Heart for Macroeconomics and Improvement

The Belt and Street Initiative (BRI), launched by Xi Jinping, accomplished its tenth anniversary this 12 months. It has entered a 3rd section.

The initiative introduced a seal to China’s financing and development of infrastructure overseas that had already totaled greater than US$400 billion within the earlier 10 years. Along with using funding tasks as a part of Chinese language “mushy energy”, the BRI served to extend ranges of utilization of the nation’s extra put in capability.

China’s financial rebalancing past its overinvestment-based progress mannequin of the many years earlier than the worldwide monetary disaster was applied progressively, with actual property and infrastructure development bubbles permitting it to bear a really gradual slide of progress charges, from double-digit GDP progress charges as much as 6% in 2019, the final 12 months earlier than the pandemic. BRI match like a glove.

Along with providing a supply of funding for creating international locations in dire want of infrastructure, the BRI proposed itself to be a platform with speedy implementation and with out a lot due diligence relating to environmental, social and governance requirements. Moreover, the BRI would reinforce what we known as on the time an “overlapping” or “parallel” globalization to the present one, based mostly on Chinese language trade on this case.

Certainly, China has turn into the most important bilateral supply of worldwide improvement financing. By 2018, primarily directed in direction of infrastructure and the power sector, China’s improvement loans to Latin America and the Caribbean reached ranges higher than the sum of loans from the World Financial institution, the Inter-American Improvement Financial institution (IDB) and the Financial institution of Improvement of Latin America (CAF). The presence of such operations within the area got here to be seen as a “competitors for affect”. One thing comparable occurred in Africa.

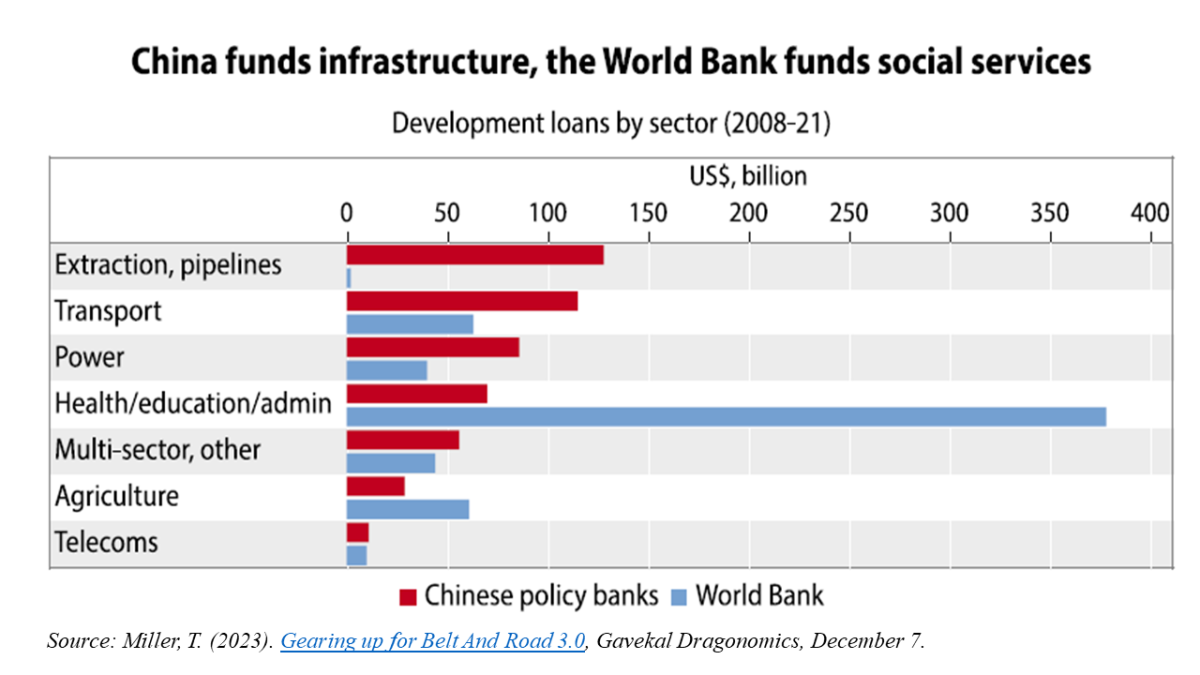

Based on knowledge collected by Boston College’s World Improvement Coverage Heart (Determine 1), the amount of loans from Chinese language public improvement banks – Exim and China Improvement Financial institution – surpassed these from the World Financial institution, within the interval from 2008 to 2021, in areas akin to oil extraction and pipelines, transport, power, telecommunications and others. The World Financial institution maintained its lead solely in well being, schooling, governance, and agriculture, along with direct budgetary help. In whole for the interval, mortgage commitments by the 2 Chinese language public improvement banks reached US$498 billion, that’s, 83% of the World Financial institution’s whole (US$601 billion).

