[ad_1]

Tule Canyon Property

The Tule Canyon Property consists of sixty (60) federal lode mining claims, situated in Esmeralda County, Nevada, United States of America. Tule Canyon is a mesothermal high- grade gold and silver goal with two former mines and quite a few showings and previous workings alongside a 5km structural hall.

Silver Vary and WLR have executed a Letter of Intent (“LOI”) granting WLR the choice to accumulate 100% of the Tule Canyon Property (“Tule Canyon”). WLR has a primary choice to accumulate 80% of Tule Canyon by paying Silver Vary an mixture $480,000 over 4 years (all quantities in United States foreign money) and finishing 1,500 meters of diamond drilling by March 8, 2028. A second choice to accumulate the remaining 20% of Tule Canyon could also be exercised by WLR figuring out a Nationwide Instrument 43-101 compliant measured or indicated useful resource at Tule Canyon (the “Tule Useful resource”) by the tip of 2033.

The particular phrases of the transaction are as follows:

Topic to the Royalty (as outlined beneath), Silver Vary hereby grants Walker Lane an irrevocable choice to accumulate an eighty p.c (80%) curiosity within the Tule Canyon Property (the “Choice”) to be exercisable by Walker Lane by means of periodic funds of $480,000 within the mixture, as set out beneath:

First Choice

Money Securities, Exploration, and/ or Different Work Commitments

- Signing of the LOI $20,000

- Signing of the Definitive Settlement $20,000

- 12 months 1 anniversary $40,000

- 12 months 2 anniversary $75,000 (1)

- 12 months 3 anniversary $100,000 (1)

- Finishing not lower than an mixture 1,500 metres of diamond drilling on the Tule Canyon Property on or earlier than the third anniversary.

- 12 months 4 anniversary $225,000 (1)

(1) As much as half of the money funds could also be happy by means of the issuance of frequent shares of Walker Lane and the worth shall be issued on the larger of:

(i) $0.21;

(ii) the amount weighted common buying and selling worth of the Walker Lane shares for the twenty buying and selling days instantly previous to the sooner of the date of which any such shares are issued to Silver Vary;

(iii) if the worth of the Walker Lane shares is lower than $0.21 on the time the cost is due and owing to Silver Vary, the total quantity of such cost shall be happy by means of a money cost. For larger certainty, if the worth of Walker Lane shares is lower than $0.21 on the time the cost is due and owing to Silver Vary, the total quantity of such cost shall be happy by means of money cost;

(iv) However the aforementioned sections hereof, Walker Lane shall not be entitled to subject Walker Lane shares to Silver Vary as partial cost the place the issuance of such shares will lead to Silver Vary holding an mixture of larger than 19.9% of the issued share capital of Walker Lane on account of such share issuance; and,

(v) The steadiness of any cost owing to Silver Vary shall be made in money the place the provisions of Part (v) develop into operative.

(2) the anniversary date to be utilized is Could 12 of every relevant yr.

The money cost of $20,000 due at signing of the LOI has been issued to Walker Lane Assets Ltd.

Second Choice

(i) Upon the train of the First Choice, Silver Vary, shall grant to Walker Lane an irrevocable choice to acquire a further twenty p.c (20%) curiosity within the Tule Canyon Property (the “Second Choice”). With the intention to train the Second Choice, Walker Lane shall be required to finish a Nationwide Instrument 43-101 compliant report figuring out a measured or indicated useful resource on the Tule Canyon Property (the “Useful resource Report”) at any time on or earlier than December 31, 2033.

(ii) For larger certainty, the measured or indicated useful resource as contained within the Useful resource Report shall be calculated in accordance with the definitions for mineral sources, mineral reserves, and mining research utilized by the Canadian Institute of Mining, Metallurgy and Petroleum.

Royalty and Purchase-Again Choice

(i) On the time the Second Choice is exercised, Silver Vary shall be deemed to have retained a two and one-half p.c (2.5%) internet smelter return royalty curiosity in any and all future proceeds from industrial manufacturing of all commodities from the Tule Canyon Property (the “Royalty”).

(ii) At any time after the train of the Second Choice and previous to the graduation of business manufacturing from any mine on the Tule Canyon Property, Walker Lane shall have the irrevocable proper to buy as much as sixty p.c (60%) of the Royalty. Walker Lane shall have the correct to buy as much as sixty p.c (60%) in a single transaction or in a variety of transactions of not lower than twenty p.c (20%) of the Royalty in every transaction.

