Coverage Heart for the New South

Otaviano Canuto and Antônio Jorge Martins

The highway to decarbonizing the planet runs by way of the power transition, which incorporates the shift from fossil-fueled vehicles to renewable power autos (Canuto, 2021). This automotive transition is unfolding as a real revolution within the trade.

For the reason that nineteenth century, the automotive sector has undergone profound transformations, initially pushed by European, American, Japanese, and later, Korean giants. These conventional automakers performed a elementary function in world automotive industrialization, shaping the market’s evolution all through the 20th century.

The evolution towards mass take-up of electrical and hybrid autos has are available tandem with the ascent of Chinese language producers. Within the present context of geopolitical and technological rivalries, the automotive transition has been marked by an intense commerce warfare, with implications for the trajectory of decarbonization.

The Rise and Maturing of the Automotive Trade

From the emergence of small family-owned companies on the finish of the nineteenth and early twentieth centuries, to the evolution of a few of them into world giants, the automotive sector has undergone a number of phases of transformation. A serious milestone for the automotive trade occurred in 1886 with Germany’s improvement of inner combustion engines. Till the Nineteen Nineties, American, European, Japanese, and Korean firms had been primarily answerable for the evolution seen within the sector, however their dominance waned after 2003 due to the revolution led by Tesla with electrical autos (EVs) and autonomous driving, in addition to China’s emergence in 2010 as a key participant within the world automotive trade. China affords low-cost, high-tech manufacturing, making it the biggest automotive market on the earth, with native manufacturers gaining world prominence.

The introduction of the meeting line in 1913 by Henry Ford revolutionized the automobile trade, making vehicles accessible to a wider public. Within the twentieth century, the exponential development of the automotive trade throughout all continents, particularly after the Second World Warfare, noticed the rise of automakers together with Ford, VW, Mercedes-Benz, Renault, Fiat, Peugeot, and Citroën. This development was pushed by the strategic acquisition of small firms centered on area of interest markets, and by optimizing industrial operations, resulting in higher participation within the world market. Partnerships and alliances performed an important function in advancing applied sciences and standardizing processes, additional accelerating the sector’s improvement.

Within the second half of the 20th century, Japan strengthened its place within the automotive sector, with its automakers turning into world benchmarks for high quality and effectivity by way of the creation of latest industrial processes. Within the Nineteen Nineties, Korea emerged as a world competitor, with its automakers gaining prominence in Western and rising markets, establishing themselves as world gamers.

Brazil within the Nineteen Seventies developed the Nationwide Alcohol Program (Proálcool), aiming to advertise using ethanol (alcohol) instead gasoline to gasoline in an effort to scale back dependency on oil imports. Using biofuels—mixed with fossil fuels—has been a particular function of the nation (Canuto, 2007).

Tesla, China and the Emergence of a New Disruptive Part

Within the early twenty-first century, nevertheless, a brand new disruptive part started to take form. Tesla started to play a major function within the sector, not solely popularizing EVs but in addition, by way of autonomous driving know-how, turning into a logo of innovation and sustainability within the automotive trade. Some American firms have sought to undertake Tesla’s mannequin of services, however have failed to attain the identical success. Complacency accompanying the dominance of combustion engine autos left Western automakers unprepared for the rise of EVs, forcing them now to rethink their methods.

The emergence of EVs and hybrid vehicles, in addition to the rise of Chinese language automakers challenged the dominance of conventional producers. Corporations corresponding to Tesla, with its autonomous vehicles, and Chinese language automakers, corresponding to BYD, started to dominate the sector by introducing electrical and hybrid autos with superior know-how and aggressive costs. This new panorama caught Western automotive industries off guard, as they had been accustomed to the continual success of combustion engines.

