[ad_1]

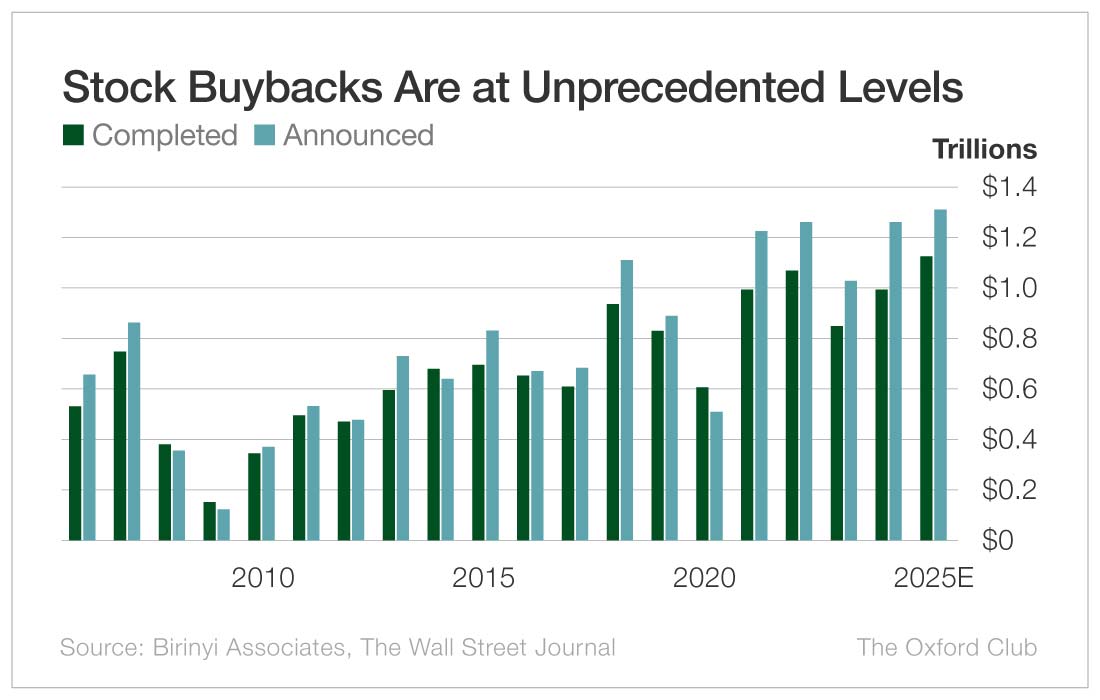

In 2025, U.S. corporations are anticipated to purchase again $1.1 trillion price of inventory. (That’s equal to the scale of all the financial system of Turkey, the 18th-largest on the earth.) Firms have already introduced $984 billion price of buyback authorizations. Each are report numbers.

By the top of 2025, corporations are anticipated to have introduced over $1.3 trillion in buybacks.

