Scottie Sources Corp. (TSXV: SCOT,OTC:SCTSF) (OTCQB: SCTSF) (FSE: SR80) (“Scottie” or the “Firm”) is happy to report on the sale of its Bulk Pattern which was mined, crushed, and transported over the 2025 summer season season on the Bend Vein pit on the Scottie Gold Mine Undertaking (SGMP) and is at present ready to be shipped.

After having acquired the Bulk Pattern allow in late July this yr, Scottie rapidly mobilized contractors and tools and commenced work on the Bulk Pattern with a view to finishing this system earlier than the top of the yr.

Executing the sale, transport, and export of the Bulk Pattern required detailed logistical planning and successfully mirrored the anticipated workflow of future Direct Ship Ore (“DSO”) operations. As outlined within the 2025 Preliminary Financial Evaluation (“PEA”) –see information launch dated October 28, 2025-11-25 the Bulk Pattern tonnage represents roughly 10 days of full manufacturing on the Scottie Gold Mine Undertaking, demonstrating the scalability of the event plan.

Highlights:

-

An estimated 4,588 moist tonnes have been ready for export to an Ocean Companions facility in Taiwan with better-than-expected common preliminary assays of 15.89 g/t gold and 42.28 g/t silver

-

Per the Firm’s settlement with Ocean Companions, a 90% upfront cost is to be acquired 5 days after crusing at a gold value of US$4100/oz and silver value of US$49.50/oz

-

Vessel has been booked and is anticipated to be loaded between December 10th and 12th 2025

-

The ultimate 10% cost will reconcile any distinction between estimated and ultimate ounces and can be priced primarily based on metallic values on the time grades are finalized and agreed upon

“We’re extraordinarily happy with the success of this season’s Bulk Pattern program,” commented Dr. Thomas Mumford, President of the Firm. “Along with producing roughly $9 million in internet income, we have gained invaluable technical and logistical insights. From allowing to mining, crushing, transporting, transport and sale of the product, we may have executed the venture in underneath a yr, successfully demonstrating a scaled ‘dry run’ of our DSO idea. With this confirmed pathway, now we have sturdy confidence within the simplicity and effectivity of our DSO mannequin. Proceeds from the sale can be used to fund our upcoming Feasibility Research and allowing work.”

Bend Vein

Bend Vein (Determine 1) is a small useful resource included within the 2025 mineral useful resource estimate that outcrops at floor adjoining to the camp entry street. Bend vein is included within the PEA as a small open pit useful resource of 25,000 tonnes with a median grade of 9.56 g/t gold for a complete of 8.9K inferred ounces of gold. Mineralization type at Bend is analogous because the vein materials on the Blueberry and Scottie Gold Mine deposits, gold-bearing large to semi-massive pyrite-pyrrhotite wealthy veins hosted in andesitic host rocks of the Hazleton Group.

Determine 1 – Overview of Bend Vein zone and drilling previous to preliminary blast.

To view an enhanced model of this graphic, please go to:

https://photos.newsfilecorp.com/recordsdata/11118/276388_e091c16b74e18852_002full.jpg

Mining/Crushing Course of

Allow purposes have been submitted for the Bulk Pattern in January 2025 and authorised in July 2025. Following receiving the required permits from the regulators, the week after, Scottie’s mining contractor (a Stewart, BC primarily based quarry operator) took the primary blast, adopted by sorting, mucking, drilling, and a second and ultimate blast for the pattern which was additionally sorted.

Sorting was carried out underneath the supervision of a Scottie geologist aware of the Bend vein, who labored immediately with the excavator operators to type mineralized rock from waste.

As soon as sorting was accomplished, the pit was backfilled with the waste materials. The mineralized materials was jaw crushed to 4″ minus with the contractor’s cellular crusher. The mineralized materials was then trucked to the contractor’s gravel pit in Stewart, BC, with a blended fleet of freeway vehicles starting from 30 t to 45 t capability.