Determine 1

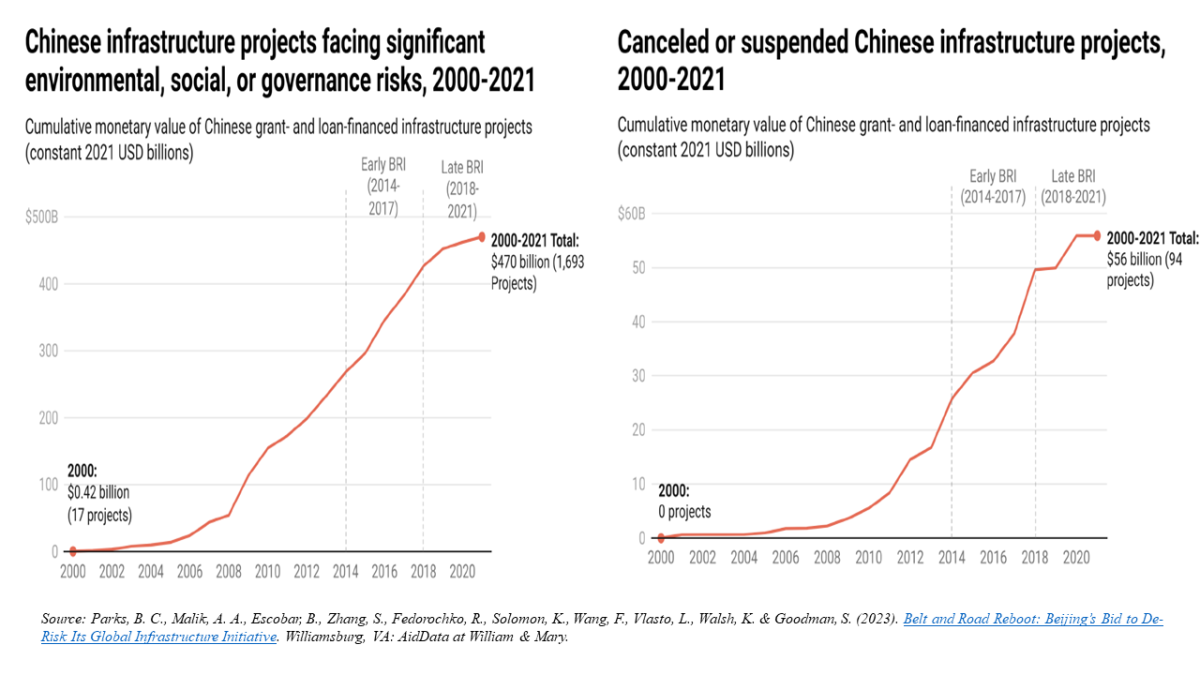

A change occurred, nevertheless, from 2018 onwards. Volumes fell and the BRI entered a section that may be known as a “correction” (Parks et al, 2023) (Miller, 2023). A brake was utilized by imposing extra demanding approval requirements and shifting financing from Chinese language official improvement banks to state-owned business banks. The draw back of the laxity of requirements with respect to environmental, social, and governance dangers turned more and more clear and the variety of canceled or suspended infrastructure tasks rose considerably (Determine 2).

