Coverage Heart for the New South

Final week was my twenty-third consecutive week attending the World Financial institution and IMF Spring Conferences in Washington, DC. I not participate within the official classes, however I’m nonetheless invited to the various facet conventions and debates that happen round them.

A key second is at all times the discharge of the IMF’s World Financial Outlook report. This 12 months, it obtained particular consideration attributable to curiosity over how the establishment would undertaking the impacts of the tariff battle initiated by Trump’s second administration.

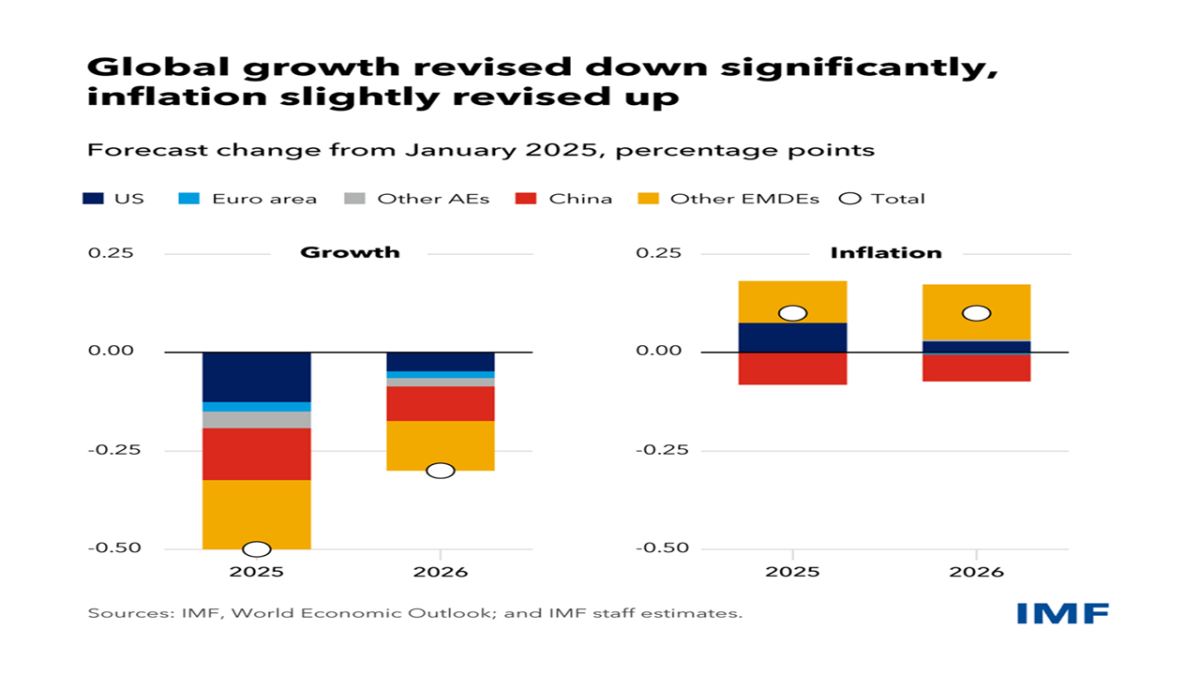

The IMF downgraded its world progress forecast by half a share level to 2.8% for this 12 months and lowered its 2026 forecast to three% (Determine 1). This represents a slowdown from the three.3% progress charge in 2024, with the Fund warning of the “main damaging shock” from rising commerce obstacles. The forecast factored in solely the tariff bulletins from the U.S. and retaliatory measures from different international locations between February 1 and April 4—earlier than Trump introduced a 90-day pause on most of his so-called “reciprocal tariffs,” whereas concurrently growing tariffs on China.

Determine 1

The Fund reduce its U.S. progress forecast for 2025 to 1.8%—down from the earlier 2.7% projection—and to 1.7% in 2026. Whereas this nonetheless retains the U.S. because the fastest-growing G7 financial system for this 12 months and subsequent, it marks a transparent drop from the two.8% growth seen in 2024. The IMF additionally downgraded progress projections for all different G7 international locations, in addition to for different main economies, together with China, India, Brazil, and South Africa.

China is anticipated to decelerate, with the IMF forecasting 4% progress for each this 12 months and subsequent, in comparison with 5% in 2024. Brazil’s actual GDP progress forecast was lowered to 2% for each 2025 and 2026. Amongst G20 international locations, solely Turkey, Argentina, and Russia confirmed improved progress projections.