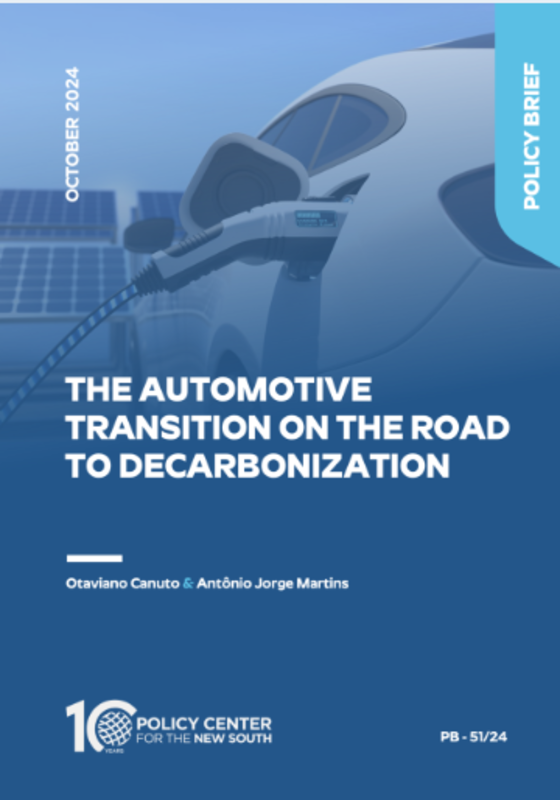

Because the world’s largest automotive market and a significant export hub for all continents, China emerged as a pacesetter within the EV market, together with each totally electrical and hybrid autos, with its firms supplying the worldwide market with extremely technological autos at costs decrease than their opponents (Determine 1).

Determine 1: China as a Producer and Purchaser of EVs

Supply: Beattie, A. (2024).

The success of Chinese language producers started in 2001 when the automotive sector was designated a ‘Precedence Scientific Analysis Challenge’ beneath China’s 5-Yr Growth Plan. The challenge gained important momentum in 2007 when the Chinese language authorities determined that improvement efforts ought to deal with ‘electrical motorization’ moderately than bettering combustion engines, allocating substantial human and monetary sources to analysis and improvement of the challenge.

You will need to be aware that, to fulfill this strategic goal of electrical motorization for Chinese language firms, there have been no limits set on the variety of events or particular insurance policies in the direction of present firms or startups. In consequence, over 100 newcomers emerged, although many finally exited or went bankrupt. This led to the rise of quite a few Chinese language EV producers, with notable gamers together with BYD, GWM, NIO, Xpeng, Geely, and SAIC Motor. A parallel will be made with the way in which during which South Korea’s conglomerates developed on account of a Schumpeterian ‘inventive destruction’ course of, with each winners and losers alongside the way in which (Canuto, 2020).

To enter the huge Chinese language market, Western firms had been compelled to type joint ventures with native companions, facilitating the absorption of automotive know-how by native teams, a lot of whose shareholders had educational {and professional} backgrounds from the U.S. Moreover, the rise of automotive startups, many backed by tech teams, accelerated innovation and the evolution of the EV and hybrid markets.

An exception to the three way partnership rule was Tesla, which acquired approval to construct its personal manufacturing facility in Shanghai (Gigafactory 3), the corporate’s first unit outdoors america, which began operations in 2019. By not following the normal mannequin, Tesla fashioned strategic partnerships and collaborations with Chinese language teams, together with native provide agreements with CATL and LG Chem (LG Power Answer). The mix of LG Chem and CATL batteries helps Tesla optimize prices and diversify and export its automobile lineup to achieve a broader viewers.

Tesla’s operational mannequin allowed higher management over its operations and speedy scalability within the Chinese language market, persevering with to be a key participant in Tesla’s world operations right now.

It’s price noting that overseas producers dominated China’s automotive market beginning in 1984, with VW promoting thousands and thousands of autos and attaining important income. Nonetheless, this dominance ended with the meteoric rise of native manufacturers in each the home and worldwide markets.

For a holistic retrospective of China’s automotive sector:

· Overseas automakers’ market share of automobile gross sales fell from 53% in July 2022 to 33% in the identical month of 2024 (information from CPCA-ANFAVEA China), whereas Chinese language manufacturers elevated from 47% to 67%.

