Individuals hate after I present them this chart.

Most buyers are perpetually Pollyanna-ish. If the market’s up, all is nicely.

Not me.

I deal in info, figures, and plain truths – whether or not they make me comfy or not.

That’s not cynicism. It’s realism. And realism pays.

So after I say individuals hate this chart, it’s as a result of there’s nothing comfy about it.

The cyclically adjusted price-to-earnings (CAPE) ratio – additionally referred to as P/E 10 – makes use of inflation-adjusted earnings averaged over the previous decade. It smooths the cycle and offers a clearer long-term view of worth versus earnings.

The chart beneath plots the CAPE of the S&P 500 in normal deviations from its long-term imply. In easy phrases, it exhibits how far right now’s valuation sits from “regular.”

Proper now the studying is close to three normal deviations above common.

That’s an excessive stage by any historic yardstick. Readings that top present up solely a tiny fraction of the time – roughly just a few tenths of 1 %.

For years, I’ve tried to alert buyers to the market’s wealthy valuation. However we dwell in a value-blind regime. Most people solely care about rising costs and earnings development.

These matter. However they’re not the whole lot.

If you concentrate on the suitable issues – not simply surface-level hype – you develop into a extra principled, disciplined investor.

It doesn’t imply you cease investing. It means you elevate your requirements.

A market drenched in wealthy valuations isn’t one to keep away from. It’s one which calls for scrutiny and knowledge – the sort worth buyers have practiced for many years.

You weigh worth towards high quality. You insist on a margin of security. You settle for that the gang will be incorrect for a very long time.

Frankly, I like when most individuals ignore this. It offers me an edge. I look the place others received’t as a result of they’re busy chasing buzz. (My August 15 Worth Meter column is an ideal instance.)

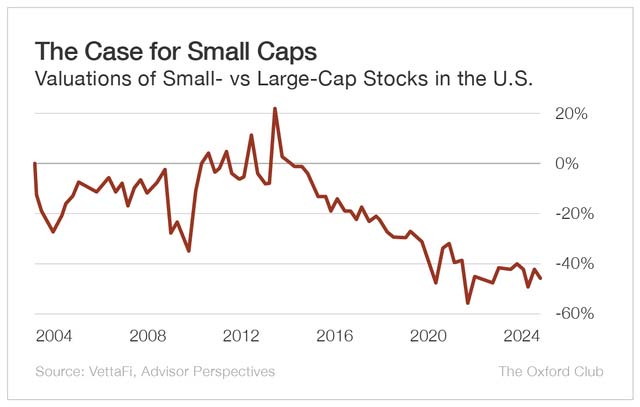

Proper now, the very best values I see are in small caps. They commerce at a transparent low cost to massive caps.

Over full market cycles, that’s usually the place management flips and extra returns emerge. So long-term buyers ought to be ecstatic about this.

Historical past favors small caps on a world scale, which makes right now an actual alternative.

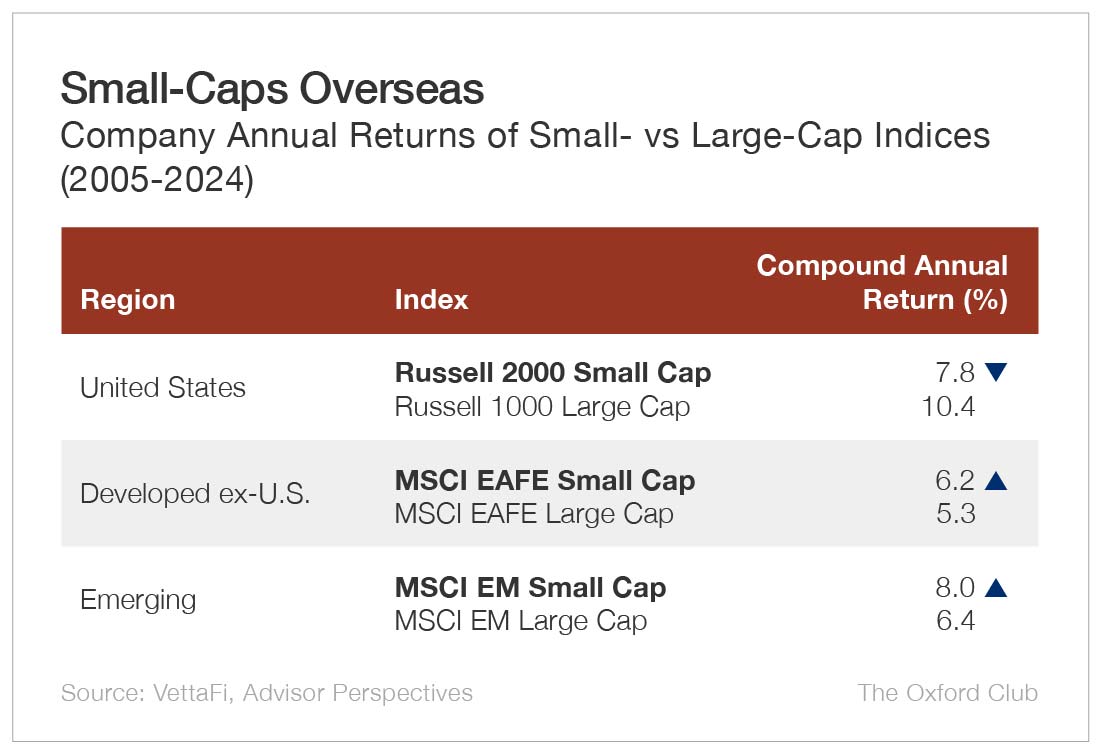

However don’t look solely on the U.S.

Over the previous 20 years, U.S. small caps have lagged massive caps. However overseas, the story flips. In developed worldwide markets – and in rising markets – small caps have led.

Management rotates. Valuation gaps shut. That’s how cycles work.

The long-run knowledge additionally suggests the U.S. hole is more likely to slender. Tendencies mean-revert, and present valuations assist. (When you should buy sturdy small companies at a reduction whereas consideration fixates on mega-cap winners, the percentages tilt in your favor.)

That’s why it’s higher to purchase when small caps are out of favor – when focus is elsewhere and sentiment is bitter. It’s not about calling a prime or a backside. It’s about treating worth as a key a part of the method and letting time do the heavy lifting.

At present, that self-discipline appears boring. Good. Boring units you aside.