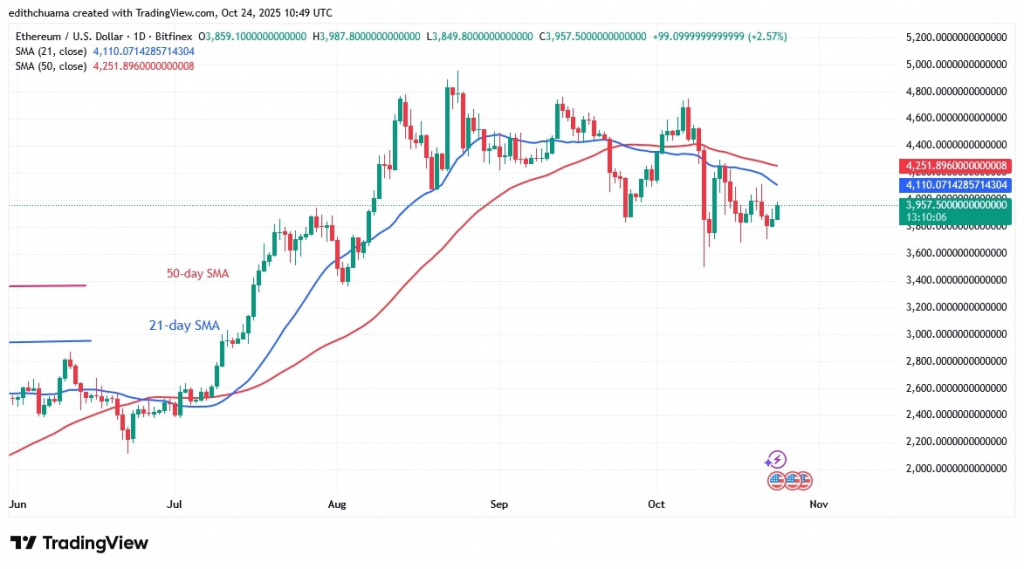

Coinidol.com: Ethereum’s worth is presently shifting inside a spread above the $3,750 assist and under the shifting common traces.

Ethereum worth long-term evaluation: ranging

Because the worth drop on October 10, the most important altcoin has traded inside a slender band. On October 13, patrons didn’t preserve the worth above the 21-day SMA, permitting bears to proceed promoting throughout modest rallies, as Coinidol.com reported beforehand. The prolonged candlestick wicks point out sturdy promoting strain at latest highs.

On the draw back, if bears break the $3,750 assist, Ether might fall to its earlier low of $3,510. Conversely, if bulls break above the 21-day SMA, they may acquire a bonus, and Ether might advance to the subsequent resistance stage at $4,559.00. As of this writing, Ether is buying and selling at $3,952.

Technical Indicators:

-

Key Resistance Ranges – $4,500 and $5,000 -

Key Assist Ranges – $3.000 and $2,500

ETH indicator evaluation

The shifting common traces are horizontal, and the worth bars fluctuate under them. The cryptocurrency is leaving lengthy candlestick wicks and tails because it continues its range-bound motion. On the 4-hour chart, the worth bars are above the horizontal shifting averages.

ETH/USD every day chart – September 24, 2025

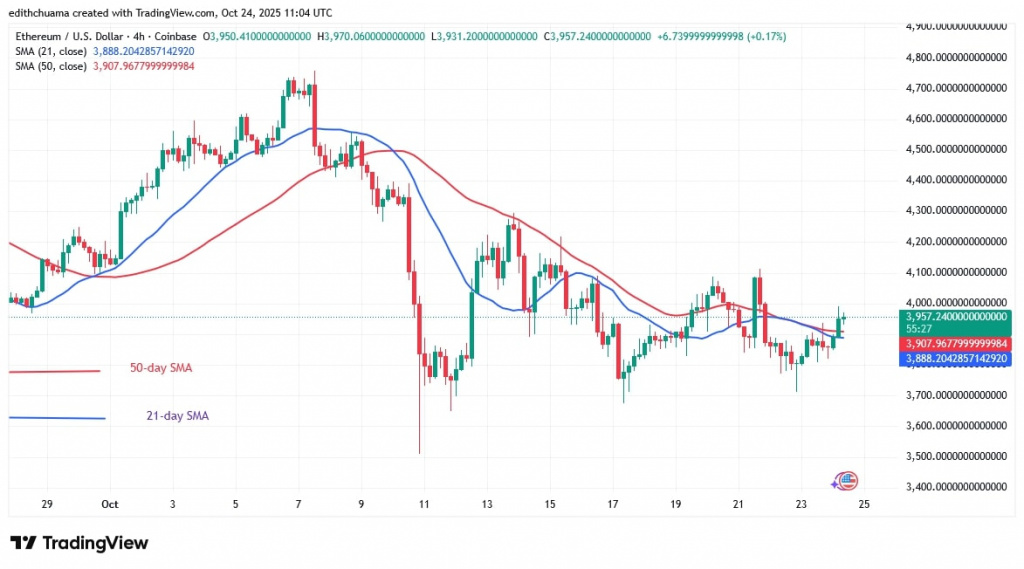

What’s the subsequent route for ETH?

The 4-hour chart exhibits Ethereum’s worth shifting in a spread above the $3,750 assist. Ether is buying and selling above the $3,750 assist however under the $4,300 excessive. Upward worth actions are resisted on the latest peak. The cryptocurrency is lingering above the shifting common traces, awaiting rejection close to the $4,000 stage.

ETH/USD 4-hour chart – September 24, 2025

Disclaimer. This evaluation and forecast are the private opinions of the creator. The info supplied is collected by the creator and isn’t sponsored by any firm or token developer. This isn’t a suggestion to purchase or promote cryptocurrency and shouldn’t be considered as an endorsement by Coinidol.com. Readers ought to do their analysis earlier than investing in funds.