Property taxes have been rising in lots of cities, slicing off the oxygen provide for actual property buyers, stymying money circulation, and placing landlords and householders in monetary jeopardy. Now the states are preventing again.

Regardless of the significance of property taxes in producing funds for faculties, roads, and important providers equivalent to hearth prevention for native governments, a tipping level of unaffordability for residents has tilted the scales, inflicting states to take motion.

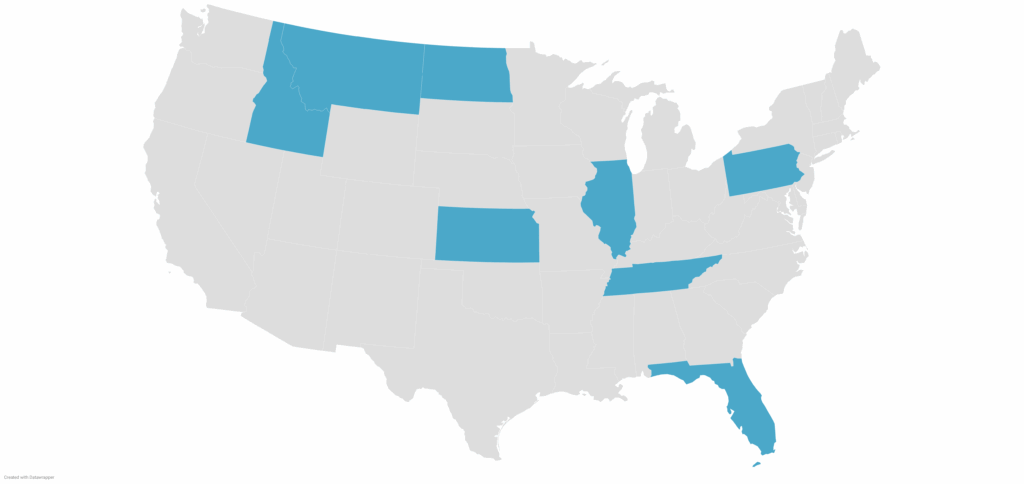

It follows 5 years of constant actual property tax will increase of virtually 30% nationwide, in line with brokerage Redfin, to a month-to-month median of $250. Now, Realtor.com stories that Florida, Illinois, Kansas, Montana, North Dakota, Pennsylvania, and Tennessee are a few of the states contemplating repeals and reforms.

A Advantageous Line

Trimming taxes whereas making certain native governments are adequately funded is a high-quality line.

“The affordability advantages to householders of lowering property tax charges as property tax values enhance are nice,” Susan Wachter, Albert Sussman Professor of Actual Property and Finance, and co-director of the Penn Institute for City Analysis, instructed Newsweek. “This may be executed whereas holding tax revenues wanted for native bills fixed. Reducing greater than this imposes actual prices, both in misplaced group providers or in the necessity to increase different taxes.”

A State-by-State Breakdown

Right here’s a have a look at what’s happening in these locations.

Florida

Florida, which not too long ago authorised a invoice to assist decrease householders affiliation (HOA) prices for apartment house owners, has made headlines for being the primary state to suggest eliminating property taxes altogether, changing them with a gross sales tax, The Wall Road Journal reported. Governor DeSantis first introduced up the subject in February, writing on his X account:

“Property taxes are native, not state. So we’d must do a constitutional modification (requires 60% of voters to approve) to get rid of them (which I might assist) and even to reform/decrease them… We should always put the boldest modification on the poll that has an opportunity of getting that 60%… I agree that taxing land/property is the extra oppressive and ineffective type of taxation.”

Idaho

Property tax reduction is a actuality in Idaho after a March vote from the Idaho Senate. Following the signing of a invoice, which directs $100 million in reduction to property taxpayers, Governor Brad Little stated in a press launch:

“America desires what Idaho has: protected communities, sturdy faculties, and a bustling financial system that gives large alternatives for our folks to prosper. I’m proud to hitch the devoted leaders of the Idaho Home and Senate for the signing of this necessary invoice in the present day.”

Illinois

Invoice 1862, presently being thought of within the Illinois Senate, proposes a tax minimize for householders who’ve lived of their property for 30 years or extra.

Kansas

A proposed invoice features a residents’ board to guage property tax exemptions. Nevertheless, this invoice is presently stalled after lawmakers had been unable to succeed in an settlement in April.

Montana

Home Invoice 231 and Senate Invoice 542 handed property tax reduction for householders, shifting the burden to second householders with high-value trip properties.

North Dakota

North Dakota’s major residence tax credit score has been tripled because of the reform and reduction bundle handed in Could. Governor Kelly Armstrong, who handed the invoice, has grander ambitions: searching for to finish property taxes fully by way of funding from oil income.

Pennsylvania

Property taxes may additionally doubtlessly be on the chopping block in Pennsylvania in 2030 after Republican Consultant Russ Diamond proposed Home Invoice 900.

Tennessee

Voters will get to determine within the forthcoming November election whether or not Tennessee ought to ban property taxes after the Home of Representatives handed a decision proposing an modification to the Structure to ban the legislature from enacting taxes on property.

Cities With Property Tax Points

These states usually are not the one ones the place property taxes could possibly be in play. In Boston, the collapse in business actual property values is projected to push a $1 billion tax burden onto householders, in line with The Wall Road Journal. To make up for the offset, householders have obtained bigger tax payments, which have been incurred together with the fast rise in dwelling property values, additional growing taxes.

The Journal stories that Boston has been notably impacted as a result of greater than a 3rd of Boston’s tax income comes from business property taxes, which is the very best within the nation. Makes an attempt to reform property taxes final yr failed.

In New York Metropolis, the place taxes are assessed primarily based on neighborhood appreciation, somewhat than the metrics of particular person buildings, the NYC Advisory Fee has proposed a sweeping reform that reorganizes property lessons, ends evaluation caps, and introduces extra equitable valuation strategies. The proposals are particularly designed to alleviate the monetary burden on particular person householders.

Closing Ideas: How Reforms May Have an effect on Actual Property Traders

Decrease property taxes translate into increased money circulation for actual property buyers. Nevertheless, buyers ought to have a look at any potential tax financial savings, or not, holistically, together with potential financial savings, equivalent to these included within the current One Large Stunning Invoice.

Moreover, though lots of the potential tax reforms are aimed at owner-occupants, not buyers, landlords who partially lease out their residences by way of short-term leases, or who stay in a single unit of a small multifamily constructing, might also be eligible for financial savings.

Landlords must also routinely problem the tax assessments on their buildings, whether or not they stay in them or not. In response to the Nationwide Taxpayers Union Basis, between 30% and 60% of taxable property in the US is overassessed; nonetheless, fewer than 5% of taxpayers problem their assessments. Taxpayers typically win a partial victory.

A Actual Property Convention Constructed In another way

October 5-7, 2025 | Caesars Palace, Las Vegas

For 3 highly effective days, interact with elite actual property buyers actively constructing wealth now. No principle. No outdated recommendation. No empty guarantees—simply confirmed ways from buyers closing offers in the present day. Each speaker delivers actionable methods you’ll be able to implement instantly.