Apollo Silver Corp. (” Apollo ” or the ” Firm “) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF0) is happy to announce the outcomes of an up to date impartial Mineral Useful resource estimate (“MRE”) for its Calico Silver Challenge (“Calico” or the “Calico Challenge”) positioned in San Bernardino County, California. Complete silver (“Ag”) Measured & Indicated (“M&I”) tonnes on the Waterloo property have elevated by 61% to a complete of 55 million tonnes (“Mt”) at a grade of 71 grams per tonne (“gt’) Ag for a complete content material of 125 million troy ounces (“Moz”). This represents a 14% improve in Ag ounces in comparison with the earlier MRE (dated March 6, 2023). Along with updating the gold useful resource at Waterloo, inaugural barite (“BaSO4”) and zinc (“Zn”) assets have been included in each the Indicated and Inferred classes.

Information Highlights

- New mixed Measured and Indicated whole of 55 Mt at a grade of 71 g/t Ag for a complete of 125 Moz Ag

- 61% improve in tonnage and a 14% improve in Ag ounces representing a rise of 15 Moz contained Ag

- Inferred whole of 0.6 million tonnes at a grade of 26 g/t Ag for a complete of 0.51 Moz contained Ag

- Sensitivity analyses present resiliency of the Ag useful resource to modifications in steel worth

- Inaugural BaSO 4 and Zn assets are estimated as:

- Indicated: 36 Mt @ 7.4% BaSO 4 and 0.45% Zn for a complete content material of two.7 Mt BaSO 4 and 354 million kilos (“Mlbs”) Zn

- Inferred: 17 Mt @ 3.9% BaSO 4 and 0.71% Zn for a complete content material of 0.65 Mt BaSO 4 and 258 Mlbs Zn

- Gold ounces have elevated by 86% within the Inferred class for a brand new whole of 17 Mt at a grade of 0.25 g/t Au and whole Au content material of 0.13 Moz

- One single pit for all metals at Waterloo deposit with a low strip ratio of 0.8:1

- The elevated portions of Ag and Au, the addition of two new important minerals, and the bigger single pit with low strip ratio has derisked the Calico Challenge

Additional Progress Alternatives

- Silver : There stay additional alternatives to develop the Ag mineralization beneath the bottom of the 2025 MRE within the northern area of the Waterloo deposit.

- Barite and Zinc : The indicated and inferred mineral assets for BaSO 4 and Zn present clear potential to be upgraded into M&I by way of infill drilling and re-assays.

- Gold : Mineralization stays open alongside strike and at depth. Future work will goal extra mineralization alongside strike with a selected concentrate on the high-grade constructions.

- Langtry Property : Many areas underneath the Quaternary cowl stay untested. As well as, the potential for BaSO 4 and different metals haven’t but been evaluated intimately at Langtry.

Ross McElroy, President and CEO for Apollo, commented: ” The Calico Challenge continues to extend in worth, scale and optionality. Already boasting one of many largest undeveloped silver deposits within the US, new information confirms the presence of extra minerals, akin to barite and zinc, that are included on the US important mineral record. These findings will contribute to our challenge growth plans, together with an upcoming Preliminary Financial Evaluation (PEA). Notably, a lot of the mineralization happens at shallow depths, leading to a low financial strip fee. With a considerable land place, there may be sturdy potential for additional discoveries at Calico. ”

CALICO PROJECT 2025 MINERAL RESOURCE ESTIMATE

The 2025 MRE centered on upgrading and increasing the Waterloo useful resource estimate from that declared in 2023 (see information launch dated March 6, 2023). Probably the most important change within the 2025 MRE is the addition of BaSO4 and Zn to the Ag and Au mineral assets for the Waterloo deposit and up to date mineral useful resource estimate cut-off (“COG”) grades for each the Waterloo and Langtry deposits. The Waterloo MRE now incorporates 125 Moz Ag in 55 Mt at a median grade of 71 g/t Ag in M&I classes, and 0.51 Moz Ag in 0.6 Mt at a median grade of 26 g/t Ag within the Inferred class. The Langtry MRE now incorporates 57 Moz Ag in 24 Mt at a median grade of 73 g/t Ag within the Inferred class.

