- Pitfield confirmed because the world’s most important new titanium discovery, with unparalled scale, consistency of high-grade and purity.

- Largest drilling marketing campaign to this point launched on the Thomas Prospect delivered excellent outcomes and recognized a big high-grade near-surface core, averaging ~6% TiO₂ over a steady 3.6km strike.

- Metallurgical testwork achieved a 99.25% TiO₂ product, demonstrating a extremely environment friendly and probably lower-cost processing route.

- Course of improvement work has confirmed that Pitfield’s weathered ore is ideally suited to traditional mineral separation and refining, differentiating it from ilmenite-based initiatives which generally face decrease recoveries, increased prices, and important environmental challenges.

- Maiden Mineral Useful resource Estimate (“MRE”) on observe for launch within the coming weeks.

- £4.5m raised in Could 2025 to speed up Pitfield improvement, with sturdy institutional assist.

- Additional strengthening of board and technicial workforce with appointment of Phil Brumit as Non-Government Director, Alan Rubio as Examine Supervisor and Pocholo Aviso as Hydro-metallurgist.

- Commenced US buying and selling on the OTCQX within the US, broadening worldwide investor entry.

Shaun Bunn, Managing Director, commented:“The primary half of 2025 has been a interval of exceptional exercise and momentum for Empire. Pitfield is now not only a discovery story – it’s quick changing into recognised as a undertaking of world significance, with outcomes that proceed to exceed expectations. Our drilling campaigns have delivered a number of the highest TiO₂ grades we have seen to this point, confirming not solely the distinctive high quality of the deposit but in addition its scale consistency and ease.

“Metallurgical testwork has proven that we will obtain a product of extraordinary purity utilizing simple, typical processing strategies.This uncommon mixture of scale, grade and ease underpins our confidence that Pitfield can emerge as one of many world’s main titanium initiatives, able to supplying high-value sectors comparable to aerospace and defence for many years to come back.

“From an operational standpoint, we are actually on the cusp of delivering our maiden MRE, which we imagine will firmly set up Pitfield among the many world’s main titanium property. Past that, the pathway is obvious: full our expanded testwork, progress to pilot-scale operations, and start participating straight with end-users – significantly in high-value markets comparable to aerospace and defence, the place titanium’s strategic significance is rising quickly.

“It’s also encouraging to see the energy of market assist for what we’re constructing and I’m assured that Empire can deliver this once-in-a-lifetime discovery to industrial fruition in an expedient method. With a world-class asset, a strengthened technical workforce, and robust monetary backing, we’re exceptionally nicely positioned for the subsequent section of development.”

Market Abuse Regulation (MAR) Disclosure

Sure data contained on this announcement would have been deemed inside data for the needs of Article 7 of Regulation (EU) No 596/2014, as included into UK legislation by the European Union (Withdrawal) Act 2018, till the discharge of this announcement.

For additional data please go to www.empiremetals.com or contact:

CHAIRMAN’S STATEMENT

The progress we have now made throughout 2025 at our flagship Pitfield Undertaking in Western Australia has been nothing in need of transformational, positioning the Firm on the forefront of what we imagine is essentially the most important titanium discovery globally. This represents a generational alternative quickly shifting from exploration success towards industrial actuality.

Over the previous six months, our workforce has demonstrated not solely technical excellence but in addition the flexibility to ship outcomes which have redefined the notion of the Firm out there. We’ve moved from exploration to efficiently establishing Pitfield’s potential to assist long-term, large-scale, and high-value titanium provide. This achievement is mirrored within the sturdy assist we proceed to obtain from institutional traders, with £4.5 million raised in Could 2025, and within the exceptional efficiency of our share value, which has risen greater than 500% for the reason that starting of the 12 months in response to a sequence of consequential milestone achievements.