(iii) The acquisition worth to be paid to Silver Vary for the acquisition of every twenty p.c (20%) curiosity within the Royalty pursuant to paragraph (ii) above shall be $500,000. For larger certainty, sixty p.c (60%) of the Royalty as set out in paragraph (ii), represents a one and one-half p.c (1.5%) curiosity in internet smelter returns from industrial manufacturing on the Tule Canyon Property and could have an mixture buy worth of $1,500,000.

Milestone Cost

(i) Along with the Royalty, Silver Vary shall be entitled to a one-time money cost of $10.00 per ounce of gold (or the equal worth in different metals and minerals) contained in any measured or indicated mineral useful resource recognized on the Tule Canyon Property as contained within the Useful resource Report (the “Milestone Cost”).

(ii) The Milestone Cost shall be paid to Silver Vary inside six months of the completion date of the Useful resource Report.

Cambridge Property

The Cambridge Property is comprised of an mixture 51 federal lode claims, consisting of three adjoining blocks of mining claims, all situated in Lyon County, Nevada, United States of America. The three declare blocks comprising the property are: (i) the Cambridge claims; (ii) the JC claims; and (iii) the Enigma claims.

Silver Vary, Auburn Gold Mining LLC (“Auburn”) and WLR have executed a LOI granting WLR the choice to accumulate 100% of the Cambridge Property (“Cambridge”). WLR has a primary choice to accumulate 75% of Cambridge for whole consideration of $460,000 over 4 years, incurring $1,500,000 in exploration expenditures and finishing 1,500 meters of diamond drilling on the property. A second choice to accumulate the remaining 25% of the property will be exercised by WLR making a further mixture $75,000 to Silver Vary and Auburn and by figuring out a Nationwide Instrument 43-101 compliant measured or indicated useful resource at Cambridge (the “Cambridge Useful resource”) by the tip of 2033.

The particular phrases of the transaction are as follows:

First Choice

Money Securities (on the idea of fifty% – Silver Vary 50% – Auburn Exploration) and/or Different Work Commitments

- Upon TSX Enterprise Change approval of the LOI $10,000* to each Silver Vary and Auburn;

- Signing of the Definitive Settlement $10,000 to each Silver Vary and Auburn;

- 12 months 1 anniversary $10,000 cost to each Silver Vary and Auburn

- 12 months 2 anniversary $40,000 (1) cost to each Silver Vary and Auburn

- 12 months 3 anniversary $50,000 (1) to each Silver Vary and Auburn

- 12 months 4 anniversary $110,000 (1) to each Silver Vary and Auburn

- Incurring an mixture of $1,500,000 in exploration expenditures on the Cambridge Property, together with the completion of not lower than an mixture 1,500 metres of diamond drilling on the Property.

(1) One-half of the money funds could also be happy by means of the issuance of Walker Lane shares to Silver Vary and Auburn. The value of which any Walker Lane shares issued to Silver Vary and Auburn shall be issued on the larger of:

(i) $0.21;

(ii) the amount weighted common buying and selling worth of the Walker Lane shares for the twenty buying and selling days instantly previous to the sooner of the date of which any such shares are issued to Silver Vary and Auburn;

(iii) if the worth of the Walker Lane shares is lower than $0.21 on the time the cost is due and owing to Silver Vary and Auburn, the total quantity of such cost shall be happy by means of a money cost. For larger certainty, if the worth of Walker Lane shares is lower than $0.21 on the time the cost is due and owing to Silver Vary, the total quantity of such cost shall be happy by means of money cost;

(iv) However the aforementioned sections hereof, Walker Lane shall not be entitled to subject Walker Lane shares to Silver Vary as partial cost the place the issuance of such shares will lead to Silver Vary holding an mixture of larger than 19.9% of the issued share capital of Walker Lane on account of such share issuance; and,

(v) The steadiness of any cost owing to Silver Vary shall be made in money the place the provisions of Part (v) develop into operative.(2) the anniversary date to be utilized is Could 12 of every relevant yr.

The money funds of $10,000 to Silver Vary Assets and Auburn Mining due at approval of the LOI by the TSX Enterprise Change are actually being issued.