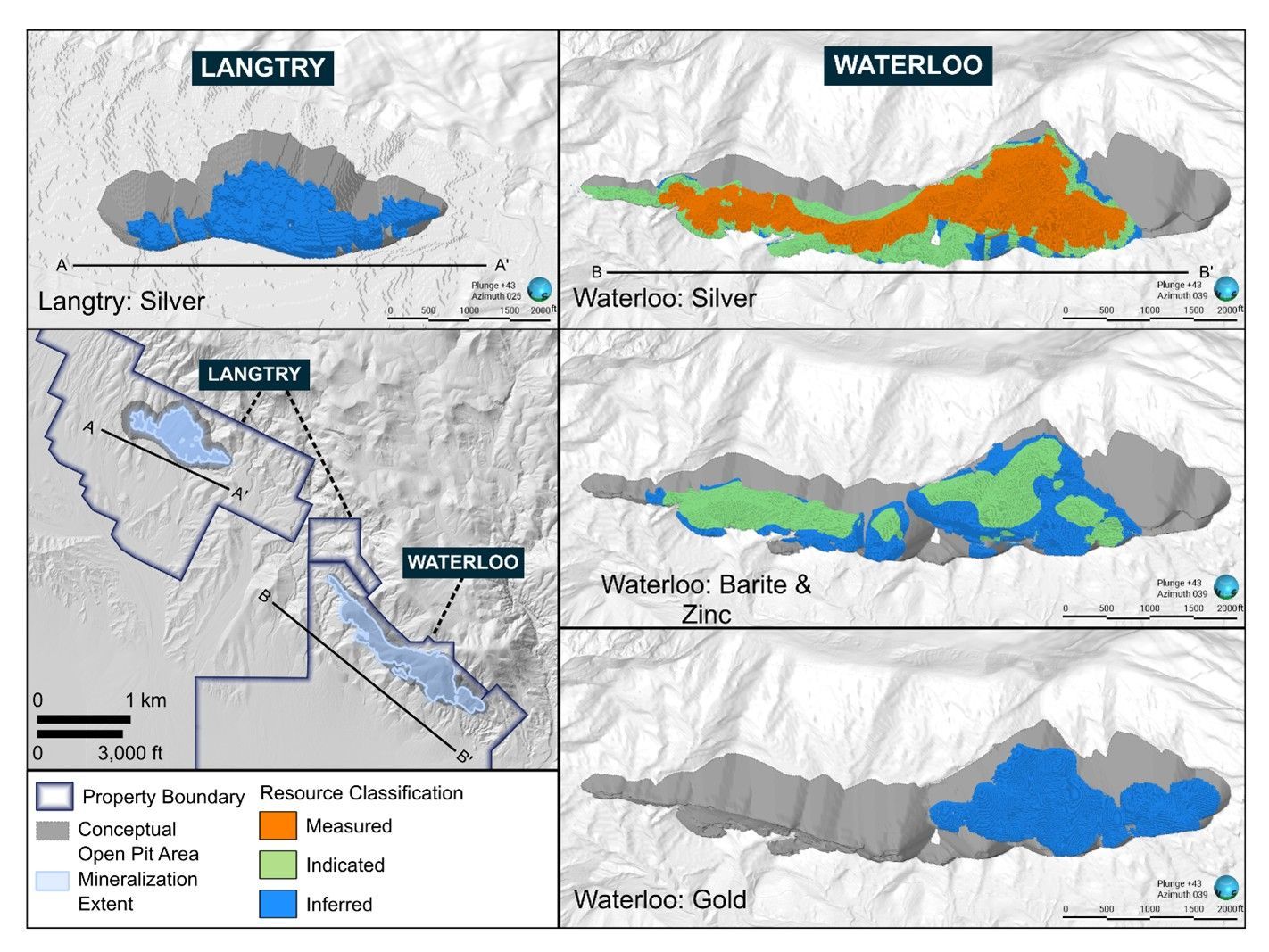

Along with its sturdy Ag useful resource, the Waterloo useful resource now incorporates 2.7 Mt BaSO4 and 354 Mlbs Zn in 36 Mt at a median grade of seven.4 % BaSO4 and 0.45 % Zn within the Indicated class, and 0.65 Mt BaSO4 and 258 Mlbs Zn in 17 Mt at a median grade of three.9 % BaSO4 and 0.71 % Zn within the Inferred class. Additionally, 0.13 Moz oxide Au contained in 17 Mt at a median grade of 0.25 g/t Au within the Inferred class. Oxide Au mineralization has been drilled over 1,000 m strike size and stays open in a number of instructions. Figures 1 and a pair of current the mineral useful resource block mannequin grade and classification for every of the metals, respectively.

