Just lately, we’ve obtained a number of Security Web requests that each one fall below the identical discipline: finance. These names are T. Rowe Worth (Nasdaq: TROW), Western Union (NYSE: WU), and Peoples Bancorp (Nasdaq: PEBO).

So, whereas Chief Earnings Strategist Marc Lichtenfeld is out this week, I believed it could be enjoyable to shake issues up a bit and evaluate all three of those shares at one time – pitting them in opposition to each other to search out the final word champion.

Let’s begin by T. Rowe Worth, an funding administration agency much like Vanguard or Constancy. An enormous quantity of the corporate’s revenue comes from funding advisory charges, and income has seen a gentle enhance previously 12 months. At present costs, the inventory yields 4.8%.

Free money movement took a large hit in each 2022 and 2023. Nevertheless, 2024 noticed a bounce again with a 38.5% achieve, and free money movement is projected to almost double this 12 months.

A serious draw back is that T. Rowe Worth’s dividend payout ratio at present sits at 90%, which is above our threshold of 75%. The excellent news is that the corporate has elevated its dividend yearly for the final decade, incomes it some brownie factors.

Subsequent, let’s speak about Western Union. This firm focuses on cash switch, permitting its prospects to securely ship cash to folks or companies throughout borders. The corporate covers the areas that banks can’t by performing as a liaison for people who don’t have a checking account or who want money instantly. (A financial institution wire switch can take one to a few days.)

Turning to the protection of its dividend, we see a few crimson flags that might jeopardize its enticing 11.2% yield.

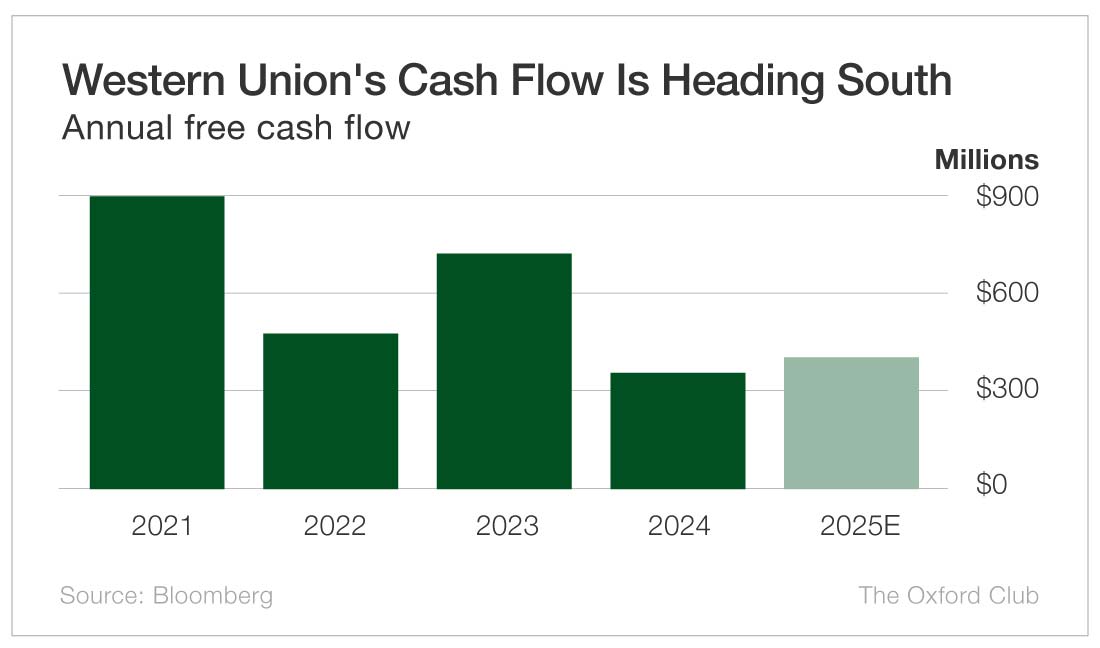

First off, Western Union’s free money movement has been in all places. It peaked in 2021 at $900 million however has been bouncing round ever since. Free money movement in 2024 was down 50% from the earlier 12 months and down 60% from three years prior.

On prime of that, Western Union introduced in August that it is going to be buying Worldwide Cash Categorical (Nasdaq: IMXI), which can end in a significant hit to the corporate’s free money movement.

The corporate’s dividend payout ratio, similar to T. Rowe Worth’s, is sitting above our 75% threshold at 90%.

