Investor Perception

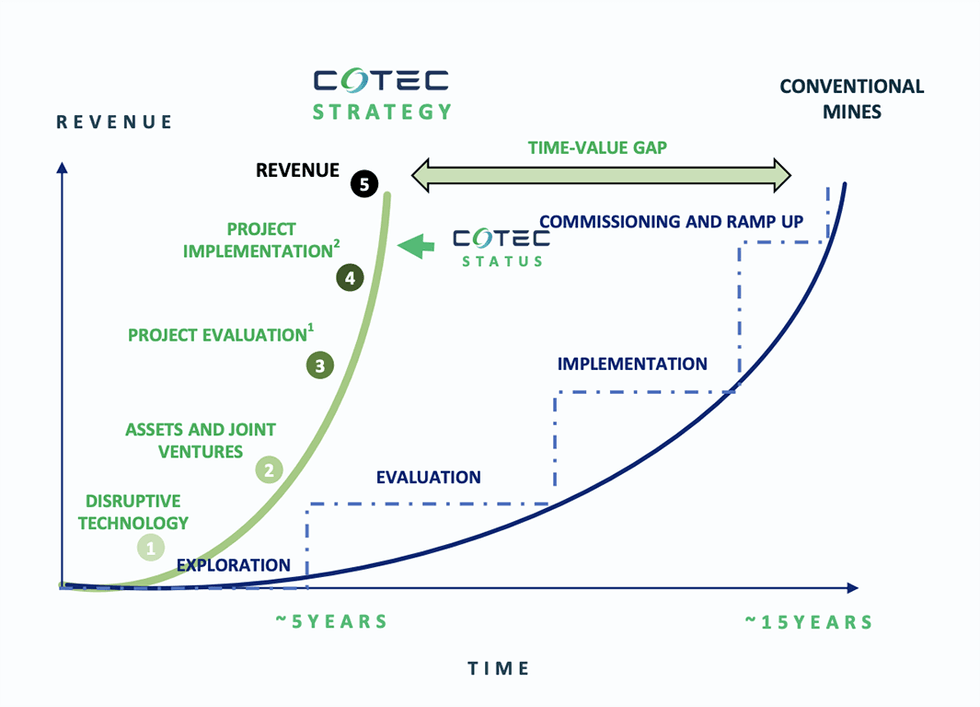

CoTec Holdings (CoTec) is a useful resource extraction and processing firm that identifies and deploys breakthrough applied sciences to show undervalued belongings into high-margin companies. By combining innovation with strategic execution, the corporate gives a novel funding alternative, characterised by low price, decrease capex, quicker money stream era, and superior returns.

Overview

CoTec (TSXV:CTH,OTCQB:CTHCF) applies revolutionary, disruptive expertise to undervalued useful resource belongings, aiming to create a portfolio of 20 to 30 modular “mini-mines” or processing amenities. By specializing in strategic minerals — resembling uncommon earths, copper and iron ore — important to superior manufacturing, protection, AI and electrification, the corporate transforms waste supplies into worthwhile strategic commodities. This method establishes the potential for high-margin income streams and positions CoTec for continued progress.

Via investments and environment friendly processing strategies, CoTec targets areas like uncommon earth magnet recycling, inexperienced metal manufacturing and copper waste processing — sectors essential to at present’s evolving economies. For traders, this represents an easy alternative to help a forward-thinking firm poised for long-term appreciation.

CoTec is advancing six cutting-edge applied sciences and three strategic belongings, with a medium-term purpose of buying 10 applied sciences and 20 to 30 belongings. The corporate’s enterprise mannequin is supported by partnerships, joint ventures (JVs), and a disciplined capital administration technique to unlock worth throughout its portfolio.

CoTec is guided by a extremely skilled administration staff and board of administrators with deep experience in mining, expertise and company finance.

Why Put money into CoTec?

Traders in search of a high-potential alternative with sturdy alignment to world developments in sustainability and expertise will discover CoTec a sexy selection. Right here’s why:

- Vital Upside Potential: CoTec’s revolutionary method to deploying cutting-edge, disruptive applied sciences throughout undervalued and waste belongings creates a scalable enterprise mannequin. By focusing on sectors of strategic significance resembling uncommon earth magnet recycling, inexperienced metal manufacturing, and copper waste processing, CoTec aligns with important world developments that guarantee relevance and progress.

