This text might comprise references to services or products from a number of of our advertisers or companions. We might obtain compensation whenever you click on on hyperlinks to these services or products. Nonetheless, our opinions are our personal.

The knowledge offered on this article is correct to the perfect of our data on the time of publication. Nonetheless, data is topic to vary, and no ensures are made in regards to the continued accuracy or completeness of this content material after its publication date.

![]()

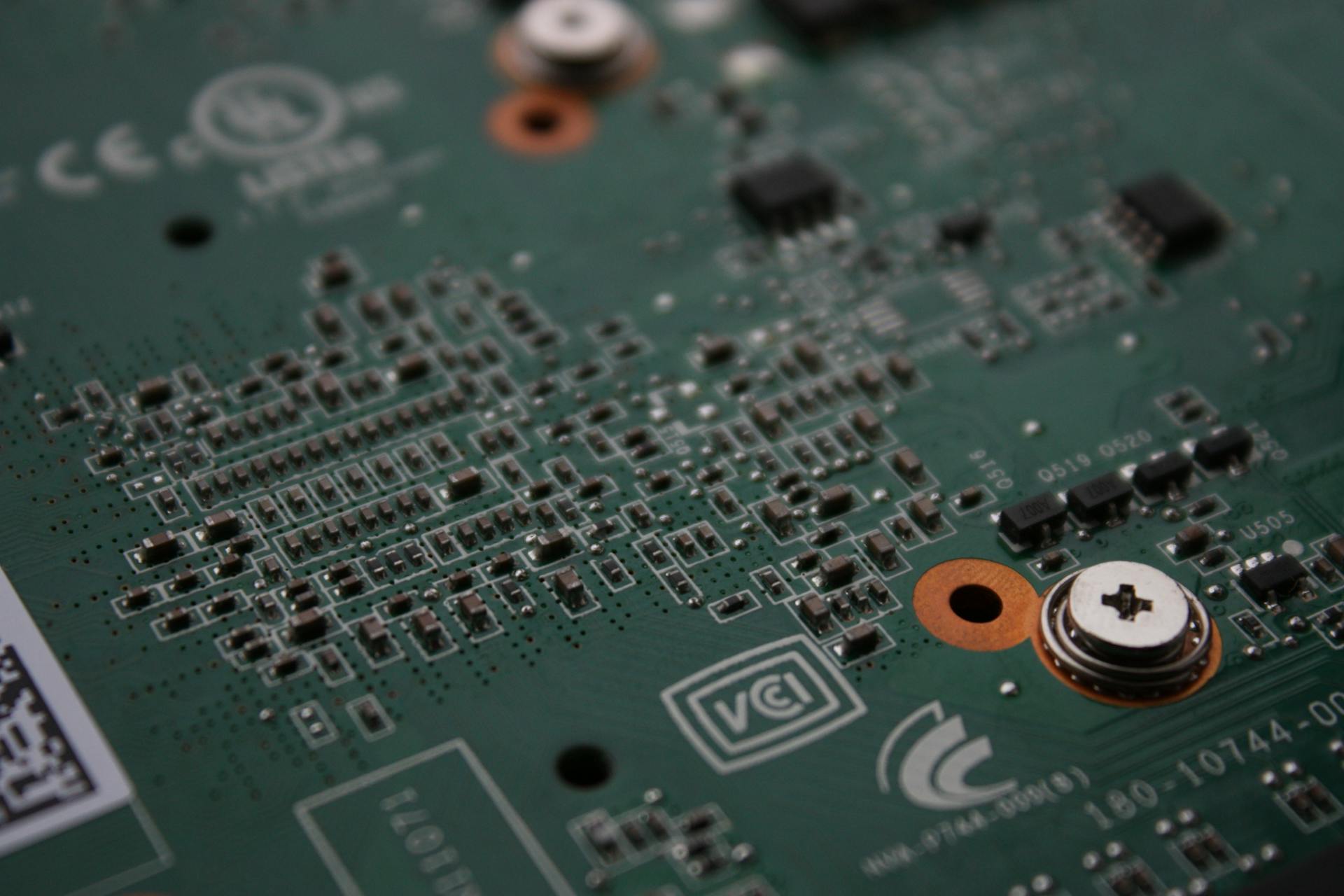

Nvidia stands as a central determine within the rise of synthetic intelligence {hardware}, powering superior computing purposes throughout industries. Its ascent has been propelled by innovation, strategic market positioning, and a globally built-in provide chain. But, rising geopolitical tensions and new waves of protectionist coverage, might tariffs disrupt Nvidia’s momentum and the broader evolution of AI?