Mineralization at Waterloo and Langtry is shallow and exhibits excessive continuity alongside the 1.8 km lengthy strike size at Waterloo and 1.25 km at Langtry of the deposit. The 2025 MRE is calculated to a most open pit depth of roughly 192 m (630 ft) at Waterloo and roughly 149 m (490 ft) at Langtry for all metals. An open pit optimization is used to find out cheap prospects for financial extraction, the calculated waste to mineralization tonnage ratio for the entire useful resource at Waterloo is 0.8:1and 2.8:1 at Langtry.

Desk 1: Calico Challenge 2025 MRE. Efficient June 30, 2025.

| Valuable Metals | ||||||||||

| Deposit | Steel | Class | Cutoff | Imperial Items | Metric Items | Contained Steel | ||||

| Grade | Quantity (Myd 3 ) |

Tons | Grade | Quantity (Mm 3 ) |

Tonnes | Grade | Moz | |||

| (g/t) | (Mst) | (oz/st) | (Mt) | (g/t) | ||||||

| Waterloo 1 | Silver | Measured | AgEQ ≥ 47 | 23 | 48 | 2.2 | 18 | 43 | 75 | 104 |

| Indicated | 6.3 | 13 | 1.7 | 4.8 | 12 | 57 | 21 | |||

| Measured + Indicated | 29 | 61 | 2.1 | 22 | 55 | 71 | 125 | |||

| Inferred | 0.32 | 1.0 | 0.77 | 0.25 | 0.60 | 26 | 0.51 | |||

| Gold | Inferred | AgEQ ≥ 47 | 5.3 | 11 | 0.01 | 4.1 | 10 | 0.2 | 0.07 | |

| AgEQ | 3.6 | 7.5 | 0.01 | 2.8 | 6.8 | 0.3 | 0.06 | |||

| Inferred Complete | 8.9 | 18.4 | 0.01 | 6.9 | 17 | 0.25 | 0.13 | |||

| Langtry 2 | Silver | Inferred | Ag ≥ 43 | 13 | 27 | 2.1 | 9.9 | 24 | 73 | 57 |

| Base and Industrial Metals | |||||||||||

| Deposit | Steel | Class | Cutoff | Imperial Items | Metric Items | Contained Steel | |||||

| Grade | Quantity (Myd 3 ) | Tons | Grade | Quantity (Mm 3 ) | Tonnes | Grade | Mlbs | Mt | |||

| (g/t) | (Mst) | (%) | (Mt) | (%) | |||||||

| Waterloo 1 | Barite | Indicated | AgEQ ≥ 47 | 19 | 40 | 7.4 | 15 | 36 | 7.4 | – | 2.7 |

| Inferred | 8.9 | 18 | 3.9 | 6.8 | 17 | 3.9 | – | 0.65 | |||

| Zinc | Indicated | AgEQ ≥ 47 | 19 | 40 | 0.45 | 15 | 36 | 0.45 | 354 | – | |

| Inferred | 8.9 | 18 | 0.71 | 6.8 | 17 | 0.71 | 258 | – | |||

- Ounces reported as troy ounces.

- Base-case useful resource estimate reported in Desk 1 utilizing 47 g/t Ag equal (“AgEQ”) and 0.17 g/t Au cut-off grades for Waterloo and 43 g/t Ag for Langtry.

- CIM definitions are adopted for classification of the mineral useful resource.

