West Pink Lake Gold Mines Ltd. (“West Pink Lake Gold” or “WRLG” or the “Firm”) (TSXV: WRLG) (OTCQB: WRLGF) is happy to announce the graduation of a completely funded infill and conversion drilling program at its 100% owned Rowan Venture situated within the Pink Lake Gold District of Northwestern Ontario, Canada.

HIGHLIGHTS:

- West Pink Lake Gold introduced outcomes for a Preliminary Financial Evaluation (“PEA”) for the Rowan Venture on July 8, 2025 which demonstrates strong preliminary economics for an underground mine at Rowan producing a mean of 35,230 ounces (“oz”) per 12 months over a 5-year mine life at a mean grade of 8.0 grams per tonne gold (a duplicate of this information launch could be seen HERE 1 ).

- The drill program at Rowan (Determine 1) will include 5,000 metres (“m”) of HQ diameter diamond drilling together with infill drilling on Veins 001 and 004 to assist the potential improve of Inferred assets to Indicated 2 and conversion-focused drilling on Veins 006b and 013 to supply knowledge that will allow mine design consideration forward of a deliberate mixed Pre-Feasibility Research (“PFS”) for the Madsen Mine and Rowan initiatives. This deliberate research will consider the potential for creating the 2 initiatives utilizing shared infrastructure and built-in mine planning, with the objective of figuring out doable operational and financial synergies 3 .

- Conversion drilling 2 at Rowan can be centered on Veins 001 and 004, with the target to carry Inferred assets to an Indicated class. These veins account for almost all of PEA manufacturing tonnes. Roughly 63% of the tonnes and 72% of the ounces had been already within the Indicated class within the Rowan PEA.

- Infill drilling can be centered on Veins 006b and 013 to supply knowledge for potential inclusion within the deliberate mixed PFS. Integration of Veins 006b and 013 couldn’t solely lengthen mine life at Rowan, however can also permit for ore extraction to start roughly 6 months sooner as a result of nearer proximity to the entry portal. Accessing and mining mineralization earlier at Rowan has the potential to positively impression the online current worth (“NPV”) of the challenge. Inclusion of Veins 006b and 013 in future mine plans and the impression such inclusion might have is topic to the outcomes of the drill program and the end result of the mixed PFS as reviewed by a Certified Particular person.

- Additional geotechnical, metallurgical and engineering research are additionally deliberate at Rowan to tell the deliberate PFS. These research can be carried out along side ongoing allowing efforts to advance Rowan in direction of Superior Exploration standing, which is required for bulk pattern extraction. Permits to assist Superior Exploration actions, together with underground mine improvement, are focused for 2027, topic to regulatory evaluation and session.

- The Superior Exploration allow is focused for approval in 2027, a timeline supported by the latest launch of the One Venture, One Course of mine allowing framework in Ontario that goals to chop evaluation occasions inside the mine allowing course of in half for Designated Initiatives, a standing the Firm is pursuing at Rowan. 4

Shane Williams, President and CEO, acknowledged, “It is very thrilling to have a drill turning once more at Rowan. The Rowan challenge, in keeping with the PEA, is projected to supply 35,000 ounces of gold a 12 months. Success in advancing Rowan by way of allowing and improvement might place WRLG to focus on a mixed manufacturing price of as much as 100,000 ounces per 12 months gold 5 in Pink Lake within the coming years. The drilling at Rowan not solely goals to extend confidence within the current mineral useful resource however will even present the bodily core materials wanted to finish superior metallurgical and geotechnical research forward of the deliberate mixed PFS.

“With gold costs persevering with to commerce round all time highs we anticipate sturdy economics within the mixed PFS, which is predicted to be accomplished by Q3 2026. This research can be a major milestone for WRLG, establishing a valuation benchmark for our complete Pink Lake belongings. The research will even inform our allow functions; based mostly on our discussions with allowing authorities in Ontario, we’re inspired that the brand new One Venture, One Course of allowing framework has potential to actually expedite allowing of initiatives like Rowan.”