Second Choice

Second Choice Upon the train of the First Choice, Silver Vary and Auburn shall grant to Walker Lane an irrevocable choice, however not an obligation, to accumulate a further twenty-five p.c (25%) curiosity within the Cambridge Property (the “Second Choice”), to be exercisable by Walker Lane as follows:

(i) Finishing a Nationwide Instrument 43-101 compliant report figuring out a measured or indicated useful resource on the Cambridge Property (the “Useful resource Report”) at any time on or earlier than December 31, 2033;

(ii) Paying every of Silver Vary and Auburn $75,000 inside ten (10) days of the completion of the Useful resource Report; and

(iii) The measured or indicated useful resource as contained within the Useful resource Report shall be calculated in accordance with the definitions for mineral sources, mineral reserves, and mining research utilized by the Canadian Institute of Mining, Metallurgy and Petroleum.

Royalty and Purchase-Again Choice

(i) On the time the Second Choice is exercised, Silver Vary shall be deemed to have retained a one and one-half p.c (1.5%) internet smelter return royalty curiosity in any and all future proceeds from industrial manufacturing from the Cambridge Property (the “Silver Vary Royalty”).

(ii) On the time the Second Choice is exercised, Auburn shall be deemed to have retained a one p.c (1.0%) internet smelter return royalty curiosity in any and all future proceeds from industrial manufacturing from the Cambridge Property (the “Auburn Royalty”).

(iii) At any time previous to the graduation of business manufacturing from a mine on the Cambridge Property, Walker Lane shall have the irrevocable proper to buy as much as two-thirds (66.67%) of the Silver Vary Royalty. For larger certainty, two-thirds (66.67%) of the Silver Vary Royalty represents a one p.c (1.0%) curiosity in internet smelter returns from industrial manufacturing on the Cambridge Property.

(iv) At any time previous to the graduation of business manufacturing from a mine on the Cambridge Property, Walker Lane shall have the irrevocable proper to buy as much as one-half (50%) of the Auburn Royalty. For larger certainty, one-half (50%) of the Auburn Royalty represents a one-half p.c (0.5%) curiosity in internet smelter returns from industrial manufacturing on the Property.

(v) The acquisition worth to be paid as follows: a. To Silver Vary for the acquisition of two-thirds curiosity within the Silver Vary Royalty pursuant to paragraph (iii) above shall be $750,000; and b. To Auburn for the acquisition of one-half curiosity within the Auburn Royalty shall be $500,000. (vi) Part (iii) and (iv) royalty buy rights have to be totally exercised by Walker Lane and might not be exercised individually or partly with out the prior written settlement of all events to the Cambridge Property LOI.

Milestone Cost

(i) Along with the Silver Vary Royalty, Silver Vary shall be entitled to a one-time money cost of $6.00 per ounce of gold (or the equal worth in different metals and minerals) contained in any measured or indicated mineral useful resource recognized on the Cambridge Property as contained within the Useful resource Report (the “Silver Vary Milestone Cost”), as much as a most of $300,000.

(ii) Along with the Auburn Royalty, Auburn shall be entitled to a one-time money cost of $4.00 per ounce of gold (or the equal worth in different metals and minerals) contained in any measured or indicated mineral useful resource recognized on the Cambridge Property as contained within the Useful resource Report (the “Silver Vary Milestone Cost”), as much as a most of $200,000.

Silver Mountain Property

The Silver Mountain Property consists of eight (8) federal lode mining claims, situated in Esmeralda County, Nevada, United States of America throughout the Walker Lane Gold Development Space.

Silver Vary and CMC have executed a LOI granting WLR the choice to accumulate 100% of the Silver Mountain Property (“Silver Mountain”) for whole consideration of $200,000, payable in installments of $5,000 per yr till 2034 with a remaining cost of $150,000 by August 1, 2035. As much as half of the ultimate cost could also be made in WLR shares. As well as, WLR can be required to finish 1,000 meters of drilling in the course of the time period of the choice.

The particular phrases of the transaction are as follows:

Topic to the Royalty and Milestone Cost (as every is outlined beneath), Silver Vary hereby grants Walker Lane an irrevocable choice to accumulate a hundred percent (100%) curiosity within the Silver Mountain Property (the “Choice”) to be exercisable by Walker Lane by means of the cost of any mixture $200,000, as set out beneath:

First Choice

Money Securities, Exploration and/or Different Work Commitments

- On or earlier than August 1, 2025 a cost of $5,000

- On or earlier than August 1 of every of the calendar years 2026 by means of 2034, a cost of $5,000

- On or earlier than August 1, 2035 $150,000 (1)

- Finishing not lower than an mixture 1,000 metres of diamond drilling on the Silver Mountain Property on or earlier than August 1, 2035.

