When most folk hear “pure sources,” they image oil wells and fuel rigs. However the true useful resource driving the subsequent decade isn’t liquid fuels.

It’s the obscure minerals that energy trendy tech – particularly “uncommon earth parts,” that are used within the ultra-strong magnets inside electrical automobile motors and wind generators. Proper now, China dominates over 90% of worldwide market share, which is why the West is scrambling to construct safe provide at house.

That backdrop places a highlight on NioCorp Developments (Nasdaq: NB). Consider NioCorp as a small-cap lever on a number of essential supplies that the U.S. nonetheless largely imports.

The corporate is advancing a challenge close to Elk Creek in Nebraska to supply minerals like niobium, scandium, and titanium, and it’s evaluating whether or not so as to add one other class of supplies known as “magnetic uncommon earth oxides.” These embrace neodymium-praseodymium, dysprosium, and terbium.

Washington is paying consideration. In August, the Pentagon awarded as much as $10 million below the Protection Manufacturing Act to assist NioCorp’s Elk Creek unit develop a home scandium provide chain.

However there’s an issue. The corporate is pre-revenue and nonetheless in growth.

In its newest quarterly report, money and equivalents had been simply $1.3 million, and administration disclosed substantial doubt concerning the firm’s means to proceed at its present tempo with out further financing. The nine-month money movement assertion confirmed working money outflows of $5.9 million, offset solely by financing raises.

On the funding entrance, NioCorp has reported progress in its utility for roughly $800 million from the U.S. Export-Import Financial institution, however that continues to be in preliminary levels.

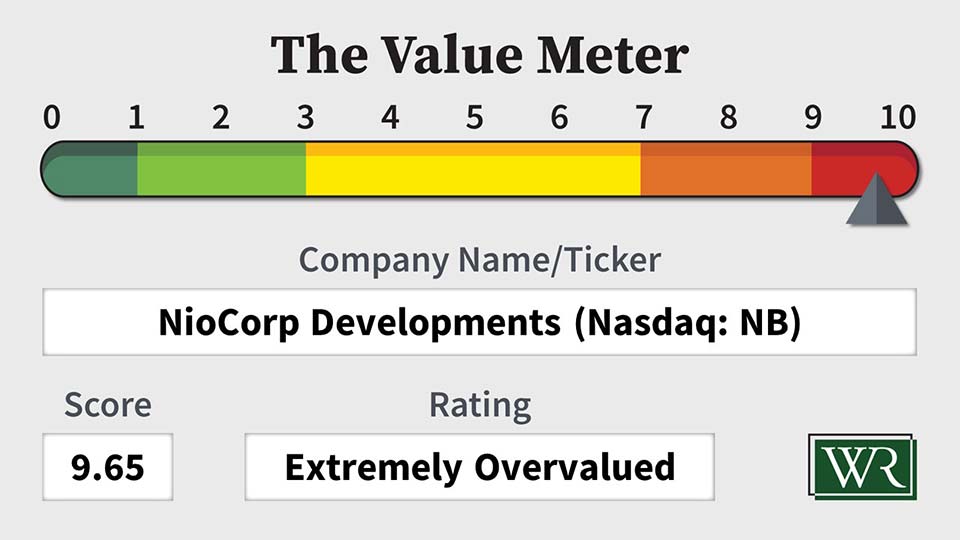

Once we put these info by The Worth Meter, the numbers inform a stark story.

The corporate’s enterprise value-to-net asset worth ratio stands at 322.2, in contrast with a peer universe common of 6.53. Which means buyers right this moment are paying $322 for each $1 of internet property – an excessive premium in contrast with NioCorp’s friends.

Free money flow-to-net asset worth is -291.7%, in contrast with a peer common of -2.0%, reflecting the heavy money burn relative to property. Over the previous 12 quarters, the pattern in free money movement enchancment is roughly consistent with friends at 45.5% versus 46.2%, however that also represents enchancment off a destructive base.

Briefly, the corporate has not produced sustained optimistic free money movement up to now three years, which implies the enterprise mannequin stays a guess on future financing and execution slightly than a mirrored image of present money returns.

Regardless of this, the inventory has delivered fireworks. Shares are up greater than 200% yr thus far.

These are the sorts of strikes which can be pushed by coverage headlines and shortage enthusiasm greater than underlying fundamentals. Momentum merchants can experience that wave for some time, however value-oriented buyers would do finest to remain clear.

That is the place perspective issues.

I like the theme. The West wants safe provides of niobium, scandium, and uncommon earths, and NioCorp is likely one of the few U.S. names attempting to construct them. Plus, the DoD grant and NioCorp’s curiosity earnings from its financing actions are actual tailwinds.

However value nonetheless issues. At right this moment’s ranges, our Worth Meter framework says you’re paying an excessive premium for property that also want years of capital and flawless execution earlier than they start producing money.

Shares which can be this stretched can – and infrequently do – hold working, however that’s a dealer’s recreation, not a worth investor’s. In my expertise, restraint beats worry of lacking out.

The Worth Meter charges NioCorp Developments as “Extraordinarily Overvalued.”

What inventory would you want me to run by The Worth Meter subsequent? Put up the ticker image(s) within the feedback part beneath.