International equities methods are having a second this yr. Though US tech continues to be crimson scorching and the funding darling, American shares general are lagging the remainder of the world on a year-to-date foundation, in accordance with a set of ETFs by means of Tuesday’s shut (Oct. 28).

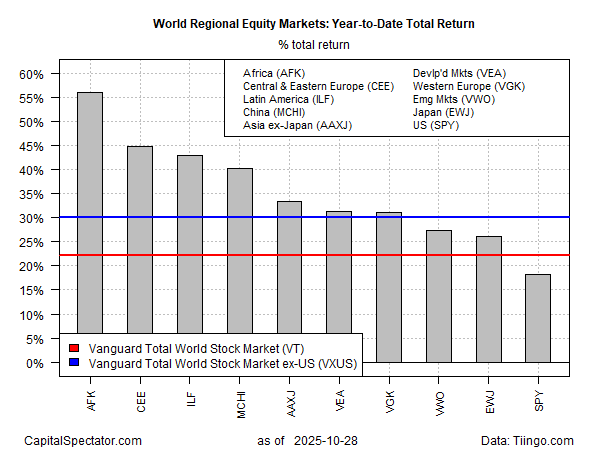

The SPDR S&P 500 ETF (SPY) in isolation seems to be robust, posting a 18.3% year-to-date achieve. That’s a stable above-average efficiency vs. the market’s long-run historical past. Nevertheless it’s subpar vs. international shares usually in 2025. For instance, a world inventory fund ex-US (VXUS) is way forward within the horse race, posting a 30.1% complete return this yr.

Reviewing shares on a regional foundation highlights even stronger efficiency, led by shares in Africa through AFK, which has surged 56.1% to date this yr.

US shares, in contrast, are in final place in 2025. The rating highlights a key function for asset allocation within the calendar yr: minimizing world diversification for equities has been a non-trivial drag on relative efficiency.

The bullish turnaround in offshore markets has revived curiosity in world diversification, however 2025 continues to be an outlier over the longer sweep of efficiency historical past. The talk facilities on whether or not the relative power in international shares is a one-off occasion that can revert to type in 2026.

Solely time will inform, but it surely’s helpful to trace sentiment for international shares relative to US shares through a pair of ETFs for perspective. The chart beneath reminds that whereas traders have favored world equities ex-US this yr, an extended view of the development (beginning in 2011) suggests the jury’s nonetheless out for deciding if the US has misplaced its management on a longer-term foundation.

For now, this yr’s rally in shares ex-US seems to be like one other momentary bounce in ongoing development of US management, as depicted by the falling line, which is the ratio of worldwide shares ex-US (VXUS) vs. US shares (SPY). It stays to be seen if the VXUS:SPY development turns up within the months forward and delivers a distinct story. Meantime, the controversy about whether or not outperformance in international shares is sign or noise continues.