Investor Perception

Angkor Assets is an rising power and mineral improvement firm mixing conventional oil and gasoline with copper and gold exploration in Cambodia, whereas producing income by means of oil manufacturing and carbon seize initiatives in Canada. With over a decade of operational expertise in Southeast Asia and a popularity for sustainable practices, the corporate is strategically positioned to ship each development and resilience for buyers.

Firm Highlights

- Diversified Power & Mineral Portfolio: Publicity to high-impact oil and gasoline exploration in Cambodia (Block VIII), recurring power revenues in Canada, and copper-gold porphyry programs with gold epithermal near-surface prospects in Cambodia.

- Close to-term Catalysts:

- Outcomes from copper porphyry in Cambodia inside 30 to 60 days;

- Seismic completion and interpretation for drill targets on Block VIII inside 90 days; and

- Acquisition of oil manufacturing for elevated recurring income streams.

- Transformational Asset: Block VIII is Cambodia’s first onshore oil and gasoline exploration license, strategically situated close to export infrastructure. Potential minimal targets estimated at 25 to 50+ million recoverable barrels.

- Income-backed Mannequin: EnerCam Canada offers recurring income streams through oil manufacturing, water disposal, gasoline processing, and carbon seize options, insulating Angkor from over-reliance on fairness markets.

- Sturdy ESG Dedication: Acknowledged on the United Nations for sustainability, Angkor integrates carbon seize, neighborhood partnerships and environmental accountability into each mission.

- Aligned Shareholder Base: Over 40 p.c insider possession with common insider shopping for, demonstrating administration’s confidence in long-term development.

Overview

Based in 2009 and publicly listed in 2011, Angkor Assets (TSXV:ANK,OTCQB:ANKOF) has constructed a singular dual-focused enterprise throughout power and minerals in Asia and North America.

On the power aspect, the corporate is advancing acquisition of money stream by means of oil manufacturing and carbon seize in Canada, and is poised for transformational development by means of the first-ever onshore oil and gasoline exploration program in Cambodia. Its Canadian subsidiary, EnerCam Exploration, is already producing income from oil manufacturing, water disposal and gasoline processing, whereas additionally implementing carbon gasoline seize and conversion options for provincial markets. In Southeast Asia, Angkor’s Cambodian subsidiary, EnerCam Assets, is spearheading a national-scale initiative to carry Cambodia its first home hydrocarbon power, with exploration actions underway on the corporate’s Block VIII concession.

On the mineral aspect, Angkor has positioned itself as a first-mover in Cambodia’s underexplored mineral belts, holding licenses at Andong Meas and Andong Bor. These initiatives goal each valuable and base metals, with copper porphyry programs and high-grade gold mineralization now confirmed by means of exploration outcomes.

Angkor’s technique is designed to mitigate shareholder danger by diversifying income streams, mixing recurring Canadian money stream with high-impact exploration upside in Cambodia. The corporate’s administration emphasizes hydrocarbons and copper as priorities, noting the potential worth of 25 million recoverable barrels in Cambodia alongside vital copper-gold discoveries.