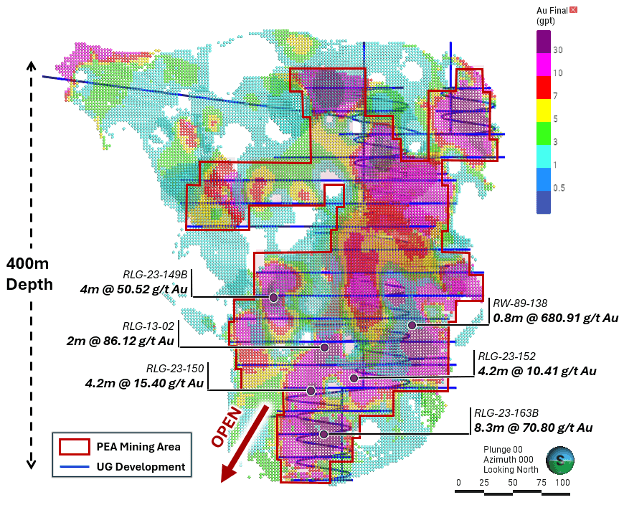

Determine 1. Plan view displaying Rowan Veins 001, 003, 004, 006b and 013 with proposed infill and conversion drilling and present PEA underground mine design [1] .

[1] Mineral assets are estimated at a cut-off grade of three.80 g/t Au and a gold worth of US$1,800/oz. Please confer with the technical report entitled “Rowan Venture NI 43-101 Technical Report and Preliminary Financial Evaluation, Ontario, Canada”, ready by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is offered on the Firm’s web site and on SEDAR+ at www.sedarplus.ca .

DISCUSSION

There are a number of alternatives to probably develop and improve the useful resource and mine plan at Rowan.

The Rowan useful resource contains 26 domains that seize a number of parallel veins. Three of these veins – 001, 003 and 004 – are mined within the PEA. A fourth vein with sturdy gold grades, known as 006b, is the third largest contributor of tonnes and ounces within the present mineral useful resource estimate (“MRE”) however was not included within the PEA mine plan as a result of its knowledge stems largely from historic drilling, which suffers from unsampled intervals. . Vein 013 runs adjoining and sub-parallel to Vein 006b and will display related useful resource improve potential, topic to affirmation drilling and subsequent useful resource estimation by a Certified Particular person.

Historic operators usually solely sampled and assayed drill core with quartz veining containing seen gold. Surrounding rock, together with vein margins, slender gaps between veins, and adjoining wall rock, was usually not sampled. Through the MRE estimation course of these unsampled intervals had been assigned a worth of half detection restrict equal to 0.0025 grams per tonne (“gpt”) gold (“Au”). This excessively diluted these areas within the useful resource mannequin, which was constructed on 2-metre minimal composites for longhole stoping design consideration. Through the 2023 drill marketing campaign, WRLG demonstrated that gold mineralization frequently persists into the altered wall rock adjoining to high-grade gold veins. Selective sampling would have missed mineralization of this sort. Moreover, many of the drilling on Veins 006b and 013 is from the 1980’s using very small 27-millimeter diameter AQ drill core with no current competent historic core obtainable for resampling. The 2025 drilling program can be accomplished with 63.5-millimeter diameter HQ drill core and can intention to infill the gaps within the historic analytical knowledge set on Veins 006b and 013 with the objective of bringing these veins again into consideration for mine design.

The subsequent layer of alternative at Rowan relies on increasing the deposit. Notably, the highest-grade intercept ever drilled at Rowan was achieved in the course of the 2023 drill marketing campaign when gap RLG-23-163B returned 70.8 g/t gold over 8.3 metres (interval reported as core size; true width is unknown). This intercept got here from the deeper portion of Vein 001 and signifies potential for mineralization to proceed at depth. The Rowan vein system has solely been outlined all the way down to roughly 400 metres and stays large open for growth at depth (Determine 2). The Rowan deposit additionally stays open alongside strike to the east and west.

Determine 2. Lengthy part of Rowan block mannequin at 1 gpt Au cutoff displaying PEA mine design (blue) and description of areas deliberate for lengthy gap stoping on Veins 001, 003 and 004 (purple define). Notable assay intercepts have been highlighted to point the energy of gold mineralization and growth potential at depth. [Intercepts are reported as core length unless otherwise stated; true widths are estimated where available.] [2] .

