After explaining why Rubber futures is usually a nice marketplace for merchants, we’ll give attention to iron ore immediately. That is one other essential product traded on the SGX in Singapore.

Iron ore is the first uncooked materials used within the manufacturing of metal. The SGX futures contract is among the many world’s most essential benchmarks for iron ore given the contract’s specs and Singapore’s distinctive strategic location within the seaborne commerce. Do not forget that China accounts for about two-thirds of seaborne iron ore demand, and far of it goes by way of the Strait of Malacca.

Not like rubber, which is a smaller market, iron ore is large and rather more liquid. That doesn’t imply it’s robotically higher. In actual fact, I feel you’ll discover higher alternatives in rubber as a dealer. Nonetheless, it might be clever to a minimum of watch the worth motion in iron ore for those who commerce commodities usually, particularly metals.

Why bigger markets are extra essential

Do you know that following iron ore costs can profit you immensely, even when you don’t commerce the iron ore futures themselves? I’m talking from my very own expertise. Whereas I don’t commerce iron ore, I do commerce metals like silver, copper, and platinum by way of ETFs and (hardly ever) miners.

What does iron ore must do with these completely different markets? To start with, they’re all metals and are correlated to one another more often than not. And second, there’s a sure hierarchy inside the particular person commodity teams. For instance, silver is a tiny market in comparison with copper. Which means the worth swings in silver could be comparatively massive because it doesn’t take a lot cash to maneuver this small market in both path.

However, this typically results in the silver value getting out of contact with the truth within the bodily market. That’s precisely the explanation why you usually see us carefully watching the copper market in our premium analysis when making forecasts for silver. The copper market is way larger and subsequently more durable to control. Sure, silver can lead typically. However as a rule, it’s copper that’s appropriate if the 2 markets disagree. As a result of in the long run, steel costs rely upon financial circumstances. And if the economic system is weak, it’s most unlikely {that a} explicit steel can defy gravity regardless of short-term speculative flows.

Now that you just perceive the logic, we are able to transfer a step greater. Whereas the copper market is massive, the iron ore market is even larger. It’s the biggest commodity market amongst metals. An instance is best than a thousand phrases.

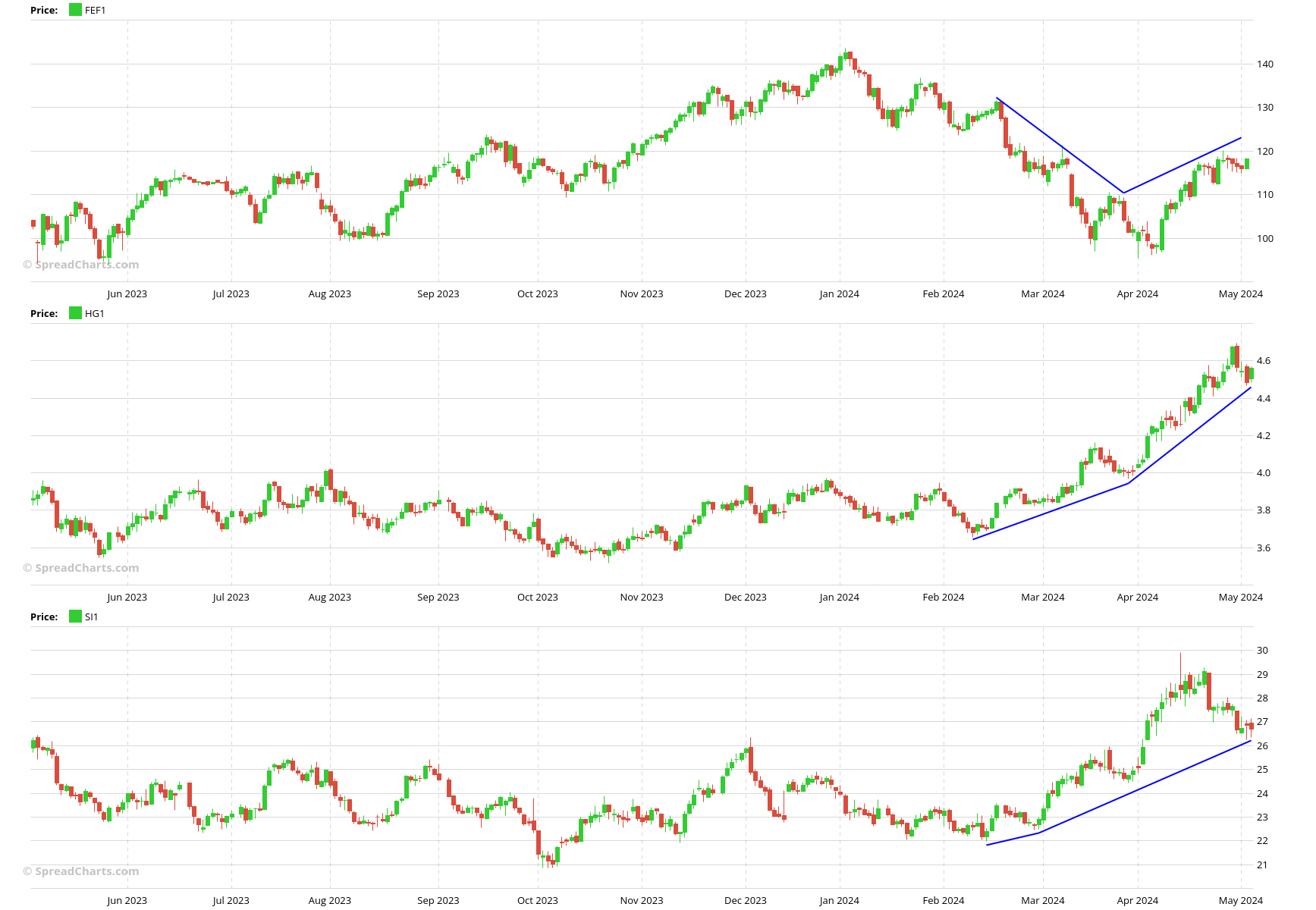

Do you keep in mind after we have been unfazed by silver’s rally in spring 2023, when all of the gold bugs have been calling for $30+ costs to be simply across the nook? Effectively, we noticed that copper and iron ore costs didn’t assist that view.