Walker Lane might speed up the train of the Choice by making all the funds and finishing the drilling requirement set out above underneath the Choice, at any time previous to August 1, 2035.

(1) As much as one-half (50%) of the money cost could also be happy by means of the issuance of frequent shares of Walker Lane.

The value at which the Walker Lane shares shall be issued shall be the larger of:

(i) $0.21;

(ii) the amount weighted common buying and selling worth of the Walker Lane shares for the twenty buying and selling days instantly previous to date on which any such shares are issued to Silver Vary;

(iii) if the worth of Walker Lane shares is lower than $0.21 on the time the cost is due and owing to Silver Vary, the total quantity of such cost shall be happy by means of a money cost. For larger certainty, if the worth of Walker Lane shares is lower than $0.21 on the time the cost is due and owing to Silver Vary, the total quantity of such cost shall be happy by means of money cost.

(iv) However the aforementioned sections hereof, Walker Lane shall not be to subject Walker Lane shares to Silver Vary as partial cost the place the issuance of such shares will lead to Silver Vary holding an mixture of larger than 19.9% of the issued share capital of Walker Lane on account of such share issuance.

(v) The steadiness of any cost owing to Silver Vary shall be made in money the place the provisions of Part (v) develop into operative.

Royalty and Purchase-Again Choice

(i) On the time the Choice is exercised, Silver Vary shall be deemed to have retained a two and one-half p.c (2.5%) internet smelter return royalty curiosity in any and all future proceeds from industrial manufacturing of all commodities from the Silver Mountain Property (the “Royalty”).

(ii) At any time after the train of the Choice and previous to the graduation of business manufacturing from any mine on the Silver Mountain Property, Walker Lane shall have the irrevocable proper to buy as much as sixty p.c (60%) of the Royalty. Walker Lane shall have the correct to buy as much as sixty p.c (60%) in a single transaction or in a variety of transactions of not lower than twenty p.c (20%) of the Royalty in every transaction.

(iii) The acquisition worth to be paid to Silver Vary for the acquisition of every twenty p.c (20%) curiosity within the Royalty pursuant to paragraph (ii) above shall be $500,000. For larger certainty, sixty p.c (60%) of the royalty as set out in paragraph (ii), represents a one and one-half p.c (1.5%) curiosity in internet smelter returns from industrial manufacturing on the Silver Mountain Property and could have an mixture buy worth of $1,500,000.

Milestone Cost

(i) Along with the Royalty, Silver Vary shall be entitled to a one-time money cost of $10.00 per ounce of gold (or the equal worth in different metals and minerals) contained in Nationwide Instrument 43-101 compliant report figuring out a measured or indicated useful resource on the Silver Mountain Property (the “Assets Report”) at any time on or earlier than or after the choice has been train (the “Milestone Cost”); and,

(ii) For larger certainty, the measured or indicated useful resource as contained within the Useful resource Report shall be calculated in accordance with the definitions for mineral sources, mineral reserves, and mining research utilized by the Canadian Institute of Mining, Metallurgy and Petroleum; and (iii) The Milestone Cost shall be paid to Silver Vary inside six months of the completion date of the Useful resource Report.