Key Initiatives

Onshore Cambodia – Block VIII Oil & Gasoline Concession

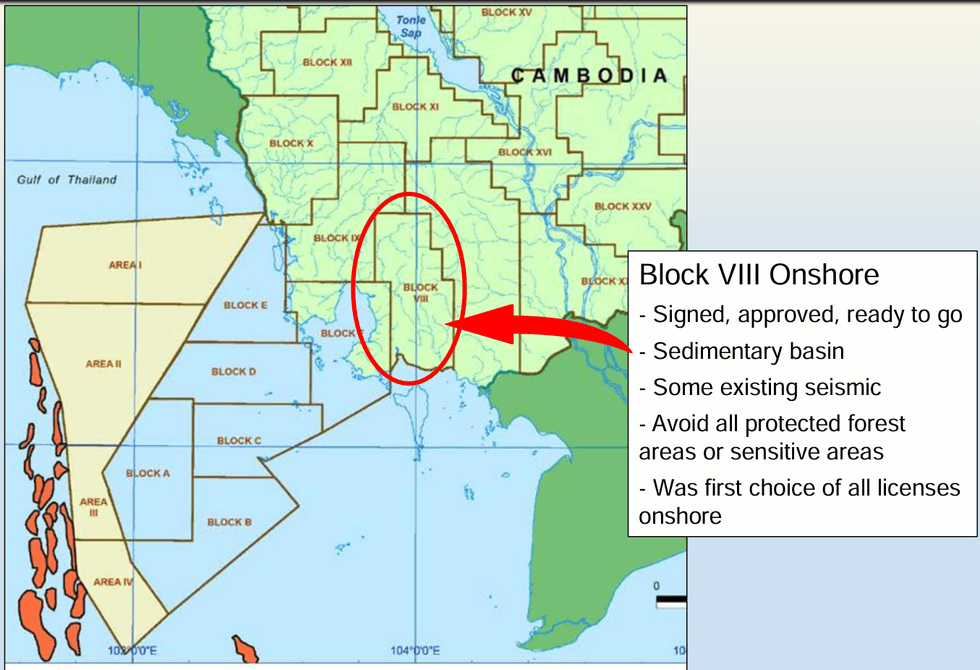

Angkor’s flagship asset is Block VIII, a 4,300 sq km oil and gasoline concession in Cambodia’s underexplored onshore sedimentary basin. The license, structured beneath a 30-year Manufacturing Sharing Settlement with renewal choices, represents the primary onshore hydrocarbon exploration license within the nation. Geoscientific research performed by Danish, Canadian and European specialists have recognized robust indications of a foreland basin system and rift formations with vital petroleum potential. Over 21 pure oil seeps have been mapped and testing of the seeps by Schlumberger confirms the presence of hydrocarbons. Gasoline showings are additionally evident throughout the block.

The block is ideally situated adjoining to export infrastructure, near port with freeway entry to Phnom Penh and proximity to a deepwater port. Cambodia presently imports all of its petroleum merchandise, making Block VIII strategically essential each nationally and regionally. EnerCam, Angkor’s subsidiary, is implementing Cambodia’s first onshore 2D EnviroVibe seismic program, designed to attenuate environmental footprint whereas mapping structural traps and stratigraphic options.

Technical projections counsel that when industrial amount of recoverable hydrocarbons is confirmed, Block VIII may host Cambodia’s first onshore oil manufacturing. Angkor’s phased improvement plan consists of finishing seismic interpretation, definition of drill targets or further 3D seismic adopted by stratigraphic check wells and eventual improvement drilling. This mission is anticipated to be the corporate’s most vital worth driver and is prioritized as its primary company focus.

Canadian Power & Carbon Seize – EnerCam Exploration

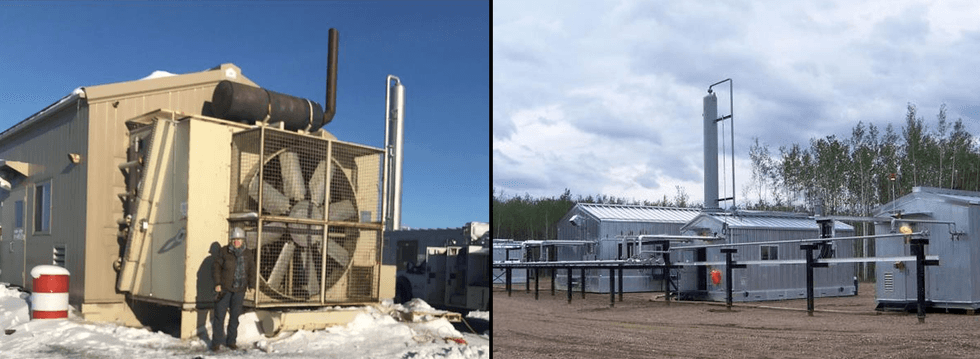

In Canada, Angkor operates by means of EnerCam Exploration Canada, which is a 40 p.c curiosity holder in oil manufacturing and carbon options throughout 30 properly websites spanning 516 hectares in Saskatchewan. These wells, shut in since 2018 as a consequence of low oil costs and mismanagement by earlier operators, have been systematically refurbished and restarted. EnerCam participates within the full manufacturing cycle, together with oil restoration, water separation and gasoline dealing with.

