Bloomberg Information

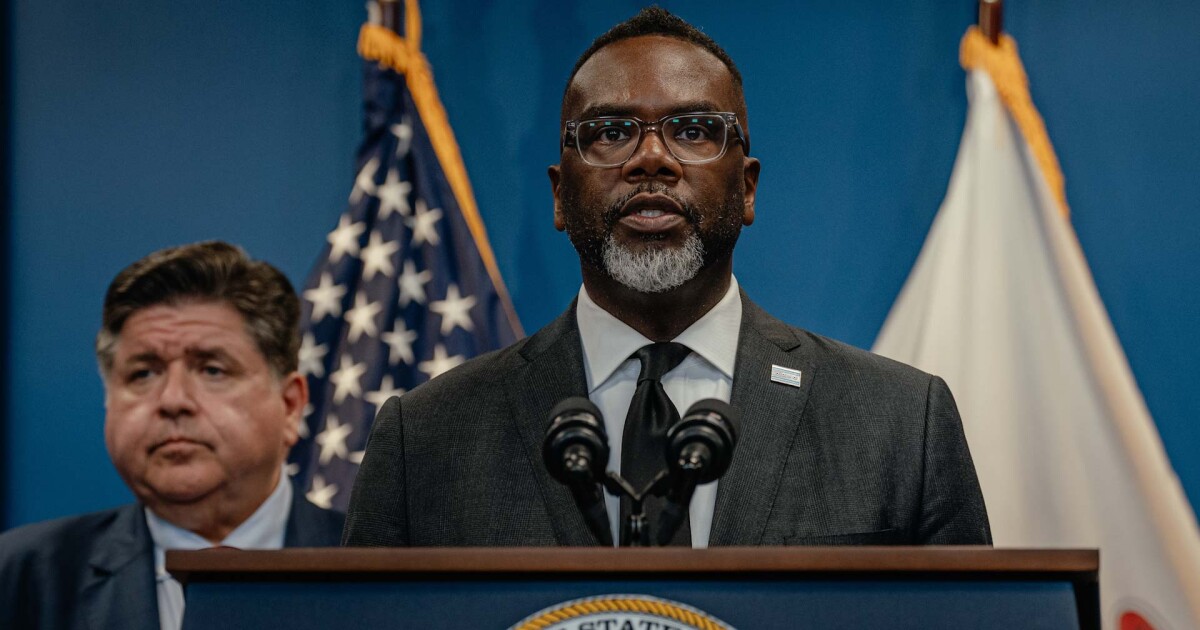

Chicago Mayor Brandon Johnson’s proposed $16.6 billion 2026 price range would cut back the supplemental pension contributions that had lifted the town’s credit score stature.

The price range, launched Thursday, calls for brand new revenues, however avoids the property tax hikes that fell flat with Metropolis Council final 12 months.

“I feel bond traders are all the time trying on the pension scenario,” stated Howard Remedy, associate and director of municipal bond analysis at Evercore Wealth Administration. “It was unhealthy when the state put by laws

The superior pension funds are above what’s required by state regulation, however the contribution ranges required underneath state regulation are a part of the explanation the town’s pensions

New income sources proposed within the price range embody an worker head tax, which the Johnson administration has labeled the “group security surcharge,” and new taxes on social media, on-line sports activities betting and hemp merchandise.

It might declare the biggest tax increment financing surplus within the metropolis’s historical past, and use short-term borrowing to fund police misconduct settlement funds and retroactive firefighter pay will increase.

Johnson stated his administration is “decreasing the price of administering authorities” with out slashing providers, by actual property consolidation, improved fleet administration, streamlined administrative capabilities and particular occasion price restoration.

Score companies stated they’re ready to see how the price range debate performs out in Metropolis Council, however signaled some considerations.

“Lowering the pension fee is credit score unfavourable as a result of it ends in contributions which can be inadequate to curb progress within the reported unfunded legal responsibility,” David Levett, vp and senior credit score officer at Moody’s Scores, stated by electronic mail.

Moody’s charges Chicago basic obligation bonds Baa3 with a secure outlook after a

KBRA views the price range’s one-time income sources much less favorably than recurring revenues, stated Linda Vanderperre, managing director on the ranking company.

These one-time sources embody roughly $500 million of proposed TIF surplus past the standard annual TIF surplus, a proposed bond refunding, the proceeds from the sale or lease of city-owned land, and borrowing for settlements.

On the flip facet, she stated, the worker head tax could be a credit score constructive.

“Whereas the proposed $21 per 30 days head tax on corporations with over 100 workers might face opposition from the enterprise group, we view the administration’s efforts to determine potential options to the structural deficit favorably, together with the formation in April of

On stability, the mayor’s proposed price range would doubtless be credit score impartial if handed in its present type, she stated. KBRA charges Chicago GOs A-minus after

Municipal Market Analytics stated in a Monday report that the mayor’s price range might stress the town’s scores.

“As a bellwether for credit score spreads, traders will need to be aware of budget-related widening; if that occurs, extra cheapening by different story credit might be imminent,” MMA stated. “The proposal does an excellent job articulating the administration’s values… however falls quick on sustainably financing them.”