[ 2 ] Mineral assets are estimated at a cut-off grade of three.80 g/t Au and a gold worth of US$1,800/oz. Please confer with the technical report entitled “Rowan Venture NI 43-101 Technical Report and Preliminary Financial Evaluation, Ontario, Canada”, ready by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is offered on the Firm’s web site and on SEDAR+ at www.sedarplus.ca .

________________________

1 The PEA is preliminary in nature; it contains Inferred mineral assets which can be thought-about too speculative geologically to have the financial concerns utilized to them that will allow them to be categorized as mineral reserves; there isn’t a certainty that the PEA outcomes can be realized.

2 There could be no assurance that drilling at Rowan will consequence within the conversion of Inferred assets to Indicated; any such improve will rely upon the outcomes of the drill program and subsequent useful resource estimation by a Certified Particular person.

3 There could be no assurance that the deliberate mixed PFS will assist the event of the Madsen Mine and Rowan initiatives as a single operation or utilizing frequent infrastructure. Any such willpower will rely upon the end result of such PFS and subsequent technical and financial research.

4 https://information.ontario.ca/en/launch/1006621/ontario-implements-one-project-one-process-to-build-mines-faster

5 T he Rowan challenge manufacturing projection relies on the PEA for Rowan. The Madsen Mine is supported by a Pre-Feasibility Research technical report, efficient January 7, 2025, ready in accordance with NI 43-101 and obtainable on SEDAR+. The PEA is preliminary in nature; it contains Inferred mineral assets which can be thought-about too speculative geologically to have the financial concerns utilized to them that will allow them to be categorized as mineral reserves. There is no such thing as a certainty that the PEA outcomes can be realized. Any reference to a mixed or goal manufacturing price for Rowan and Madsen is present for illustrative functions solely ; no mixed financial evaluation or manufacturing schedule has been ready. The Rowan PEA and Madsen Pre-Feasibility Research are separate research ready to completely different ranges of confidence, and their outcomes shouldn’t be blended or thought-about as a single challenge situation. There could be no assurance that the initiatives can be developed utilizing frequent infrastructure or as a single operation, or that such a price can be achieved. Any such willpower will rely upon the end result of the deliberate mixed PFS and receipt of all vital approvals.

QUALITY ASSURANCE/QUALITY CONTROL

The Rowan Mine deposit presently hosts a Nationwide Instrument 43-101 – Requirements of Disclosure for Mineral Initiatives (“NI 43-101”) Indicated useful resource of 478,707 tonnes containing 196,747 ounces (“oz”) of gold grading 12.78 g/t Au and an Inferred useful resource of 421,181 tonnes containing 118,155 ouncesof gold grading 8.73 g/t Au. Mineral assets are estimated at a cut-off grade of three.80 g/t Au and a gold worth of US$1,800/oz. Mineral assets that aren’t mineral reserves shouldn’t have demonstrated financial viability. Please confer with the technical report entitled “Rowan Venture NI 43-101 Technical Report and Preliminary Financial Evaluation, Ontario, Canada”, ready by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is offered on the Firm’s web site and on SEDAR+ at www.sedarplus.ca .

The technical info introduced on this information launch has been reviewed and accepted by Will Robinson, P.Geo., Vice President of Exploration for West Pink Lake Gold and the Certified Particular person for exploration on the West Pink Lake Venture, as outlined by NI 43-101. Mr. Robinson is just not impartial of WRLG. The PEA and Mineral Useful resource disclosure summarized herein is derived from the impartial technical report ready by Fuse Advisors Inc.