What units Pitfield aside is not only its extraordinary scale, however the distinctive high quality of its titanium mineralisation. Not like many different titanium initiatives around the globe, Pitfield advantages from high-grade mineralisation from floor which has been confirmed to be of remarkable purity, being very low in deleterious contaminants but in addition amenable to easy, typical mining strategies resulting from its distinctive geological profile. Equally necessary, our metallurgical work has confirmed that straightforward, typical processing can ship an exceptionally pure titanium dioxide product, grading 99.25% TiO₂.

This mixture of scale, grade, purity, and processing simplicity places Pitfield in a league of its personal. The Undertaking can be situated in Western Australia – a Tier One mining jurisdiction with world-class infrastructure, secure governance, a talented workforce and a deeply rooted mining tradition. Collectively, these benefits create a basis for Pitfield to change into a globally important supply of titanium provide.

Throughout the first half of 2025, we superior Pitfield throughout a number of fronts. A significant drilling marketing campaign was launched in February that supplied not solely the majority metallurgical samples that enabled a big scale-up of our metallurgical check work programme in the course of the interval, but in addition represented the subsequent step in direction of defining a Mineral Useful resource Estimate (“MRE”) for Pitfield.

An extra drill marketing campaign was launched in June 2025, the biggest at Pitfield to this point. The programme lined greater than 11 sq. kilometres and focused high-grade titanium mineralisation throughout the in-situ weathered cap on the Thomas Prospect, with the target of delivering the MRE. This programme delivered a number of the highest titanium dioxide grades recorded to this point, with chosen intercepts together with: 44m @ 7.87% TiO2 from floor (AC25TOM159); 50m @ 7.84% TiO2 from 4m (AC25TOM130); 54m @ 7.41% TiO2 from floor (AC25TOM118); 98m @ 7.05% TiO2 from 2m (RC25TOM062); and 98m @ 7.05% TiO2 from 2m (RC25TOM068). A big, high-grade central core was recognized from this drilling which averaged ~6% TiO2 throughout a steady 3.6km strike size. As well as, practically two thirds of all drillholes averaged > 4% TiO2, with over 90% exceeding a 2% TiO2 cut-off grade.

We are actually on the cusp of delivering our maiden MRE, which is anticipated within the coming weeks. Primarily based on the outcomes to this point, we count on the MRE to be world-class and to function a basis for the subsequent section of undertaking improvement together with mine scoping research.

Following the method improvement breakthrough introduced put up interval finish in August 2025, we’re progressing by the bench-scale and large-scale batch metallurgical testwork programme, which we count on to finish by early 2026. This work will feed into the design of a steady pilot plant, enabling us to refine the industrial flowsheet and to supply bulk samples for analysis by potential end-users.

Whereas a lot of the world’s titanium feedstock is used to supply titanium dioxide for pigments in paints, coatings, and plastics, Pitfield’s distinctive high quality opens doorways to higher-value markets. Specifically, titanium sponge (to be used in titanium steel manufacturing) stands out as a strategic development alternative. Titanium steel is important in defence and aerospace functions resulting from its exceptional strength-to-weight ratio and resistance to excessive circumstances. These attributes make it important for fighter jets, naval vessels, spacecraft, and next-generation applied sciences.

At a time when the geopolitical panorama is shifting quickly, the safety of titanium provide has by no means been extra necessary. China has tripled its titanium sponge output since 2018 and now controls practically 70% of world provide. The USA is 95% reliant on imports of titanium sponge and 86% reliant on imports of mineral concentrates. Equally, the European Union is uncovered to provide dangers, with no significant home manufacturing. Pitfield due to this fact represents a novel alternative for Empire to determine itself as a safe, Western-aligned generational provider of titanium. This strategic positioning is already resonating strongly with traders and potential business companions.

Company

As Pitfield advances towards improvement, we have now made strategic additions to our workforce to make sure we have now the fitting experience in place. In January 2025, we have been delighted to welcome Phil Brumit to the Board as a Non-Government Director and Chair of our Technical Committee. Phil brings greater than 40 years of operational and undertaking administration expertise throughout main world mining corporations, together with Freeport-McMoRan, Lundin Mining, and Newmont Company. His confirmed observe document in overseeing large-scale initiatives from improvement by to manufacturing will proceed to be invaluable as we pursue an expeditious improvement of Pitfield.

