Munis had been narrowly blended Monday because the entrance finish of the curve was barely weaker and the asset class noticed small good points out lengthy. U.S. Treasuries had been regular to firmer in spots and equities rallied.

The 2-year muni-UST ratio Monday was at 68%, the five-year at 65%, the 10-year at 69% and the 30-year at 90%, in response to Municipal Market Information’s 3 p.m. EDT learn. ICE Information Providers had the two-year at 68%, the five-year at 66%, the 10-year at 69% and the 30-year at 89% at a 4 p.m. learn.

Regardless of the continuing heavy slate of issuance, the muni market strengthened all through final week.

“The story stays the identical: strong demand is greater than sufficient to take down the sizable new challenge provide,” stated Daryl Clements, a portfolio supervisor at AllianceBernstein.

The speed power in investment-grade munis final week bolstered the bullishness in muni market individuals, in response to Birch Creek Capital analysts.

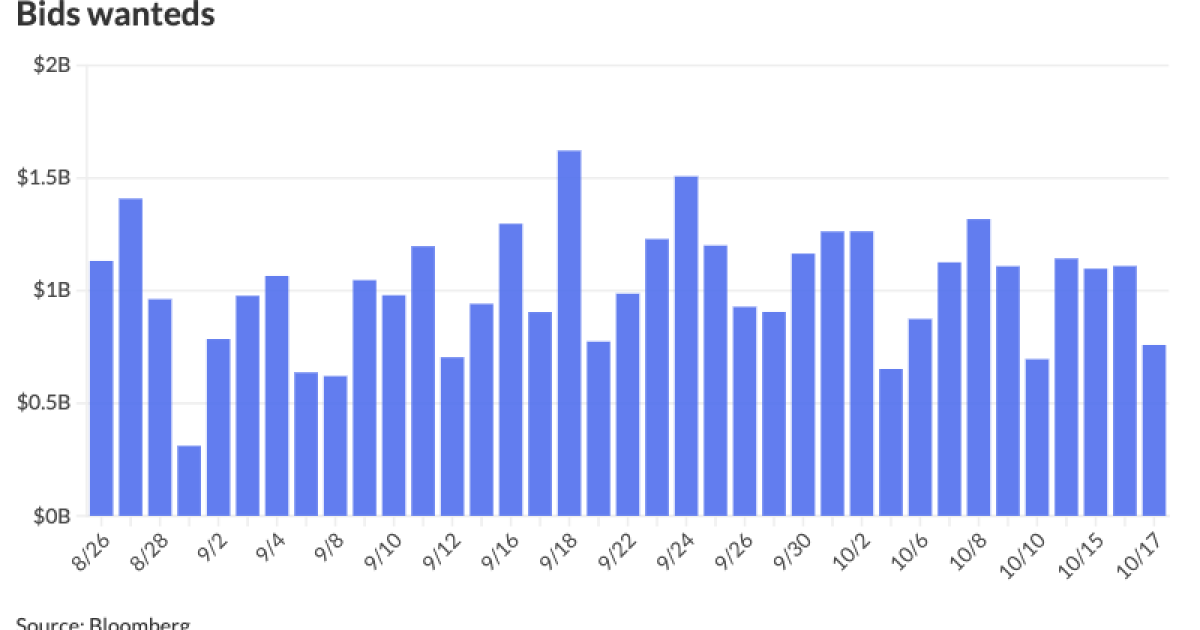

Funding-grade muni mutual funds noticed $663 million in inflows, in response to LSEG Lipper, ” bolstering demand and lowering the necessity to generate liquidity, as [bid wanted] volumes fell by 7-17% in 5y+ maturities,” Birch Creek’s analysts wrote within the agency’s weekly market commentary.

Moreover, “sellers reported loads of inquiry within the secondary market, resulting in strong volumes and buyer purchases off simply 3% from latest averages,” they stated.

Most new points pricing final week noticed oversubscriptions, Birch Creek reported. The Dormitory Authority of the State of New Yorks $1.46 billion deal, for instance, noticed yields reprice as a lot as 10-15 foundation factors from the retail order interval to the ultimate pricing.

The high-yield market, in the meantime, remains to be grappling with low provide, Birch Creek stated.

A number of main asset managers have underperformed this yr, Birch Creek famous, after “taking outsized positions on troubled credit and as broader macro considerations start popping up exterior of the asset class.”