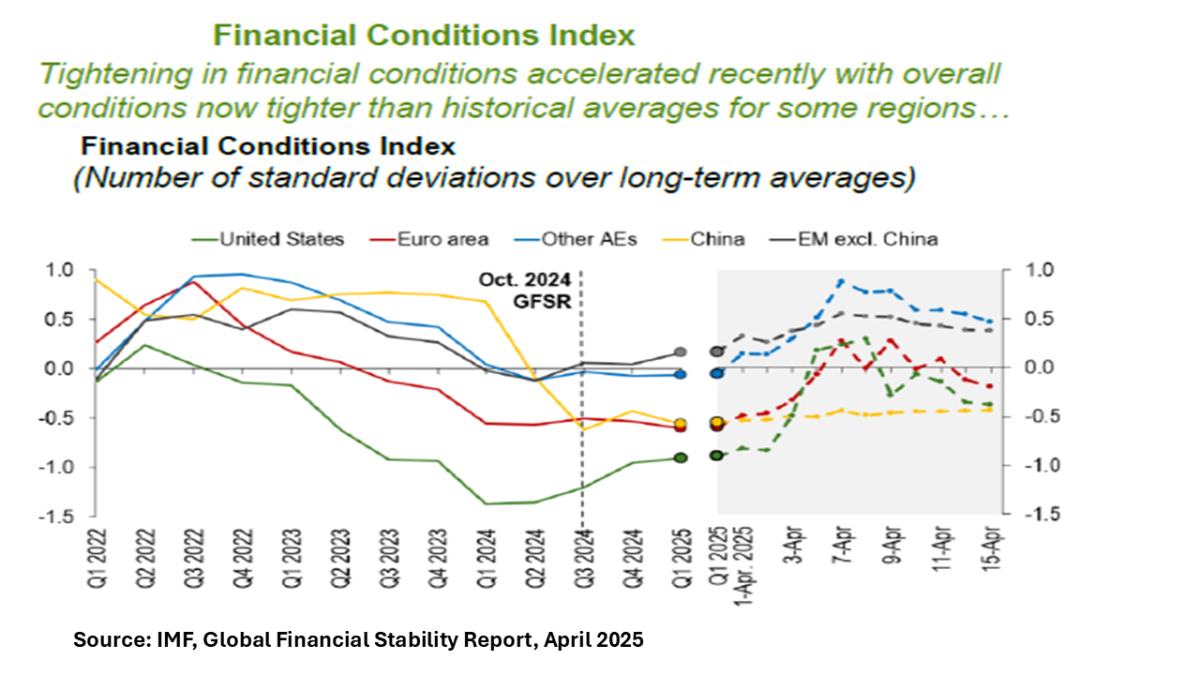

The IMF’s World Monetary Stability Report additionally drew vital consideration, significantly attributable to monetary market turbulence for the reason that begin of April. The report concluded that dangers to markets have “elevated considerably” for the reason that White Home’s tariff strikes, with a selloff in U.S. equities and authorities debt contributing to a “tightening of monetary circumstances” (Determine 2).

Determine 2

The announcement of the “reciprocal tariffs” on April 2 had a right away damaging impression on inventory markets, and beginning on April 7, comparable results have been seen in U.S. authorities bond markets. We began witnessing phenomena usually related to rising markets dealing with capital flight: yields on 10-year Treasury bonds rose whereas the greenback depreciated… World portfolios visibly started shedding U.S. belongings.

