Jangada Mines Plc (AIM: JAN), a Brazil targeted pure useful resource growth firm, is happy to announce that its 15-hole 1,800m diamond drilling (“DD”) programme has commenced on the 7,211-hectare Paranaíta Gold Venture (“Paranaíta” or the “Venture”) positioned in Brazil’s traditionally important Alta Floresta-Juruena Gold Province.

Highlights:

- 3,100m of trenching accomplished – additional extremely visually mineralised veins recognized

- 15-hole, 1,800m diamond drilling programme commenced

- Drilling to deal with excessive grade mineral sequences recognized from trenching, topographic research and intensive historic knowledge

- Drilling marketing campaign aiming to extend useful resource to 350,000 oz gold below JORC

- Vital potential for additional useful resource development with a number of extra targets already recognized

Following the completion of three,100m of trenching, which yielded additional extremely visually mineralised veins, the evaluation of current knowledge, and two topographic research, a 10-week drill programme at Paranaíta has been designed primarily focusing on the high-grade TP2 and TP3.2 (inside TP3) targets. The primary 8 drill holes of c.120m every will goal the recognized mineral sequence from trenches TR-02 to TR-08, the place the mineralised vein was properly recognized over greater than 700m and contained seen gold.

—

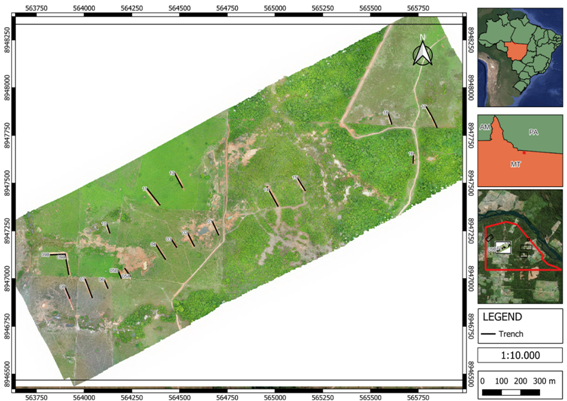

Determine 1: Drill holes on TP2

The remaining holes will goal TP3.2 the place the trenches TR-19 to TR-31 had been executed with glorious outcomes yielding properly recognized mafic dikes and disseminated granites. TR-18 recognized a 2m thick vein (See Determine 2). The situation of those is now being finalised and can rely on the chemical evaluation outcomes due in This autumn.

|

Determine 2: 2m thick vein at TR18

The drill programme is concentrated on increasing the present useful resource from 210,000 oz Au @3.165 g/t to ~350,000 oz Au below the JORC code. The TP2 and TP3.2 zones have a useful resource of c.106,600 oz @ 16.65 g/t Au and c.34,600 oz @ 1.35 g/t Au respectively and are two of the six recognized excessive precedence targets alongside the 8km mineralised hall. This hall has 15+ high-grade gold occurrences and historic sampling as much as 135 g/t Au.

Jangada CEO, Paulo Misk, stated: “With trenching now full and having confirmed additional visually mineralised vein methods, we’re happy to announce the launch of our inaugural drill programme on the high-grade Paranaíta Gold Venture. This 15-hole, 1,800-metre marketing campaign will deal with two of the six recognized high-grade, near-surface zones. Our speedy aim is to broaden the present useful resource to roughly 350,000 ounces of gold. Nevertheless, with a number of extra targets throughout the broader challenge space, we consider there may be important potential for additional useful resource development via continued exploration.

“Within the present gold value atmosphere, high-grade, shallow deposits are particularly enticing, as they sometimes fall on the decrease finish of the capital price curve and provide strong margins with sturdy worth potential. We consider Paranaíta exemplifies these traits. Accordingly, we sit up for fast-tracking its growth and that continued success will underpin a significant revaluation of Jangada.”

Trench Places TP2:

Certified Individual’s Assertion

The technical data on this announcement has been reviewed by Mr. Peter Heinrich Müller who’s a member of the South African Council of Pure Scientific Professions (#114766). Mr. Müller is a senior skilled geologist with +17 years of expertise within the mining trade, which is related to the type of mineralisation and sort of deposit into consideration and to the exercise which he has undertaken to qualify as a Competent Individual as outlined within the 2012 version of the JORC Code. Mr. Müller additionally meets the necessities of a reliable particular person below the AIM Notice for Mining, Oil and Gasoline Corporations. Mr. Müller has no financial, monetary or pecuniary curiosity within the Firm, and he consents to the inclusion on this doc of the issues based mostly on his technical data within the kind and context by which it seems.

ENDS

For additional data please go to www.jangadamines.com or contact:

|

Jangada Mines plc |

Brian McMaster (Chairman) |

Tel: +44 (0)20 7317 6629 |

|

Strand Hanson Restricted (Nominated & Monetary Adviser) |

Ritchie Balmer James Spinney David Asquith |

Tel: +44 (0)20 7409 3494 |

|

Tavira Monetary Ltd (Dealer) |

Jonathan Evans |

Tel: +44 (0)20 7100 5100 |

|

Investor Relations |

Hugo de Salis |

hugo@lepanto.co.uk |

The knowledge contained inside this announcement is deemed by the Firm to represent inside data as stipulated below the Market Abuse Regulation (EU) No. 596/2014 because it varieties a part of United Kingdom home legislation by advantage of the European Union (Withdrawal) Act 2018, as amended by advantage of the Market Abuse (Modification) (EU Exit) Laws 2019.

This data is supplied by RNS, the information service of the London Inventory Change. RNS is authorized by the Monetary Conduct Authority to behave as a Main Info Supplier in the UK. Phrases and situations referring to the use and distribution of this data might apply. For additional data, please contact rns@lseg.com or go to www.rns.com.

RNS might use your IP handle to substantiate compliance with the phrases and situations, to analyse the way you have interaction with the data contained on this communication, and to share such evaluation on an anonymised foundation with others as a part of our business companies. For additional details about how RNS and the London Inventory Change use the private knowledge you present us, please see our Privateness Coverage.