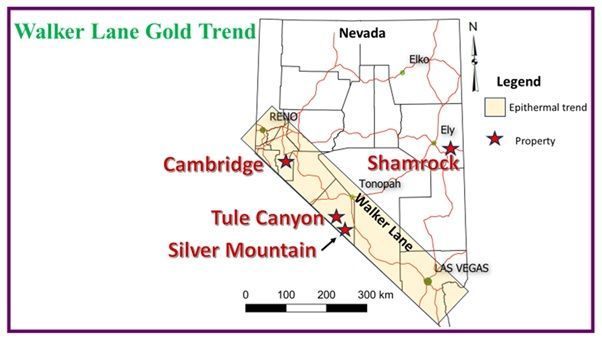

Walker Lane Gold Development Space

Walker Lane has established a strong place within the Walker Lane Gold Development Space which has a wealthy historical past of mining and exploration and stays vastly underexposed to fashionable exploration strategies, providing substantial upside potential. The Walker Lane space is host to notable valuable steel deposits such because the Comstock Lode, Spherical Mountain (Kinross), Silicon and Merlin (AngloGold Ashanti), Mesquite and Fort (Equinox Gold) and plenty of different vital deposits. This well-liked and rising district presents junior exploration corporations exploration targets at manageable prices. These targets are additionally engaging in that they’re related to high-grade gold, silver and base steel mineralization, have close by glorious infrastructure, appreciable street accessibility, an area, certified and competent labor drive, a various vary of provide corporations, and are situated inside among the finest allowing and coverage regimes on this planet. The 2023 Fraser Institute Mining Business Survey ranked Nevada second on this planet when it comes to funding attractiveness index.

Abstract

Walker Lane Assets Ltd. has optioned three extremely potential gold and silver initiatives within the Walker Lane Space. Our firm intends to pursue exploration of those properties in 2025 which can additionally embrace an preliminary drill program at Tule Canyon.

Certified Individual

Certified Individual Kevin Brewer, a registered skilled geoscientist, is the Firm’s President and CEO, and Certified Individual (as outlined by Nationwide Instrument 43-101). He has given his approval of the technical data pertaining reported herein. The Firm is dedicated to assembly the very best requirements of integrity, transparency and consistency in reporting technical content material, together with geological reporting, geophysical investigations, environmental and baseline research, engineering research, metallurgical testing, assaying and all different technical knowledge.

About Walker Lane Assets Ltd.

Walker Lane Assets Ltd. is a growth-stage exploration firm targeted on the exploration of high-grade gold, silver and polymetallic deposits within the Walker Lane Gold Development District in Nevada and the Rancheria Silver District in Yukon/B.C. and different property property in Yukon and Newfoundland and Labrador. The Firm initially intends to provoke a complete exploration program to advance the Tule Canyon (Walker Lane, Nevada) and Amy (Rancheria Silver, B.C.) initiatives with expectations of a multi-year exploration efforts with preliminary exploration success.

On behalf of Walker Lane Assets Ltd.:

“Kevin Brewer”

Kevin Brewer, President, CEO and Director

Walker Lane Assets Ltd.

For Additional Info and Investor Inquiries:

Kevin Brewer,

P.Geo., MBA, B.Sc. (Hons), Dip. Mine Eng.

President, CEO and Director

Tel: (709) 327 8013 kbrewer80@hotmail.com

Suite 1600-409 Granville St., Vancouver, BC, V6C 1T2

Cautionary and Ahead Trying Statements

This press launch and associated figures, comprise sure forward-looking data and forward-looking statements as outlined in relevant securities legal guidelines (collectively known as forward-looking statements). These statements relate to future occasions or our future efficiency. All statements aside from statements of historic truth are forward-looking statements. Using any of the phrases “anticipate”, “plans”, “proceed”, “estimate”, “count on”, “might”, “will”, “mission”, “predict”, “potential”, “ought to”, “consider” “focused”, “can”, “anticipates”, “intends”, “seemingly”, “ought to”, “might” or grammatical variations thereof and comparable expressions is meant to establish forward-looking statements. These statements contain identified and unknown dangers, uncertainties and different elements which will trigger precise outcomes or occasions to vary materially from these anticipated in such forward-looking statements. These statements converse solely as of the date of this presentation. These forward-looking statements embrace, however will not be restricted to, statements regarding: our technique and priorities together with sure statements included on this presentation are forward-looking statements throughout the that means of Canadian securities legal guidelines, together with statements concerning the Tule Canyon, Cambridge, Silver Mountain, and Shamrock Properties in Nevada (USA), and its properties together with Silverknife and Amy properties in British Columbia, the Silver Hart, Blue Heaven and Logjam properties in Yukon and the Bridal Veil property in Newfoundland and Labrador all of which now comprise the mineral property property of WLR. WLR has assumed different property of CMC Metals Ltd. together with frequent share holdings of North Bay Assets Inc. and all situations and agreements pertaining to the sale of the Bishop mill gold processing facility and stay topic to the situation of the choice of the Silverknife property with Coeur Mining Inc. These forward-looking statements mirror the Firm’s present beliefs and are based mostly on data at present obtainable to the Firm and assumptions the Firm believes are cheap. The Firm has made numerous assumptions, together with, amongst others, that: the historic data associated to the Firm’s properties is dependable; the Firm’s operations will not be disrupted or delayed by uncommon geological or technical issues; the Firm has the flexibility to discover the Firm’s properties; the Firm will be capable of increase any essential further capital on cheap phrases to execute its marketing strategy; the Firm’s present company actions will proceed as anticipated; normal enterprise and financial situations is not going to change in a cloth opposed method; and budgeted prices and expenditures are and can proceed to be correct.

