Platinum and palladium are each basking in gold’s glow, nevertheless their efficiency is tempered by every metallic’s distinctive market dynamics.

Of the 2, platinum has been the most important winner in 2025. The worth of the dear metallic climbed by 90 % to its year-to-date excessive of US$1,725 per ounce it reached briefly on October 16. Though the market has since skilled a pull again under the US$1,600 degree, platinum costs stay at 12-year highs.

As for palladium, the dear metallic rose by practically 80 % to succeed in a peak of US$1,630 on October 16. Nonetheless, the palladium worth has since fallen again to the US$1,430 degree.

In its annual Treasured Metals Funding Focus report printed October 25, Metals Focus showcased key provide and demand traits transferring the market and costs for treasured metals resembling platinum and palladium.

Platinum market reflecting greater than gold’s shine

Platinum is little question benefitting from robust investor demand for treasured metals on stagnation fears in 2025. However the metallic’s sturdy provide and demand fundamentals are additionally at play, in keeping with Metals Focus analysts.

Above floor inventories of platinum stay tight whereas future mine manufacturing is slowed down in operation challenges. “In Southern Africa, outages and heavy rainfall have disrupted manufacturing, whereas North America is present process restructuring,” famous the report.

On the demand aspect, the platinum demand from the jewellery sector has posted vital features this 12 months, particularly in China. As the worth of gold skyrockets, platinum jewellery has change into a way more enticing various. Funding flows into platinum exchange-trade merchandise in China and the US are one other key demand driver for the metallic this 12 months.

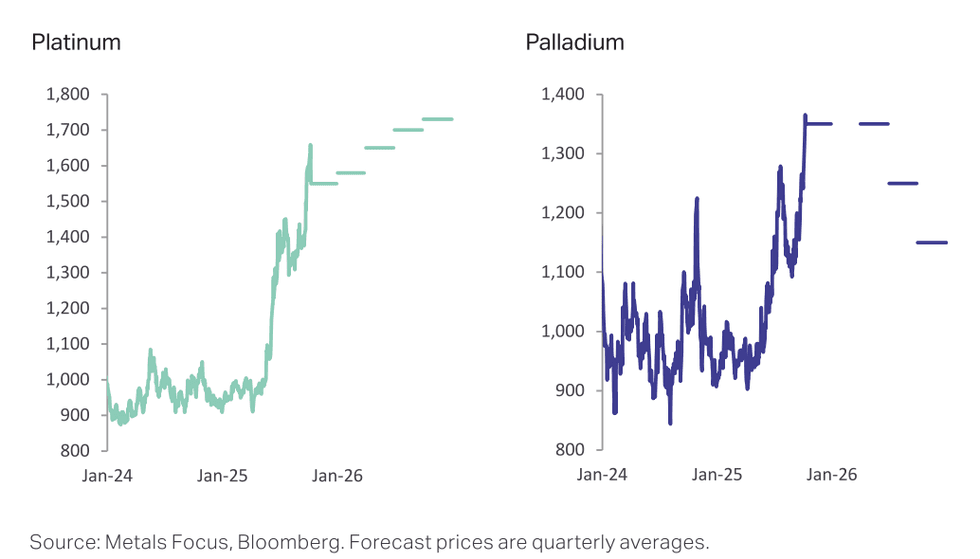

Platinum and palladium costs

Chart by way of Metals Focus, Bloomberg

Whereas platinum costs are at ranges not seen in 12 years, palladium costs are solely experiencing a 2-year excessive. “Palladium has additionally benefited on the margin, however stays a laggard, with a extra lacklustre elementary outlook limiting investor enthusiasm,” in keeping with Metals Focus.

2026: Platinum bull and palladium bear

Platinum costs will proceed to profit from the general upward development in treasured metals costs within the the rest of 2025 and nicely into 2026. The continuing provide deficit within the platinum market can also be extremely worth supportive.

Metals Focus is forecasting a 3rd consecutive 12 months of bodily deficit for 2025, totaling 415,000 ounces as platinum mine output is anticipated to say no by 6 % year-over-year. Demand is projected to fall by 4 % largely resulting from decrease outputs within the glass and automotive sectors.

Platinum’s provide deficit is anticipated to proceed into 2026 and develop to an estimated 480,000 ounces as mine provide is forecast to fall by 2 % to a 12 12 months low (excluding COVID 2020). “With few new initiatives coming on-line after years of underinvestment, mine provide is present process structural decline,” famous the report’s authors.

This shall be taking place on the similar time that demand is anticipated to rebound by 1 % on renewed industrial demand, particularly out of the glass and chemical sector in China. But, Metals Focus cautions that demand out the automotive and jewellery sectors are prone to contract.

The development towards electrification is the auto trade might have slowed, nevertheless it’s nonetheless anticipated to erode platinum demand, particularly as catalytic converter producers shift again to less expensive palladium.

Metals Focus is forecasting a 2026 common platinum worth of US$1,670 per ounce, up 34 % over the earlier 12 months.

Platinum and palladium worth outlook

Chart by way of Metals Focus, Bloomberg

Wanting over to palladium, Metals Focus has a extra bearish view. The agency is projecting palladium costs to common US$1,350 per ounce in This fall 2025, falling to US$1,150 by This fall 2026. Though the palladium market has been in a bodily deficit for the previous few years, that deficit is anticipated to shrink from 566,000 ounces in 2024 to 367,000 ounces in 2025 earlier than narrowing even additional to 178,000 in 2026.

The identical structural points plaguing platinum are additionally in fact weighing on palladium mine provide, which is forecast to fall by 3 % in 2026. Nonetheless, secondary provide is projected to extend by 10 % as recycling exercise recovers. General, whole palladium provide is anticipated to develop by 1 % for the 12 months. On the similar time, demand for palladium is ready to say no by simply over 1 % in 2026 on a drop from the automotive sector.

Investor takeaway

Each platinum and palladium are thought-about treasured metals based mostly on their rarity and use in jewellery fabrication and bodily bullion. As such, they each are recognized to profit when investor sentiment for safe-haven gold is excessive.

Nonetheless, not all treasured metals are treasured to traders on the similar time. Simply ask silver. The economic makes use of for these metals is a a lot larger driver of demand in comparison with the funding house. For 2026, it’s platinum that may proceed to trip gold’s rally and supply traders with loads of upside based mostly on its robust fundamentals.

Don’t overlook to observe us @INN_Resource for real-time information updates!

Securities Disclosure: I, Melissa Pistilli, presently maintain no direct funding curiosity in any firm talked about on this article.

From Your Website Articles

Associated Articles Across the Internet