· VW misplaced its place because the best-selling automobile model in China to BYD in 2023, a title it had held since 2000.

· The joint ventures of GM and Toyota in China reported important losses on the finish of the primary half of 2024, with GM’s gross sales dropping from a peak of over 4 million in 2017 to 2.1 million final yr.

· Honda, Hyundai, and Ford additionally took drastic measures, together with layoffs and manufacturing facility closures, to chop prices as native shoppers more and more favored Chinese language manufacturers over overseas ones.

· In the meantime, BYD offered a report 3.02 million autos globally in 2023, together with EVs and hybrids, marking a 62% enhance in comparison with 2022.

Lately, the rise of Chinese language manufacturers has been meteoric. Along with dominating the home market, Chinese language producers have expanded their world presence, exporting autos to all continents.

The Automotive Transition, Competitors, and Commerce Wars

The rise of electrical and hybrid autos is a transparent world development within the automotive sector right now. China, particularly, has stood out in each the manufacturing and export of those autos. The Chinese language home market continues to develop, pushed by favorable authorities insurance policies and growing demand for sustainable mobility options.

Even with the world’s largest market situated in China, exports have risen due to authorities incentives and the massive variety of native producers, which has resulted in a major worth warfare. To shift their focus to new markets and scale back stress to decrease costs, quite a few producers have turned to overseas markets.

Like BYD, Tesla operates on all continents, specializing in luxurious electrical autos, autonomous driving methods, charging infrastructure, and photo voltaic panels. China’s world exports of EVs grew by 70% from 2022 to 2023.

This Chinese language enlargement has fueled a worth warfare within the EV market. With so many producers competing, many turned their efforts to exterior markets, in search of aid from the bounds of native demand development and the corresponding deflationary stress. On this state of affairs, BYD and Tesla responded in a different way to the extraordinary competitors. Whereas BYD diversified its world operations, Tesla centered on autonomous driving methods, corresponding to Autopilot and Full Self-Driving (FSD), creating technological differentiators which have freed it from purely price-based competitors.

A important level for the success of EVs is the charging infrastructure, which stays underdeveloped in lots of markets. Hybrid autos try and strike a stability, providing some power effectivity with out the logistical challenges of totally electrical autos.

Chinese language competitiveness, pushed by authorities assist, has put Western automakers beneath intense stress. For a lot of European and American producers, competing with Chinese language manufacturers has turn out to be a frightening activity, particularly due to the assist Chinese language firms obtain when it comes to innovation and analysis and improvement (R&D). In response, a few of these automakers are forming strategic alliances with Chinese language producers, aiming to strengthen the event of electrical autos and increase their presence in European and Latin American markets, although with restricted success.

The worldwide automobile gross sales panorama in 2023 returned to pre-pandemic ranges, with 65 million items offered. Nonetheless, the market is extra fragmented than ever, with the rise of latest startups, notably Chinese language ones, in search of to ascertain themselves globally. For conventional automakers, this new setting calls for speedy adaptation. Survival and success are immediately tied to the flexibility to innovate, enabling higher competitiveness in a market that values cutting-edge know-how and power effectivity above all else.

The sharp depreciation of totally electrical autos (EVs), which has brought on resale difficulties—both due to the arrival of newer, cheaper fashions, or issues in regards to the excessive value of battery substitute and the shortage of charging stations—has led hybrid autos to realize a distinguished place amongst shoppers, attaining higher market penetration worldwide.

The risk posed by Chinese language manufacturers to century-old automotive industries has triggered tariffs in Europe, North America, and Brazil, on electrical autos imported from China. Within the U.S., tariffs on EVs from China will quadruple, from 25% to 100% this yr. There are at present only a few EVs from China within the U.S., however the Biden Administration and U.S. automakers fear that low-priced, closely backed EVs may quickly flood the U.S. market.