- For the Waterloo Property, a AgEQ cut-off grade was calculated utilizing the next variables: floor mining working prices (US$2.8/st), processing prices plus basic and administrative value (US$26.5/st), Ag worth (US$28/oz), BaSO 4 worth (US$120/t), Zn worth (US$1.22/lb), Au worth (US$2,451/oz), and steel recoveries (Ag 65%, Au 80%, BaSO 4 85%, Zn 80%). For the Waterloo Property gold-only assets the Au cut-off grade was calculated utilizing above Au worth, Au restoration and gold-only processing prices plus basic and administrative value (US$8.2/st).

- For the Langtry Property, a silver-only equal cut-off grade was calculated utilizing above Ag worth, Ag restoration and silver-only processing prices plus basic and administrative value (US$24/st).

- Sources reported in Desk 1 are constrained to inside a conceptual financial pit shell concentrating on mineralized blocks inside the specified cutoff grade limits proven within the desk. Particular gravity for the mineralized zone is fastened at 2.44 t/m 3 (13.13 ft 3 /st). For the Waterloo Property solely the next drillhole grades have been capped previous to estimation: Ag 450 g/t, Au 2 g/t, Ba 31% and Zn 7%.

- Totals might not characterize the sum of the elements attributable to rounding.

- 1,2 The 2025 MRE has been ready by Derek Loveday, P. Geo., of Stantec Consulting Providers Ltd., an impartial Certified Particular person, in co-operation with Mariea Kartick, P.Geo. (impartial Certified Particular person for drilling information QA/QC) and Johnny Marke P.G. (impartial Certified Particular person for useful resource estimation). The 2025 MRE was produced in conformance with NI 43-101. Mineral assets usually are not mineral reserves and would not have demonstrated financial viability. There is no such thing as a certainty that any mineral useful resource might be transformed right into a mineral reserve.

- No drilling was accomplished on the Waterloo Property and Langtry Property for the reason that declaration of the 2023 MRE for Waterloo and 2022 MRE for Langtry. The 2025 MRE replace accounts for modifications in commodity costs, mining prices since 2022/2023, and barite testing of present drill samples from the Waterloo Property.

Determine 1: Calico Challenge, 2025 Mineral Useful resource Block Mannequin Grade

Determine 2: Calico Challenge, 2025 Mineral Useful resource Classification

Knowledge Enter

The 2025 MRE thought-about drilling data as much as and together with essentially the most lately accomplished program in 2022, in addition to geological data from Apollo’s 2021, 2022 and 2025 exploration actions. Drilling information supporting the 2025 MRE contains data from historic drilling information from 258 holes (18,679 m/61,282 ft), and 2022 drilling information from 85 holes (9,729 m/31,918 ft) for a complete of 343 holes (28,407 m/93,199 ft). Nominal drill gap spacing is 30 x 46 m (100 x 150 ft) inside the Measured portion of the 2025 MRE. Of the drill information set used, 332 holes are rotary or reverse circulation holes, and 11 holes are diamond drill holes.

For the 2025 MRE, extra re-assaying of seven,431 historic and up to date drill pulps by X-Ray Fluorescence for barium (“Ba”) and barium oxide (“BaO)”) was accomplished or a complete of seven,893 Ba samples used for estimation. The Ba in addition to present Zn assay (4-acid or aqua-regia) assay outcomes have been topic to a complete high quality assurance/high quality management (“QAQC”) program that was reviewed by Mariea Kartick, P.Geo. (Stantec), an impartial “Certified Particular person” (or “QP”) as such time period is outlined inside Nationwide Instrument 43-101 – Requirements of Disclosure for Mineral Initiatives (“NI 43-101”). As well as, detailed floor mapping and rock sampling have been accomplished within the Burcham space of the Waterloo Property. The mapping and sampling offered a greater understanding of the extent of the Au mineralization at floor and inside the Pickhandle Formation in addition to helped refine orientations of high-angle gold-bearing constructions within the geologic mannequin.

No extra Ag and Au assay information was used for the 2025 MRE from that acquired for the 2023 MRE. Materials modifications in Ag and Au useful resource within the 2025 MRE from the 2023 MRE are attributable to altering economics from 2023 to 2025 and inclusion of BaSO4 and Zn within the general useful resource for the Waterloo deposit. Verification of drilling exploration information used for the 2025 MRE was carried out by Mariea Kartick, P.Geo. (Stantec), an impartial QP.

