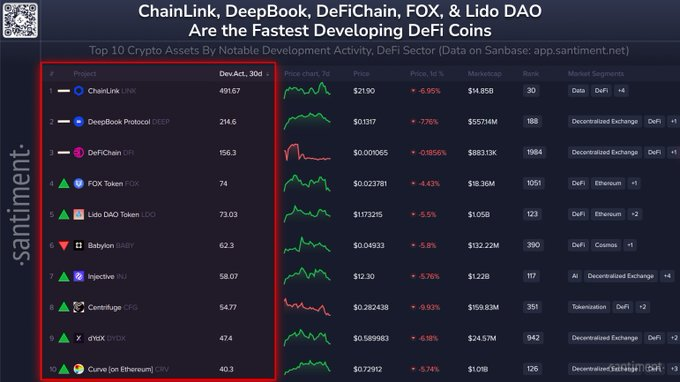

In response to a number one on-chain analytics agency, Santiment, Chainlink (LINK) has reaffirmed its dominance in decentralized finance (DeFi) improvement, widening its lead over opponents.

Previously 30 days, Chainlink posted a improvement exercise rating of 491.67, greater than double that of its closest rival, DeepBook Protocol (214.6), whereas DeFiChain trailed in third with 156.3.

The info highlights Chainlink’s sustained innovation and its strengthening place as DeFi’s high oracle community.

Santiment’s improvement exercise metric measures the frequency of code commits, upgrades, and enhancements throughout public GitHub repositories, serving as a robust indicator of a venture’s long-term potential.

Notably, sustained improvement alerts lively innovation and strong developer confidence within the community’s future.

Chainlink’s continued dominance underscores its important position on the coronary heart of decentralized finance. Its oracle community powers lots of of protocols throughout Ethereum, Polygon, Arbitrum, and extra, securely connecting real-world information to good contracts.

Over the previous yr, Chainlink has expanded its affect with the Cross-Chain Interoperability Protocol (CCIP), enabling seamless blockchain-to-blockchain communication, and Information Streams, a high-speed information supply answer driving next-generation DeFi functions.

Chainlink Revisits Key Assist Channel After Sturdy Rally

In response to famend market analyst Lingrid, Chainlink (LINK) is revisiting its ascending help channel after a measured pullback from the $26.00 area.

Following a sturdy rally that shattered a number of resistance ranges, LINK now consolidates close to key help, probably constructing momentum for its subsequent decisive breakout.

Lingrid famous that Chainlink just lately shaped distinct impulsive buildings, breaking a number of triangle patterns that had constrained value motion for weeks.

This breakout confirmed sturdy bullish momentum, fueled by rising on-chain exercise and rising developer participation. Chainlink’s rising affect in DeFi infrastructure and real-world asset tokenization continues to attract robust institutional and retail curiosity.

On the time of this writing, Chainlink was buying and selling at $16.48 per CoinGecko information.