Lastly, let’s have a look at Peoples Bancorp, an organization that gives banking companies from Ohio to Maryland. The inventory yields a stable 5.5%.

The corporate’s greatest income supply is web curiosity revenue, or NII – the distinction between the cash it earns from loans and investments and the curiosity expense it pays on deposits. We shall be utilizing that metric to measure free money movement.

NII is up each on the 12 months and over the past three years. The forward-looking estimates predict a fair bigger enhance this 12 months.

The corporate’s payout ratio at present sits at 16%, effectively under our 75% threshold. Its steadiness sheet appears stellar as effectively.

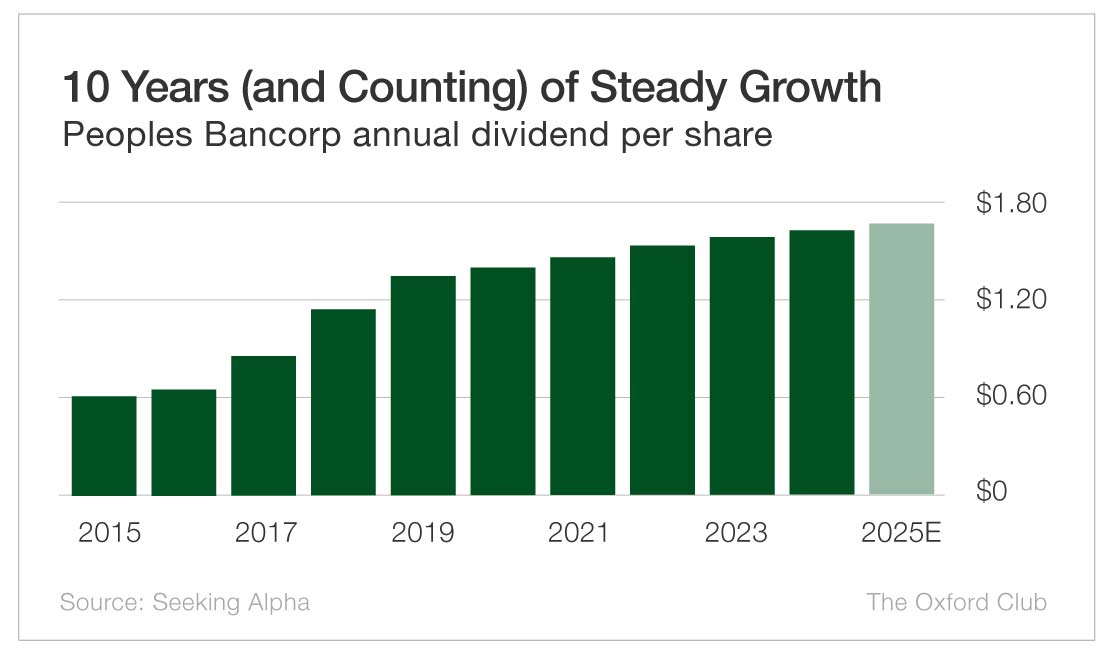

On prime of all of that, Peoples Bancorp has elevated its dividend yearly for the previous 10 years.

Now, it’s time to disclose the outcomes of our first-ever Conflict of the Finance Titans (it’s a working title).

In third place, we’ve Western Union with a grade of “F.”

Primarily based on our scoring system, the corporate’s dividend has a excessive threat of being minimize. I’m involved about its inconsistent money movement and excessive payout ratio.

In second, we’ve T. Rowe Worth with a “C.”

There’s some threat right here, however the firm’s money movement progress projections and robust dividend monitor document ought to assist.

And in first place, we’ve Peoples Bancorp with a mighty “A.”

This is without doubt one of the most secure dividends I’ve ever seen. I’d even go so far as to say that you just’re extra more likely to see a dividend increase than a dividend minimize.

Western Union Dividend Security Score: F

T. Rowe Worth Dividend Security Score: C

Peoples Bancorp Dividend Security Score: A

In case you loved this format, tell us by both commenting under or sending us an electronic mail right here.

And, as at all times, be happy to ship us extra firms whose dividends you’d like us to evaluate.

You can even have a look to see whether or not we’ve written about your favourite inventory just lately. Simply click on on the phrase “Search” on the prime proper a part of the Rich Retirement homepage, kind within the firm identify, and hit “Enter.”

Additionally, understand that Security Web can analyze solely particular person shares, not exchange-traded funds, mutual funds, or closed-end funds.