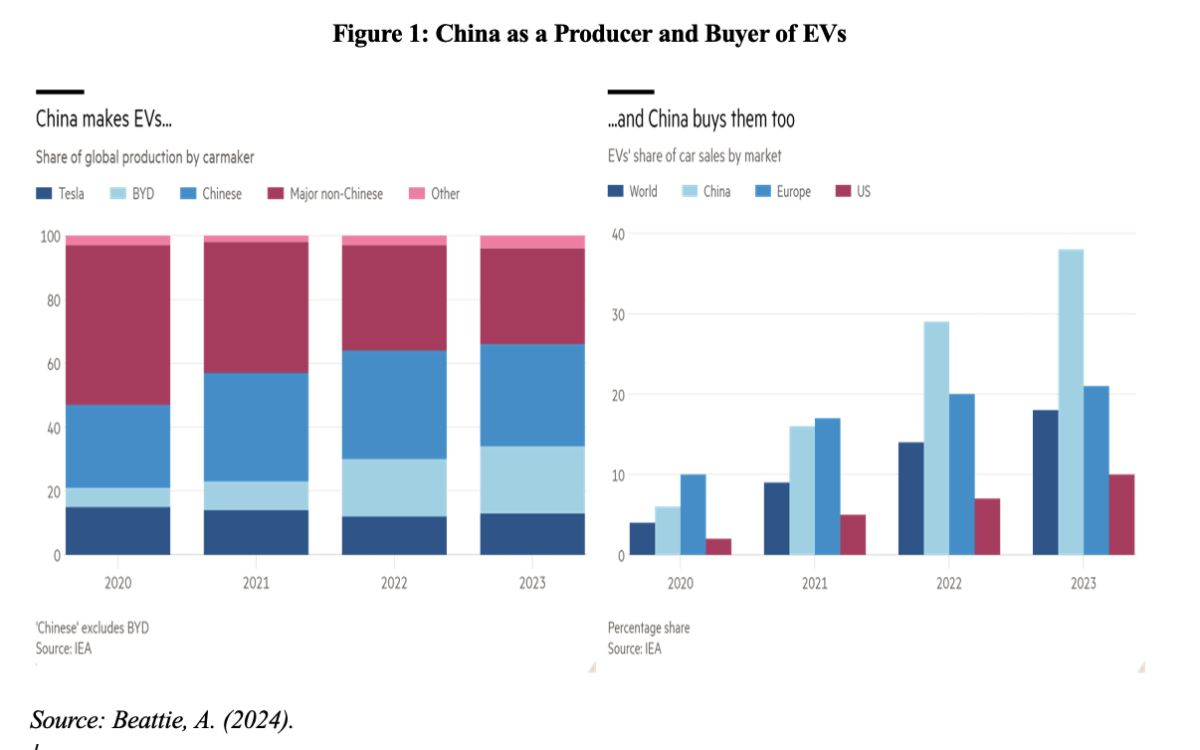

European Union member states have in flip agreed to ascertain tariffs of as much as 45% on imports of Chinese language EVs, although assist for this was not unanimous, with a lot of nations, together with Germany and Hungary, voting towards the tariffs, or abstaining (Bounds et al, 2024). Determine 2 illustrates why this issues considerably from China’s perspective.

Determine 2:

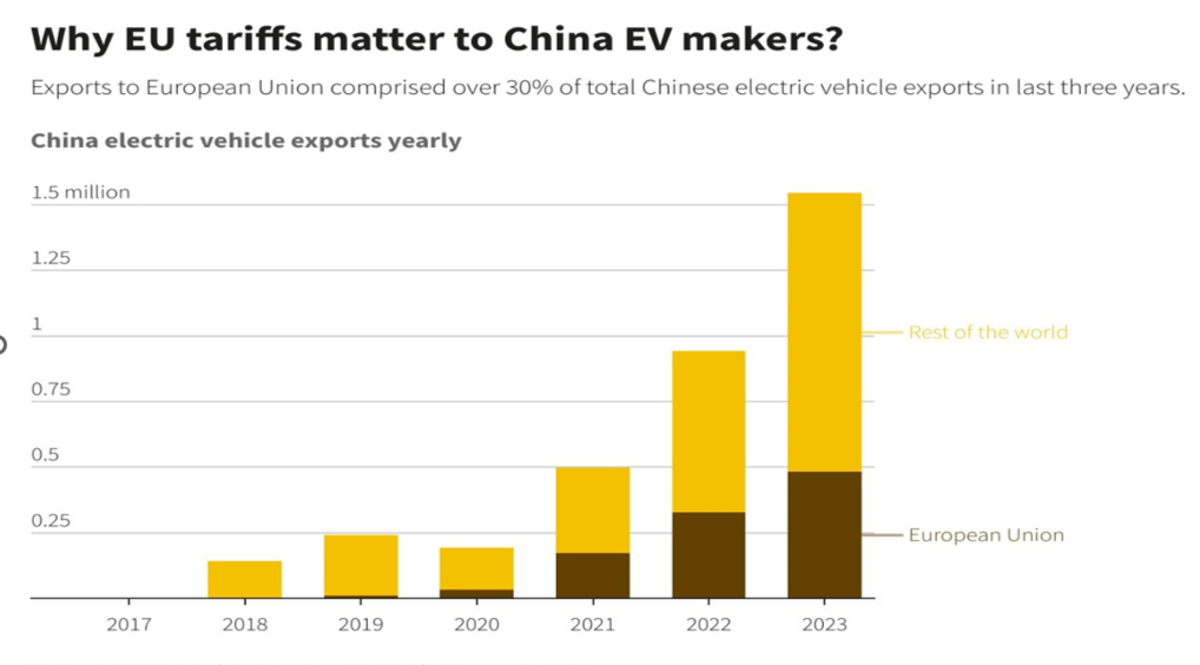

In Europe, there are even threats of manufacturing facility closures, which may have important impacts on employment in sure areas. It has turn out to be impractical for European automakers, nonetheless missing plentiful electrical automobile know-how, to compete with lower-cost Asian firms, that are pushed to extend their competitiveness by fierce home competitors and authorities assist for innovation and R&D.

Some century-old automakers face challenges stemming from shareholder agreements, with uncertainties round successors, and priorities given to stakeholders over the core enterprise. Moreover, they grapple with excessive fastened labor and power prices, that are incompatible with the present world manufacturing setting, pushed by robotics, automation, and excessive manufacturing volumes. The share costs and anticipated revenue margins of European carmakers have mirrored this state of play (Determine 3).

Determine 3:

Supply: Inagaki, Ok. (2024).

You will need to be aware that the intensifying EV competitors in China, pushed by quite a few producers and startups, has each native and world penalties:

- Chinese language EV producers deal with providing hybrids due to excessive costs and insufficient assist for charging stations.

- Smaller Chinese language rivals face monetary difficulties or are eradicated due to the abundance of producers.

- European automakers have scaled again their electrification ambitions due to new EV market situations, focusing as a substitute on growing hybrids to compete with Chinese language manufacturers.

- BYD’s scale and vertical integration assist its profitability, offering higher flexibility in pricing and making it tougher for different opponents—Chinese language, Japanese, Korean, or European—to penetrate the market.

- BYD plans to extend its worldwide gross sales from 12% to round 50% within the coming years, signaling continued fierce competitors.

At the moment, only some automotive teams, corresponding to Tesla and BYD, are recording distinctive income, regardless of current worth reductions in autos. Tesla lately shifted its technique, specializing in strengthening its Autopilot system already utilized in its vehicles and its Full Self-Driving (FSD) system, to flee the extraordinary worth competitors plaguing the EV market. The earlier technique of manufacturing high-demand autos at decrease costs proved much less efficient within the present part, as these autos are extra delicate to cost volatility. There’s no denying that Tesla’s valuation is larger than some other automotive firm due to the worth it has created by way of its robust fame as a sustainable, revolutionary firm—first by launching EVs and now with FSD, supported by information from Baidu, China’s main firm in robotaxis.

Past electrification, automobile automation and robotics are additionally turning into important elements. The idea of autos appearing as ‘smartphones on wheels’, geared up with superior know-how, is reshaping the driving expertise.

