Years in the past, I used to be hooked on technical evaluation. Though many on Wall Avenue giggle at it, I discovered worth in studying worth and quantity like a map.

I constructed a software – one in all many I’ve created over time – that used volatility to identify fast trades in choices, usually holding for not more than every week or two.

That software labored fairly nicely. The truth is, one in all my greatest wins was from the very firm we’re as we speak. (It gave me a pleasant 100% possibility win in lower than 24 hours.)

However as we speak, we’re not chasing short-term spikes. We’re wanting on the firm’s financials.

Samsara (Nasdaq: IOT) helps corporations run their bodily operations extra effectively. Its software program tracks vehicles, trailers, gear, and extra, utilizing information and AI to chop waste and enhance security.

Let me provide the info…

Within the first quarter of fiscal 2026, which ended on Could 3, Samsara introduced in $367 million in income, up 31% from the identical time final 12 months. The corporate’s internet loss shrank to $22.1 million, an enormous enchancment from $56.3 million a 12 months in the past. It additionally turned in $45.7 million in free money movement, in contrast with $18.6 million final 12 months.

Margins are transferring the correct manner, too. Gross margin hit 79%, up from 77%. Adjusted working margin was 14%, additionally up 12 months over 12 months. Administration now expects full-year income of $1.547 billion to $1.555 billion, with adjusted free money movement margin set to beat final 12 months’s determine by about 1 proportion level.

The enterprise is rising throughout the board. Samsara now has 2,638 clients spending over $100,000 per 12 months. That’s up 35% from final 12 months. It added 154 new massive clients within the final quarter alone. Wins embrace names like 7-Eleven, Dallas Fort Value Worldwide Airport, and Knife River, a development agency that was spun off from MDU Assets.

However what do the numbers say?

Samsara’s EV/NAV is 16.61, in contrast with a universe common of 6.09. That tells us traders are paying a premium – seemingly for future development and excessive retention.

Its FCF/NAV ratio is 0.44%. That will not sound like a lot, but it surely beats the universe common of -1.19%. The corporate’s free money movement has grown quarter over quarter 63.6% of the time, in contrast with 46.3% for the standard inventory.

Put merely: Samsara remains to be scaling, but it surely’s doing so with higher money self-discipline than most.

Now, the inventory isn’t low cost. But it surely’s additionally not using a hype wave. It’s truly down this 12 months.

That may be signal: The market isn’t overreacting even because the enterprise retains bettering.

If you’d like publicity to AI – particularly via an organization tied to extra concrete issues like vehicles, warehouses, and discipline work – Samsara is price an in depth look. It’s not a screaming cut price, but it surely’s constructing one thing sturdy.

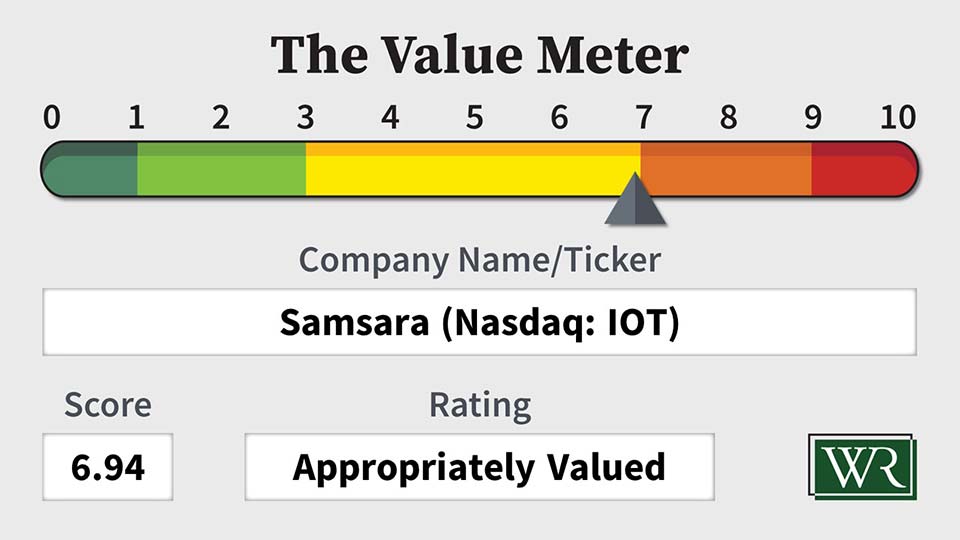

The Worth Meter charges Samsara as “Appropriately Valued.”

What inventory would you want me to run via The Worth Meter subsequent? Publish the ticker image(s) within the feedback part beneath.