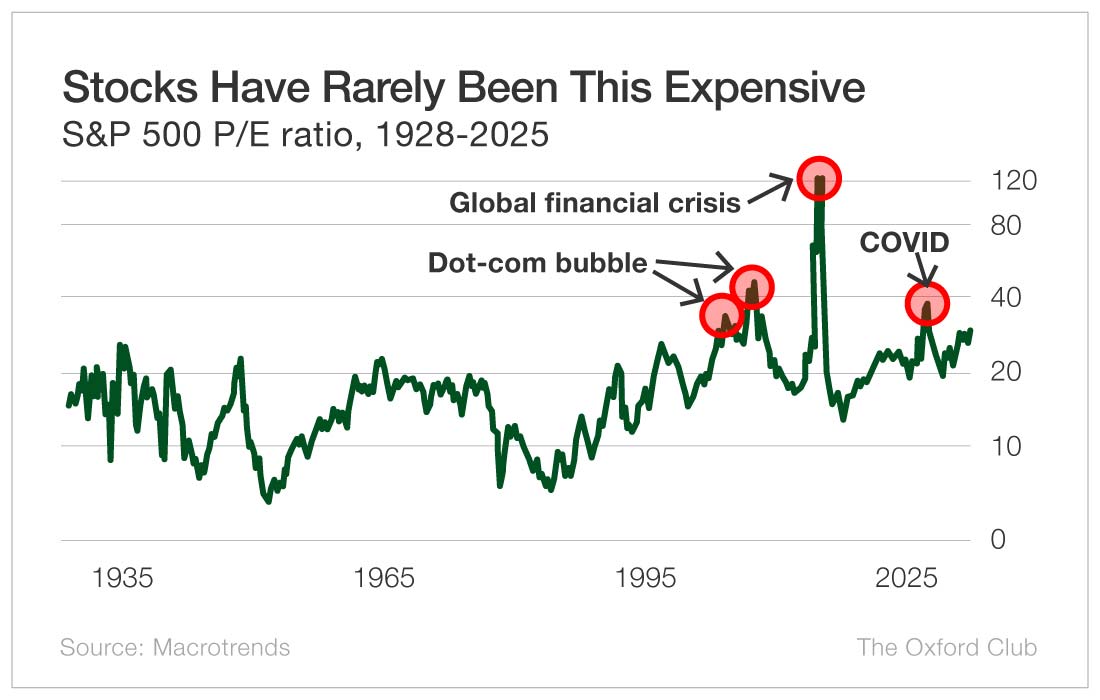

That is taking place at a time when markets are at all-time highs and price-to-earnings, or P/E, ratios are very prolonged. In truth, the market’s P/E ratio is the very best it’s been aside from throughout market anomalies just like the COVID pandemic, the worldwide monetary disaster, and the dot-com bubble.

I don’t consider that the P/E ratio is the definitive measure of a market’s valuation or its possible path. But it surely’s a helpful indicator of how frothy a market is, and it doesn’t make sense for corporations to be snapping up shares at these costs simply because they’ve the cash.

As a substitute, they need to purchase again shares when markets tank, however they virtually by no means do.

I’ve three major arguments in opposition to buybacks.

1. Let me determine what to do with the additional money.

Buybacks are thought-about a way of returning money to shareholders. If an organization has money that it needs to return to shareholders, then I need to determine whether or not the inventory is an efficient worth. I don’t belief a CEO who could also be incentivized to control the numbers with a purpose to enhance earnings per share.

Right here’s what I imply.

Let’s say an organization earns $100 million and has 100 million shares excellent. Meaning it earns $1 per share.

The corporate buys again 10 million shares.

The next yr, earnings are flat and it once more makes $100 million in revenue. However now there are solely 90 million shares, so earnings per share are actually $1.11 – exhibiting 11% progress regardless that the corporate didn’t make any more cash.

2. Firms purchase again shares on the flawed time.

In my ebook Get Wealthy with Dividends, I cite a research by Azi Ben-Rephael, Jacob Oded, and Avi Wohl that was printed in Overview of Finance that discovered that small corporations usually purchase again shares at depressed ranges, however massive corporations don’t, as a result of they’re “extra within the disbursement of free money.”

In different phrases, administration groups of huge corporations are extra involved with exhibiting the general public that they’re doing one thing with the surplus money slightly than being good stewards of capital.

3. Administration groups are sometimes hypocrites.

Executives are joyful to purchase again shares at excessive costs along with your cash whereas they’re promoting their very own shares.

The three largest introduced buybacks this yr are from Apple (Nasdaq: AAPL), Alphabet (Nasdaq: GOOG), and JPMorgan Chase (NYSE: JPM).

There have been no insider buys at Apple in a decade. In the meantime, on August 8, Apple’s senior vp of retail and folks, Deirdre O’Brien, offered $7.8 million price of inventory. Final yr, she offered $23 million price.

Chris Kondo, the principal accounting officer, offered $934,000 price in Could – and that’s on prime of the $5 million that he offered final yr.

And this yr, CEO Tim Prepare dinner has offered greater than $24 million price of inventory.

So Prepare dinner and associates are cashing in whereas utilizing shareholder cash to repurchase as much as $100 billion in shares.

Does that cross the scent check?

Similar story at JPMorgan Chase. No insider shopping for since 2023, however an entire lot of promoting, together with by CEO Jamie Dimon, who has offered greater than $170 million price of inventory this yr.

But the corporate licensed a brand new $50 billion inventory repurchase plan final month.

You see the sample.

Insiders promote for plenty of legitimate causes. They could be diversifying their portfolios, property planning, paying for a marriage, and so on. However ought to they be allowed to promote their shares, accumulating tens of millions of {dollars}, whereas utilizing your cash to help the inventory?

If a administration group stands by its repurchase choice, how about all of the insiders decide to not promoting any shares for a yr?

I belief administration to run the enterprise. I don’t belief them to make the fitting selections with extra money except they’re additionally shopping for shares themselves.

When an organization has an excessive amount of money, it ought to pay shareholders a particular dividend or enhance the common dividend. We’re all higher off making our personal selections on what to do with the cash, slightly than having a administration group with conflicts of curiosity make the choice for us.

[ad_2]