Reduce-Off Grade and Cheap Prospects for Eventual Financial Extraction

For the Waterloo MRE two base-case cut-off grades are used. A silver equal (“AgEQ”) cut-off grade of 47 g/t was calculated for a mixed restoration of Ag, BaSO4, Zn and Au and the place the mixed mineralization of those metals was lower than AgEQ COG, gold-only restoration have been evaluated for a Au COG grade of 0.17 g/t. For Langtry silver-only restoration is taken into account for a decrease Ag COG grade of 43 g/t. The above cut-off grades have been decided utilizing the next assumptions:

- Silver worth of US$28 per troy ounce, gold worth of US$2,451 per troy ounce, barite worth of US$120 per mt and zinc worth of US$ 1.22 per pound

- Mixed steel (Ag, BaSO 4 , Zn, Au) processing prices of US$26.5 per quick ton;

- Gold solely processing value of US$8.2 per quick ton

- Silver solely processing value of US$24 per quick ton

- Included in all processing prices are basic and administrative prices of US$3 per quick ton;

- Mining prices of US$2.8 per quick ton; and

- Silver restoration of 65%, BaSO 4 restoration of 85%, Zn restoration of 80% and Au restoration of 80%.

Steel recoveries are primarily based on outcomes from the 2022 Metallurgical Take a look at Program (see information releases dated February 14, 2023, February 23, 2023 and Could 2, 2023) and revealed recoveries for comparative operations. Silver, Zn and Au costs have been calculated by averaging revealed month-to-month commodity costs from the final 24 months as much as June 2025 primarily based on information from the World Financial institution. Barite worth was primarily based on historic BaSO4 pricing tendencies from 2013 to 2023, the final yr when publicly out there barite pricing information was out there. Adjustments in steel costs, optimized processing parameters and/or improved steel recoveries will all affect cut-off grade and any resultant MRE.

Cheap prospects for eventual financial extraction have been assessed by calculating recovered block revenues for silver grade blocks above cut-off grade, much less floor mining prices, and producing an optimized Hexagon© MinePlan Pseudoflow financial pit shell at fixed slope of 45 levels that’s constrained to inside the property declare boundaries.

Sensitivity Evaluation

A sensitivity evaluation was undertaken to look at the impacts of various the cut-off grades for AgEQ grades and tonnes for the Waterloo deposit inside the base case financial pit shell and for Ag solely grades and tonnes within the Langtry deposit. The out there tonnes and common grade for every COG from inside the 2025 MRE financial pit shell is proven in Desk 2 for Waterloo and in Desk 3 for Langtry.

Desk 2: Sensitivity evaluation of the grade and tonnage relationships at various pit-constrained silver equal cut-off grades for the Waterloo Property. Efficient June 30, 2025.

| Classification | AgEQ COG (g/t) |

Tonnes (Mt) |

Common Ag Grade (g/t) |

Strip Ratio (t:t) | Contained Silver (Moz) |

| Measured | ≥ 35 | 49 | 67 | 0.6 | 109 |

| ≥ 40 | 47 | 71 | 0.6 | 107 | |

| ≥ 47 | 43 | 75 | 0.8 | 104 | |

| ≥ 50 | 42 | 77 | 0.8 | 103 | |

| ≥ 55 | 39 | 79 | 0.9 | 100 | |

| ≥ 60 | 36 | 83 | 1.1 | 97 | |

| Indicated | ≥ 35 | 14 | 52 | 0.6 | 23 |

| ≥ 40 | 13 | 54 | 0.6 | 22 | |

| ≥ 47 | 12 | 57 | 0.8 | 21 | |

| ≥ 50 | 11 | 58 | 0.8 | 21 | |

| ≥ 55 | 10 | 61 | 0.9 | 20 | |

| ≥ 60 | 9.3 | 64 | 1.1 | 19 | |

| Inferred | ≥ 35 | 0.8 | 23 | 0.6 | 0.6 |

| ≥ 40 | 0.7 | 25 | 0.6 | 0.6 | |

| ≥ 47 | 0.6 | 26 | 0.8 | 0.5 | |

| ≥ 50 | 0.6 | 26 | 0.8 | 0.5 | |

| ≥ 55 | 0.5 | 27 | 0.9 | 0.4 | |

| ≥ 60 | 0.4 | 29 | 1.1 | 0.4 |

Desk 3: Sensitivity evaluation of the grade and tonnage relationships at various pit-constrained silver equal cut-off grades for the Langtry Property. Efficient June 30, 2025.