Nonetheless, most high-yield managers have constructed giant money cushions from their sturdy inflows, “so it will probably take a streak of sizable outflows earlier than the market begins to meaningfully underperform.”

Elsewhere, lengthy bonds have had an “spectacular rally, which has closed the underperformance hole with shorter bonds,” Clements stated.

Regardless of the latest long-bond rally, the “upside in lengthy bonds stays engaging,” he stated.

“With only a decline of fifty foundation factors in yields, lengthy bonds would return roughly 8.7%,” he stated.

And provided that the 10s/20s curve is twice the longer-term common, it is “cheap” to anticipate the curve to proceed to flatten and lengthy bonds to outperform shorter maturity bonds.

AAA scales

MMD’s scale was narrowly blended: 2.47% (+2) in 2026 and a couple of.37% (+2) in 2027. The five-year was 2.34% (+1), the 10-year was 2.74% (-2) and the 30-year was 4.13% (unch) at 3 p.m.

The ICE AAA yield curve was narrowly blended: 2.43% (+1) in 2026 and a couple of.35% (+2) in 2027. The five-year was at 2.36% (+2), the 10-year was at 2.77% (-1) and the 30-year was at 4.08% (-1) at 4 p.m.

The S&P International Market Intelligence municipal curve was narrowly blended: The one-year was at 2.46% (+2) in 2025 and a couple of.38% (+2) in 2026. The five-year was at 2.34% (+1), the 10-year was at 2.75% (-2) and the 30-year yield was at 4.11% (unch) at 3 p.m.

Bloomberg BVAL was narrowly blended: 2.40% (+1) in 2025 and a couple of.36% (+1) in 2026. The five-year at 2.25% (+1), the 10-year at 2.75% (-1) and the 30-year at 4.07% (-1) at 4 p.m.

Treasuries had been firmer out lengthy.

The 2-year UST was yielding 3.462% (flat), the three-year was at 3.465% (flat), the five-year at 3.577% (-2), the 10-year at 3.987% (-2), the 20-year at 4.546% (-3) and the 30-year at 4.576% (-3) close to the shut.

Main to come back

The Texas Transportation Fee (Aaa//AAA/) is about to cost Tuesday $1.772 billion of common obligation mobility fund refunding bonds. Loop Capital Markets.

CPS Vitality (Aa2/AA-/AA-/) is about to cost Tuesday $1.398 billion of taxable income refunding bonds, New Sequence 2025A. BofA Securities.

CPS Vitality (Aa3/A+/AA-/) can also be set to cost Wednesday $514.83 million of variable price junior lien income and refunding bonds, Sequence 2025A. Truist.

Moreover, CPS Vitality (Aa2/AA-/AA-/) is about to cost Tuesday $324.13 million of income refunding bonds, New Sequence 2025B. BofA Securities.

The New Jersey Transportation Belief Fund Authority (A1/A/A/A/) is about to cost Wednesday $1.5 billion of transportation program bonds, Sequence 2025 AA. J.P. Morgan.

The New York Metropolis Transitional Finance Authority (Aa1/AAA/AAA/) is about to cost Wednesday $1.5 billion of future tax secured tax-exempt subordinate bonds, Fiscal 2026 Sequence B. Siebert Williams Shank.

The Kentucky State Property and Buildings Fee (Aa3//AA-/) is about to cost Wednesday $940.27 million of Challenge No. 133 income bonds, consisting of $775 million of Sequence A bonds and $165.27 million of Sequence B refunding bonds. BofA Securities.

The California State Public Works Board (Aa3/A+/AA-/) is about to cost Tuesday a $642.505 million deal, consisting of $621.195 million of Sequence 2025C and $21.31 million of Sequence 2025D. J.P. Morgan.

The Wayne County Airport Authority (A1/A+//AA/) is about to cost Tuesday $465.58 million of Detroit Metropolitan Wayne County Airport income refunding bonds, consisting of $28.965 million of Sequence D, $194.405 million of Sequence E, $7.125 million of Sequence F, $189.91 million of Sequence G and $45.175 million of Sequence H. Siebert Williams Shank.

