Investor Perception

Sankamap Metals provides publicity to new copper–gold discovery potential in one of many final underexplored areas of the Ring of Hearth, with two totally owned, drill-ready property positioned alongside a world-class mineral belt.

Firm Highlights

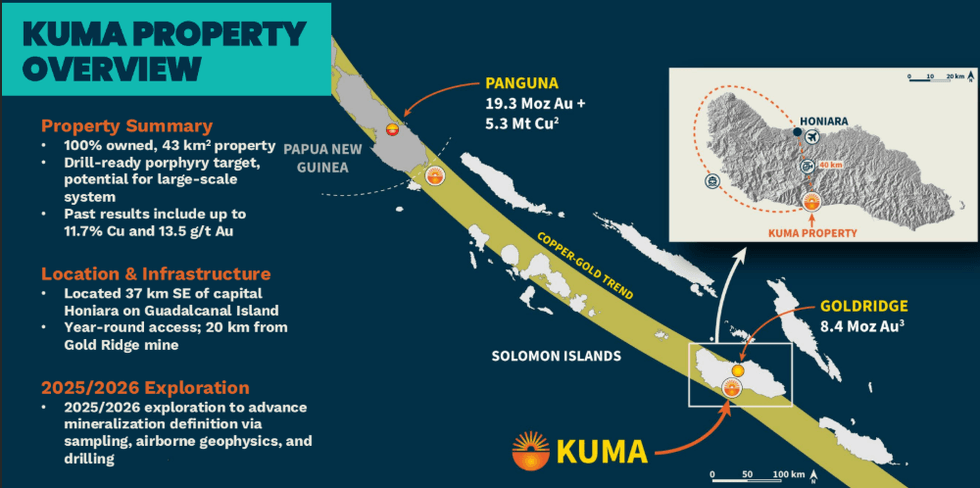

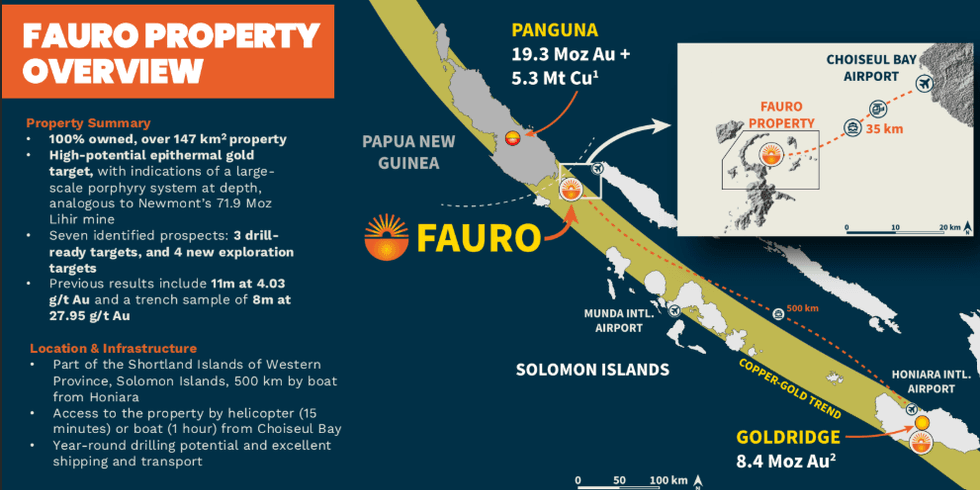

- Two 100% owned copper and gold properties – Kuma and Fauro – inside a extremely potential copper-gold pattern within the Solomon Islands.

- Drill-ready targets supported by sturdy historic sampling, together with seize samples as much as 11.7 % copper, 13.5 grams per ton (g/t) gold at Kuma, and 173 g/t gold; plus, drill intercepts of 35 m at 2.08 g/t gold at Fauro.

- Strategically situated alongside the identical mineral belt as main deposits, together with Newmont’s 71.9 Moz Lihir gold mine.

- Underexplored mining-friendly jurisdiction with sturdy authorities help and established native workforce.

- Massive-scale system potential, together with a km-scale copper-gold anomaly at Kuma and a number of high-grade epithermal and porphyry-style targets at Fauro.

- Inaugural drilling at Kuma, scheduled to start in January 2026, marking a serious catalyst for the mission.

- Robust technical management, with a administration staff that has collectively raised over $1 billion and delivered important shareholder returns.

Overview

Sankamap Metals (CSE: SCU) is a Canadian exploration firm advancing the Oceania Challenge, a high-impact copper–gold alternative within the mineral-rich South Pacific. The mission consists of two totally permitted properties – Kuma and Fauro – within the Solomon Islands, one of many final untapped frontiers of the Pacific Ring of Hearth.