| Classification | AgEQ | Tonnes (Mt) | Common Ag Grade (g/t) | Strip Ratio (t:t) | Contained Silver (Moz) |

| COG (g/t) | |||||

| Inferred | ≥ 35 | 29 | 68 | 2.1 | 63 |

| ≥ 40 | 26 | 71 | 2.5 | 59 | |

| ≥ 43 | 24 | 73 | 2.8 | 57 | |

| ≥ 50 | 19 | 81 | 4.1 | 49 | |

| ≥ 55 | 16 | 86 | 4.7 | 44 | |

| ≥ 60 | 13 | 92 | 5.8 | 39 |

Useful resource Estimation Methodology

The 2025 MRE was ready in accordance with the necessities of NI 43-101 and relevant tips disseminated by CIM. Mineral Sources that aren’t Mineral Reserves would not have demonstrated financial viability. The amount and grade of reported Inferred assets are unsure in nature as there was inadequate exploration to outline these Inferred Sources as Indicated or Measured.

The 2025 MRE useful resource block mannequin was oriented alongside regional strike of mineralization controlling vary entrance fault (Calico fault) and bedding, at roughly 045 levels. Steel grades have been estimated utilizing odd kriging right into a 20 ft x 20 ft x 10 ft block mannequin utilizing 5 ft drill gap composites and a bulk density of two.44 t/m 3 (13.13 ft 3 /st). The block fashions are constrained to the west by the Calico vary entrance fault and to the east by the contact between the mineralized Barstow formation sedimentary rocks and the Pickhandle formation rhyolitic rocks. Each constructions are mineralization controlling options. A grade capping analysis was carried out, and for the Waterloo Property solely the next drillhole grades have been capped previous to estimation: Ag 450 g/t, Au 2 g/t, Ba 31% and Zn 7%. No grade capping was deemed crucial for the Langtry Property.

The MRE was internally audited, and peer reviewed by Stantec previous to being launched to the Firm and being declared remaining. Additional, the Firm accomplished an inner overview of the 2025 MRE information equipped by Stantec. A full description of the information and the information verification course of might be detailed within the technical report related to the 2025 MRE, which might be ready in accordance with NI 43-101 Requirements of Disclosure for Mineral Initiatives and filed inside 45 days of this information launch on the Firm’s web site and on SEDAR+ at www.sedarplus.ca .

SAMPLING AND QUALITY ASSURANCE/QUALITY CONTROL

Extra sampling for the reason that 2023 MRE and previous to the 2025 MRE included re-assaying of seven,797 drill pulps (major plus QAQC) by X-Ray Fluorescence for Ba and BaO at ALS in Reno, Nevada and a metallurgical testing program for barite from 5 PQ drill core composites was accomplished at McClelland Laboratories Inc., in Sparks, Nevada. Outcomes from the metallurgical check have been introduced in a previous Information Launch (Could 2, 2023).

Pulps from historic and the 2022 drill program have been submitted to ALS Reno for pattern preparation and Ba evaluation. Historic pulps have been homogenized by gentle pulverizing (HOM-01) and the pulverisers have been washed between samples (WSH22). After preparation, splits of ready pulps are securely shipped to ALS Vancouver, British Columbia for evaluation. Many of the pulps have been analyzed utilizing X-Ray Fluorescence Spectroscopy (“XRF”) strategies ME-XRF10, aside from a number of samples that have been analysed with ME-XRF15c (samples with excessive sulphide content material) or ME-XRF26 (chosen samples for a extra full suite of parts). The detection limits for Ba with ME-XRF10 is between 0.01 and 45%, between 0.01 and 50% with ME-XRF15C and for BaO with ME-XRF26 0.01-66%. All analyses have been accomplished at ALS Vancouver.