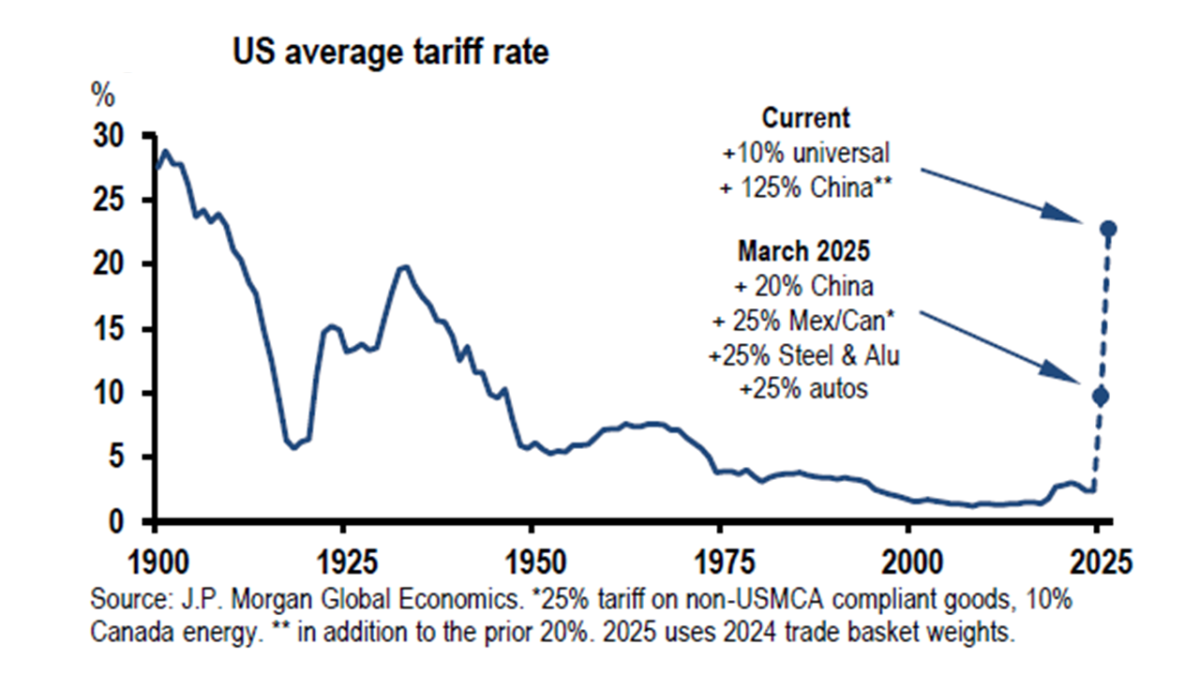

These market strikes mirrored a shift in notion about who has Trump’s ears. Up till the announcement of the large “reciprocal tariffs” on April 2 (Determine 3), it was believed that Treasury Secretary Scott Bessent’s view prevailed—that Trump’s tariffs have been primarily “transactional” instruments for negotiation functions. This had been the case with Mexico throughout Trump’s first time period, in addition to the early bulletins concerning Canada and Mexico throughout his second time period.

The shock got here on April 2, when it turned obvious that the dominant logic is likely to be pure and easy protectionism, with the rise of Howard Lutnick (Secretary of Commerce), Peter Navarro (Senior Counselor for Commerce and Manufacturing), and Jamieson Greer (U.S. Commerce Consultant). Markets shifted focus to the damaging actual financial system and monetary impacts highlighted within the two IMF reviews final week.

Determine 3

It was no coincidence that the 90-day postponement of the “reciprocal tariffs”—even with the China-specific will increase—got here throughout Scott Bessent’s presence on the White Home. The transient market aid that adopted mirrored renewed hope that the “transactional” strategy may prevail. Nevertheless, chaos within the bond markets was quickly strengthened by Trump’s risk to fireplace Federal Reserve Governor Jeremy Powell, a risk that was denied on Monday of final week.

The escalation of tariffs and different retaliatory measures from China appeared to catch the Trump administration without warning. Remarkably, the U.S. intensified the tariff battle with China with out even minimal preparation for realities comparable to China presently processing over 90% of vital minerals and magnets essential for digital merchandise.

A high-stakes sport of bluff – a poker sport—appears to have been established between the U.S. and Chinese language governments. Trump and Bessent converse of negotiations between the 2 international locations, whereas the Chinese language insist that talks can solely start as soon as the U.S. rolls again particular new measures concentrating on China.

On Tuesday, April 22, Secretary Scott Bessent stated at a convention organized by JPMorgan that he hoped the 2 international locations would ultimately attain an settlement, noting {that a} commerce battle with China was “unsustainable.”

On Friday 25 of April, there have been reviews that China’s Ministry of Commerce was reviewing sectors affected by Beijing’s 125% tariffs on U.S. merchandise, in keeping with Michael Hart, president of the American Chamber of Commerce in China. In the meantime, though Donald Trump claimed Chinese language President Xi Jinping had “known as” him, Beijing denied that any negotiations to ease commerce tensions between the world’s two largest economies had began.

One other scorching matter final week was the Trump administration’s relationship with multilateral establishments. One in all Trump’s first govt orders was a overview of those relationships, with a report due in August. Final 12 months, a report from the influential conservative suppose tank, the Heritage Basis, even proposed that the U.S. withdraw from the Bretton Woods establishments.

At one of many facet occasions throughout this week’s IMF and World Financial institution Spring Conferences, hosted by the Institute of Worldwide Finance, Secretary Scott Bessent didn’t name for an exit however emphasised tying U.S. contributions to a shift in institutional focus. He criticized the IMF and World Financial institution for “mission drift,” demanding they steer away from “in depth and unfocused agendas” like local weather change and gender points.

Going again to the IMF reviews of final week: additionally they outlined much less pessimistic situations in case negotiations between the U.S. and its main buying and selling companions result in tariff reductions. In line with Tobias Adrian, director of the IMF’s Financial and Capital Markets Division, though the damaging results of tariffs have already been “considerably priced in,” fairness and bond costs might “definitely” fall additional if negotiations fail. So, it’s both profitable negotiations or additional stress and downgrades.

Let’s want for the perfect after such a spring of tariff remorse.

Otaviano Canuto, based mostly in Washington, D.C, is a former vp and a former govt director on the World Financial institution, a former govt director on the Worldwide Financial Fund, and a former vp on the Inter-American Improvement Financial institution. He’s additionally a former deputy minister for worldwide affairs at Brazil’s Ministry of Finance and a former professor of economics on the College of São Paulo and the College of Campinas, Brazil. Presently, he’s a senior fellow on the Coverage Heart for the New South, a professorial lecturer of worldwide affairs on the Elliott College of Worldwide Affairs – George Washington College, a nonresident senior fellow at Brookings Establishment, a professor affiliate at UM6P, and principal at Heart for Macroeconomics and Improvement.