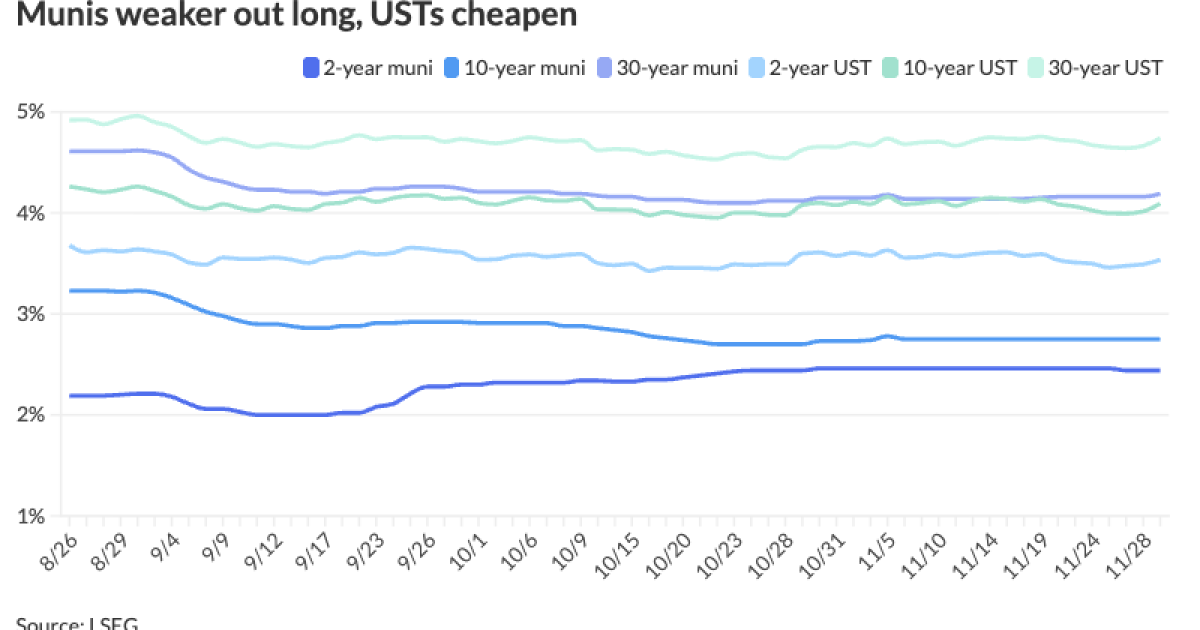

Municipals are weaker out lengthy to open December as U.S. Treasuries cheapened and equities ended down.

Muni yields had been reduce as much as three foundation factors, whereas UST yields rose 5 to 9 foundation factors.

The 2-year muni-UST ratio Monday was at 69%, the five-year at 66%, the 10-year at 67% and the 30-year at 88%, in line with Municipal Market Information’s 3 p.m. EDT learn. ICE Information Providers had the two-year at 70%, the five-year at 67%, the 10-year at 69% and the 30-year at 88% at a 3 p.m. learn.

The muni market recorded its fourth straight month of constructive returns in November and December is more likely to hold the streak going with one other robust month to spherical out the yr.

Funding-grade munis noticed features of 0.23% in November and 4.15% year-to-date. Excessive-yield munis noticed returns of 0.39% final month and a pair of.71% YTD.

Taxable munis noticed features of 0.64% in November and eight.27% YTD.

Jason Wong, vp of municipals at AmeriVet Securities, is anticipating one other “robust rally” in December, as the ultimate month of the yr “sometimes sees a rally, with only one detrimental efficiency within the final 10 years.”

The explanation for his optimism is the “sometimes mild calendar” of latest points, the fourth smallest month of the yr, which “ought to gas a rally for secondary demand as buyers look to tax-loss swapping to wrap up for the yr.”

November issuance totaled $38.487 billion, up 51.1% year-over-year. Issuance year-to-date is $535.15 billion, up 11.5% from $479.829 billion over the identical interval in 2024. This formally tops 2024’s report $507.585 billion quantity.

New situation provide is predicted to persist at report ranges, however that must be “comfortably absorbed” by the market, Lind Capital Companions says in its newest Municipal Market Commentary.

“Indicators of a weakening labor market and declining shopper confidence in the end renewed conviction in a December fee reduce,” which ought to increase the market and assist take in provide, Lind stated. “Mixed with holiday-driven investor complacency (that) ought to make for a enjoyable month.”

Munis completed flat in November and underperformed Treasuries throughout the curve, Wong stated.

The 2-year muni-UST ratio ended the month at 71.15%, in comparison with 69.51% at the beginning of the month, whereas the five-year ratio closed the month at 67.50% versus 65.02% on the finish of October.