Following the interval finish, we additional strengthened our technical management with the appointments of Alan Rubio as Examine Supervisor and Pocholo Aviso as Hydrometallurgist. Alan brings practically three a long time of expertise in undertaking analysis and improvement, and can play a central function in assessing mining and infrastructure situations, in addition to overseeing key financial research. Pocholo, along with his background within the TiO₂ pigment business and metallurgical experience, will lead the product improvement programme, optimising course of flowsheets and assessing market pathways. Collectively, these appointments considerably improve our capability to shortly advance Pitfield towards feasibility examine stage with confidence and precision.

Alongside our operational and company progress, we have now additionally been proactive in broadening consciousness of the Empire funding proposition to a wider worldwide viewers. A key a part of this technique was our determination to begin buying and selling of our shares on the OTCQB Market in the USA in March 2025. We have been significantly happy to be upgraded to the OTCQX Market only some months later, which is a big step ahead in offering US traders with higher visibility of, and entry to, Empire.

Buying and selling on OTCQX opens the Firm to a deep and numerous pool of recent shareholders, lots of whom are actively looking for publicity to strategic metals. Titanium is formally recognised as a important mineral in quite a few jurisdictions, together with the USA, and our advertising and marketing initiatives throughout North America have confirmed the sturdy urge for food for high-quality funding alternatives on this sector. Empire is due to this fact exceptionally nicely positioned to seize rising worldwide investor curiosity as Pitfield advances towards commercialisation.

Monetary

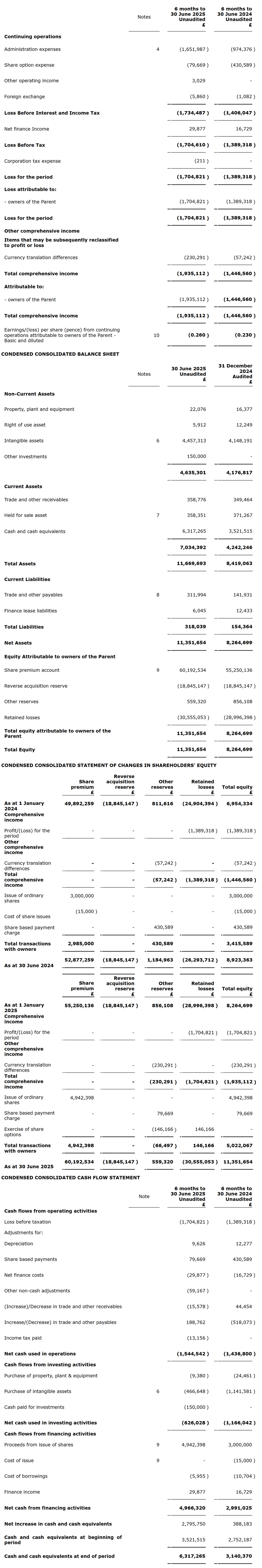

As an exploration and improvement group which has no income, we’re reporting a loss for the six months ended 30 June 2025 of £1,704,821 (30 June 2024: lack of £1,389,318).

