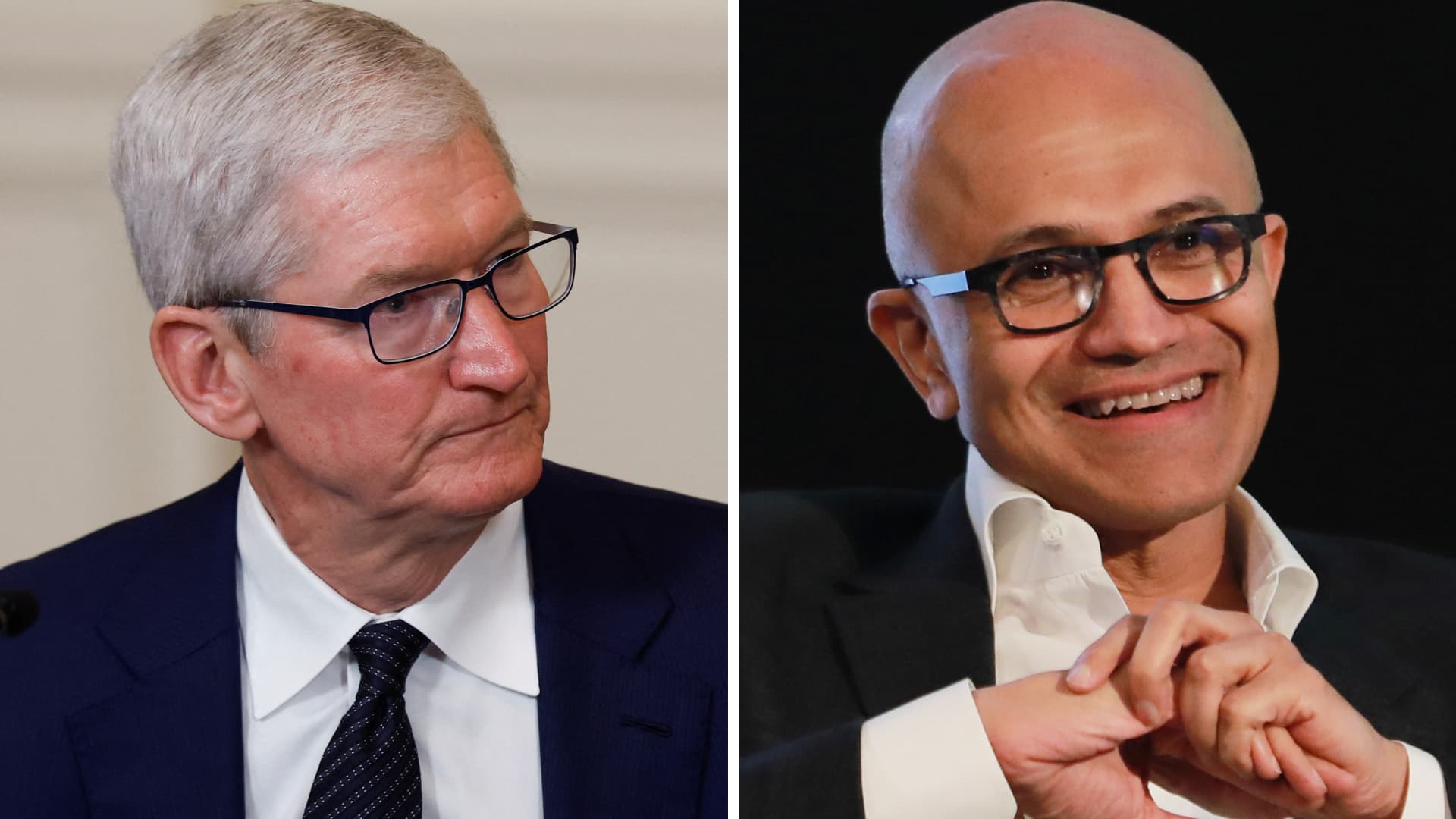

Apple CEO Tim Cook dinner, left, and Microsoft CEO Satya Nadella.

Reuters

Apple and Microsoft shares rose on Tuesday, pushing the businesses over a market cap of $4 trillion.

Each corporations are nonetheless behind Nvidia, which is the world’s most dear firm with a market cap of over $4.6 trillion. Microsoft beforehand hit the $4 trillion benchmark in July.

Microsoft inventory climbed about 3% on information that the corporate finalized a 27% in OpenAI’s for-profit enterprise. The corporate has backed the ChatGPT maker since 2019.

The milestone comes as Apple shares have been surging in latest weeks as a result of iPhone 17 fashions, launched in September, look like promoting higher than their predecessors.

Apple shares are up 25% over the previous 3 months. It studies fiscal fourth-quarter earnings on Thursday. Microsoft, which is up 6% prior to now 3 months, studies earnings on Wednesday.

“Apple shares are heading into the upcoming earnings print with a higher halo of positivity than any time prior to now yr,” JPMorgan analyst Samik Chatterjee wrote in a Monday observe. He has the equal of a purchase score on the inventory and raised his worth goal on Monday to $290 per share.

The corporate additionally seems to have prevented the worst-case situations associated to Trump administration tariffs. Apple has moved a lot of its U.S.-bound provide chain to India and Vietnam whereas additionally sustaining a pleasant relationship with the administration round U.S. manufacturing.

“Announcement of an elevated tempo of home funding together with a fast shift in product manufacturing for the US market exterior of China (India, Vietnam) has improved Apple’s positioning within the tariff panorama,” Chatterjee wrote.