Semiconductors have gotten the brand new oil of the automotive trade, with China already prioritizing this sector. In 2024, the nation invested $25 billion in semiconductor manufacturing gear, with plans to double that quantity by the top of the yr. These investments are essential for the event of extra autonomous and energy-efficient autos. The US is main the aggressive race for semiconductors, whereas China goals to take care of its edge in clear power, together with EVs.

The automotive transition is already being impacted by the geopolitical rivalry between america, Europe, and China. In addition to the tariffs imposed by the U.S. and Europe on Chinese language EVs, the Biden Administration has alluded to a possible ban on Chinese language-made digital parts in autos working within the U.S. due to ‘nationwide safety’ issues.

Whither the Automotive Trade?

Hybrid autos nonetheless provide sure short-term benefits due to their decrease value and issues in regards to the availability of charging stations in some areas. Nonetheless, stricter rules on autos with gasoline engines can be applied steadily (e.g. with key modifications in California and the European Union beginning in 2035).

In 2024, Chinese language automakers are gaining floor within the world market, with BYD aiming to promote 4.0 million autos, putting it on par with Ford, which ranked sixth in 2023 with 4.4 million autos offered. Alternatively, regardless of the expansion of China’s exports in 2023, Japanese, European, and Korean manufacturers nonetheless keep their management and prime positions within the world market.

In an effort to reverse declining gross sales in China, Volkswagen acquired a 5% stake in Xpeng, aiming for a strategic partnership to collectively develop electrical autos (EVs). Stellantis acquired a 20% stake within the worldwide subsidiary of the Chinese language EV producer Leapmotor, with plans to start promoting these autos in a number of European and Latin American nations in 2024.

Along with the pressing have to launch hybrid autos to counter the present world inflow of Chinese language EVs, the issues of different automakers working on this market will stay centered on growing their competitiveness within the face of fierce competitors. Together with technological developments and the observe of lowered pricing, world producers will proceed to bolster their investments in solid-state batteries to scale back prices, enhance sturdiness, and scale back the necessity for frequent recharging.

Though the wealthy economies are collectively lifting commerce obstacles towards competitors from China, in observe the techniques are barely totally different. Some European corporations are keen to combine with the Chinese language trade, whereas the Individuals are pursuing a decoupling (Beattie, 2024).

As autos more and more turn out to be ‘smartphones on wheels’, and contemplating the rising quantity of built-in know-how, semiconductors have gotten important for important methods together with management, administration, power effectivity, and autonomous driving.