Tariff Pressures on Nvidia’s Provide Chain

Tariffs on semiconductors and AI-enabling elements can considerably alter price constructions and logistics. Nvidia depends upon international suppliers, particularly in Asia, for key applied sciences like GPUs and AI accelerators. Any improve in commerce friction might set off cascading results throughout its operational mannequin.

Disruptions in Element Sourcing

When core elements face tariffs, the ensuing price will increase can pressure corporations to think about various sourcing or onshoring manufacturing. These shifts are sometimes expensive and time-consuming.

Results on Operational Technique

- Elevated Provide Chain Prices: Tariffs elevate the value of imported components, placing stress on manufacturing budgets.

- Publicity to Geopolitical Danger: Worldwide provide chains are susceptible to sudden coverage adjustments.

- Product Timelines: Adjusting manufacturing workflows might lead to launch delays and useful resource reallocation.

Impression Abstract

- Manufacturing Prices: Rising as a consequence of tariff publicity

- Product Improvement Cycles: Danger of delays and inefficiencies

- Retail Pricing: Increased prices could also be handed to finish customers

Commerce Coverage and Its Affect on AI Momentum

AI infrastructure depends upon high-performance chips, constant entry to innovation, and market fluidity. Commerce coverage shifts can alter these dynamics considerably, particularly for corporations working at scale.

Coverage-Pushed Price Shifts

Tariffs starting from 15% to 25% on elements like GPUs, logic chips, and AI accelerators can materially elevate enterprise infrastructure prices. In flip, this could dampen AI investments and cut back competitiveness.

Broader Trade Implications

- Slowdown in AI Improvement: Increased {hardware} prices can restrict the variety of improvement cycles, particularly for smaller organizations.

- Market Segmentation: Restrictions might isolate sure areas from modern applied sciences.

- Lowered {Hardware} Entry: AI initiatives in price-sensitive markets could also be postponed or cancelled.

Tariff Snapshot:

- GPUs: 25% estimated import tariff

- AI Accelerators: 20%

- Logic Chips (e.g., CPUs): 15%

These figures mirror common developments throughout latest U.S.-China commerce measures.

Pressures on Profitability and Monetary Flexibility

Commerce boundaries can instantly impression Nvidia’s monetary efficiency. Buyers and analysts usually monitor these developments carefully, as they introduce volatility and strategic uncertainty.

Margin Compression and Market Sensitivity

- Rising COGS: Elevated enter prices problem gross margins.

- Value Transmission Dangers: Passing prices to prospects might cut back competitiveness or result in decrease gross sales volumes.

- Investor Notion: Persistent commerce dangers can have an effect on market confidence and inventory valuation.

Abstract of Monetary Results

- Gross Margin: In danger as a consequence of rising prices

- Gross sales Quantity: Could decline in cost-sensitive areas

- Inventory Volatility: Heightened throughout coverage shifts

Strategic Positioning in a Altering Commerce Setting

As worldwide insurance policies evolve, Nvidia and related companies should reassess strategic investments and danger administration practices.

Funding and Market Reallocation

Buyers are reevaluating publicity to international tech corporations dealing with tariff threats, usually favoring companies with localized provide chains or larger pricing energy.

Portfolio Changes Price Contemplating

- Diversification: Cut back overreliance on corporations closely depending on worldwide suppliers.

- Sector Shifts: Rebalance portfolios towards home producers the place acceptable.

- Geopolitical Monitoring: Monitor rising insurance policies that will redefine chip entry or exports.

Funding Space Outlook

- AI {Hardware} Producers: Excessive tariff danger; assess provide chain resiliency

- Home Tech Companies: Doable short-term benefit as a consequence of lowered overseas competitors

- International ETFs: Evaluation regional publicity and rebalance if essential

Adapting to Friction in International Commerce

Nvidia’s continued dominance in AI {hardware} will depend upon how effectively it navigates a extra fragmented commerce atmosphere. Though the corporate’s innovation monitor report is powerful, tariffs introduce new challenges associated to price management, market entry, and operational continuity.