Nevertheless, markets can behave unpredictably. The current rally in metals is a chief instance, with each silver and copper main iron ore. Understanding the catalysts that truly transfer the market is useful. Observing cross-market relationships past simply metals could be useful on this regard, which is one thing we give attention to closely in our premium analysis.

Maintaining the above caveat in thoughts, I’d nonetheless say that bigger markets like iron ore often prevail, on condition that smaller markets like silver are extra inclined to being squeezed by speculators. Subsequently, the current underperformance of iron ore ought to make you vigilant.

Perception into the bodily market

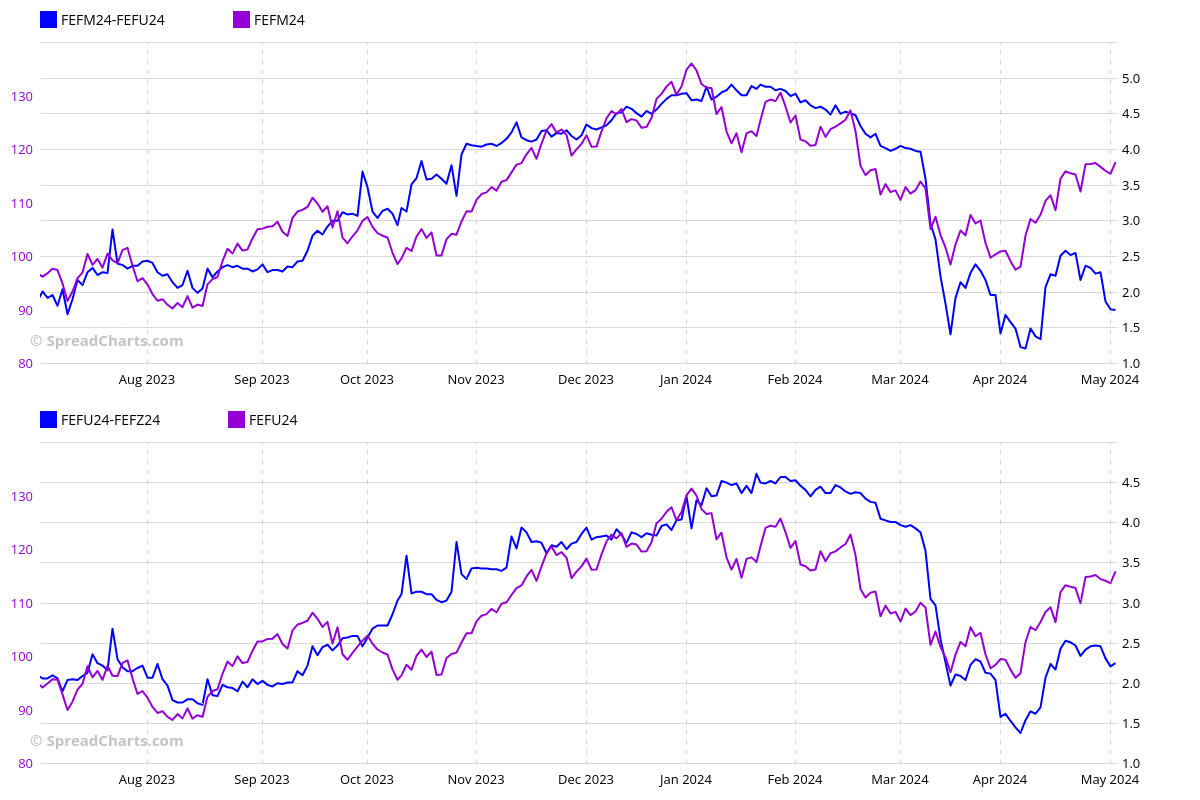

Whereas cross-market evaluation is useful, the interdelivery spreads present even deeper perception into the market. We watch them every day as they’re in all probability probably the most priceless piece of short-term information on the market. These spreads are much less susceptible to broad market manipulation and higher mirror the precise circumstances within the bodily market. We use them as affirmation of the pattern we see within the underlying commodity.

In fact, the perfect alternatives emerge when there’s a divergence between the spreads (blue) and the underlying (purple). If the divergence is sustained over a time period, the spreads are often appropriate, and the underlying commodity catches up. Whereas these are short-term phenomena solely and don’t work 100% of the time (like nothing in markets), it gives an unimaginable edge in commodity buying and selling.

In the event you’re accustomed to our premium analysis, you already know that we carefully watch the copper and platinum spreads. Now you may observe the iron ore spreads too as an extra piece of immensely priceless information. The total contract specs for iron ore are listed under.

We have been capable of signal the license with the SGX and add this new information into the app solely because of our premium subscribers. If you wish to see extra information within the app, contemplate buying the premium subscription.

|

|

|

| Contract title | SGX TSI Iron Ore CFR China (62% Fe Fines) |

|

|

|

| Alternate | SGX |

|

|

|

| Ticker | FEF |

|

|

|

| Expiration months | F, G, H, J, Okay, M, N, Q, U, V, X, Z |

|

|

|

| Foreign money | USD |

|

|

|

| Contract dimension | 100 metric tonnes |

|

|

|

| Level worth | $100 |

|

|

|

| Tick dimension / worth | 0.05 / $5 |

|

|

|

| Settlement | Monetary |

|

|

|