The ten-year ratio climbed to 68.51% from 67.02%. The 30-year maturity was the perfect performer, with the ratio to comparable Treasuries rising by solely 0.2 proportion factors to 88.49%.

The common yield on 10-year muni bonds ended the month at 2.71%, unchanged from October.

The muni curve held regular at 163 foundation factors for the week and the month.

Though the seven-week muni mutual fund influx streak led to November, flows remained “firmly constructive” final month, totaling $1.25 billion, Lind stated.

Buyers added $679.5 million to municipal bond mutual funds within the week ended Wednesday, following $905.8 million of outflows the prior week, in line with LSEG Lipper knowledge.

Excessive-yield funds noticed small inflows of $97 million in comparison with outflows of $142.1 million the earlier week.

Nonetheless, the agency famous that fund circulate knowledge has been “distorted” recently by a number of current conversions of muni bond mutual funds to exchange-traded funds whose belongings “proceed to set annual data, because the construction stays in vogue.”

AAA scales

MMD’s scale was reduce out lengthy: 2.50% (unch, no Dec. roll) in 2026 and a pair of.44% (unch, no Dec. roll) in 2027. The five-year was 2.41% (unch, no Dec. roll), the 10-year was 2.75% (unch, no Dec. roll) and the 30-year was 4.19% (+3) at 3 p.m.

The ICE AAA yield curve was reduce two to 3 foundation factors: 2.49% (+2) in 2026 and a pair of.47% (+2) in 2027. The five-year was at 2.43% (+3), the 10-year was at 2.77% (+3) and the 30-year was at 4.13% (+3) at 3 p.m.

The S&P World Market Intelligence municipal curve was reduce out lengthy: The one-year was at 2.50% (unch) in 2025 and a pair of.44% (unch) in 2026. The five-year was at 2.40% (unch), the 10-year was at 2.75% (unch) and the 30-year yield was at 4.16% (+3) at 3 p.m.

Bloomberg BVAL was reduce as much as three foundation factors: 2.50% (unch) in 2025 and a pair of.46% (unch) in 2026. The five-year at 2.39% (unch), the 10-year at 2.73% (+1) and the 30-year at 4.08% (+3) at 3 p.m.

Treasuries had been weaker.

The 2-year UST was yielding 3.538% (+5), the three-year was at 3.552% (+7), the five-year at 3.672% (+8), the 10-year at 4.095% (+8), the 20-year at 4.714% (+9) and the 30-year at 4.746% (+8) at 3 p.m.

Major to come back

Connecticut (Aa2/AA/AA/AAA/) is about to cost Wednesday $1.56 billion of transportation infrastructure functions particular tax obligation refunding bonds, Collection 2025A. Raymond James.

The Utility Debt Securitization Authority, New York, (Aaa/AAA/AAA/) is about to cost Thursday $1.026 billion of restructuring bonds, consisting of $112.03 million of Collection 2025 inexperienced bonds and $914.275 million of Collection 2025 TE-2 bonds. BofA Securities.

Massachusetts (Aa1/AA+/AA+/) is about to cost Wednesday $1.019 billion of GOs, consisting of $750 million of Collection 2025G bonds and $269.585 million of Collection 2025B refunding bonds. BofA Securities.

The California Neighborhood Alternative Financing Authority (Aa1///) is about to cost $950 million of inexperienced clear power mission income bonds, Collection 2025G. Goldman Sachs.

The San Francisco Airport Fee (Aa3/AA-//) is about to cost Tuesday $930.28 million of San Francisco Worldwide Airport second sequence income bonds, consisting of $874.645 million of Collection 2025D bonds and $55.635 million of Collection 2025E bonds. J.P. Morgan Securities.

The Battery Park Metropolis Authority (Aaa//AAA/) is about to cost Wednesday $662.285 million of senior income sustainability refunding bonds, RBC Capital Markets.

CPS Vitality (Aa2/AA-/AA-/) is about to cost Thursday $599.765 million of income refunding bonds, New Collection 2026A. Jefferies.

The Maryland Well being and Larger Academic Services Authority (Aa2/AA-/AA-/) is about to cost Wednesday $335.115 million of income bonds (The Johns Hopkins Well being System Situation), Collection 2025A. J.P. Morgan.

Oakland (Aa2/AA-//) is about to cost Wednesday $333.99 million of Measure U GO bonds, consisting of $94.26 million of tax-exempt Collection 2025B-1 bonds, $48.94 million of tax-exempt Collection 2025 Refunding bonds, $180.745 million of taxable Collection 2025B-2 bonds, and $10.045 million of taxable Collection 2025B-3 bonds.