Determine 2

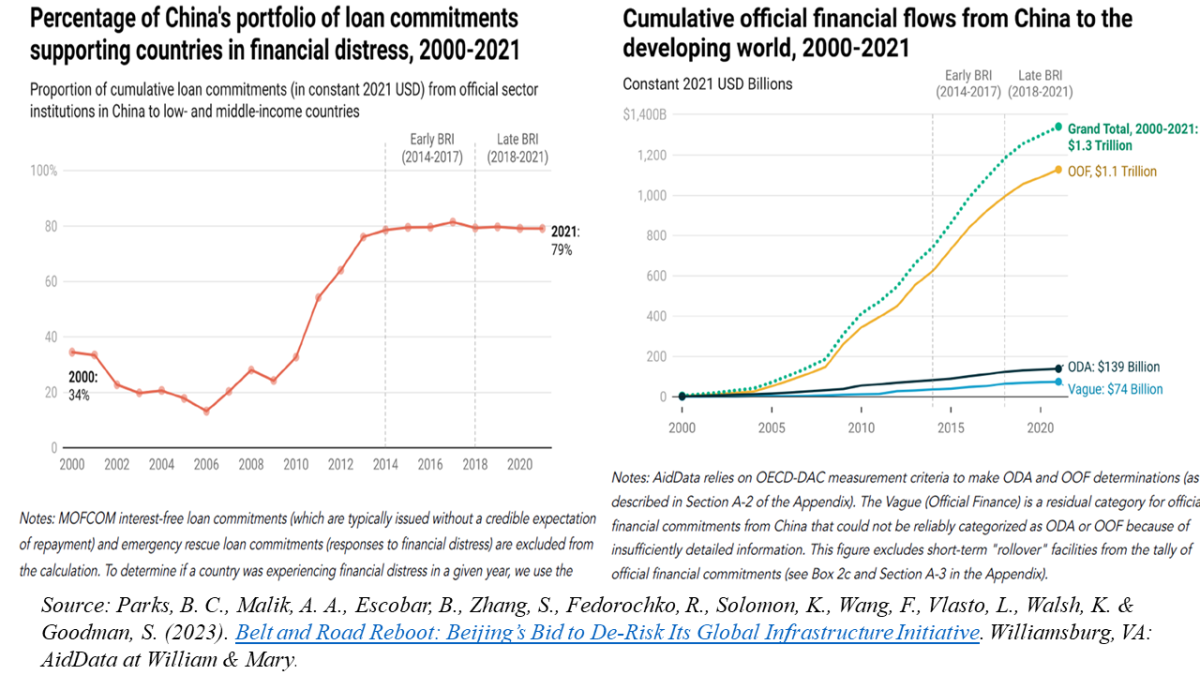

With many borrowing international locations getting into “debt misery” conditions, the nation’s central financial institution additionally opened emergency traces of credit score. Strictly talking, many of the assets since 2020 went to emergency loans to forestall a number of low- and middle-income international locations from having to default on the service debt of earlier tasks and to not finance new ones (Determine 3, left facet).

Determine 3

Whole debt owed to China by low- and middle-income international locations is between US$1.1 and US$1.5 trillion (Determine 3, proper facet). About 80% of China’s mortgage portfolio is in international locations presently experiencing monetary difficulties.

In 2021, 58% of Chinese language loans had been bailouts, with lower than a 3rd for brand new infrastructure tasks. Greater than half of the loans to low- and middle-income international locations got here within the type of forex swap traces with China’s central financial institution or from the exterior reserve supervisor: the State Administration of International Change Reserves. This 12 months Argentina averted defaulting on the IMF due to the credit score line between its central financial institution and the Chinese language one.

Greater than half of China’s official BRI loans have already entered their principal compensation intervals, with the quantity anticipated to succeed in 75% by 2030. Which means that China’s debtors are starting giant repayments at a time when rates of interest have risen, the US greenback has appreciated, and international financial progress is slowing down. As Parks et al (2023) places it, China is now transitioning from being the world’s largest bilateral improvement creditor to “the world’s largest official debt collector”.

China’s emergence because the world’s largest bilateral creditor and its insistence on bilateral debt restructuring processes by itself phrases (which hardly ever embrace compensation of principal), with out absolutely taking part in multilateral processes, signifies that the decision of the debt misery that creating international locations are grappling with is predicted to pull on for a number of years.

However after the “peak” (2014-17) and “correction” (from 2018 onward) phases, the BRI appears to have entered a 3rd section, judging by the statements made by Chinese language authorities throughout the Third BRI Discussion board in Beijing in October. The main focus will now be on “smaller, smarter” tasks, in coordination with the nation’s clear power industrial insurance policies.

The BRI will now need to develop markets for Chinese language photo voltaic and wind power producers, along with guaranteeing entry to vital minerals for its battery manufacturing worth chain. Given the context of technological rivalry – together with in clear power – between China and america and its allies, a comparable response to the BRI in its third section, if any, has but to be seen.

Otaviano Canuto, based mostly in Washington, D.C, is a former vice chairman and a former government director on the World Financial institution, a former government director on the Worldwide Financial Fund, and a former vice chairman on the Inter-American Improvement Financial institution. He’s additionally a former deputy minister for worldwide affairs at Brazil’s Ministry of Finance and a former professor of economics on the College of São Paulo and the College of Campinas, Brazil. At present, he’s a senior fellow on the Coverage Heart for the New South, a professorial lecturer of worldwide affairs on the Elliott College of Worldwide Affairs – George Washington College, a nonresident senior fellow at Brookings Establishment, a professor affiliate at UM6P, and principal at Heart for Macroeconomics and Improvement.