- Strategic Positioning: The corporate is well-positioned in sectors which are more and more acknowledged as strategic priorities, with the appliance of uncommon earths and different important minerals in synthetic intelligence, renewable vitality and protection.

- Skilled Management and Insider Confidence: With a management staff boasting many years of expertise within the useful resource sector and vital insider possession (roughly 74 % of the corporate is owned by administration and insiders), CoTec’s management is deeply invested within the firm’s success.

- Environmental Accountability: CoTec’s give attention to low-carbon useful resource extraction applied sciences not solely aligns with world sustainability targets but additionally allows traders to generate monetary returns whereas contributing to environmental stewardship.

- Catalysts for Development: The corporate has a transparent roadmap with a number of catalysts within the close to time period, which can embrace research, expansions and potential funding bulletins, that are anticipated to unlock additional worth for shareholders.*

Firm Highlights

- CoTec deploys cutting-edge, low-carbon applied sciences to marginal belongings, reclamation alternatives and recycling initiatives, reworking waste supplies into strategic, high-value commodities.

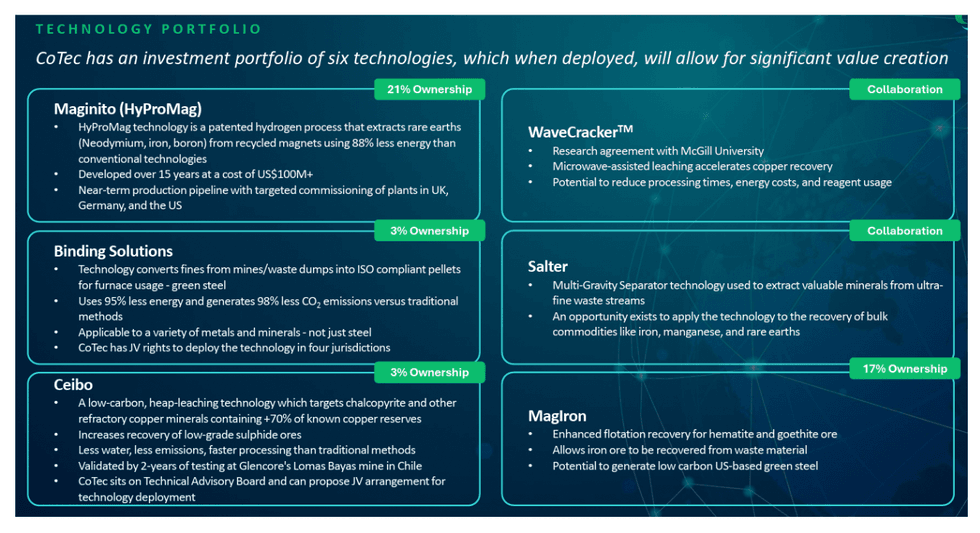

- The corporate holds stakes in six groundbreaking applied sciences — HyProMag, Binding Options, MagIron, Ceibo, WaveCrackerTM, and Salter. These applied sciences are designed to unlock vital worth throughout strategically chosen belongings. The Lac Jeannine iron undertaking in Quebec, with an after tax NPV of US$59.9 million, stands by itself deserves however might see additional financial and environmental enhancements by way of the appliance of CoTec’s applied sciences. Equally, HyProMag USA is pioneering the rollout of HyProMag’s uncommon earth recycling expertise in america, delivering low-cost, magnet-to-magnet restoration of uncommon earth sintered magnets.

- CoTec accelerates the transition from discovery to manufacturing by way of proprietary applied sciences and strategic joint ventures, enabling considerably quicker income era in comparison with conventional mining operations.

- Backed by a administration staff with intensive experience in mining, finance and expertise, CoTec is uniquely positioned to drive innovation and progress within the important minerals sector.

- Roughly 74 % of the corporate is owned by administration and insiders, demonstrating the management’s sturdy dedication to the corporate’s success.

- Though CoTec is buying and selling at an ~88 % low cost to its Web Asset Worth, varied near-term catalysts have the potential to cut back this valuation hole

Key Applied sciences and Belongings

HyProMag USA Venture

The HPMS course of allows magnet-to-magnet short-loop recycling to supply domestically sourced recycled uncommon earth magnets with a really low price, and lowest CO2 footprint, bypassing the intensive chemical refining and reprocessing of conventional long-loop processes. HPMS makes use of 88 % much less vitality, 85 % much less water and reduces CO2 by 85 %. It eliminates advanced separation levels, reduces materials losses, and lowers operational threat. This streamlined method is quicker, extra economical, and strategically important for the U.S., guaranteeing self-sufficiency in AI, robotics, and protection, the place reliance on Chinese language uncommon earths poses a serious geopolitical threat.