MMA pointed to the absence of a rise in property taxes “that would offer a secure, recurring income supply.”

Alderpeople have some questions in regards to the mayor’s price range, stated Ward 32 Alderman Scott Waguespack.

“Undoubtedly the credit score affect is a priority,” he stated. That features from the road of credit score the Johnson administration needs to take out — a $100 million line of credit score with an rate of interest probably upwards of 9%, he stated.

The borrowing for police misconduct settlements is one other concern.

“That is a step backward from what we had (completed) previously,” Waguespack stated. “(The) Emanuel and Lightfoot (administrations) took police misconduct settlements off the books… and so they’re going proper again to that.”

He additionally criticized the idea behind the brand new social media tax.

“The social media corporations are difficult all of these (taxes),” he stated, noting that such taxes have usually been struck down. “Even among the liberal judges have stated (it raises) a reasonably severe First Modification challenge… It isn’t a slam dunk like they’re saying.”

If the tax is rejected by Metropolis Council or struck down by a courtroom, it may go away a gaping gap within the price range, forcing the mayor to show to a property tax hike as a possible hole nearer, he stated.

The social media tax is an attention-grabbing thought however is problematic for a number of causes, stated Justin Marlowe, analysis professor on the College of Chicago’s Harris College of Public Coverage and director of the Middle for Municipal Finance.

“There’s clearly a number of motion on this course in state and native tax coverage towards taxing providers, taxing digital property, taxing digital providers and so forth,” he stated. However “I feel the mayor might be three to 5 years too early on this.”

Tax coverage consultants have additionally raised considerations about relocation incentives if digital providers are taxed on the municipal stage. It is higher to tax these corporations on the state or regional stage, Marlowe stated.

There are additionally

Marlowe stated any settlement in that litigation may additional undermine the case for native taxation, with social media corporations prone to argue that they’d completed their penance by the settlement.

The advance pension funds “have been an actual credit score constructive for the town,” Marlowe stated, and famous that the administration’s justification for now not making the total fee raises considerations in regards to the future.

The justification is basically that the earlier administration of Lori Lightfoot had put in place an assigned portion of the company fund stability that is now been exhausted, so the funding supply for the advance pension funds is now not there.

“To my data, there was actually no point out previous to any of this about how the superior pension fee was contingent on there being assets in that assigned basic fund stability,” Marlowe stated. “So now, not solely is it that they don’t seem to be making the fee, however they’re signaling that they are prone to quick the superior funds sooner or later… The ranking companies will most definitely take discover of that.”

On the short-term borrowing for settlements, Marlowe stated pace is vital: “The timing is somewhat bit extra accommodating proper now,” he stated. “I feel if they’ve to attend six months or one thing to do it, that could be a distinct story.”

One may make the case {that a} shorter length, taxable GO would most likely value fairly nicely lately, he added. If the administration borrowed on the town’s credit score, within the present market, “they’re most likely taking a look at one thing within the neighborhood (of) like, 5% yield for three-year cash, or four-year cash — which is excessive for certain, however not almost as excessive as you may assume,” Marlowe stated.

If the administration had been to borrow on the gross sales tax securitization company credit score, it could be taking a look at a extra cheap price, he stated. “Say they are saying they do $300 million stage debt service, $100 million a 12 months over three years, one thing like that; then you definitely’re taking a look at most likely within the neighborhood of $30 to $40 million of debt service prices,” Marlowe stated.

Which will look like quite a bit, he stated, however the Johnson administration could make the case that getting these liabilities off the books, and eradicating that factor of uncertainty, is a constructive step.

Nonetheless, with no coverage framework for coping with these misconduct funds sooner or later, there’s the potential for extra giant liabilities that might seem at any second.

“I am undecided what they’re doing to stop that going ahead,” Evercore’s Remedy stated of the misconduct borrowing. “They are not able to maintain including debt for issues which can be brought on by the town itself.”

Remedy additionally raised considerations in regards to the metropolis’s relationship with the Trump administration. “You’ll be able to’t have a dialogue a couple of main metropolis anymore with out enthusiastic about its relationship with the federal authorities,” he stated.

The complete affect of Trump’s tax and spending invoice on issues like schooling, well being, SNAP, Head Begin and transit stays to be seen, he stated. Is the state going to drive the town to shoulder these burdens, and is the president going to additional goal Chicago?

“What I am watching is also what sort of cooperation the mayor’s going to get from the Metropolis Council, as a result of

He instructed that the destiny of the advance pension funding coverage can even be key to look at.

“You simply don’t need them to lose self-discipline on their pensions, as a result of that is the largest knock on the town. It isn’t the financial system,” he stated. “You need to see them preserve some self-discipline of their price range. However that is going to require some robust negotiations with metropolis workers.”

S&P World Scores assigns Chicago a BBB ranking with a secure outlook after a one-notch downgrade in January. Fitch Scores charges the GO credit score A-minus and

The STSC credit score is rated A-plus by S&P and AAA by Fitch and KBRA.