[ad_1]

69,511.

That’s what number of variables my Worth Meter spreadsheet is crunching proper now. And out of all that information, one quantity jumped off the display.

It reveals the perfect money generator in all the dataset.

It’s not a tech darling. Not a useful resource big. Not a financial institution.

It’s a flooring firm – the form of “boring” enterprise most hype-obsessed buyers fully overlook (in the event that they’ve even heard of it).

Fortunately, you received’t be one in every of them.

To be truthful, Mohawk Industries (NYSE: MHK) isn’t simply a flooring firm. It’s the biggest flooring firm on the earth, and it sells its merchandise beneath well-known manufacturers like Daltile, American Olean, Pergo, and Karastan.

It sells to each residential and industrial prospects, with a vertically built-in mannequin that features manufacturing, distribution, and logistics. That integration helps the corporate management prices, defend margins, and reply quicker to shifts in demand.

Plus, Mohawk’s attain is international, spanning North America, Europe, and different areas, which supplies it economies of scale. In the meantime, its concentrate on design innovation and premium product strains helps it compete in each high-end and price range markets.

The corporate simply wrapped up its second quarter of fiscal 2025 with $2.8 billion in gross sales, which was flat 12 months over 12 months regardless of a sluggish housing market. Adjusted earnings per share got here in at $2.77, and the corporate produced roughly $125 million in free money circulate for the quarter.

Margins have been somewhat softer, with adjusted gross margin slipping to 26.4% and working margin to eight.0%. However Mohawk nonetheless discovered room to return capital to shareholders, shopping for again $42 million price of inventory and authorizing a brand new $500 million repurchase program. Web debt stands round $1.7 billion, with leverage at simply 1.2 instances EBITDA (earnings earlier than curiosity, taxes, depreciation, and amortization).

At first look, Mohawk Industries would possibly appear like a strong however unremarkable industrial.

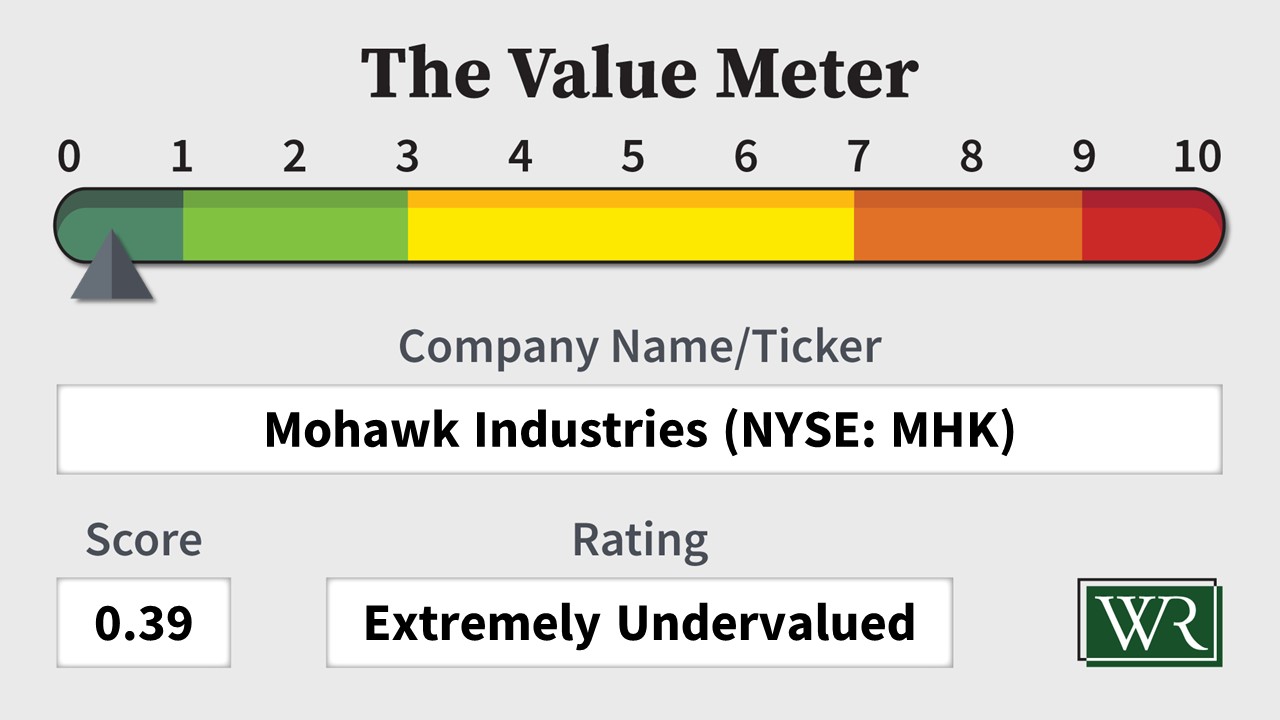

However The Worth Meter sees one thing else completely.