HyProMag USA, a US Authorities Minerals Safety Partnership Venture, leverages the Hydrogen Processing of Magnetic Scrap (HPMS) expertise to recuperate NdFeB magnets from end-of-life electronics and industrial waste. This revolutionary hydrogen-based recycling course of supplies a a lot easier, lower-risk, and more cost effective various to traditional uncommon earth extraction, lowering reliance on conventional mining and imports. Over US$100 million was spent on R&D, developed by the College of Birmingham over 15 years.

A feasibility research launched in November 2024, underscored the HyProMag USA undertaking potential to turn out to be a game-changing home supply of recycled uncommon earth magnets for america. CoTec, which owns 60.3 % of HyProMag USA (50 % by way of the US JV with Maginito, and CoTec’s 20.3 % fairness possession in Maginito), is focusing on a complete annual manufacturing capability of 1,041 tons of recycled NdFeB magnets over a 40-year working life, post-tax internet current worth (NPV) of US$262 million at present market costs, growing to US$503 million at impartial forecast costs. HyProMag USA is focusing on 10 % of USA’s home demand for NdFeB magnets inside 5 years of commissioning, with three crops focusing on ~3,000 tons of recycled NdFeB magnets, which is thrice what was contemplated within the November 2024 feasibility research.

By tapping into america’ push for domestically sourced important mineral sources, HyProMag USA will place itself as a pivotal participant in reshaping the everlasting magnet provide chain, offering traders with a chance to align with a undertaking on the intersection of sustainability, innovation and financial progress.

Lac Jeannine Iron Venture

Situated in Quebec, the Lac Jeannine Venture is an advanced-stage iron tailings undertaking with a broadcast Preliminary Financial Evaluation (PEA – preliminary financial evaluation). The undertaking entails reprocessing roughly 73 million tonnes (Mt) of tailings to supply high-purity iron focus. The PEA included the 2023 drill-program, offering an preliminary Inferred Mineral Useful resource of roughly 73 Mt at 6.7 % complete Fe for 4.9 Mt of contained complete Fe. Although the PEA is predicated on an preliminary 10-year lifetime of mine, estimates are the lifetime of mine may very well be prolonged by as a lot as an extra 10 years with additional drilling and useful resource definition in the course of the feasibility research in 2025. Primarily based on open-pit extraction strategies and the manufacturing of a gravity focus through standard processing methods and at a reduction fee of seven % (based mostly solely on an preliminary 10-year lifetime of mine), the PEA indicated a pre-tax NPV of US$93.6 million, and an IRR of 38 %, and an after tax NPV of US$59.5 million, and an IRR of 30 %.

The Unbiased Certified Individual as outlined by NI 43-101 for the Lac Jeannine Mineral Useful resource, Mr. Christian Beaulieu, P.Geo., is a member of l’Ordre des géologues du Québec (#1072). The Certified Individual has reviewed and accredited the scientific and technical content material referring to the Lac Jeannine Mineral Useful resource.

MagIron

MagIron focuses on restarting a brownfield iron ore concentrator in Minnesota to supply DR-grade iron focus for low-carbon metal manufacturing. The corporate is focusing on manufacturing capability of two to three Mt of focus yearly with an operational life exceeding 20 years. MagIron is positioned to capitalize on the demand for U.S.-based inexperienced metal, with preliminary valuations exhibiting vital uplift since CoTec’s preliminary funding. CoTec has a 16 % fairness curiosity in MagIron.

Binding Options (BSL)

BSL’s chilly agglomeration expertise converts mining waste into ISO-compliant pellets or briquettes, primarily for inexperienced metal manufacturing. This course of is a game-changer within the {industry}, providing substantial reductions in vitality use and emissions. CoTec’s fairness in BSL has grown considerably in worth, with the newest valuation of the corporate exceeding US$158 million, a 107 % improve from CoTec’s preliminary funding.