A key milestone was the acquisition of the pipeline community and compressor station, which resolved historic venting points and allowed EnerCam to seize related gasoline. This gasoline is transformed into pure gasoline power and bought into provincial markets. Angkor’s Canadian income streams additionally embody water disposal charges, gasoline plant operations, and oil manufacturing revenues, supplemented by ongoing carbon seize and enhanced restoration of water conversion and injection wells initiatives.

Angkor holds a 40 p.c curiosity in oil and gasoline manufacturing ventures in Saskatchewan, making certain a recurring income stream. This platform not solely offsets G&A prices but in addition offers a basis for emission management and potential for additional gasoline seize with surrounding producers within the space.

Cambodia Mineral Properties – Copper and Gold Portfolio

By means of its subsidiary Angkor Gold Cambodia, the corporate holds a strategic portfolio of copper and gold belongings in potential belts. These licenses embody Andong Bor and Andong Meas.

The Andong Bor license has emerged as a cornerstone of Angkor’s mineral portfolio. In June 2025, the corporate confirmed the presence of a copper-gold porphyry system, the primary discovery of its variety in Cambodia. This breakthrough positions the mission as a possible district-scale copper-gold system. Additional drilling is anticipated to check depth extensions and delineate mineralized zones.

On the Andong Meas license, exploration has revealed high-grade gold mineralization, with floor samples returning assays as much as 70 grams per ton (g/t) gold throughout a 0.8 km by 1.5 km space. This anomaly stays largely untested by drilling and represents a big near-term goal for useful resource enlargement.

Administration Group

Delayne Weeks – CEO

With over 25 years of world improvement expertise spanning finance, enterprise improvement, financial improvement and ESG initiatives. She has spearheaded Angkor’s CSR applications in Cambodia, incomes UN recognition for sustainability management. Weeks has overseen Angkor’s transition into power and its enlargement into cash-flowing operations.

Mike Weeks – President, Govt VP Operations

Brings over 4 a long time of operational and govt expertise in worldwide useful resource initiatives. Mike Weeks is president of Angkor Gold Corp. Cambodia and EnerCam Assets Cambodia. He has had an extended and profitable profession within the oil and gasoline trade with over 30 years’ expertise in mission administration of petroleum-related industries. Weeks additionally spent greater than 15 years negotiating with overseas governments in creating and implementing pure useful resource licenses. His expertise consists of oil manufacturing in North Africa, engineering and design in Europe, the event of gasoline processing services and area and plant operations in Canada. Weeks has labored with worldwide oil and gasoline producers together with AEC West, Wintershall, Zuetina, Encana and Amoco.

Dennis Ouellette – VP Exploration, Minerals

Skilled geologist with over 40 years of exploration expertise in Canada, Central America and Asia. Dennis Ouellette has been a federal geologist within the Yukon for over 5 years, overseeing the exploration and mining trade throughout the Yukon by all trade individuals. He leads Angkor’s mineral exploration applications, together with the copper porphyry discovery at Andong Bor and a second porphyry goal on Andong Meas. Ouellette has labored in a number of Canadian provinces, Nevada and Guatemala, and was the trade advocate director for the Yukon Chamber of Mines and president of Yukon Prospectors Affiliation

Keith Edwards – Technical Supervisor, EnerCam Assets Cambodia

Keith Edwards is a senior geophysicist with over 39 years’ expertise in all points of geophysics, from acquisition by means of processing to interpretation. He’s identified for his confirmed progressive problem-solving capabilities in software program improvement, consulting companies, interpretation and administration. Edwards spent 12 years at Kuwait Oil firm mentoring junior workers and performing many quantitative seismic interpretation initiatives. He developed a number of MatLab functions for Seismic Facies Classification, VSP integration, 3D design and lots of others.