Pasadena Unified College District (Aa3///) is about to cost Tuesday $300 million of GOs, consisting of $250 million of Election of 2020 Collection D bonds, and $50 million of 2024 Election Collection 2025A bonds. Raymond James.

The Oklahoma Water Assets Board (/AAA//) is about to cost Thursday $261.81 million of state mortgage program income bonds, Collection 2025C. BOK Monetary Securities.

The Monroe County Industrial Improvement Corp. (Aa3/AA-//) is about to cost Tuesday $223.215 million of College of Rochester mission bonds, consisting of $122.445 million of non-AMT Collection 2025A bonds and $100.77 million of taxable Collection 2025B bonds. BofA Securities.

The Pennsylvania Turnpike Fee (A1/AA-/AA-/) is about to cost Wednesday $206.595 million of motorcar registration charge income bonds, Collection 2025. BofA Securities.

The Georgia Housing and Finance Authority (/AAA//) is about to cost Tuesday $205.065 million of non-AMT single-family mortgage bonds, Collection 2025G. Morgan Stanley.

The North Dakota Housing Finance Company (Aa1///) is about to cost Wednesday $185 million of non-AMT housing finance program social bonds (Dwelling Mortgage Finance Program), Collection 2025C. RBC Capital Markets.

Ohio (Aa1/AA+/AA+/) is about to cost Wednesday $173.82 million of tax-exempt capital amenities lease-appropriation bonds, consisting of $89.59 million of psychological well being amenities enchancment fund tasks, Collection 2025A; $58.055 million of parks and recreation enchancment fund tasks refunding bonds, Collection 2025A; and $26.175 million of grownup correctional constructing fund tasks refunding bonds, Collection 2025C. Jefferies.

The Summit County Improvement Finance Authority (/AA//) is about to cost Wednesday $157.595 million of BAM-insured pupil housing income bonds (PRG – Akron Properties LLC – The College of Akron Mission), consisting of $157.305 million of Collection 2025A bonds and $209,000 of taxable Collection 2025B bonds. RBC Capital Markets.

The Arkansas Improvement Finance Authority (/AAA/AAA/) is about to cost Wednesday $150 million of revolving mortgage fund income bonds, Collection 2026. Stephens Inc.

CSU Strata (/BB+//) is about to cost Thursday $144.435 million of pupil housing income bonds (The Prospect Mission), consisting of $137.15 million of Collection 2025A bonds and $7.285 million of subordinate Collection 2025B bonds. Morgan Stanley.

The South Carolina Jobs-Financial Improvement Authority (/A+//) is about to cost Thursday $132.79 million of credit-enhanced residential improvement income bonds (Sixteenth Flooring Obligated Group Initiatives), Collection 2025. KeyBanc Capital Markets.

Fort Price Impartial College District (Aaa///) is about to cost Thursday $131.54 million of PSF-insured limitless tax refunding bonds, Collection 2025A. BofA Securities.

The IPS Multi-College Constructing Corp. (/AA+//) is about to cost Tuesday $121.205 million of social limitless advert valorem property tax first mortgage bonds. Stifel, Nicolaus & Co.

The Public Finance Authority (/AA//) is about to cost Thursday $120.24 million of BAM-insured pupil housing income bonds (PRG – Oxford Properties LLC Mission), consisting of $117.59 million of Collection 2025A and $2.65 million of Collection 2025B. Raymond James.

Irving Impartial College District (/AAA//) is about to cost Wednesday $118.655 million of PSF-insured limitless tax refunding bonds. BOK Monetary Securities.

The Eagle Mountain-Saginaw Impartial College District (Aaa//AAA/) is about to cost this week $112.775 million of PSF-insured limitless tax refunding bonds, Collection 2025-A. Mesirow Monetary.

Aggressive

The California Infrastructure and Financial Improvement Financial institution (Aaa//AAA/) is about to promote $554.625 million of inexperienced clear water and consuming water state revolving fund income bonds at 11:30 a.m. Japanese Thursday.

King County, Washington, (/AAA//) is about to promote $234.170 million of restricted tax GOs and refunding bonds, Collection 2025B, at 10:45 a.m. Wednesday, and $118.035 million of taxable restricted tax GOs, Collection 2025C, at 11:15 a.m. on Wednesday.

St. Petersburg, Florida, (Aa2//AA/) is about to promote $127.940 million of public utility income bonds, Collection 2025C, at 10:30 a.m. Wednesday.

The Moorestown Township Board of Training is about to promote $108.298 million of faculty bonds at 11 a.m. Wednesday.

Jessica Lerner and Christy Baker contributed to this report.