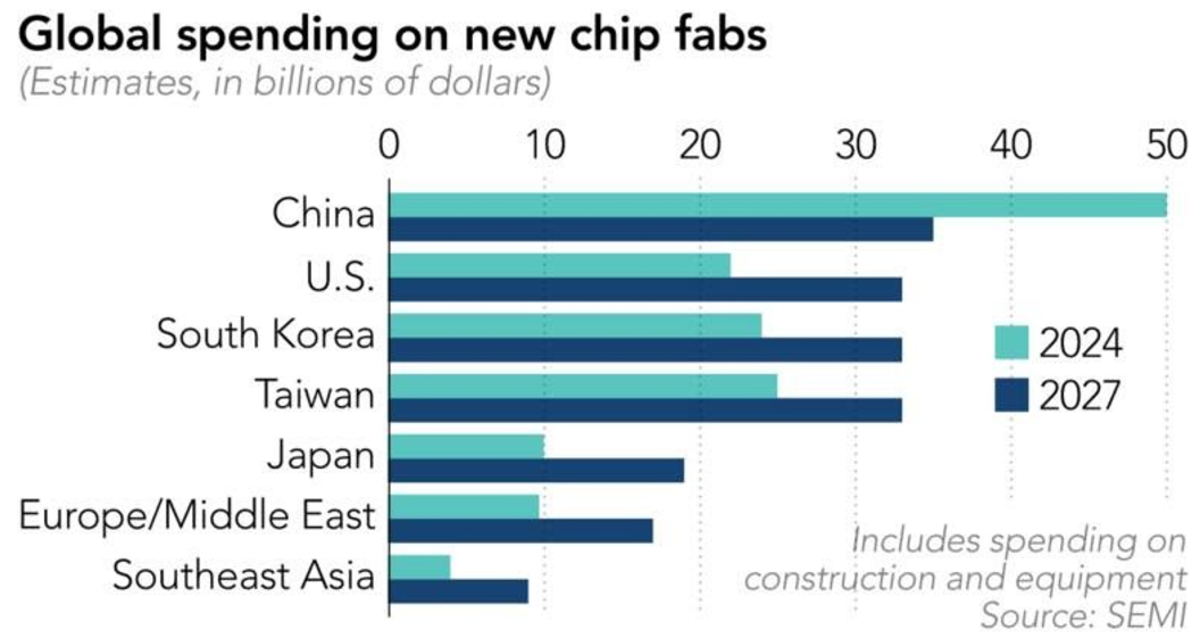

Semiconductor producers in developed nations are making notable progress in advancing their merchandise, together with the mixing of synthetic intelligence. Final yr, China spent a report $25 billion on chip-making gear, surpassing South Korea, Taiwan, and the U.S. mixed, in accordance with the worldwide chip trade affiliation. The rising annual relevance of AI in semiconductors aimed on the digitization of merchandise, companies, and processes is obvious from projected excessive spending on gear by way of 2027 (Determine 4).

Beijing’s report funding in chip manufacturing gear is pushed not solely by its top-tier chip producers but in addition by the growing efforts of its small and medium-sized chipmakers, supported by authorities incentives to foster startups. China’s coverage on this space mirrors its strategy to EVs, with over 100 producers now available in the market. The U.S. nonetheless leads the technological race on semiconductors, however the Chinese language are clearly attempting to catch up (Canuto, 2023a).

Determine 4

The automotive transition is proving to be a fancy and non-linear part of the broader power transition. Had been it not for the price enhance related to protectionist insurance policies, the toll on the highway to decarbonization could be decrease (Canuto, 2021). However that appears to be the worth of rising geopolitical and technological rivalry, accompanied by dangers of geoeconomic fragmentation (Canuto, 2023b).

References

Beattie, A. (2024). Why the US can’t impose its will over world commerce in electrical vehicles, Monetary Occasions, October 3.

Bounds, A.; White, E.; and Inagaki, Ok. (2024). EU member states conform to impose tariffs on Chinese language electrical autos, Monetary Occasions, October 4.

Canuto, O. (2007). Biofuels and Growth: The Third Dividend, paper introduced on the panel “The way forward for ethanol, biofuels, and power coverage within the Americas”, Americas Society and Council of the Americas, New York, February 22,

Canuto, O. (2020). Brazil, South Korea: Two Tales of Climbing an Revenue Ladder, Coverage Heart for the New South, PB-20/70, September.

Canuto, O. (2021). Decarbonization and “Greenflation”, December.

Canuto, O. (2023a). A Story of Two Know-how Wars: Semiconductors and Clear Power, Coverage Heart for the New South, PB-41/23, November.

Canuto, O. (2023b). Development Implications of a Fractured Buying and selling System, Coverage Heart for the New South, September 21.

Inagaki, Ok. (2024). European carmakers brace for a deeper and longer downturn, Monetary Occasions, October 2.

Otaviano Canuto is a Senior Fellow on the Coverage Heart for the New South, a non-resident Senior Fellow on the Brookings Establishment, and Director on the Heart for Macroeconomics and Growth in Washington. He has served as Vice President and Government Director on the World Financial institution, Government Director on the IMF, and Vice President on the Inter-American Growth Financial institution.

Antonio Jorge Martins is a coordinator at Getúlio Vargas basis (FGV) and a enterprise marketing consultant. He holds a level in engineering from UFRJ, a postgraduate diploma in finance from PUC-RJ and a grasp’s diploma in company sustainability from Senac-São Paulo. He has enterprise expertise as a CFO in publicly traded firms and as a Superintendent at BNDESpar.