This week, I need to pull the curtain again a bit and clarify one of many core pillars of The Worth Meter – a measure that quietly does extra heavy lifting than nearly some other quantity we use.

I’m speaking about free money flow-to-enterprise worth, or FCF/EV.

It’s not a flashy metric. You gained’t hear it tossed round on monetary TV or splashed throughout brokerage reviews. But it surely’s the quantity that tells us, greater than some other, whether or not we’re a real discount or a price lure.

It’s additionally why The Worth Meter so typically spots cash-rich, underpriced companies that others miss.

Free money move is the money an organization has left over after paying its payments and sustaining its enterprise. It’s the true cash that can be utilized to pay dividends, purchase again inventory, or scale back debt.

Enterprise worth, alternatively, represents what it might value to purchase the entire firm – fairness, debt, and all – whereas subtracting money.

After we divide one by the opposite, we learn how a lot money a enterprise produces for each greenback it might value to personal it outright.

That’s why FCF/EV is the truest “earnings yield” there’s. It ignores accounting video games, one-time beneficial properties, and headline noise. It’s the best measure of what actually issues: how effectively an organization converts its assets into spendable {dollars}.

This isn’t a concept we dreamed up in isolation, by the way in which. A number of the largest and most disciplined buyers on the earth depend on this similar strategy.

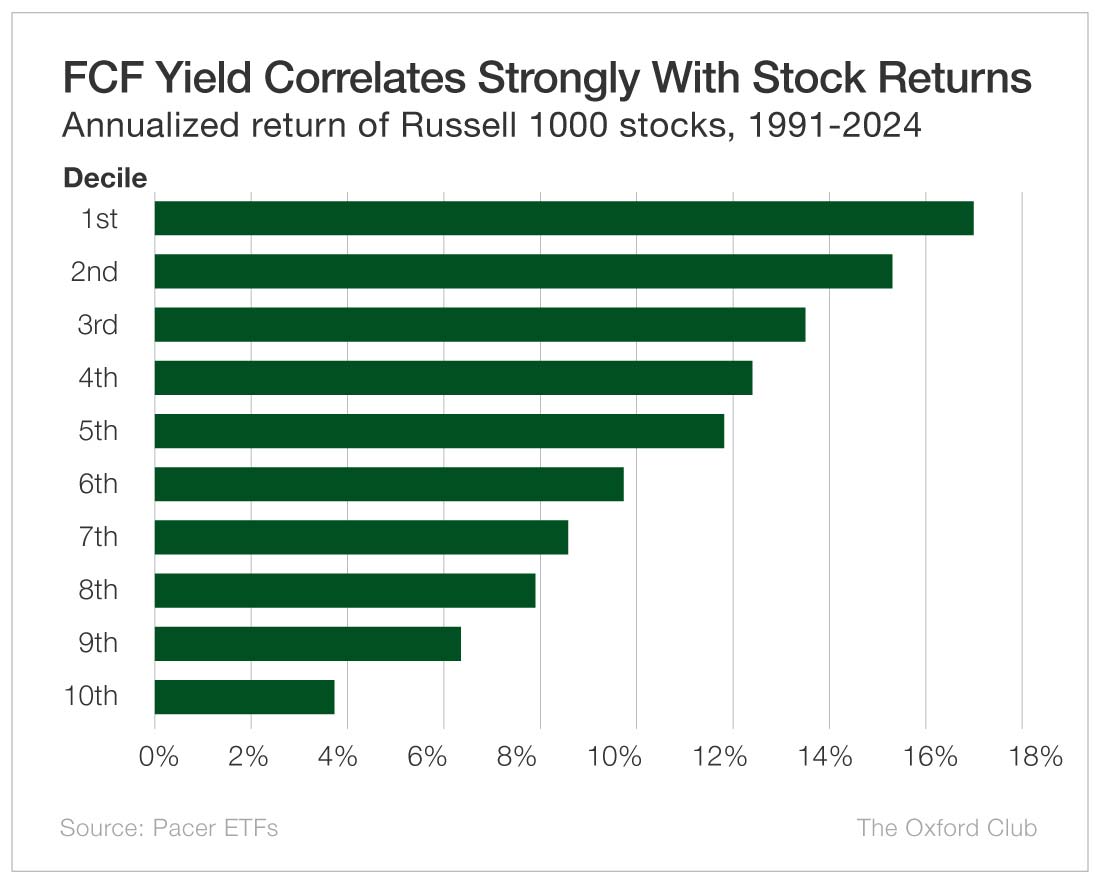

AQR Capital, a quantitative large managing greater than $100 billion, contains free money flow-to-enterprise worth as a core think about its long-term worth methods. AQR’s analysis exhibits that firms with excessive FCF/EV persistently outperform these with low FCF/EV, even after adjusting for measurement, leverage, and business.

S&P Dow Jones has additionally leaned into this precept. In 2024, it launched the S&P High quality Free Money Circulate Aristocrats Index, which screens for firms that generate sturdy and secure money flows relative to their belongings.

The outcomes converse for themselves. These shares have proven larger resilience throughout market drawdowns and stronger returns over full cycles.

In the meantime, buyers can see the ability of this metric in real-world efficiency. The Pacer U.S. Money Cows 100 ETF (BATS: COWZ), which ranks firms purely by FCF/EV (additionally known as FCF yield), has crushed the Russell 1000 Worth Index by roughly seven proportion factors per 12 months over the previous 5 years.

That’s not luck. That’s free money move doing its job by figuring out companies that generate actual cash relative to what they value.

Conventional measures like price-to-earnings or price-to-book merely can’t compete. Earnings could be massaged with artistic accounting, and ebook worth has misplaced its that means in a world the place essentially the most priceless belongings – software program, patents, and types – don’t seem on a stability sheet.

Money is unambiguous. It doesn’t want interpretation.

When an organization persistently produces extra free money than its friends for each greenback of enterprise worth, it’s normally as a result of it runs a greater enterprise, not due to monetary smoke and mirrors.

For this reason FCF/EV sits on the coronary heart of The Worth Meter.

The opposite metrics we use – free money flow-to-net asset worth and enterprise value-to-net asset worth – inform us how effectively a enterprise converts its belongings into money and the way costly these belongings have turn into. However FCF/EV ties all of it collectively. It’s the ratio that tells us what we’re paying for the corporate’s skill to provide actual, recurring money. It’s our “fact serum.”

The takeaway is straightforward: In a market filled with noise, money move stays the one quantity that may’t be faked. It’s essentially the most direct sign of whether or not a enterprise actually earns greater than it spends.

That’s why free money flow-to-enterprise worth isn’t simply one other ratio – it’s the cornerstone of how we discover real worth. And it’s why it would keep on the middle of The Worth Meter lengthy after price-to-earnings ratios are not related.