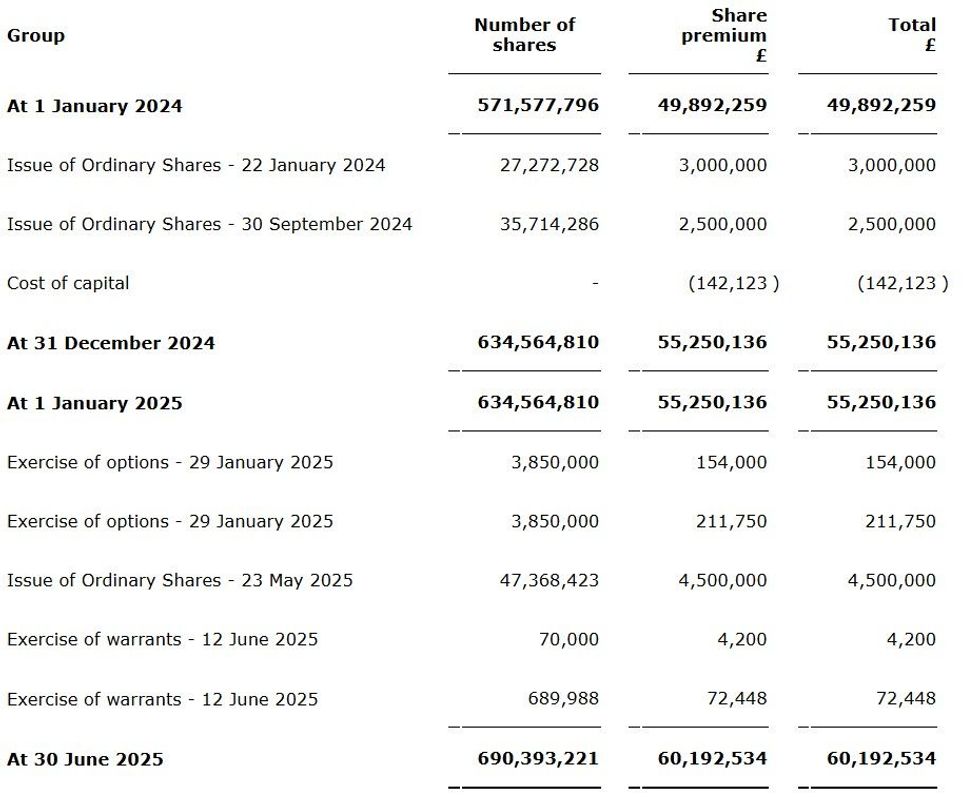

In Could 2025, the Firm introduced that it had raised £4.5 million earlier than bills by means of a inserting of 47,368,423 new extraordinary shares of no par worth to new and present traders at 9.5p per share.

The Group’s money place as at 30 June 2025 was £6.3 million.

Outlook

The months forward will likely be a busy and thrilling time for Empire Metals. The maiden MRE will present a basis for detailed undertaking analysis, whereas ongoing metallurgical testwork will additional optimise our flowsheet and advance our understanding of Pitfield’s product potential. As we transition into the pilot testing section, we will likely be participating extra intently with potential prospects, together with these within the titanium steel provide chain, to place Pitfield as a long-term, strategic supply of safe provide.

On the similar time, we are going to proceed to strengthen our workforce and capabilities to match the dimensions of the chance earlier than us. With a world-class asset, a extremely skilled workforce, sturdy monetary backing, and a supportive market, we’re exceptionally nicely positioned to ship on the unprecendented alternative Pitfield presents.

I want to thank our shareholders for his or her continued assist and confidence in Empire. The progress we have now made in such a short while has been extraordinary, and I firmly imagine we’re solely originally of a extremely rewarding journey that may see Pitfield change into established as one of the necessary titanium initiatives globally.

With Pitfield, we’re constructing the foundations of a safe, generational-scale titanium provide enterprise that has the potential to reshape the worldwide titanium business. The approaching months promise to be each thrilling and defining, and I stay up for updating you on our continued progress.

Neil O’Brien

Non-Government Chairman

3 September 2025

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. Normal Info

The principal exercise of Empire Metals Restricted (‘the Firm’) and its subsidiaries (collectively ‘the Group’) is the exploration and improvement of treasured and base metals. The Firm’s shares are quoted on the AIM Market of the London Inventory Trade. The Firm is included within the British Virgin Islands and domiciled in the UK. The Firm was included on 10 February 2010 beneath the title Gold Mining Firm Restricted. On 10 October 2016 the Firm modified its title from Noricum Gold Restricted to Georgian Mining Company and subsequently on 10 February 2020 modified its title from Georgian Mining Company to Empire Metals Restricted.

