Munis have been combined within the secondary market Wednesday as the first market took focus, with a number of billion-dollar offers pricing. U.S. Treasuries noticed small features and equities ended up.

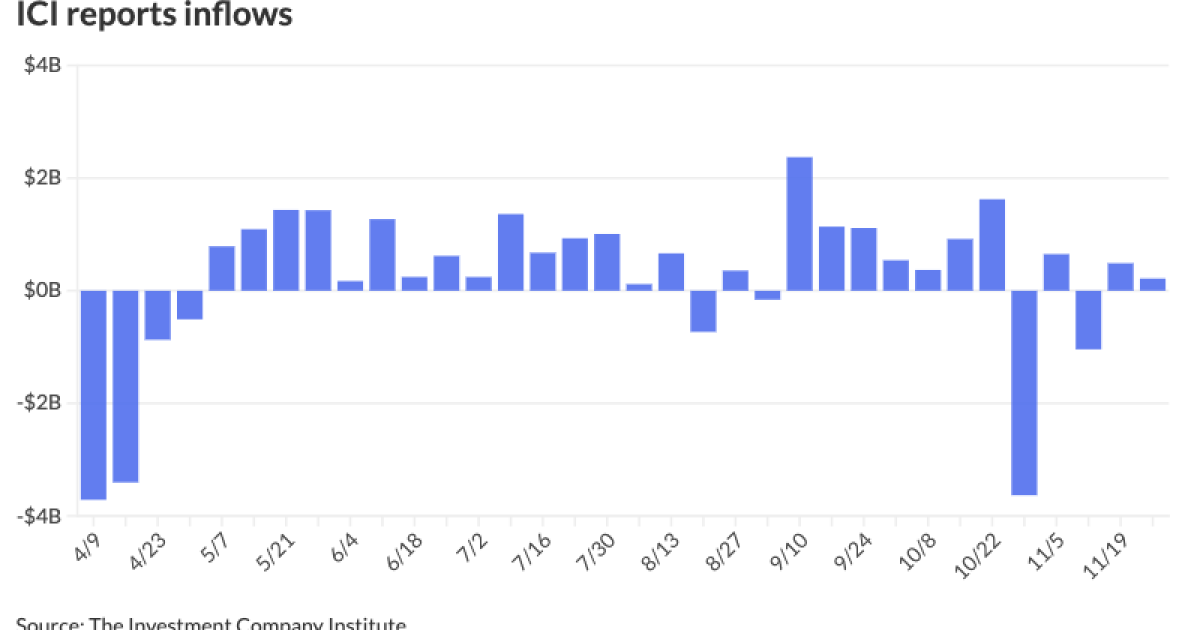

The Funding Firm Institute Wednesday reported inflows of $217 million for the week ending Nov. 25, following $488 million of inflows the earlier week.

Trade-traded funds noticed inflows of $1.089 billion after $366 million of inflows the week prior, per ICI information.

The muni market is coping with elevated provide this week and secondary flows have “reacted in tandem,” stated Kim Olsan, senior fastened revenue portfolio supervisor at NewSquare Capital, noting secondary quantity reached its highest degree in two months Tuesday at $10.1 billion.

The “cycle of excessive provide” comes as generic yields are 40 to 60 foundation factors under their second-quarter closing ranges, Olsan stated. She sees “broad-based demand, the place muni consumers have a number of causes to stay engaged, even when at modest changes.”

“There’s renewed deal with optimizing taxable-equivalent yields because the broad outlook is positioning for decrease yields in 2026,” she stated. “Given these issues, a stability of curve extension and credit score high quality comes into play.”

The 2-year muni-UST ratio Wednesday was at 70%, the five-year at 67%, the 10-year at 68% and the 30-year at 89%, in line with Municipal Market Information’s 3 p.m. EDT learn. ICE Information Companies had the two-year at 70%, the five-year at 65%, the 10-year at 67% and the 30-year at 88% at a 4 p.m. learn.

Regardless of 2025’s volatility, MMD-UST ratios “will doubtless find yourself not removed from 2024 yearend ranges,” Barclays analysts led by Mikhail Foux wrote, “not less than for the entrance finish.”

“Going into this yr, municipal bond traders have been involved concerning the results of tax reform on the asset class. We have been skeptical about substantial adjustments to the tax exemption, but in addition thought that municipals may lose not less than some portion of the market,” Barclays wrote. “Clearly, our issues have been misplaced and never solely did munis not lose something they really added some sectors and makes use of.”

Not like most years, high-yield has underperformed investment-grade. The transportation and tobacco sectors dragged down general high-yield efficiency, in line with Barclays.