The Sacramento Metropolis Unified College District, California, (/AA//) is about to cost Thursday $451.88 million of GO bonds, consisting of $262.5 million of GO 2020 Election (Measure H) bonds, Sequence C; $143 million of GO 2024 Election (Measure D) bonds, Sequence A; $9.855 million of 2025 GO refunding bonds, Sequence A; and $36.525 million of 2025 GO refunding bonds, Sequence B. Loop Capital Markets.

The Williamsburg Financial Growth Authority, Virginia, (/A+//) is about to cost Tuesday $330 million of taxable Colonial Williamsburg Basis Challenge income bonds. Wells Fargo.

The Cumberland County Industrial Services and Air pollution Management Financing Authority (Aa1///) is about to cost Tuesday $250 million of Challenge Aero strong waste disposal income bonds. Oppenheimer.

The Frisco Unbiased College District, Texas, (Aaa/AAA//) is about to cost Tuesday $214.4 million of PSF-insured limitless tax refunding bonds, Sequence 2025B. Piper Sandler.

North Slope Borough, Alaska, (/AA//AA+/) is about to cost Wednesday $186.75 million of GOs. Jefferies.

The Oklahoma Metropolis Water Utilities Belief (Aaa/AAA//) is about to cost Thursday $185.91 million of utility system income refunding and enchancment bonds. Morgan Stanley.

The Conroe Unbiased College District, Texas, (Aaa/AAA//) is about to cost Wednesday $185.14 million of PSF-insured limitless tax refunding bonds. RBC Capital Markets.

The Comal Unbiased College District, Texas, (Aaa///) is about to cost Tuesday $184.21 million of PSF-insured limitless tax refunding bonds. Frost Financial institution.

The Missouri Joint Municipal Electrical Utility Fee (A3//A/) is about to cost Tuesday $151.37 million of Marshall Vitality Heart Challenge energy venture income. Wells Fargo.

The Glendale Industrial Growth Authority, Arizona, (/AA-/AA/) is about to cost Thursday $150 million of Midwestern College income. Raymond James.

Metrocare Providers (Aa3///) is about to cost Wednesday $142.49 million of income bonds. Raymond James.

The Maryland Well being and Larger Academic Services Authority (A1/AA//) is about to cost Wednesday $135.565 million of TidalHealth challenge income bonds, Sequence 2025C. KeyBanc.

The Village Group Growth District No. 16, Florida, is about to cost Thursday $127 million of nonrated particular evaluation income bonds. Jefferies.

The Colorado Well being Services Authority (/A-//) is about to cost Thursday $125 million of Craig Hospital Challenge hospital income bonds, consisting of $105 million of Sequence A and $20 million of Sequence B. RBC Capital Markets.

The South Carolina Scholar Mortgage Corp. (/AA//) is about to cost Thursday $112.1 million of taxable senior pupil mortgage income bonds, Sequence 2025A. RBC Capital Markets.

Oregon (Aa1/AA+/AA+/) is about to cost Thursday $109.44 million of GOs, Sequence 2025K. Morgan Stanley.

The IPS Multi-College Constructing Corp., Indiana, (/AA+//) is about to cost Wednesday $107.75 million of social advert valorem property tax first mortgage bonds. Stifel.

Pensacola, Florida, (/A+/A+/A+/) is about to cost Tuesday $104.625 million of AMT airport income bonds. BofA Securities.

The Mission Financial Growth Corp. (A1///) is about to cost Wednesday $100 million of Vinton Metal LLC Challenge strong waste disposal income bonds. Jefferies.

Aggressive

The Triborough Bridge and Tunnel Authority, New York, is about to promote $230 million of second subordinate income bond anticipation notes, Sequence 2025A, at 10:45 a.m. Tuesday.

Suffolk County, New York, (/AA-/AA-/) is about to promote $188.735 million of public enchancment serial bonds, Sequence 2025A, at 11 a.m. Thursday.

Fayetteville, North Carolina, (Aa2/AA/AA/) is about to promote $156.135 million of public works fee income bonds, at 11 a.m. Tuesday.

Henrico County, Virginia, (///AAA/) is about to promote $125 million of water and sewer system income bonds, Sequence 2025D, at 10:30 a.m. Thursday.

Lawrence, Kansas, is about to promote $121.57 million of water and sewage system enchancment and refunding income bonds at midday Thursday.

Jessica Lerner contributed to this story.