Revealed: Dec 01, 2025 at 14:16

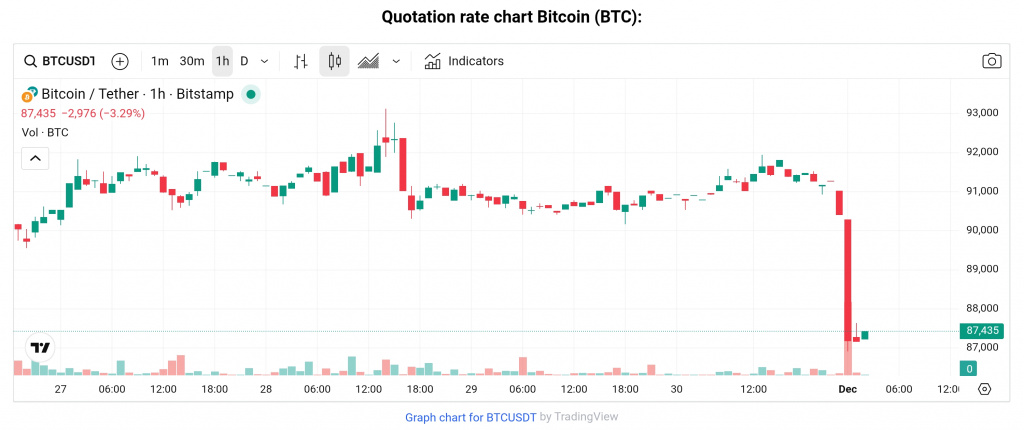

Coinidol.com: The risky tug-of-war in worth motion resumed on December 1st, with Bitcoin (BTC) worth slipping over 4% in early buying and selling, signaling a renewed “risk-off” temper because the market reacted to international financial uncertainty and poor information reads.

Macro-driven volatility

Bitcoin traded close to $86,000 following the dip, shedding the momentum it had gained simply days prior when it briefly recaptured the $90,000 stage. This volatility coincided with Asian shares falling and US futures dropping, underscoring the excessive correlation between crypto and broader threat belongings.

The instant catalyst for the renewed promoting was a Chinese language manufacturing unit exercise report displaying continued contraction in November, extending a streak of declines that sign a deepening financial slowdown within the area. Since China is a significant international financial driver, this information stoked international threat aversion, pushing buyers out of speculative belongings.

Institutional concern

Analysts famous that the shortage of constant, robust inflows into Bitcoin Change-Traded Funds (ETFs) is exacerbating the draw back. The market stays delicate to exterior cues, confirming that whereas institutional infrastructure exists, institutional perception is closely influenced by the macroeconomic outlook, significantly relating to the US Federal Reserve’s stance on rates of interest.

Coinidol.com reported beforehand that following weeks of extreme corrections that pushed Bitcoin as little as the $87,000 vary, the cryptocurrency staged a vital rebound on November 28, transferring decisively again above the $90,000 stage.

Now, the promoting stress on December 1 serves as a harsh reminder that, regardless of its potential as an inflation hedge, Bitcoin stays essentially pushed by international liquidity and threat urge for food within the brief time period.

Disclaimer. This text is for informational functions solely and shouldn’t be seen as an endorsement by Coinidol.com. Coinidol.com is an unbiased Blockchain media outlet that delivers information, cryptocurrency analytics and evaluations. The information supplied is collected by the creator and isn’t sponsored by any firm or developer. They don’t seem to be a advice to purchase or promote cryptocurrency. Readers ought to do their analysis earlier than investing in funds.