Tax-exempt munis underperformed this yr, Barclays wrote, due to valuations and heavy issuance.

“Tax-exempts began the yr wealthy relative to Treasuries, and even elevated yields (which generally entice extra traders) didn’t justify such low ratios, in our view,” Barclays wrote.

Barclays analysts are “cautiously optimistic” about 2026.

Muni traders ought to place themselves defensively heading into the brand new yr, however stay optimistic, Barclays wrote. Decrease charges and steeper curves will create a tailwind, whereas ratios ought to decline considerably on the entrance and lengthy ends, however doubtless not within the stomach of the curve.

“Issuance will stay heavy and may come again with pressure within the first quarter, price volatility will doubtless return firstly of the yr and retail has began to commit extra capital to the asset class, however we have to see extra,” Barclays analysts wrote.

Barclays does not foresee main coverage adjustments within the muni sectors past greater schooling and hospitals. Moreover, its analysts count on the financial system to speed up within the first two quarters of 2026, whereas inflation moderates barely.

The course of the muni market will probably be decided extra by the UST market than common, in line with Barclays strategists. They count on stronger efficiency from the UST entrance finish, which is able to encourage the Federal Reserve to select up easing and reduce charges.

“Lengthy charges ought to stay sticky and are anticipated to say no solely marginally due to lingering issues concerning the finances deficit, authorized challenges to the present tariff regime, and a big enhance in company issuance that must also put strain on lengthy Treasuries,” Barclays analysts wrote.

New-issue market

Within the main market Wednesday, Raymond James priced for Connecticut (Aa2/AA/AA/AAA/) $1.551 billion of particular tax obligation bonds (transportation infrastructure functions), Collection 2025A, with 5s of seven/2026 at 2.54%, 5s of 2030 at 2.60%, 5s of 2035 at 2.92%, 5s of 2040 at 3.54%, 5s of 2045 at 4.09% and 5s of 2046 at 4.14%, callable 10/1/2035.

Goldman Sachs priced for the California Group Alternative Financing Authority (Aa1///) $1.035 billion of inexperienced clear power mission income bonds, Collection 2025G, with 5s of 12/2035 at 3.88%.

BofA Securities priced for Massachusetts (Aa1/AA+/AA+/) $1.018 billion of GOs. The primary tranche, $750 million of Collection 2025G bonds, noticed 5s of 12/2029 at 2.50%, 5s of 2030 at 2.49%, 5s of 2035 at 2.89%, 5s of 2040 at 3.48%, 5s of 2045 at 4.06%, 5s of 2050 at 4.39% and 5s of 2055 at 4.49%, callable 12/1/2035.

The second tranche, $268.21 million of Collection 2025B refunding bonds, noticed 5s of 6/2027 at 2.52%, 5s of 2030 at 2.49%, 5s of 2035 at 2.86%, 5s of 2040 at 3.48%, 5s of 2045 at 4.06%, and 5s of 2046 at 4.17%, callable 6/1/2025.

RBC Capital Markets preliminarily priced for the Battery Park Metropolis Authority (Aaa/AAA/) $662.285 million of senior sustainability income bonds, with 5s of 11/2039 at 3.30%, 5s of 2040 at 3.47%, 5s of 2045 at 4.11%, 5s of 2050 at 4.39% and 5.25s of 2055 at 4.43%, callable 11/1/2035.

J.P. Morgan priced for the Maryland Well being and Larger Academic Services Authority (Aa2/AA-/AA-/) $359.755 million of Johns Hopkins Well being System concern income bonds, Collection 2025A, with 5s of 5/2026 at 2.63%, 5s of 2030 at 2.70%, 5s of 2035 at 3.04%, 5s of 2040 at 3.67% and 5.25s of 2055 at 4.59%, callable 11/15/2035.

BofA Securities priced for the Pennsylvania Turnpike Fee (A1/AA-/AA-/) $206.19 million of registration charge income refunding bonds, with 5s of seven/2030 at 2.63%, 5s of 2035 at 3.00%, 5s of 2040 at 3.59% and 5s of 2041 at 3.71%, callable 7/15/2035.

Within the aggressive market, King County, Washington, (Aaa/AAA/AAA/) bought $234.17 million of restricted tax GO and refunding bonds, Collection B, to BofA Securities, with 5s of 12/2026 at 2.50%, 5s of 2030 at 2.53%, 5s of 2035 at 2.85%, 5s of 2040 at 3.44%, 5s of 2045 at 4.03%, 5s of 2050 at 4.29%, and 5s of 2055 at 4.39%, callable 12/1/2035.

