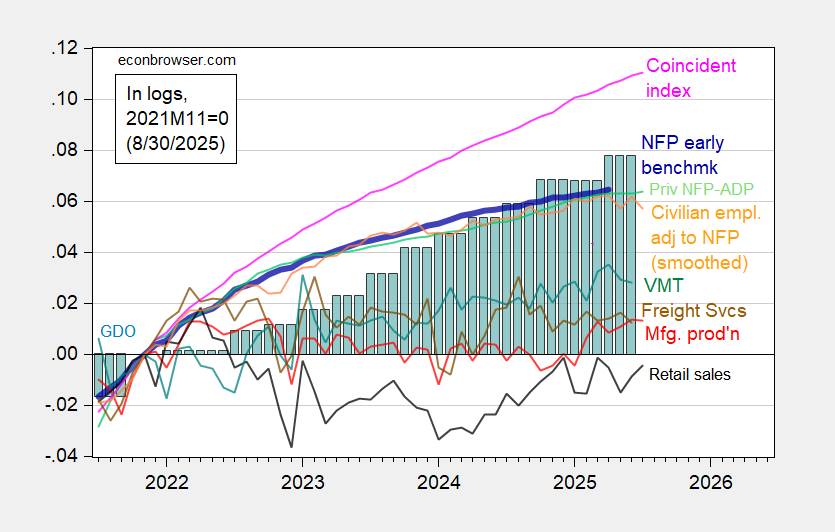

Actual private revenue ex-transfers, manufacturing and commerce business gross sales, civilian employment, civilian employment adjusted to NFP idea, industrial and manufacturing manufacturing, actual retail gross sales, car miles traveled, and freight transportation providers are all beneath latest peaks. Aside from that, the financial system is rising.

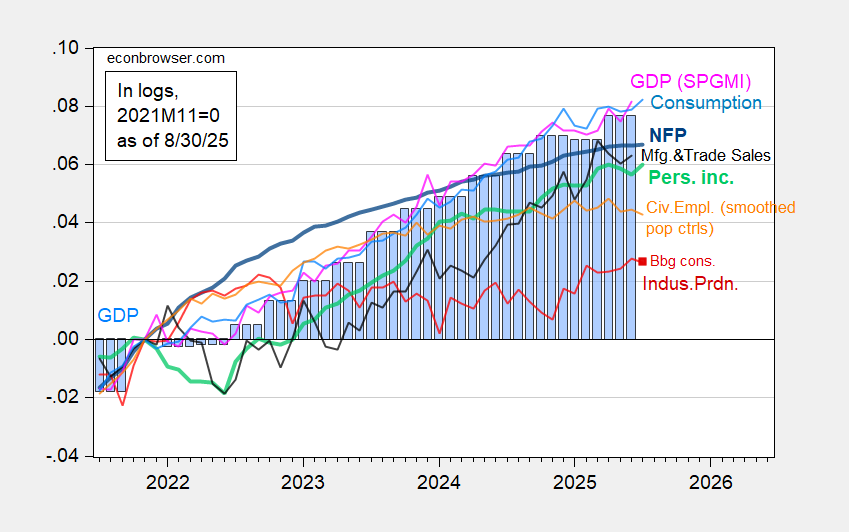

Listed here are indicators adopted by the NBER’s Enterprise Cycle Courting Committee, with nonfarm payroll and private revenue — key indicators — in daring blue and inexperienced respectively.

Determine 1: Nonfarm Payroll from CES (daring blue), civilian employment with smoothed inhabitants controls (orange), industrial manufacturing (pink), Bloomberg consensus industrial manufacturing of 8/14, (pink sq.), private revenue excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2025Q2 second launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2025 launch), and creator’s calculations.

And various indicatrs:

Determine 2: Implied Nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted to nonfarm payroll idea, with smoothed inhabitants controls (orange), manufacturing manufacturing (pink), car miles traveled (teal), actual retail gross sales (black), and coincident index in Ch.2017$ (pink), BTS Freight Companies Index (brown), GDO (blue bars), all log normalized to 2021M11=0. Retail gross sales deflated by chained CPI, seasonally Supply: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve through FRED, BEA 2025Q2 second launch, DoT BTS, and creator’s calculations.