The handle of the Firm’s registered workplace is Craigmuir Chambers, PO Field 71, Street City, Tortola BVI.

2. Foundation of Preparation

The condensed consolidated interim monetary statements have been ready in accordance with the necessities of the AIM Guidelines for Firms. As permitted, the Firm has chosen to not undertake IAS 34 “Interim Monetary Statements” in getting ready this interim monetary data. The condensed interim monetary statements must be learn at the side of the annual monetary statements for the 12 months ended 31 December 2024, which have been ready in accordance with Worldwide Monetary Reporting Requirements (IFRS) as adopted by the European Union.

The interim monetary data set out above doesn’t represent statutory accounts. They’ve been ready on a going concern foundation in accordance with the popularity and measurement standards of Worldwide Monetary Reporting Requirements (IFRS) as adopted by the European Union. Statutory monetary statements for the 12 months ended 31 December 2024 have been authorised by the Board of Administrators on 5 June 2025. The report of the auditors on these monetary statements was unqualified.

Going concern

The Administrators, having made applicable enquiries, contemplate that satisfactory assets exist for the Group to proceed in operational existence for the foreseeable future and that, due to this fact, it’s applicable to undertake the going concern foundation in getting ready the condensed interim monetary statements for the interval ended 30 June 2025.

The components that have been extant within the 31 December 2024 Annual Report are nonetheless related to this report and as such reference must be made to the going concern be aware and disclosures within the 2024 Annual Report.

Dangers and uncertainties

The Board constantly assesses and screens the important thing dangers of the enterprise. The important thing dangers that would have an effect on the Group’s medium-term efficiency and the components that mitigate these dangers haven’t considerably modified from these set out within the Group’s 31 December 2024 Annual Report and Monetary Statements, a replica of which is out there on the Group’s web site: https://www.empiremetals.co.uk. The important thing monetary dangers are liquidity danger, international alternate danger, credit score danger, value danger and rate of interest danger.

Crucial accounting estimates

The preparation of condensed interim monetary statements requires administration to make estimates and assumptions that have an effect on the reported quantities of property and liabilities, earnings and bills, and disclosure of contingent property and liabilities on the finish of the reporting interval. Vital objects topic to such estimates are set out in be aware 4 of the Group’s 31 December 2024 Annual Report and Monetary Statements. Precise quantities might differ from these estimates. The character and quantities of such estimates haven’t modified considerably in the course of the interim interval.

3. Accounting Insurance policies

The identical accounting insurance policies, presentation and strategies of computation have been adopted in these condensed interim monetary statements as have been utilized within the preparation of the Group’s annual monetary statements for the 12 months ended 31 December 2024.

3.1 Adjustments in accounting coverage and disclosures

(a) New and amended requirements obligatory for the primary time for the monetary durations starting on or after 1 January 2025.

The Worldwide Accounting Requirements Board (IASB) issued numerous amendments and revisions to Worldwide Monetary Reporting Requirements and IFRIC interpretations. The amendments and revisions have been relevant for the interval ended 30 June 2025 however didn’t lead to any materials modifications to the Monetary Statements of the Group.

b) New requirements, amendments and interpretations in subject however not but efficient or not but endorsed and never early adopted.

There are a variety of requirements, amendments to requirements, and interpretations which have been issued by the IASB which are efficient in future accounting durations and which haven’t been adopted early.

