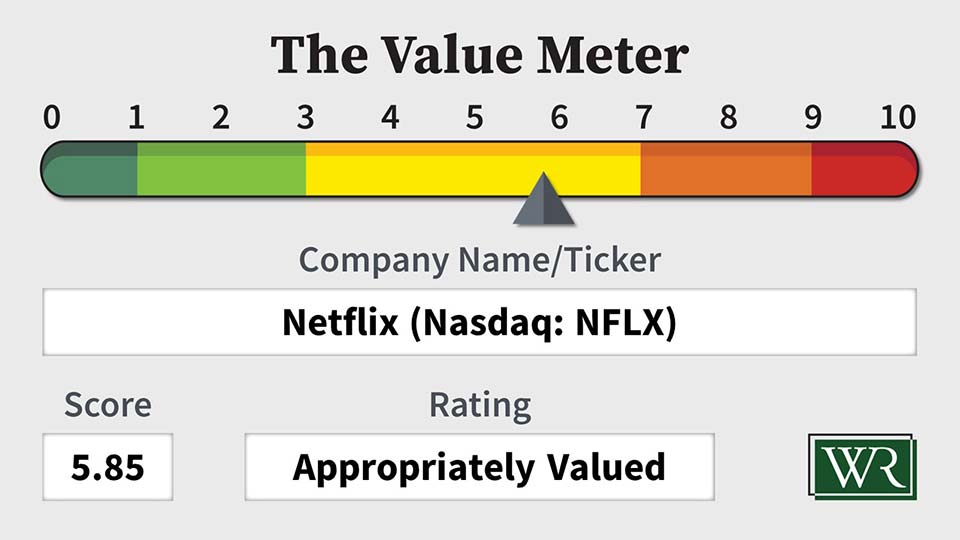

However as at all times, The Worth Meter cuts by way of the hype by three easy questions: How a lot do you pay for the enterprise relative to its belongings? How effectively does it flip these belongings into free money? And the way constantly does it generate that money?

Right here’s what the numbers say.

Netflix’s enterprise value-to-net asset worth (EV/NAV) sits at 21.6, greater than 3 times the peer common of 6.5. That’s a steep premium. However traders are clearly prepared to pay up for Netflix’s content material engine and model energy.

It is smart when you think about the corporate’s effectivity. Its free money flow-to-net asset worth (FCF/NAV) ratio is 6.7%, in contrast with the typical firm, which runs damaging at -2.0%.

But it surely’s not nearly whether or not Netflix makes cash every quarter – loads of corporations can do this. It’s additionally about how usually free money stream truly grows from one quarter to the subsequent.

Netflix has posted constructive quarter-over-quarter FCF progress in 5 of the previous 11 quarters. That’s roughly 45.5% consistency, nearly precisely in keeping with the peer universe at 46.2%.

In different phrases, the corporate isn’t a standout, nevertheless it’s not lagging both. Its money technology has been regular sufficient to justify Wall Road’s willingness to pay a premium.

Over the previous 12 months, Netflix shares have rewarded believers. The inventory has climbed strongly, fueled by better-than-expected margins.

You may see on the backside of the chart that Netflix’s 45-day relative energy index (a metric I just lately analyzed for Oxford Membership Members in The Oxford Perception) is under 50 proper now. Readings underneath 50 are likely to sign good shopping for alternatives from a strictly technical perspective.

[Editor’s Note: If you’re a Member of The Oxford Club, which is the publisher of Wealthy Retirement, you already have access to The Oxford Insight, our Members-only e-letter. Click here to read Anthony’s article from last week on the relative strength index.]

Nevertheless, Netflix’s latest positive aspects additionally imply expectations are sky-high.

So what do now we have?

On one hand, you’re paying high greenback. On the opposite, you’re shopping for an organization that reliably turns belongings into money and has a protracted runway with international content material, promoting, and stay programming.

The underside line: Should you’re in search of a screaming cut price, Netflix isn’t it. The valuation premium is actual. But it surely’s not loopy both. The money stream appears to assist it.

It is a inventory that has matured from “excessive progress” to “regular compounder” at this stage of its existence. For long-term traders, persistence is smart right here.

The Worth Meter charges Netflix as “Appropriately Valued.”

What inventory would you want me to run by way of The Worth Meter subsequent? Submit the ticker image(s) within the feedback part under.