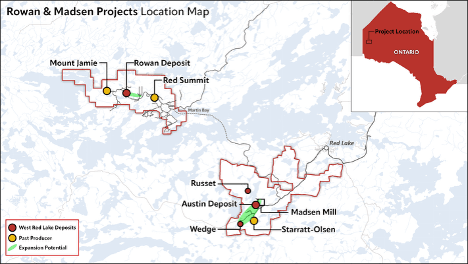

ABOUT West Pink Lake Gold Mines

West Pink Lake Gold Mines Ltd. is a gold miner improvement firm that’s publicly traded and centered on advancing and creating its flagship Madsen Gold Mine and the related 47 km 2 extremely potential land bundle within the Pink Lake district of Ontario. The extremely productive Pink Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts a few of the world’s richest gold deposits. WRLG additionally holds the wholly owned Rowan Property in Pink Lake, with an expansive property place overlaying 31 km 2 together with three previous producing gold mines – Rowan, Mount Jamie, and Pink Summit.

ON BEHALF OF West Pink Lake Gold Mines LTD.

“Shane Williams”

Shane Williams

President & Chief Govt Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen Preston

Vice President Communications

Tel: (604) 609-6132

Electronic mail: traders@wrlgold.com or go to the Firm’s web site at https://www.westredlakegold.com

Neither the TSX Enterprise Trade nor its Regulation Providers Supplier (as that time period is outlined within the insurance policies of the TSX Enterprise Trade) accepts duty for the adequacy or accuracy of this launch.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Sure statements contained on this information launch might represent “forward-looking info” inside the which means of relevant securities legal guidelines. Ahead-looking info usually could be recognized by phrases comparable to “anticipate”, “anticipate”, “estimate”, “forecast”, “deliberate”, and related expressions suggesting future outcomes or occasions. Ahead-looking info relies on present expectations of administration; nevertheless, it’s topic to recognized and unknown dangers, uncertainties and different elements that will trigger precise outcomes to vary materially from the forward-looking info on this information launch and embrace with out limitation, statements relating to outcomes of the drill program at Rowan; completion and outcomes of the geotechnical, metallurgical and engineering research to arrange for the mixed PFS; timing and receipt of superior exploration allow; anticipated timing and anticipated leads to the mixed PFS ; any untapped progress potential within the Madsen deposit or Rowan deposit; and the Firm’s future aims and plans. Readers are cautioned to not place undue reliance on forward-looking info.

Ahead-looking info includes quite a few dangers and uncertainties and precise outcomes would possibly differ materially from outcomes recommended in any forward-looking info. These dangers and uncertainties embrace, amongst different issues, market volatility; the state of the monetary markets for the Firm’s securities; fluctuations in commodity costs; and adjustments within the Firm’s enterprise plans. Ahead-looking info relies on various key expectations and assumptions, together with with out limitation, that the Firm will proceed with its acknowledged enterprise aims and its capability to lift further capital to proceed. Though administration of the Firm has tried to establish vital elements that would trigger precise outcomes to vary materially from these contained in forward-looking info, there could also be different elements that trigger outcomes to not be as anticipated, estimated or meant. There could be no assurance that such forward-looking info will show to be correct, as precise outcomes and future occasions might differ materially from these anticipated in such forward-looking info. Accordingly, readers mustn’t place undue reliance on forward-looking info. Readers are cautioned that reliance on such info is probably not applicable for different functions. Extra details about dangers and uncertainties is contained within the Firm’s administration’s dialogue and evaluation for the 12 months ended December 31, 2024, and the Firm’s annual info type for the 12 months ended December 31, 2024, copies of which can be found on SEDAR+ at www.sedarplus.ca.

The forward-looking info contained herein is expressly certified in its entirety by this cautionary assertion. Ahead-looking info displays administration’s present beliefs and relies on info at present obtainable to the Firm. The forward-looking info is made as of the date of this information launch and the Firm assumes no obligation to replace or revise such info to replicate new occasions or circumstances, besides as could also be required by relevant legislation.

For extra info on the Firm, traders ought to evaluation the Firm’s steady disclosure filings which can be obtainable on SEDAR+ at www.sedarplus.ca.

Photographs accompanying this announcement can be found at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e8531e02-445b-49c2-905e-12e98fffd8a5

https://www.globenewswire.com/NewsRoom/AttachmentNg/191b54e8-08dd-4b1d-a468-acd30608531f

https://www.globenewswire.com/NewsRoom/AttachmentNg/658777b2-0c2c-475f-b72a-96e36712c982