On the gravel pit the fabric was additional crushed to ½” minus utilizing a cellular cone crusher and cellular screening plant. Leading to an estimated 4,588 tonnes, with a moisture content material of three%. The crushed product was then trucked to a warehouse on the Stewart Bulk Terminal the place it awaits transport (Determine 2). On the warehouse the product was sampled and assayed to find out preliminary grades for pricing, and technical specs for transport functions.

Determine 2 – Photograph of Bulk Pattern at Stewart Bulk Terminal awaiting transport. Product has been crushed to ½” minus. Scottie COO Sean Masse for scale.

To view an enhanced model of this graphic, please go to:

https://photos.newsfilecorp.com/recordsdata/11118/276388_e091c16b74e18852_003full.jpg

The sale, transport and export processes are distinctive and really concerned. This has been an important planning and studying course of for Scottie, because it represents the standard course of that the DSO mannequin could be in manufacturing. Primarily based on the 2025 PEA, the Bulk Pattern would symbolize about 10 days’ manufacturing when SGMP is in full manufacturing.

Scottie used the identical advisor that helped safe the settlement with Ocean Companions for the promoting features of the Bulk Pattern (this sale was explicitly excluded from the Ocean Companions offtake settlement) and the Scottie group labored by the regulatory features of the export.

Regulatory features embody, CBSA allowing, Export licensure, Product Security Knowledge Sheets (SDS), IMSBC Code group classification (bulk cargo transport security), detailed assays for deleterious parts and their grades. All of those approvals and processes are required for manufacturing of the SGMP, now that these have been accomplished as soon as, they’d change into matter after all and be saved updated now and again.

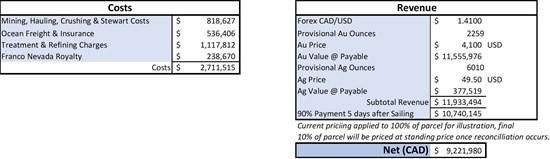

The next desk exhibits the prices, income and revenue from the Bulk Pattern:

To view an enhanced model of this graphic, please go to:

https://photos.newsfilecorp.com/recordsdata/11118/276388_scottietable1.jpg

All greenback ($) quantities on this information launch are in Canadian greenback ($) until in any other case indicated. As it is a trial mining course of it does ignore among the overheads associated to working the location and camp that will usually be attributed to the operation in regular state. Taxes are additionally not included.

Cost Phrases

Scottie has elected to “Advance Value” this parcel, which is a function of each our long run and Bulk Pattern agreements with Ocean Companions. This allows Scottie to take a futures value for any parcel, moderately than reconciling on M+1 or M+3 pricing phrases, which might be the conventional course underneath the settlement. The costs are included within the Income desk above and are available from the LME futures market by way of Ocean Companions’ hedging desk.

Provisional cost of 90% of worth can be paid 5 days after crusing of the cargo vessel. Provisional grades are primarily based on sampling carried out within the Stewart Bulk Terminal and assayed by an impartial laboratory.

Last sampling will happen at Ocean Companions’ facility in Taiwan, carried out by an impartial laboratory and assay facility in Taiwan. The parcel can be sampled on 250 t tons and samples can be taken for Scottie, Ocean Companions, the impartial umpire and a reserve pattern. Umpiring will happen if there’s a discrepancy on gold higher than 0.2 g/t of gold or 5 g/t of silver.

The ultimate 10% cost can be used to account for any discrepancy between the provisional ounces and ultimate ounces. The ultimate cost relies upon the metals pricing when the grade is finalized and agreed.

Precious Engineering

The Bulk Pattern represents not solely an important alternative to trial run a lot of the steps to the DSO mannequin for the SGMP, however it additionally gave a possibility to do some essential test-work that may assist with additional engineering.

- Bond Rod Work Index, used for understanding grinding vitality required was measured to be 11.8 kWhr/t, that is “medium to reasonably laborious”, typical supplies on this vary are uncooked cement supplies, tin ore, and so forth. This compares to a median of 15.2 kWh/t for Brucejack ore.

