[ad_1]

It’s been some time since we final checked out Capital Southwest (Nasdaq: CSWC) on this column. 4 years in the past, the inventory yielded 8.9% and it was rated “C” for dividend security. The excellent news is that the dividend was not reduce.

In the present day, due to dividend will increase and a barely decrease inventory worth, Capital Southwest yields 10%.

Let’s discover out whether or not buyers can proceed to depend on the double-digit yield.

Capital Southwest is a enterprise improvement firm, or BDC. It lends cash to firms that generate between $3 million and $25 million in EBITDA (earnings earlier than curiosity, taxes, depreciation, and amortization).

Its portfolio firms embody…

- Giving Residence Well being Care, a 13-year-old firm that gives care to individuals who grew to become sick whereas working for the U.S. Division of Vitality

- Intero Digital, a digital advertising and marketing firm

- Digs Canine Care, which offers boarding and different pet companies.

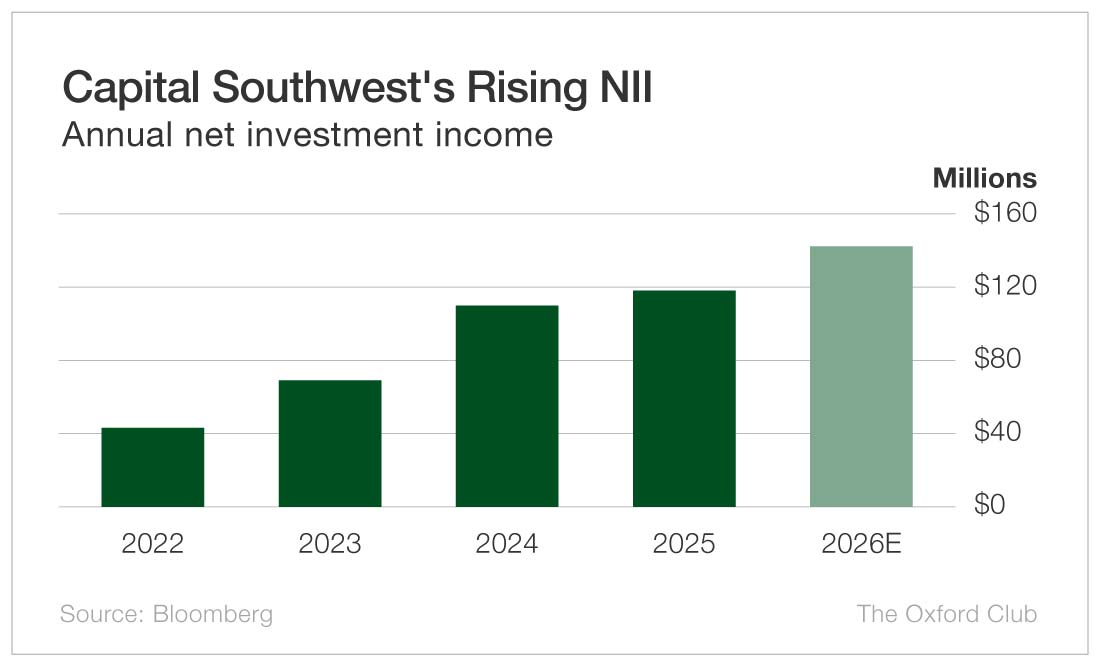

As a result of Capital Southwest is a BDC, we have a look at internet funding revenue (NII) as our measure of money circulation.

NII has been steadily rising for a number of years and is forecast to proceed rising previous 2025 as effectively.

The corporate’s fiscal yr ends in March, so fiscal 2025 numbers are full. The corporate generated $118 million in NII in fiscal 2025. The issue is it paid out $125 million in dividends. In different phrases, it didn’t generate sufficient money circulation to pay the dividend.

In fiscal 2026, NII is forecast to rise to $142 million. However the firm is forecast to pay $143 million in dividends.

BDCs usually pay out most or all of their NII in dividends – and that’s effective. However when the quantity of dividends paid exceeds NII, it’s an issue. Which means the corporate has to dip into money available or elevate cash to pay the dividend.

We by no means wish to see an organization pay out greater than 100% of its money circulation in dividends.

Capital Southwest just lately switched from a quarterly dividend to a month-to-month dividend. Moreover, it typically pays a particular dividend. For the needs of analyzing the dividend security, we solely have a look at the common dividend, as a result of the particular dividend is just not promised. It’s… effectively, particular.

The month-to-month dividend is $0.193 per share, which comes out to 10% a yr. This was the primary time in 10 years that Capital Southwest didn’t elevate the dividend.

As a result of the corporate paid out extra in dividends than it took in throughout its final fiscal yr and is anticipated to take action once more in fiscal 2026, its dividend has average danger.

If Capital Southwest’s complete dividend payout is available in beneath NII when the corporate stories its full fiscal yr ends in March, it is going to obtain an improve.

Dividend Security Score: C

What inventory’s dividend security would you want me to investigate subsequent? Depart the ticker within the feedback part.

It’s also possible to have a look to see whether or not we’ve written about your favourite inventory just lately. Simply click on on the phrase “Search” on the high proper a part of the Rich Retirement homepage, kind within the firm identify, and hit “Enter.”

Additionally, remember the fact that Security Web can analyze solely particular person shares, not exchange-traded funds, mutual funds, or closed-end funds.

[ad_2]