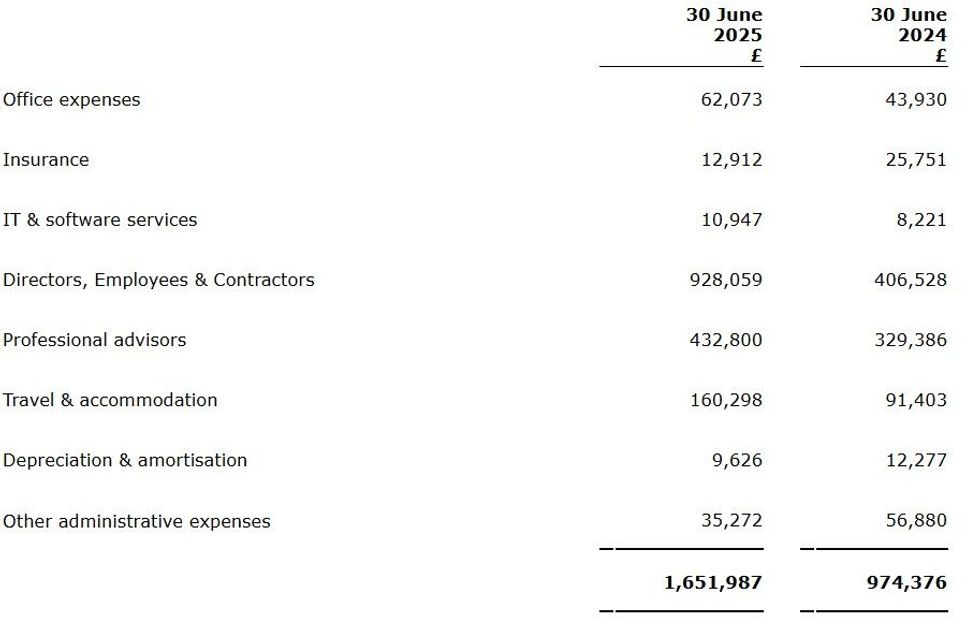

4. Administrative bills

5. Dividends

No dividend has been declared or paid by the Firm in the course of the six months ended 30 June 2025 (2024: nil).

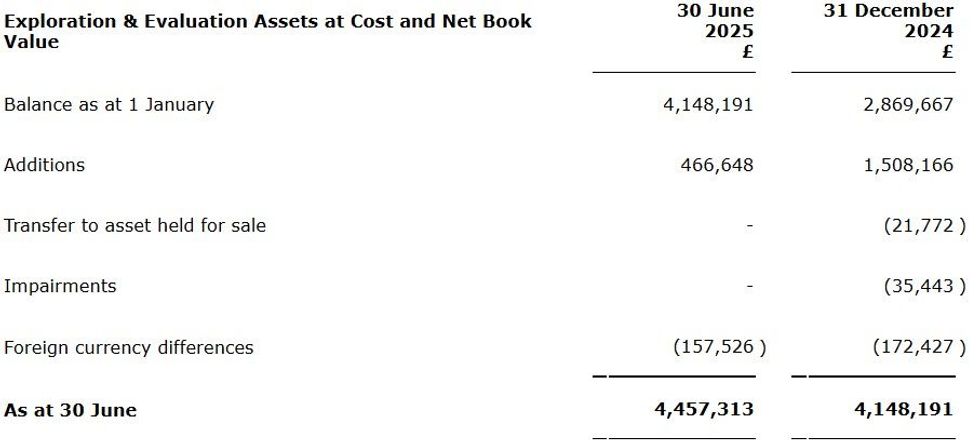

6. Intangible Property

The Exploration & Analysis additions within the present interval primarily pertains to work carried out on the Firm’s Pitfield undertaking.

The Administrators don’t contemplate the asset to be impaired.