- Bond Crushing Work Index (CWi) and Bond Abrasion Index (Ai) of 11.46 kWhr/t and Ai=0.119 respectively, these parameters are utilized in deciding on and sizing a crusher that can be used to feed the sorting system. The CWi for the Bend Vein materials is comparatively low in order that crushing to the sorting dimension ought to take a decrease vitality than a tougher materials, the abrasion index is within the medium to non-abrasive vary, that means that an impactor or jaw crusher are appropriate. This can be an vital facet to research in our subsequent examine as impactors can generate much less fines and, subsequently, enable extra of the general plant feed to be sorted, producing the next general grade and a decrease shipped tonnage.

- Grade to dimension fraction, used to grasp if gold preferentially settles throughout crushing into the finer fractions. That is of essential significance to sorting efficiency as ore sorters typically don’t type <12.5mm, this undersize materials is taken into account “fines” within the flowsheet and could be added to the focus from the sorters. That is vital issue as a result of it should each dilute the grade of the ultimate product and enhance the tonnage. Within the lab work, the gold doesn’t preferentially migrate to the fines, that is doubtless because the gold is predominantly superb (~150 micron or finer) and carefully related to sulfide minerals, moderately than bigger free gold particles that will be freed with crushing and migrate into the fines.

- Particle dimension distribution (PSD), this work determines how the fabric performs throughout crushing, indicating how a lot “fines” is produced and what’s the doubtless feed tonnage and dimension distribution that will be fed to the ore sorters. That is additionally vital to the design of the display screen decks used to type the crushed product for sorting. The outcomes of the evaluation present that the fabric produced a “superb” fraction of 21%.

Upsize to Beforehand Introduced Non-Brokered Financing

The Firm additionally broadcasts that, additional to its November 17, 2025 information launch, it has elevated the dimensions of its non-brokered personal placement (the “Providing”) in response to sturdy investor demand. The Providing will now include as much as 11,327,420 charity flow-through widespread shares (“Charity FT Shares”) at a value of $2.14 per Charity FT Share, for complete gross proceeds of as much as $24,240,678.80 (elevated from $23,500,000).

Every Charity FT Share will qualify as a “flow-through share” inside the that means of subsection 66(15) of the Earnings Tax Act (Canada) (the “Tax Act”). The gross proceeds can be used to fund “Canadian exploration bills” that qualify as “flow-through mining expenditures” underneath the Tax Act and that can be incurred in reference to the Scottie Gold Mine Undertaking in British Columbia. These expenditures can even qualify as “BC flow-through mining expenditures” underneath the Earnings Tax Act (British Columbia). All qualifying expenditures can be renounced in favour of the subscribers efficient on or earlier than December 31, 2025.

Readers are directed to the Firm’s November 17, 2025 information launch for extra particulars relating to the Providing.

High quality Assurance and Management

Outcomes from samples taken through the 2025 area season have been analyzed at SGS Minerals in Burnaby, BC or MSA Labs in Prince George, BC. The sampling program was undertaken underneath the route of Dr. Thomas Mumford. A safe chain of custody is maintained in transporting and storing of all samples. For the majority pattern analyses gold was assayed utilizing Photon Assay. Evaluation by 4 acid digestion with multi-element ICP-AES evaluation was performed on all samples with silver and base metallic over-limits being re-analyzed by emission spectrometry.

Dr. Thomas Mumford, P.Geo., non-independent and President of the Firm, a professional particular person underneath Nationwide Instrument 43-101, has reviewed and authorised the technical data contained on this information launch on behalf of the Firm.

ABOUT Scottie Sources.

Scottie Sources controls 100% of the Scottie Gold Mine Property in BC’s Golden Triangle—anchored by the high-grade, past-producing Scottie Gold Mine and the adjoining Blueberry Contact Zone. Along with the Georgia, Cambria, Sulu, and Tide North properties, the Firm instructions ~58,500 ha in one of many world’s most prolific gold districts.

The Scottie Gold Mine Undertaking hosts 3,604K tonnes at 6.1 g/t Au for 703,000 oz gold (Inferred classification), highlighting a sturdy near-surface, high-grade useful resource with room for vital development. A newly accomplished PEA outlines compelling economics with an after-tax NPV(5%) of $216–$668M (US$2,600–$4,200/oz gold), a low preliminary capex of $128.6M, common manufacturing of ~65,400 oz Au/yr, and <2-year payback. A possible toll-milling state of affairs may enhance NPV(5%) to $380–$832M (US$2,600–$4,200/oz gold), demonstrating vital optionality and upside.