Components That Could Form the Subsequent Section

- U.S.-China Relations: Future agreements or escalations will instantly affect semiconductor entry and pricing.

- Manufacturing Realignment: Strategic motion towards home manufacturing might stabilize long-term operations, although with near-term capital calls for.

- Aggressive Positioning: Different gamers might achieve share if they’re shielded from tariff publicity.

Market Forecast Themes

- Commerce Boundaries: Pressuring short-term profitability

- Export Controls: Limiting product attain in choose areas

- Localization Efforts: Prone to improve in response to international uncertainty

Conclusion

Tariffs are an enormous downside for Nvidia’s rigorously constructed international provide chain. They may elevate manufacturing prices, trigger product delays, and decrease revenue margins. Even small commerce boundaries can decelerate innovation in the entire business, particularly for smaller corporations with fewer sources. It is because AI improvement wants common entry to superior chips.

To remain on prime, Nvidia might want to take proactive steps like discovering new suppliers, trying into making merchandise within the US, and bettering its potential to deal with geopolitical dangers. Buyers and individuals who work with AI might want to regulate commerce talks, U.S.-China relations, and semiconductor coverage. The corporate’s potential to rapidly adapt to altering tariffs will have an effect on not solely its personal progress, but additionally the velocity at which AI {hardware} is growing around the globe.

Often Requested Questions

How do tariffs affect Nvidia’s profitability?

Tariffs elevate the price of imported supplies utilized in Nvidia’s merchandise. These will increase might both be absorbed by the corporate, affecting margins, or handed on to prospects, doubtlessly decreasing demand.

May tariffs hinder AI progress extra broadly?

Increased {hardware} prices can restrict entry to computing energy, slowing analysis progress and product improvement throughout industries. Smaller corporations might battle essentially the most.

How necessary is China in Nvidia’s provide chain?

China performs a major function as each a producing base and a key marketplace for Nvidia merchandise. Tariffs or restrictions affecting commerce with China might disrupt operations and diminish income potential.

Can Nvidia cut back its publicity to tariffs?

Nvidia might mitigate commerce danger by diversifying suppliers, shifting some manufacturing to home services, or investing in additional vertically built-in manufacturing fashions.

What ought to traders contemplate in mild of those dangers?

Buyers ought to monitor international coverage adjustments, analyze an organization’s provide chain geography, and assess the flexibility of that agency to adapt to altering commerce guidelines.

Reviewed and edited by Albert Fang.

See a typo or need to recommend an edit/revision to the content material? Use the contact us type to offer suggestions.

At FangWallet, we worth editorial integrity and open collaboration in curating high quality content material for readers to get pleasure from. A lot appreciated for the help.

Did you want our article and discover it insightful? We encourage sharing the article hyperlink with household and buddies to learn as effectively – higher but, sharing on social media. Thanks for the assist! 🍉

Article Title: Will Tariffs Burst Nvidia AI Progress?

https://fangwallet.com/2025/09/13/will-tariffs-burst-nvidia-ai-growth/The FangWallet Promise

FangWallet is an editorially impartial useful resource – based on breaking down difficult monetary ideas for anybody to grasp since 2014. Whereas we adhere to editorial integrity, be aware that this publish might comprise references to merchandise from our companions.

The FangWallet promise is all the time to have your greatest curiosity in thoughts and be clear and trustworthy in regards to the monetary image.

Change into an Insider

Subscribe to get a free every day funds planner printable to assist get your cash on monitor!

Make passive cash the suitable means. No spam.

Editorial Disclaimer: The editorial content material on this web page shouldn’t be supplied by any of the businesses talked about. The opinions expressed listed below are the creator’s alone.

The content material of this web site is for informational functions solely and doesn’t signify funding recommendation, or a suggestion or solicitation to purchase or promote any safety, funding, or product. Buyers are inspired to do their very own due diligence, and, if essential, seek the advice of skilled advising earlier than making any funding selections. Investing includes a excessive diploma of danger, and monetary losses might happen together with the potential lack of principal.

Advertiser Disclosure: This text might comprise references to services or products from a number of of our advertisers or companions. We might obtain compensation whenever you click on on hyperlinks to these services or products.

Write for Us

Supply Quotation References:

+ Inspo

There are not any further citations or references to notice for this text right now.