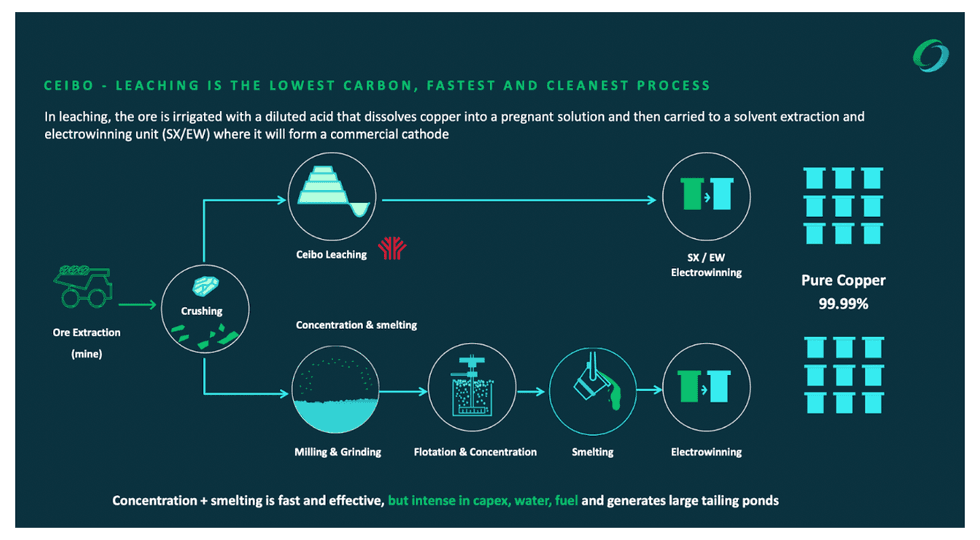

Ceibo

Ceibo’s low-carbon, low-cost oxidative heap leaching expertise enhances restoration charges for sulphide copper minerals resembling chalcopyrite. The expertise doubtlessly improves copper restoration from 30 % to 80 %, making it a possible industry-leading answer for copper extraction. CoTec has a seat on Ceibo’s technical advisory board together with its minority fairness curiosity, and is figuring out copper belongings the place the expertise may very well be utilized within the type of a three way partnership.

WaveCrackerTM

CoTec has entered right into a joint collaboration and investigation settlement with McGill College, Québec, Canada. The undertaking, WaveCrackerTM, will examine prolonged purposes of microwave applied sciences aiming to enhance low-carbon, financial restoration of worthwhile metals from a variety of mineral targets. The preliminary focus shall be on copper recoveries, significantly in superior sulphide leaching purposes. This collaboration builds upon, and extends, area data with new learnings and, together with different applied sciences, gives the potential for the low-carbon, low price manufacturing of “new” copper metallic.

As a part of the undertaking collaboration, CoTec will leverage McGill’s appreciable expertise in mineral processing and depth of analysis data within the discipline of utilized microwave applied sciences during the last 30 years.

Salter Cyclones

CoTec has signed a binding long-term exclusivity and collaboration settlement with Salter Cyclones Restricted (“Salter”) for the appliance of its Multi-Gravity Separators (MGS) expertise for the restoration of iron ore and manganese from each main mining and tailings materials.

Salter’s MGS expertise was initially developed within the Nineteen Eighties by Richard Mozley and has been in operation for a few years utilized to the restoration of worthwhile metallic minerals (tin, chromium, copper, zinc and so on). Its utility to bulk commodities resembling iron and manganese has been restricted.

CoTec believes the expertise might symbolize a step change within the bulk dealing with of iron and manganese tailings, providing the corporate the chance to supply excessive grade important mineral iron and manganese concentrates from extremely nice tailings, materials which is at present labeled as waste and despatched on to tailings storage amenities.

As a part of the collaboration CoTec can have an Exclusivity Interval for the appliance of the MGS to iron ore globally and manganese in america, South Africa and Brazil for 3 (3) years. This Exclusivity Interval could be prolonged by reaching sure milestones. CoTec and Salter will actively collaborate on an asset-by-asset foundation to use the expertise to recognized iron and manganese belongings.

Administration & Management

Julian Treger – CEO

With over three many years of expertise in pure sources and finance, Julian Treger is the driving power behind CoTec’s revolutionary method to useful resource extraction. Beforehand the CEO of Anglo Pacific Group, Treger efficiently transitioned the corporate from a coal-focused royalty enterprise to a battery-metals-focused streaming firm, rising its earnings from £3 million in 2013 to almost £62 million in 2021. Treger additionally brings vital experience from his roles at Audley Capital and varied board positions throughout the mining sector.