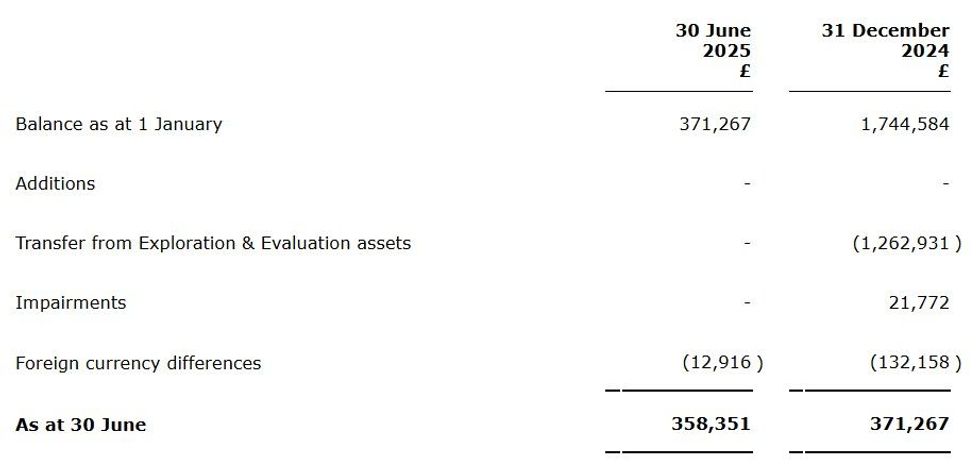

7. Held for Sale Asset

The Firm proceed to work on a possible divestment of the Eclipse undertaking and are actively engaged with quite a lot of Australian corporations working within the gold mining sector to discover a purchaser. Administration are dedicated to the sale of the Eclipse licence.

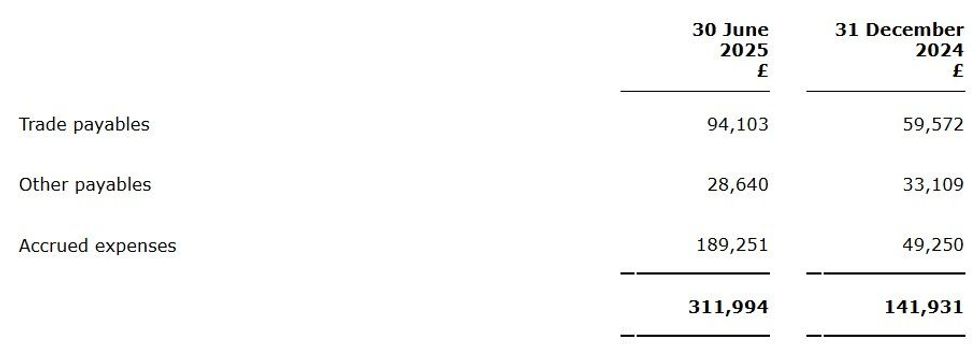

8. Commerce and Different Payables

9. Share capital and share premium

10. Earnings per share

The calculation of the whole fundamental loss per share of 0.260 pence (30 June 2024: 0.230 pence) relies on the loss attributable to fairness homeowners of the dad or mum firm of £1,704,821 (30 June 2024: £1,389,318 ) and on the weighted common variety of extraordinary shares of 651,359,884 (30 June 2024: 595,703,671) in subject in the course of the interval.

Particulars of share choices that would probably dilute earnings per share in future durations are disclosed within the notes to the Group’s Annual Report and Monetary Statements for the 12 months ended 31 December 2024.

2,000,000 choices have been granted in the course of the interval. The overall variety of choices excellent at 30 June 2025 is 67,200,000.

11. Commitments

Commitments acknowledged within the Group’s Annual Monetary Statements for the 12 months ended 31 December 2024 stay.

12. Occasions after the steadiness sheet date

There have been no occasions after the reporting date of a fabric nature.

13. Approval of interim monetary statements

The condensed interim monetary statements have been authorised by the Board of Administrators on 3 September 2025.

Market Abuse Regulation (MAR) Disclosure

Sure data contained on this announcement would have been deemed inside data for the needs of Article 7 of Regulation (EU) No 596/2014, as included into UK legislation by the European Union (Withdrawal) Act 2018, till the discharge of this announcement.

This data is supplied by RNS, the information service of the London Inventory Trade. RNS is authorised by the Monetary Conduct Authority to behave as a Main Info Supplier in the UK. Phrases and circumstances referring to the use and distribution of this data might apply. For additional data, please contact rns@lseg.com or go to www.rns.com.

Click on right here to attach with Empire Metals Restricted (LON:EEE)(OTCQX:EPMLF) to obtain an Investor Presentation