They are saying in the event you go “woke,” you go broke, and loads of firms have discovered that lesson the arduous approach lately.

Shoppers on each side of the aisle have turned in opposition to manufacturers they really feel betrayed them. (Personally, I used to be extra upset about Jaguar’s redesign. It appears to be like like my dream automobile should be an Aston Martin as an alternative.)

That’s why Cracker Barrel (Nasdaq: CBRL) has been within the highlight recently. Its newest rebrand was painted as going “woke” – which these days virtually appears to imply making any change in any respect. Then, simply days later, administration walked a lot of it again.

Whereas the media obsessed over the tradition conflict angle, buyers had been left with an easier query: Is there cash to be made on this inventory?

Let’s get to the meat and potatoes.

For the uninitiated, Cracker Barrel is a roadside staple of southern consolation, serving meatloaf, biscuits, and fried hen alongside country-themed retail. It operates about 660 eating places throughout 43 states, plus the smaller Maple Avenue Biscuit Firm chain.

The corporate has confronted a tough patch lately, and administration was pressured to slash its once-generous dividend from $1.30 per quarter to $0.25.

Income for the latest quarter got here in at $821 million, up simply 0.5% from the prior 12 months. Restaurant gross sales rose 1%, thanks largely to menu worth hikes of almost 5%. However the retail facet of the enterprise struggled, falling 3.8%.

Earnings improved 12 months over 12 months, with internet earnings swinging to $12.6 million, or $0.56 per share, versus a lack of $9.2 million or $0.41 per share final 12 months. Adjusted EBITDA (earnings earlier than curiosity, taxes, depreciation, and amortization) was primarily flat at $48.1 million, a razor-thin 0.4% enhance.

Administration did elevate full-year adjusted EBITDA steerage to $215 million to $225 million, displaying some confidence in its turnaround efforts. However on the identical time, capital expenditures stay heavy ($160 million to $170 million), and wage and commodity inflation proceed to chew.

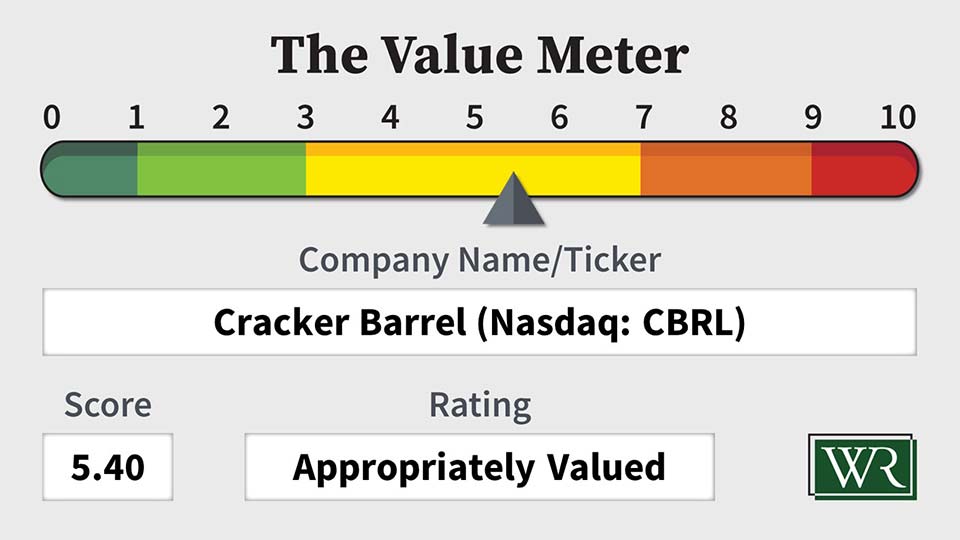

Now let’s strip away the distracting headlines and see what The Worth Meter says.

Cracker Barrel has an FCF/NAV ratio of 4.08%, in contrast with a universe common of -1.46%. Which means it’s extra environment friendly than the standard firm at changing its internet property into money. Optimistic money technology in a tricky business counts as a win.

Moreover, Cracker Barrel’s EV/NAV ratio stands at 5.25, whereas the universe common is 6.35. Put merely, buyers are paying much less for every greenback of internet property than they’d for the typical firm. That tilts the worth image in Cracker Barrel’s favor.

Nevertheless, the corporate’s money technology is spotty. Over the past three years, Cracker Barrel grew its free money circulation quarter over quarter 45.5% of the time – almost similar to the market common of 46.25%. That exhibits stability, however not outperformance. Money circulation is constructive, however not reliably rising.

Briefly, Cracker Barrel isn’t damaged, nevertheless it isn’t booming both.

It’s producing a bit more money than the typical firm relative to its property, and it trades at a reduction by way of EV/NAV. However its progress consistency is just common, and the enterprise nonetheless faces headwinds from inflation and shopper belt-tightening.

In the meantime, the inventory has been on a curler coaster. After buying and selling above $75 in late 2023, shares sank beneath $40 by late 2024 as visitors slowed and buyers anxious in regards to the dividend minimize.

However from that low, the inventory staged a powerful rebound, climbing again over $64 earlier than, once more, falling to about $35. Now, shares appear to have settled round $62.

The swings mirror a market that’s nonetheless undecided on whether or not the turnaround has actual endurance.

Traders shouldn’t count on a screaming cut price right here – nor ought to they count on a catastrophe. Cracker Barrel appears to be like to be priced about proper for what it’s: a gentle however challenged operator in a tricky business.

The rocking chairs on every restaurant’s entrance porch could also be constructed for lingering, however the inventory doesn’t give buyers a lot cause to do the identical.

The Worth Meter charges Cracker Barrel as “Appropriately Valued.”

What inventory would you want me to run by The Worth Meter subsequent? Submit the ticker image(s) within the feedback part beneath.