Lucio Genovese – Chairman

A seasoned government with greater than 30 years of expertise in metals and mining, Lucio Genovese has held management roles at Glencore and is the CEO of Nage Capital Administration in Switzerland. He’s additionally chairman at Ferrexpo and a member of the board of administrators of Mantos Copper S.A. and Nevada Copper. His deep {industry} data and experience in worth creation by way of joint ventures and operational excellence are pivotal to CoTec’s success.

Tom Albanese

Tom Albanese served as chief government officer of Rio Tinto from 2007 to 2013 and as chief government officer and director of Vedanta Assets and Vedanta Restricted from 2014 to 2017. He at present serves as lead impartial director of Nevada Copper and non-executive director of Franco-Nevada, and was beforehand on the board of administrators of Ivanhoe Mines, Palabora Mining Firm and Turquoise Hill Assets. He holds a Grasp of Science diploma in mining engineering and a Bachelor of Science diploma in mineral economics each from the College of Alaska Fairbanks.

Robert Harward – Non-executive Director

Robert Harward is a retired United States Navy vice admiral (SEAL) and a former deputy commander of america Central Command. He served on the US Nationwide Safety Council in The White Home and led a number of multi-national particular forces instructions in Afghanistan and Iraq. He joined Lockheed Martin in 2014 as their chief government within the UAE and expanded his duties to cowl the Center East, leaving to affix Defend AI as government vice-president for worldwide enterprise improvement and technique based mostly within the UAE.

Sharon Fay – Non-executive Director

A worldwide funding {industry} chief with greater than 35 years of expertise, Sharon Fay has intensive experience in company accountability and strategic analysis, making her instrumental in CoTec’s ESG initiatives and governance.

Margot Naudie – Non-executive Director

Magot Naudie is a seasoned capital markets skilled with 25 years of expertise as senior portfolio supervisor for North American and world pure useful resource portfolios. She has held senior roles at main multi-billion-dollar asset administration corporations together with TD Asset Administration, Marret Asset Administration and CPP Funding Board. Naudie is the president of Elephant Capital, and the co-founder of Abaxx Applied sciences. She sits on a variety of private and non-private firm boards. Naudie holds an MBA from Ivey Enterprise College and a BA from McGill College. She can be a chartered monetary analyst.

Erez Ichilov – Non-executive Director

With a background in mining, expertise and undertaking investments, Erez Ichilov has pushed a number of ventures in battery supplies, important minerals and sustainable exploration, aligning effectively with CoTec’s strategic targets.

John Singleton – COO

John Singleton has greater than 25 years of expertise within the mining {industry}, together with senior roles at Rio Tinto, De Beers Consolidated Mines and Centamin. His background in company improvement, technique undertaking analysis, operations and undertaking improvement equips CoTec with the experience needed for scaling its portfolio of belongings and applied sciences. He’s a Fellow of the Royal Geological Society and holds a BSc from the College of Bristol and a MSc in Engineering Geology from Imperial Faculty London.

Abraham Jonker – CFO

Abraham Jonker brings 30 years of monetary management within the mining {industry}, with a give attention to company transactions, fairness and debt financing, and strategic progress. He has performed a pivotal position in elevating over $750 million for mining ventures and has served on the boards of different distinguished mining firms.

*Ahead-Trying Statements

The knowledge above concerning the Firm and its investments which aren’t historic information are “forward-looking statements” which contain dangers and uncertainties. Since forward- trying statements tackle future occasions and situations, by their very nature, they contain inherent dangers and uncertainties. Precise leads to every case might differ materially from these at present anticipated in such statements because of recognized and unknown dangers and uncertainties affecting the Firm, together with, however not restricted to: useful resource and reserve dangers; environmental dangers and prices; labor prices and shortages; unsure provide and worth fluctuations in supplies; will increase in vitality prices; labor disputes and work stoppages; leasing prices and the provision of apparatus; heavy gear demand and availability; contractor and subcontractor efficiency points; worksite issues of safety; undertaking delays and price overruns; excessive climate situations; and social and transport disruptions. For additional particulars concerning dangers and uncertainties dealing with the Firm, please consult with “Danger Elements” within the Firm’s submitting assertion dated April 6, 2022, a replica of which can be discovered below the Firm’s SEDAR+ profile at www.sedarplus.com, and its different public filings. The Firm assumes no accountability to replace forward- trying statements on this information launch besides as required by regulation. Readers mustn’t place undue reliance on the forward-looking statements and knowledge contained on this information launch and are inspired to learn the Firm’s steady disclosure paperwork which can be found on SEDAR+ at www.sedarplus.com.