The corporate’s land bundle is strategically positioned close to world-class deposits, equivalent to Newmont Mining’s 71.9 Moz Lihir gold mine and Bougainville Copper’s historic Panguna deposit with 19.3 Moz gold and 5.3 Mt copper assets.

CEO John Florek investigating mineralized outcrop at Kuma property through the summer season website go to

Kuma and Fauro are 100% owned and drill-ready. Each property profit from compelling historic sampling, large-scale geophysical anomalies, and district-scale geological traits that help the potential for main porphyry and epithermal techniques.

The corporate focuses on systematic exploration, delineating high-priority drill targets to unlock discovery alternatives. With sturdy nationwide help for mining and a management staff deeply skilled in main international jurisdictions, Sankamap is properly positioned to generate early and significant shareholder worth as exploration advances.

Key Properties

Kuma Property

The Kuma property spans 43 sq km and lies 37 km southeast of Honiara on Guadalcanal Island. The property is taken into account a extremely compelling drill-ready porphyry goal. Historic sampling returned values as much as 11.7 % copper and 13.5 g/t gold, accompanied by a kilometre-scale copper-gold geochemical anomaly. Airborne geophysical surveys, together with cellular magnetotelluric (MT), reveal resistive and conductive options according to porphyry, epithermal and skarn-style mineral techniques.

Kuma advantages from year-round entry and proximity to the Gold Ridge mine. Lidar, floor geochemistry, and geophysics surveys have superior goal definition towards a 2026 drill program. Alteration mapping outlined a 2 km lithocap, indicating a possible important porphyry under that’s not but examined by drilling.

Kuma is positioned for discovery potential on a scale corresponding to different main techniques within the area.

Present work at Kuma is concentrated on refining precedence drill targets via ongoing evaluation of newly launched geophysical and geological datasets. A discipline go to in November was geared toward ground-truthing these targets, confirming interpretations, and finalizing on-the-ground logistics. Pad and camp development started in late November, forward of the inaugural drilling marketing campaign set for January 2026, an vital milestone in advancing the Kuma property towards discovery.

Fauro Property

The 147 sq km Fauro property encompasses a high-grade epithermal gold goal with indications of a porphyry system at depth. Shaped by the collapse of the Fauro calc-alkaline volcano, the property hosts seven prospects, three of that are drill-ready. Historic outcomes embrace a seize pattern of 173 g/t gold, trench outcomes of 8 m at 27.95 g/t gold, and drilling intercepts equivalent to 35 m at 2.08 g/t gold. A number of zones, together with Meriguna, Ballyorlo and Kiovakase, exhibit sturdy soil anomalies and magnetic highs, underscoring the property’s potential to host a large-scale deposit comparable in setting to the Lihir gold system.

Since 2024, new sampling has confirmed continued high-grade potential, with assays returning as much as 19.25 g/t gold and as much as 4 % copper, increasing proof for a hybrid epithermal-porphyry system. With year-round drilling entry and environment friendly transport through helicopter and boat, Fauro represents a serious exploration alternative with a number of present gold intercepts and untested porphyry indicators.

Administration Workforce

John Florek – Chief Govt Officer

John Florek has greater than 35 years of expertise with main and junior mining firms, together with BHP, Placer Dome, Barrick, Teck, and Detour Gold/Kirkland Lake Gold/Agnico Eagle. He has recognized and superior important mining property from early exploration via improvement and presently sits on the board of McEwen Mining. He’s additionally CEO, president and director of Emperor Metals.

John Williamson – Chairman, Co-founder and Director

An expert geologist with greater than 35 years within the international mining sector, John Williamson based greater than 20 profitable firms and the Metals Group. He has raised greater than $1 billion throughout private and non-private markets, delivering sturdy returns to shareholders.

Sean Mager – CFO and Director

With 30+ years within the international mining sector, Sean Mager brings in depth expertise in company improvement, stakeholder relations, regulatory affairs, finance and operations. He’s a co-founder of the Metals Group.

Krystle Adair – Vice-president, Exploration

A geologist with greater than 13 years of exploration expertise throughout the Americas, Krystle Adair has managed initiatives throughout a number of deposit varieties. She has labored extensively with Metals Group firms and is a registered skilled geoscientist in British Columbia.

Hannett – Director

A Bougainville Island nationwide {and professional} engineer with 17+ years of expertise, Arthur Hannett has labored with main operators together with Placer Dome, Barrick, Glencore and Agnico Eagle.

Donald Marahare – Director

A seasoned authorized skilled with 20+ years of expertise within the Solomon Islands, Donald Marahare is the principal at DNS & Companions Regulation Agency, admitted to the Excessive Courtroom in 2000. He additionally serves as president of the Solomon Islands Soccer Federation.