The Firm maintains its personal complete high quality assurance and high quality management (QA/QC”) program to make sure finest practices in pattern preparation and evaluation for samples. The QA/QC program contains the insertion and evaluation of licensed reference supplies, business pulp blanks, preparation blanks, and discipline duplicates to the laboratories. Apollo’s QA/QC program contains ongoing auditing of all laboratory outcomes from the laboratories. The Firm’s Certified Particular person is of the opinion that the pattern preparation, analytical, and safety procedures adopted are ample and dependable. The Firm just isn’t conscious of any drilling, sampling, restoration, or different elements that might materially have an effect on the accuracy or reliability of the information reported herein.

ABOUT THE PROJECT

Location

The Calico Challenge is positioned in San Bernardino County, California and includes the adjoining Waterloo, Langtry, and Mule properties which whole 8,283 acres. The Calico Challenge is 15 km (9 miles) from town of Barstow, 5 km (3 miles) from business electrical energy and has an intensive personal gravel street community spanning the property.

Geology and Mineralization

The Calico Challenge is located within the southern Calico Mountains of the Mojave Desert, within the south-western area of the Basin and Vary tectonic province. This 15 km (9 mile) lengthy northwest-southeast trending mountain vary is dominantly composed of Tertiary (Miocene) volcanics, volcaniclastics, sedimentary rocks and dacitic intrusions. Mineralization at Calico includes high-level low-sulfidation silver-dominant epithermal vein-type, stockwork-type and disseminated-style related to northwest-trending faults and fracture zones and mid-Tertiary (~19-17 Ma) volcanic exercise. Calico represents a district-scale mineral system endowment with roughly 6,000 m (19,685 ft) in mineralized strike size managed by the Firm. Silver and gold mineralization are oxidized and hosted inside the sedimentary Barstow Formation and the higher volcaniclastic items of the Pickhandle formation alongside the contact between these items.

The 2025 MRE for Waterloo Property includes 125 Moz Ag in 55 Mt at a median grade of 71 g/t Ag (M&I classes), 0.51 Moz Ag in 0.60 Mt at a median grade of 26 g/t Ag (Inferred class), 130,000 oz gold in 17 Mt at a median grade of 0.25 g/t gold (Inferred class), 2.7 Mt BaSO4 and 354 Mlbs Zn in 36 Mt at a median grade of seven.4 % BaSO4 and 0.45 % Zn (Indicated class), and 0.65 Mt BaSO4 and 258 Mlbs Zn in 17 Mt at a median grade of three.9 % BaSO4 and 0.71 % Zn (Inferred class). The 2025 MRE for Langtry property includes 57 Moz Ag in 24 Mt at a median grade of 73 g/t Ag (Inferred class).

QUALIFIED PERSONS

The scientific and technical information contained on this information launch was reviewed, and authorized by Derek Loveday, P. Geo., Johnny Marke P.G. and Mariea Kartick, P.Geo., from Stantec and are Certified Individuals impartial of the Firm. Mr. Loveday is a registered Skilled Geoscientist in Alberta, Canada, and Mr. Marke is a registered Skilled Geologist in Oregon, USA and each are accountable for the mineral useful resource estimation. Ms. Kartick is a registered Skilled Geoscientist in Ontario, Canada and is accountable for information QA/QC.

This information launch has additionally been reviewed and authorized by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director of Mineral Sources. Ms. Lépine is a registered Skilled Geoscientist in British Columbia, Canada and isn’t impartial of the Firm.

ABOUT Apollo Silver Corp.

Apollo Silver is advancing one of many largest undeveloped major silver initiatives within the US. The Calico Challenge hosts a big, bulk minable silver deposit with important barite credit – a important mineral important to the US vitality and medical sectors. The Firm additionally holds an choice on the Cinco de Mayo Challenge in Chihuahua, Mexico, which is host to a serious carbonate substitute (CRD) deposit that’s each high-grade and enormous tonnage. Led by an skilled and award-winning administration group, Apollo is nicely positioned to advance the property and ship worth by exploration and growth.

Please go to www.apollosilver.com for additional data.

ON BEHALF OF THE BOARD OF DIRECTORS

Ross McElroy

President and CEO

For additional data, please contact:

E mail: information@apollosilver.com

Phone: +1 (604) 428-6128

Neither the TSX Enterprise Change nor its Regulation Providers Supplier (as that time period is outlined within the insurance policies of the TSX Enterprise Change) accepts duty for the adequacy or accuracy of this launch.