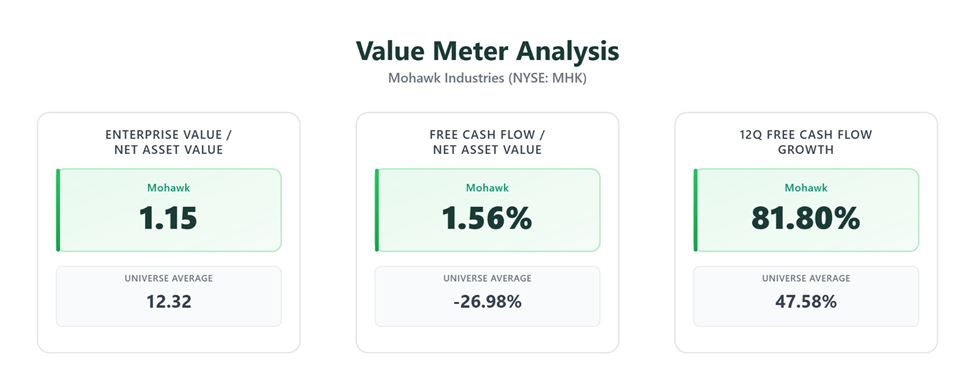

On an enterprise value-to-net asset worth (EV/NAV) foundation, Mohawk trades at 1.15. That’s a value of simply over $1 for each greenback of internet belongings – a fraction of the 12.32 common for its friends.

Subsequent is the free money flow-to-net asset worth (FCF/NAV) ratio, which stands at 1.56%. That’s a far cry from the peer group’s -26.98%, that means Mohawk is producing optimistic money circulate whereas many rivals are bleeding money.

The expansion story is equally compelling: During the last three years, Mohawk’s free money circulate has risen quarter over quarter about 82% of the time, in contrast with a median of lower than 48% for its friends.

Sure, the housing market remains to be smooth. Residential reworking and new development are sluggish, and Europe stays a problem. However tariffs on imported flooring might flip right into a progress driver – about 85% of the merchandise Mohawk sells within the U.S. are made domestically, permitting it to profit from value hikes whereas importers really feel the squeeze.

For affected person buyers, the setup is compelling: a debt-light stability sheet, a money machine of a enterprise, lively share buybacks, and the potential for margin enlargement if tariffs elevate pricing and enter prices ease after the third quarter.

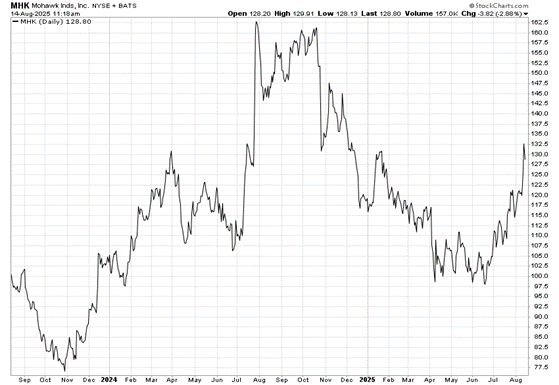

After peaking close to $160 final summer time, the inventory slid sharply into early 2025. That sell-off coincided with a weak housing market and smooth margins.

Since then, the inventory has staged a strong restoration, climbing greater than 30% off its spring lows, so some consolidation wouldn’t be stunning. However the rising development since April, coupled with the enhancing fundamentals, suggests momentum is shifting within the bulls’ favor.

In the end, Mohawk isn’t flashy. In any respect. However in a market that usually chases tales over substance, boring might be lovely – particularly when boring throws off this a lot money.

The Worth Meter offers Mohawk Industries a uncommon “Extraordinarily Undervalued” score.

What inventory would you want me to run by The Worth Meter subsequent? Publish the ticker image(s) within the feedback part under.

[ad_2]