The county additionally bought $119.12 million of taxable restricted tax GOs, Collection 2025C, to FHN Monetary, with 3.271s of 12/2026 at par, 3.793s of 2030 at par, 4.125s of 2035 at 4.277%, 4.55s of 2039 at 4.727% and 4.75s of 2045 at 4.908%, callable 12/1/2035.

St. Petersburg, Florida, (Aa2//AA/) bought $131.25 million of public utility income bonds, Collection 2025C, to BofA Securities, with 5s of 10/2027 at 2.55%, 5s of 2030 at 2.56%, 5s of 2035 at 2.92%, 5s of 2040 at 3.52%, 4.375s of 2045 at 4.35%, 4.5s of 2050 at 4.52% and 4.5s of 2055 at 4.55%, callable 10/1/2035.

The Moorestown Township Board of Training (/AA+//) bought $108.298 million of faculty bonds to UBS, with 1s of 8/2027 at 3.10%, 2s of 2030 at 3.25%, 4s of 2035 at 2.70%, 4s of 2040 at 3.65%, 4s of 2045 at 4.10% and 4s of 2050 at 4.31%, callable 8/1/2033.

AAA scales

MMD’s scale was unchanged: 2.50% in 2026 and a couple of.44% in 2027. The five-year was 2.43%, the 10-year was 2.77% and the 30-year was 4.21% at 3 p.m.

The ICE AAA yield curve was bumped as much as 4 foundation factors: 2.49% (-1) in 2026 and a couple of.45% (-2) in 2027. The five-year was at 2.39% (-4), the 10-year was at 2.76% (-2) and the 30-year was at 4.16% (unch) at 4 p.m.

The S&P World Market Intelligence municipal curve was little modified: The one-year was at 2.50% (unch) in 2025 and a couple of.44% (unch) in 2026. The five-year was at 2.43% (+1), the 10-year was at 2.77% (unch) and the 30-year yield was at 4.19% (unch) at 3 p.m.

Bloomberg BVAL was unchanged 2.50% in 2025 and a couple of.45% in 2026. The five-year at 2.39%, the 10-year at 2.73% and the 30-year at 4.09% at 4 p.m.

Treasuries have been barely firmer.

The 2-year UST was yielding 3.485% (-3), the three-year was at 3.501% (-3), the five-year at 3.623% (-3), the 10-year at 4.058% (-3), the 20-year at 4.684% (-2) and the 30-year at 4.727% (-2) close to the shut.

Main to come back

The Utility Debt Securitization Authority, New York, (Aaa/AAA/AAA/) is ready to cost Thursday $1.026 billion of restructuring bonds, consisting of $112.03 million of Collection 2025 inexperienced bonds and $914.275 million of Collection 2025 TE-2 bonds. BofA Securities.

CPS Power (Aa2/AA-/AA-/) is ready to cost Thursday $599.765 million of income refunding bonds, New Collection 2026A. Jefferies.

The Oklahoma Water Sources Board (/AAA//) is ready to cost Thursday $261.81 million of state mortgage program income bonds, Collection 2025C. BOK Monetary Securities.

CSU Strata (/BB+//) is ready to cost Thursday $144.435 million of pupil housing income bonds (The Prospect Challenge), consisting of $137.15 million of Collection 2025A bonds and $7.285 million of subordinate Collection 2025B bonds. Morgan Stanley.

The South Carolina Jobs-Financial Improvement Authority (/A+//) is ready to cost Thursday $132.79 million of credit-enhanced residential improvement income bonds (Sixteenth Ground Obligated Group Tasks), Collection 2025. KeyBanc Capital Markets.

Fort Price Impartial Faculty District (Aaa///) is ready to cost Thursday $131.54 million of PSF-insured limitless tax refunding bonds, Collection 2025A. BofA Securities.

The Public Finance Authority (/AA//) is ready to cost Thursday $120.24 million of BAM-insured pupil housing income bonds (PRG – Oxford Properties LLC Challenge), consisting of $117.59 million of Collection 2025A and $2.65 million of Collection 2025B. Raymond James.

The Eagle Mountain-Saginaw Impartial Faculty District (Aaa//AAA/) is ready to cost $112.775 million of PSF-insured limitless tax refunding bonds, Collection 2025-A. Mesirow Monetary.

Aggressive

The California Infrastructure and Financial Improvement Financial institution (Aaa//AAA/) is ready to promote $554.625 million of inexperienced clear water and ingesting water state revolving fund income bonds at 11:30 a.m. Japanese Thursday.

Jessica Lerner contributed to this report.