This information launch contains “forward-looking statements” and “forward-looking data” inside the which means of Canadian securities laws. All statements included on this information launch, aside from statements of historic truth, are forward-looking statements together with, with out limitation, statements with respect to the potential of the Calico Challenge and its general funding attractiveness; the expectation that the Calico Challenge will proceed to extend in worth, scale and optionality; the potential financial significance of the up to date mineral useful resource estimate, together with the newly outlined barite and zinc assets along with silver and gold; the potential restoration charges; the potential to additional develop the useful resource estimate and improve its confidence stage, together with potential silver, gold, barite and zinc mineralization on strike and at depth; the potential affect of barite and zinc being designated as important minerals in america; assumptions relating to mineralization at shallow depths and strip ratios; timing and execution of future deliberate drilling, exploration, preliminary engineering and extra metallurgical actions; timing of graduation and completion of a preliminary financial evaluation or different technical research; the potential for added discoveries and general challenge growth; and the Firm’s capability to advance, develop, and allow the Calico Challenge. Ahead-looking statements embrace predictions, projections and forecasts and are sometimes, however not all the time, recognized by way of phrases akin to “anticipate”, “imagine”, “plan”, “estimate”, “anticipate”, “potential”, “goal”, “funds” and “intend” and statements that an occasion or end result “might”, “will”, “ought to”, “might” or “would possibly” happen or be achieved and different comparable expressions and contains the negatives thereof.

Ahead-looking statements are primarily based on the cheap assumptions, estimates, evaluation, and opinions of the administration of the Firm made in gentle of its expertise and its notion of tendencies, present situations and anticipated developments, in addition to different elements that administration of the Firm believes to be related and cheap within the circumstances on the date that such statements are made. Ahead-looking data is predicated on cheap assumptions which were made by the Firm as on the date of such data and is topic to identified and unknown dangers, uncertainties and different elements that will have brought on precise outcomes, stage of exercise, efficiency or achievements of the Firm to be materially completely different from these expressed or implied by such forward-looking data, together with however not restricted to: dangers related to mineral exploration and growth; steel and mineral costs; availability of capital; accuracy of the Firm’s projections and estimates; realization of mineral useful resource estimates, curiosity and change charges; competitors; inventory worth fluctuations; availability of drilling gear and entry; precise outcomes of present exploration actions; authorities regulation; political or financial developments; environmental dangers; insurance coverage dangers; capital expenditures; working or technical difficulties in reference to growth actions; personnel relations; and modifications in Calico Challenge parameters as plans proceed to be refined. Ahead-looking statements are primarily based on assumptions administration believes to be cheap, together with however not restricted to the worth of silver, gold zinc and barite; the demand for silver, gold, zinc and barite; the flexibility to hold on exploration and growth actions; the well timed receipt of any required approvals; the flexibility to acquire certified personnel, gear and providers in a well timed and cost-efficient method; the flexibility to function in a protected, environment friendly and efficient matter; and the regulatory framework relating to environmental issues, and such different assumptions and elements as set out herein. Though the Firm has tried to establish necessary elements that might trigger precise outcomes to vary materially from these contained in forward-looking data, there could also be different elements that trigger outcomes to not be as anticipated, estimated or supposed. There may be no assurance that forward-looking statements will show to be correct and precise outcomes, and future occasions might differ materially from these anticipated in such statements. Accordingly, readers shouldn’t place undue reliance on ahead trying data contained herein, besides in accordance with relevant securities legal guidelines. The forward-looking data contained herein is introduced for the aim of aiding traders in understanding the Firm’s anticipated monetary and operational efficiency and the Firm’s plans and goals and is probably not applicable for different functions. The Firm doesn’t undertake to replace any forward-looking data, besides in accordance with relevant securities legal guidelines .

Photographs accompanying this announcement can be found at

https://www.globenewswire.com/NewsRoom/AttachmentNg/cce62828-4cf5-487a-b245-9c271e6dfdcf

https://www.globenewswire.com/NewsRoom/AttachmentNg/be15e1d9-2d79-4446-b086-ed7daefdb013