Scottie has efficiently accomplished a Bulk Pattern program anticipated to generate ~$9M in internet income, whereas offering a confirmed “dry run” of the Direct Ship Ore (DSO) pathway. The Firm continues lively drilling with ongoing outcomes anticipated by year-end, aiming to additional develop assets and prolong mine life.

Scottie’s skilled management group has a robust observe report in discovery, useful resource development, and venture development within the Golden Triangle. Their confirmed working, technical, and capital markets experience positions Scottie to effectively advance the Scottie Gold Mine towards near-term improvement.

FORWARD-LOOKING STATEMENTS

This information launch incorporates “forward-looking statements” inside the that means of Canadian securities laws. These embody, with out limitation, statements with respect to: the economics and venture parameters introduced within the PEA, together with IRR, AISC, NPV, and different prices and financial data; doable occasions, situations or monetary efficiency that’s primarily based on assumptions about future financial situations and programs of motion; the strategic plans, timing, prices and expectations for the Firm’s future improvement and exploration actions on the Scottie Gold Mine Property, together with metallurgical check, mineralization and useful resource estimates and grades for drill intercepts, allowing for numerous work, and optimizing and updating the Firm’s useful resource mannequin and getting ready a feasibility examine; data with respect to excessive grade areas and dimension of veins projected from underground sampling outcomes and drilling outcomes; and the accessibility of future mining on the Scottie Gold Mine Property. Such forward-looking statements or data are primarily based on quite a lot of assumptions, which can show to be incorrect. Assumptions have been made relating to, amongst different issues: the reliability of mineralization estimates, the situations on the whole financial and monetary markets; availability and prices of mining tools and expert labour; accuracy of the interpretations and assumptions utilized in calculating useful resource estimates; operations not being disrupted or delayed by uncommon geological or technical issues; potential to develop and finance the Scottie Gold Mine Undertaking; and results of regulation by governmental businesses. References to enhancements in grade or discount in dilution from ore sorting are primarily based on preliminary check work and/or manufacturing observations and aren’t essentially indicative of realized financial worth. Whereas ore sorting might enhance the grade of fabric shipped for processing, there isn’t any certainty that such sorting will lead to improved recoveries, decrease prices, or enhanced venture economics. Extra metallurgical testing, reconciliation, and financial research are required to find out whether or not ore sorting will ship optimistic worth on a industrial scale. Accordingly, buyers are cautioned to not assume that will increase in grade from sorted materials are indicative of economically viable mineralization or future profitability. The precise outcomes may differ materially from these anticipated in these forward-looking statements because of danger elements together with: fluctuations in valuable metals costs, value of consumed commodities and foreign money markets; uncertainty as to precise capital prices, working prices, manufacturing and financial returns, and uncertainty that improvement actions will lead to worthwhile mining operations; dangers associated to mineral useful resource figures being estimates primarily based on interpretations and assumptions which can lead to much less mineral manufacturing underneath precise situations than is at present estimated; the interpretation of drilling outcomes and different geological information; receipt, upkeep and safety of permits and mineral property titles; environmental and different regulatory dangers; venture price overruns or unanticipated prices and bills; and common market and trade situations. Ahead-looking statements are primarily based on the expectations and opinions of the Firm’s administration on the date the statements are made. The assumptions used within the preparation of such statements, though thought of cheap on the time of preparation, might show to be imprecise and, as such, readers are cautioned to not place undue reliance on these forward-looking statements, which converse solely as of the date the statements have been made. The Firm undertakes no obligation to replace or revise any forward-looking statements included on this information launch if these beliefs, estimates and opinions or different circumstances ought to change, besides as in any other case required by relevant legislation.

Neither TSX Enterprise Trade nor its Regulation Companies Supplier (as outlined within the insurance policies of the TSX Enterprise Trade) accepts accountability for the adequacy or accuracy of this launch.

To view the supply model of this press launch, please go to https://www.newsfilecorp.com/launch/276388