Nicely-known gold bug and monetary commentator Peter Schiff tweeted earlier at this time that Gold is extra prone to attain $1 million per ounce than Bitcoin itself. He went additional and predicted {that a} huge bear market goes to brush the digital foreign money market, and merchants should bear immense losses alongside the best way.

Schiff is thought for his pro-Gold and anti-Bitcoin views. He has been a staunch BTC critic for the higher a part of the final 8 years and favors treasured metals, particularly Gold, excessive digital foreign money.

Peter Schiff Makes Bitcoin Bear Market Prediction

Schiff was on a tweeting spree earlier at this time as he tried to create additional Worry, Uncertainty, and Doubt (FUD) round crypto following one other spectacular crash. He began off with this tweet:

“Gold is extra prone to hit $1 million than Bitcoin.”

“The losses which are about to hit the crypto business will probably be staggering. Anticipate a wave of bankruptcies, defaults, and layoffs because the sector is decimated by the approaching Bitcoin and Ether crash, which can obliterate the remainder of the altcoin market. There’s systemic danger as nicely.”

And eventually summing it up by posting:

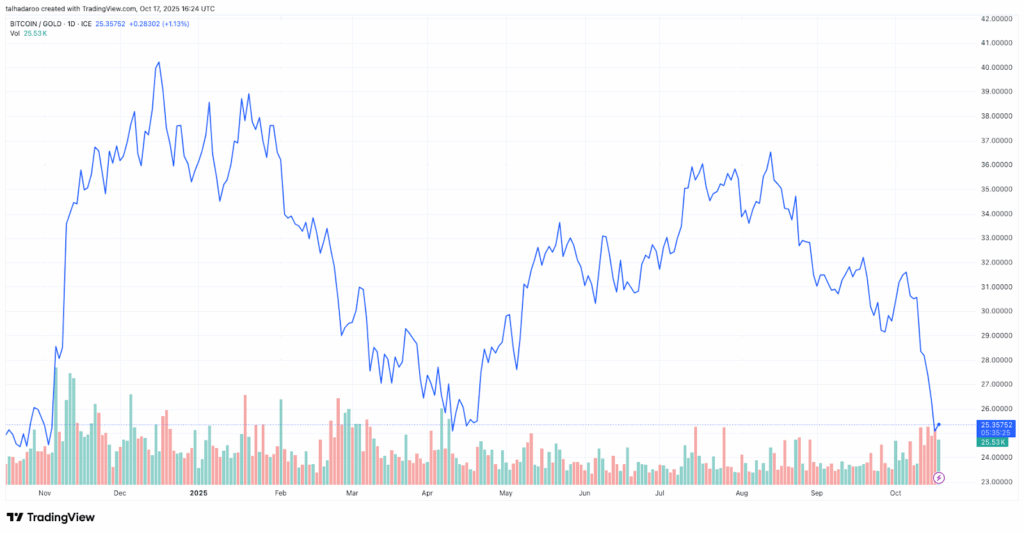

“The Bitcoin bear market continues this morning, with Bitcoin now down 34% versus gold because it hit its file excessive in August. In case you assume this bear market is nearing its finish, assume once more!”

Right here is the Bitcoin/Gold value motion over the last 12 months:

Bitcoin vs Gold Debate

The Bitcoin-Gold debate has been raging round for the higher a part of the final decade. Gold has been round for millennia, making its place in world economics and proving its value. In distinction, Bitcoin is a latest challenger that has hit the bottom working and is now valued at trillions of {dollars} by itself.

Gold, particularly, was essential all through historical past because it was the de facto reserve foreign money of the world for the higher a part of the final 2500 years. All paper cash was mainly a promise to pay the equal quantity of the yellow steel.

Nevertheless, all of it ended again in 1971 when the US, led by President Richard Nixon, ended the gold customary. Gold has since witnessed appreciable appreciation in opposition to the USD and different regional paper/fiat currencies and has maintained its sturdy place.

Bitcoin has solely had a historic presence of 16 years, but it surely has been important in its personal proper. The digital asset is an “power foreign money” that focuses on blockchain know-how to ship borderless, self-custody-based transactional capability. Some international locations now maintain Bitcoin as a part of their nationwide strategic reserves, similar to Gold itself, so Bitcoin is definitely catching up.

Schiff’s Earlier Hiccups

Schiff has taken Gold’s aspect for years and has made a number of damning tweets like those from earlier at this time, particularly when the digital foreign money is on the defensive. He has been confirmed fallacious on many events.

For instance, just some years in the past, he tweeted:

“Preserve Dreaming. Bitcoin isn’t going to hit $100,000”.

The Twitterati had been fast to remind him of his previous scorching takes that don’t are likely to age nicely. Due to the extraordinary capability and time-tested nature of each Bitcoin and Gold, the 2 belongings are prone to have a spot sooner or later. Bitcoin is at present the smaller of the 2 commodities, commanding a market cap of $2.14 trillion, whereas Gold has surpassed $30 trillion.