Precise outcomes and developments might differ materially from outcomes and developments mentioned within the forward-looking statements as they’re topic to a variety of vital dangers and uncertainties, together with: public well being threats; fluctuations in metals costs, worth of consumed commodities and foreign money markets; future profitability of mining operations; entry to personnel; outcomes of exploration and improvement actions, accuracy of technical data; dangers associated to possession of properties; dangers associated to mining operations; dangers associated to mineral useful resource figures being estimates based mostly on interpretations and assumptions which can lead to much less mineral manufacturing underneath precise situations than is at present anticipated; the interpretation of drilling outcomes and different geological knowledge; receipt, upkeep and safety of permits and mineral property titles; environmental and different regulatory dangers; adjustments in working bills; adjustments normally market and business situations; adjustments in authorized or regulatory necessities; different threat elements set out on this presentation; and different threat elements set out within the Firm’s public disclosure paperwork. Though the Firm has tried to establish vital dangers and uncertainties that might trigger precise outcomes to vary materially, there could also be different dangers that trigger outcomes to not be as anticipated, estimated or supposed. Sure of those dangers and uncertainties are past the Firm’s management. Consequently, all the forward-looking statements are certified by these cautionary statements, and there will be no assurances that the precise outcomes or developments will likely be realized or, even when considerably realized, that they may have the anticipated penalties or advantages to, or impact on, the Firm.

The data contained on this presentation is derived from administration of the Firm and in any other case from publicly obtainable data and doesn’t purport to comprise all the data that an investor might want to have in evaluating the Firm. The data has not been independently verified, might show to be imprecise, and is topic to materials updating, revision and additional modification. Whereas administration shouldn’t be conscious of any misstatements concerning any business knowledge introduced herein, no illustration or guarantee, specific or implied, is made or given by or on behalf of the Firm as to the accuracy, completeness or equity of the knowledge or opinions contained on this presentation and no duty or legal responsibility is accepted by any individual for such data or opinions. The forward-looking statements and knowledge on this presentation converse solely as of the date of this presentation and the Firm assumes no obligation to replace or revise such data to mirror new occasions or circumstances, besides as could also be required by relevant legislation. Though the Firm believes that the expectations mirrored within the forward-looking statements and knowledge are cheap, there will be no assurance that such expectations will show to be appropriate. Due to the dangers, uncertainties and assumptions contained herein, potential buyers shouldn’t learn forward-looking data as ensures of future efficiency or outcomes and shouldn’t place undue reliance on forward-looking data. Nothing on this presentation is, or ought to be relied upon as, a promise or illustration as to the longer term. To the extent any forward-looking assertion on this presentation constitutes “future-oriented monetary data” or “monetary outlooks” throughout the that means of relevant Canadian securities legal guidelines, such data is being supplied to show the anticipated market penetration and the reader is cautioned that this data might not be acceptable for every other goal and the reader shouldn’t place undue reliance on such future-oriented monetary data and monetary outlooks. Future-oriented monetary data and monetary outlooks, as with forward-looking statements typically, are, with out limitation, based mostly on the assumptions and topic to the dangers set out above. The Firm’s precise monetary place and outcomes of operations might differ materially from administration’s present expectations and, in consequence, the Firm’s income and bills. The Firm’s monetary projections weren’t ready with a view towards compliance with revealed tips of Worldwide Monetary Reporting Requirements and haven’t been examined, reviewed or compiled by the Firm’s accountants or auditors. The Firm’s monetary projections characterize administration’s estimates as of the dates indicated thereon.

Determine 1: Venture Areas in Nevada

A photograph accompanying this announcement is offered at https://www.globenewswire.com/NewsRoom/AttachmentNg/dde0eb28-834d-4587-9aac-67dd99dbca18

[ad_2]